Market Performance

S&P 500: 6,532.04 ⬆️ 0.30%

Nasdaq: 21,886.06 ⬆️ 0.03%

Dow Jones: 45,490.92 ⬇️ 0.48%

Novo Nordisk Announces Layoffs As Growth Slows

Danish pharmaceutical giant Novo Nordisk (NVO) announced plans to cut around 9,000 roles, or roughly 11.5% of its global workforce.

The company’s new CEO, Maziar Mike Doustdar, aims to streamline operations and defend its position in the increasingly competitive obesity treatment market.

Novo Nordisk, which produces the blockbuster Wegovy weight-loss medication, said the restructuring will cost $1.26 billion and help "reallocate resources towards growth opportunities in diabetes and obesity."

Around 5,000 of the cuts will occur in Denmark, marking the first significant move by Doustdar, who took over last month.

This overhaul comes as Novo faces mounting pressure from rival Eli Lilly and cheaper compounded weight-loss drugs, while struggling with supply chain issues and disappointing trial results for its next-generation obesity drug CagriSema.

Despite being the first mover in weight-loss drugs, the company has been losing market share, particularly in the crucial U.S. market.

Our Takeaway

This aggressive cost-cutting signals Novo's recognition that the weight-loss drug market has fundamentally shifted from a monopolistic landscape to a fiercely competitive battleground.

While painful, the restructuring positions the healthcare heavyweight to compete effectively on price and innovation.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

Market Overview 📈

Markets reached fresh highs on Wednesday after wholesale prices unexpectedly declined 0.1% in August, well below the 0.3% gain economists expected.

The positive inflation data fueled optimism for potential Federal Reserve rate cuts, with traders now pricing in increased odds of a 50-basis-point cut at September's meeting.

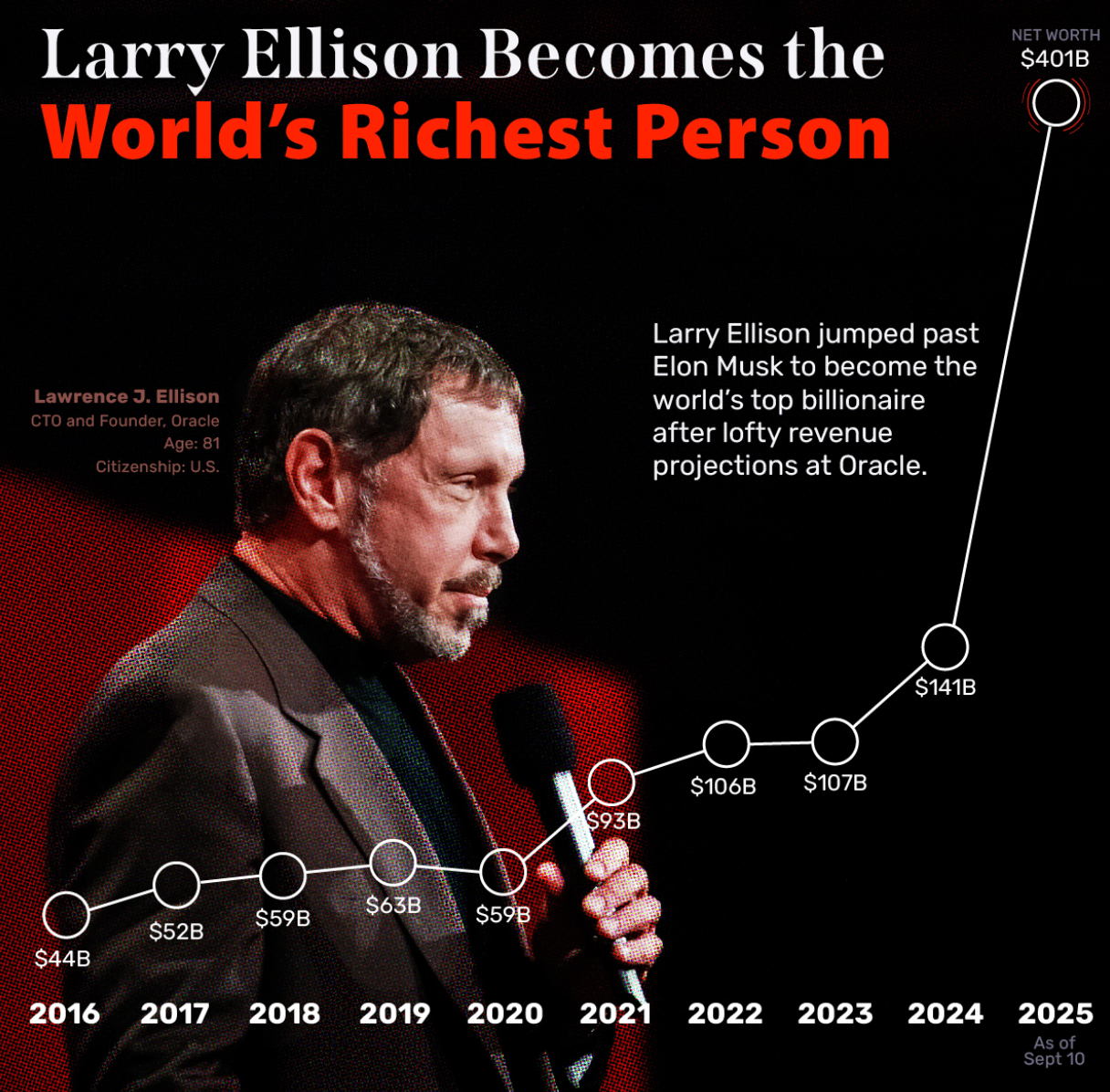

Oracle's blockbuster earnings drove much of the rally, with the tech behemoth surging 36% on the back of explosive growth in AI-driven cloud services.

Oracle’s forecast for cloud infrastructure revenue to grow 77% in fiscal 2026 to $18 billion sent shockwaves through the AI ecosystem, lifting semiconductor and data center stocks across the board.

However, breadth remained weak despite the headline gains, with more S&P 500 stocks declining than advancing.

Apple weighed on the Dow, falling 3% after its latest iPhone announcement failed to excite investors.

The mixed action underscores the market's dependence on a handful of AI-related mega-cap stocks to drive performance.

Stock Moves Deciphered 📈

Oracle (ORCL) surged 36% on strong AI-driven demand for its cloud services. The company's optimistic growth forecast, predicting an eight-fold increase in cloud revenue, fueled the record-breaking rally and marked its best day since 1992.

Arista Networks (ANET) climbed 6.21% as demand for its networking infrastructure grew. The company benefited from the broader AI-driven market rally and the increasing need for high-speed connectivity in data centers supporting AI workloads.

APA Corporation (APA) gained 7.55% after declaring a steady quarterly dividend and receiving analyst price target upgrades. Strong Q2 performance and increased cost savings guidance boosted investor confidence in the energy producer.

Headlines You Can't Miss 👀

📊 GameStop surged 3.3% after reporting Q2 earnings of $0.25 per share, beating estimates, with revenue rising to $972.2 million from $798.3 million year-over-year.

🏦 Bank of America raised price targets for energy giants, lifting Chevron to $185 (a 20% upside) and Exxon to $120, following Chevron's successful acquisition of Hess.

🇵🇱 Oil prices jumped over 1% after Poland shot down Russian drones entering its airspace, marking the first NATO engagement with Russian assets since 2022.

💊 TD Cowen upgraded Nike to a "Buy" with a $85 price target, citing "underappreciated" margin recovery potential and improving brand momentum data.

🎯 Synopsys plummeted 35% after warning that U.S.-China trade tensions severely impacted its intellectual property business, with expected deals failing to materialize.

📱 Klarna debuted on NYSE at $52 per share, raising $1.37 billion and valuing the Swedish buy-now-pay-later company at approximately $15 billion.

⚡ Energy Secretary Chris Wright said U.S. oil production may plateau temporarily as crude prices trade below many producers' breakeven costs.

🏛️ Stephen Miran cleared a key Senate committee vote on his way to confirmation for the Federal Reserve Board of Governors seat.

Trending Stocks 📊

Constellation Energy (CEG) rose over 6% as a key supplier of power to data centers. The surge in AI demand, highlighted by Oracle's results, drove gains for utilities supporting energy-intensive AI infrastructure.

Digital Realty Trust (DLR) gained 6% as the data center REIT benefited from the AI boom. Increasing demand for data center capacity to support AI workloads drove strong investor optimism in the real estate sector.

Synopsys (SNPS) plummeted 36% in its biggest one-day decline on record after missing Q3 earnings and revenue estimates. Weak Design IP performance and cautious guidance overshadowed strong revenue growth from automation.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

🛒 Kroger reports before Thursday's opening bell.

📊 Adobe reports after the closing bell on Thursday.

💸 Consumer Price Index (CPI) report Thursday - economists expect a 0.3% monthly gain.

👀 Core CPI is also expected to rise 0.3%, keeping the annual rate at 3.1%.

🏦 The Federal Reserve's decision looms, with markets pricing a 100% chance of a rate cut.

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.