- Ziggma

- Posts

- 💰 Oracle's Monstrous Order Book

💰 Oracle's Monstrous Order Book

PLUS: Why is United Health rising?

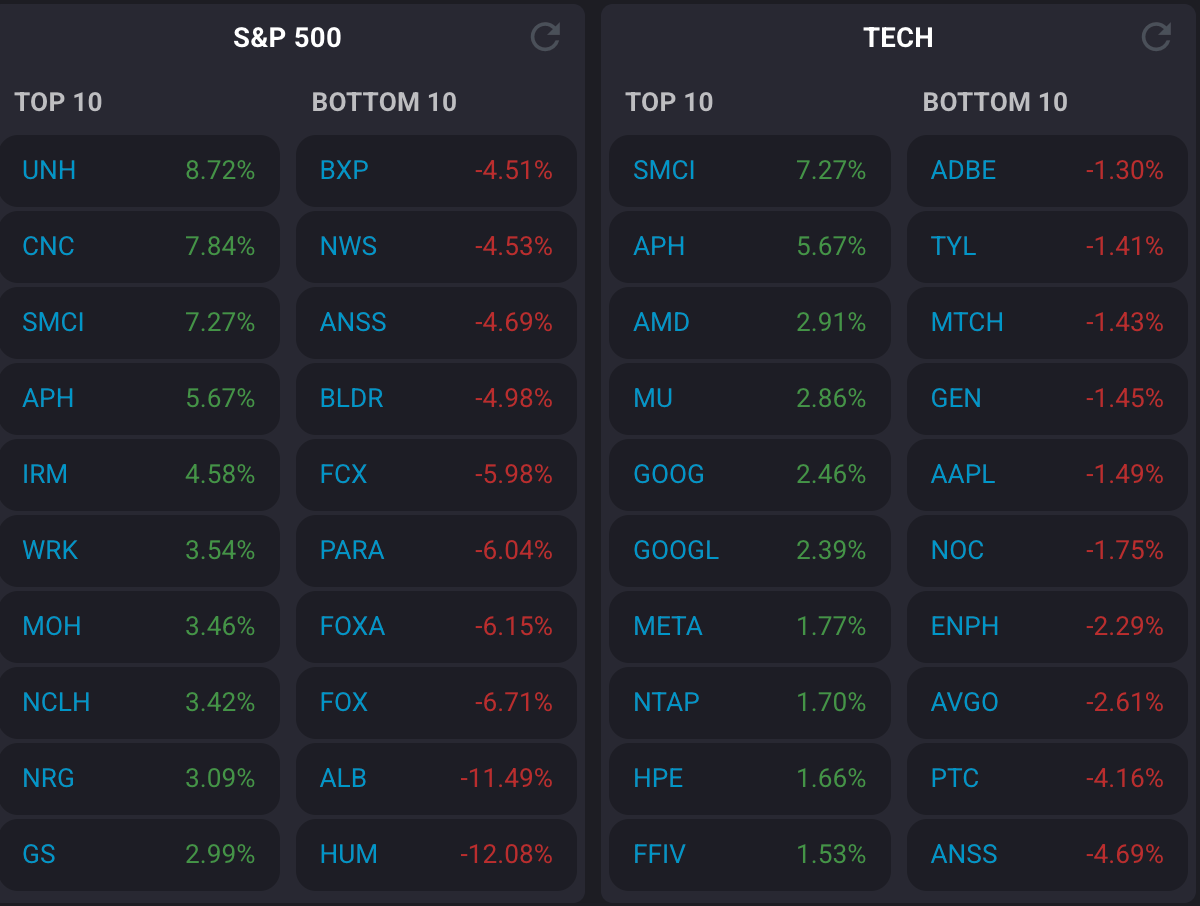

Market Performance

S&P 500: 6,512.61 ⬆️ 0.27%

Nasdaq: 21,879.49 ⬆️ 0.37%

Dow Jones: 45,711.34 ⬆️ 0.43%

Oracle’s AI Gold Rush 💸

Oracle (ORCL) stock exploded 28% in after-hours trading following earnings that revealed the database giant's transformation into an AI infrastructure powerhouse.

Despite missing revenue estimates ($14.93 billion vs. $15.04 billion expected), Oracle's remaining performance obligations increased 359% to $455 billion, signaling a massive amount of future revenue locked in.

Oracle secured four multibillion-dollar contracts in the quarter, including a landmark deal with OpenAI for 4.5 gigawatts of U.S. data center capacity.

Oracle's cloud infrastructure revenue surged 55% to $3.3 billion, with management projecting extraordinary growth ahead: $18 billion in fiscal 2026 (77% growth), scaling to $144 billion by fiscal 2030.

CEO Safra Catz highlighted Oracle's "asset-light" approach, contrasting it with competitors who prefer to own buildings, thereby allowing for more efficient capital allocation.

The company plans $35 billion in capital expenditures for fiscal 2026, representing a 65% increase over the previous year.

Larry Ellison emphasized Oracle's elevated status, noting that the company has direct dealings with CEOs and heads of state, given the strategic importance of AI.

Oracle currently has a Ziggma Stock Score of 55, primarily held back by sluggish growth in recent years. Given the new growth outlook, expect ORCL’s Stock Score to rise in the coming weeks as analysts revise their growth outlook for revenue and earnings.

Our Takeaway

Oracle's positioning as the backbone of AI infrastructure is paying dividends.

With contracted revenue visibility extending years ahead and growth projections that dwarf traditional software metrics, Oracle is successfully monetizing the AI boom through strategic partnerships rather than building everything in-house.

7+ Revenue Streams from One Business

Most companies chase one or two ways to make money. Surf Lakes has at least seven.

At the heart of it all is their patented 360° wave tech that creates 2,000 surfable rides per hour for beginners and pros alike. That single breakthrough unlocks multiple revenue streams: licensing fees, royalties, memberships, day passes, media, coaching, food, retail, and direct park operations.

It’s why surfing legends Tom Curren and Mark “Occy” Occhilupo are investing in the company.

Actor Chris Hemsworth even said this after his Surf Lakes experience: “What an incredible setup! Really thankful I got to test this out…an awesome day.”

Surf tourism is a $65B global industry, yet fewer than 1% of people can access real waves. Surf Lakes makes it possible anywhere, turning cities into surf destinations.

They’ve already sold nine licenses worldwide, and the expansion is coming. Back Surf Lakes by 9/12 and get up to 15% bonus shares.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

Market Overview 📈

All three major indices closed at record highs on Tuesday as investors moved past concerns about the economy.

The rally came despite a massive jobs revision showing that 911,000 fewer jobs were created through March than initially reported—the largest revision since 2002.

JPMorgan CEO Jamie Dimon warned that the economy is "weakening," although he remained uncertain about the risks of a recession.

The disappointing jobs data paradoxically boosted markets as traders anticipate aggressive Federal Reserve rate cuts.

The energy and communication services sectors led the gains, both up 1.4%, while the materials sector lagged with a 1.7% decline.

Stock Moves Deciphered 📈

Amphenol Corporation (APH) surged 5.7% driven by exceptional 36% order growth and major acquisitions totaling $11.5 billion. The connector specialist benefits from the momentum of AI hardware and strategic expansion.

Albemarle (ALB) tumbled 11.5% due to renewed concerns about lithium oversupply. A major Chinese producer's plan to restart its idle mining operations has significantly pressured the market.

Humana (HUM) plunged 12% after reports of stricter Medicare Advantage criteria for 2026. This contrasted sharply with UnitedHealth's positive outlook, raising concerns about profitability across the sector.

Headlines You Can't Miss 👀

📈 Nebius Group surged 49% after securing a multi-year AI infrastructure deal with Microsoft, expanding cloud computing capacity for AI workloads.

🏦 CoreWeave jumped 7% following the launch of CoreWeave Ventures, a new fund that invests in AI startups while providing access to its cloud platform.

⚡ Kingsoft Cloud gained 15% on a Bank of America upgrade to buy, citing 39% AI revenue contribution driving strong growth momentum.

🏨 Citi upgraded Hyatt Hotels to a Buy rating with a $167 target, anticipating 6-7% annual room growth and significant benefits from international expansion.

💊 Metsera rose 5% after Leerink Partners initiated coverage with an outperform rating, calling the obesity peptide therapeutics platform a potential stock doubler.

🏢 Brighthouse Financial soared 11% on reports that private equity firm Aquarian is exploring a takeover of the insurance company.

📊 NFIB Small Business Optimism Index rose to 100.8 in August from 100.3, with improved sales expectations and stronger earnings reports.

💰 Potential Trump tariff refunds could reach $750 billion to $1 trillion if the Supreme Court rules current levies illegal, Treasury Secretary warns.

Trending Stocks 📊

UnitedHealth Group (UNH) surged 8.6% after forecasting that 78% of its Medicare Advantage members will be enrolled in highly-rated plans for 2026.

This optimistic outlook suggests higher government bonus payments, which will boost investor confidence and drive the healthcare giant to new highs amid broader sector strength.

Super Micro Computer (SMCI) gained 7.2% following a partnership announcement with Nokia to develop AI-optimized networking solutions.

The collaboration signals significant growth potential in the booming artificial intelligence infrastructure sector, as demand for specialized hardware continues to accelerate across enterprise markets.

Fox (FOX) fell over 6% after the Murdoch family settled its long-running succession dispute, with Lachlan Murdoch gaining control of the media empire.

While the resolution eliminates uncertainty, investors appear concerned about potential strategic changes under the new leadership structure and future direction.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

📊 Wednesday: Producer Price Index data could influence Fed rate cut expectations ahead of next week's policy meeting.

📈 Thursday: Consumer Price Index release will be crucial for gauging inflation trends and market direction.

🏛️ Next Week: Federal Reserve policy meeting with potential rate cut decision based on recent economic data.

💼 Ongoing: Continued focus on AI infrastructure deals and semiconductor sector developments, driving tech momentum.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.