- Ziggma

- Posts

- 🫧 Will the AI Bubble Pop?

🫧 Will the AI Bubble Pop?

PLUS: Tech sell-off intensifies

Market Performance

S&P 500: 6,737.49 ⬇️ 1.66%

Nasdaq: 22,870.36 ⬇️ 2.29%

Dow Jones: 47, 457.22 ⬇️ 1.65%

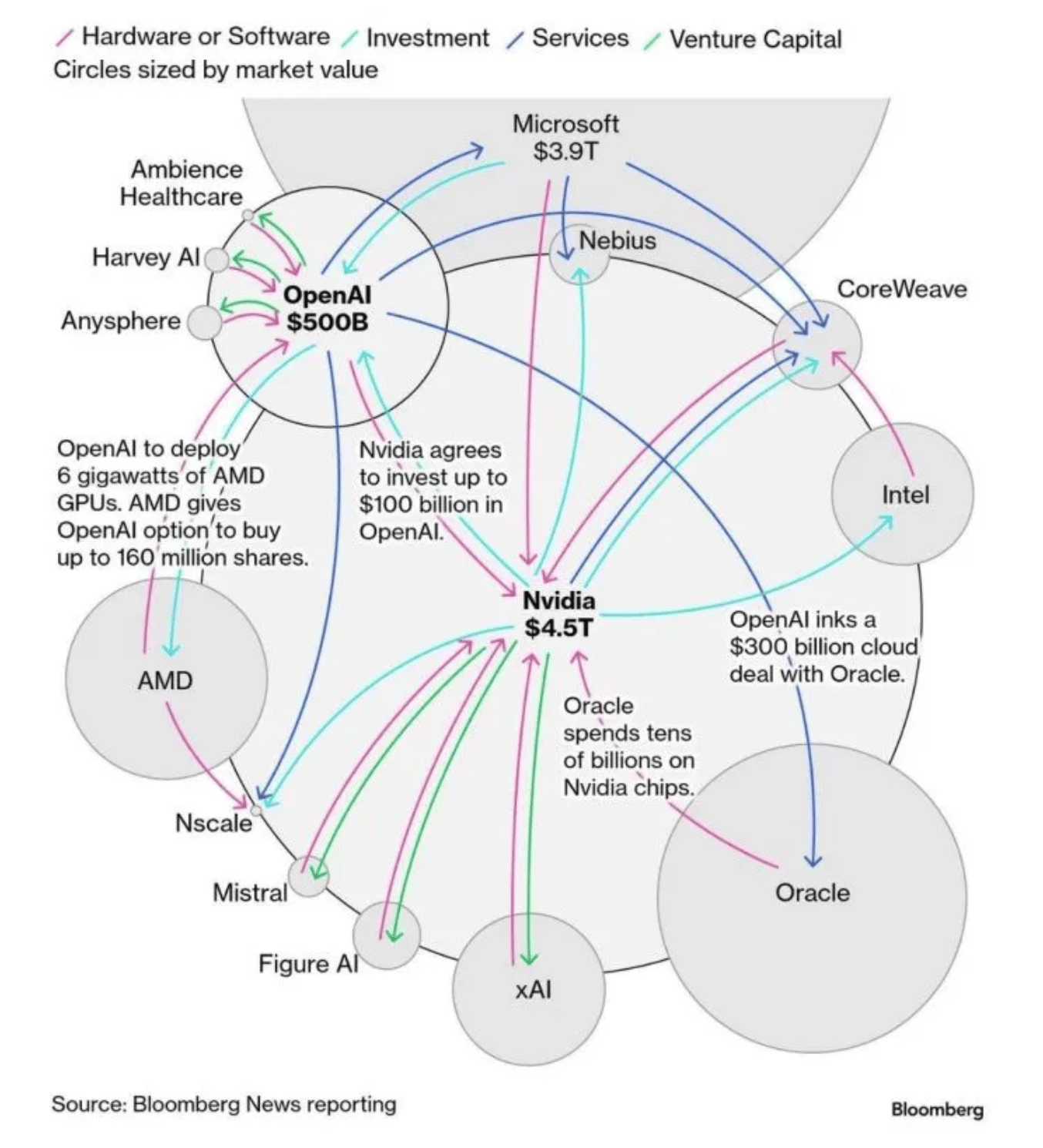

Is AI Heading for a Bust?

The ongoing selloff in artificial intelligence stocks has sparked concerns among some of the world's most influential financial figures.

Goldman Sachs CEO David Solomon warned of a "likely" 10-20% market drawdown within the next two years, while Bank of England Governor Andrew Bailey openly questioned whether the world is witnessing an AI bubble in the making.

The numbers tell a sobering story. SoftBank Group hemorrhaged nearly $75 billion in weekly losses, while legendary investor Michael Burry doubled down on his bearish stance with massive short positions against Nvidia and Palantir.

Burry has also accused major tech companies of accounting tricks, claiming they're understating depreciation by $176 billion through 2028 to inflate earnings artificially.

Not everyone's panicking, though. Companies building AI infrastructure, such as Legrand and Skanska, report robust pipelines with no signs of slowdown.

And venture capitalist Magnus Grimeland argues that this is fundamentally different from the dot-com bubble, pointing to real revenues—OpenAI has hit $10 billion in annual recurring revenue, after all.

Our Takeaway

The AI trade is at a crossroads.

While adoption is undeniably real and revenues are flowing, stretched valuations and potential accounting shenanigans warrant serious caution.

Smart investors should diversify their portfolios and look beyond the prominent mega-cap names.

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

Market Overview 📈

Thursday's brutal selloff was driven by a toxic combination of factors that rattled investor confidence across the board.

Technology stocks bore the brunt of the damage as enthusiasm for AI waned amid concerns about valuation.

Heavyweights like Nvidia, Broadcom, and Alphabet dragged the Nasdaq down 2.29%, marking its third consecutive losing session and pulling the index below its critical 50-day moving average for the first time since April.

Adding fuel to the fire, expectations for a Federal Reserve rate cut shifted dramatically.

Markets now price in just a 51% chance of a December rate cut—down sharply from 63% just a day earlier.

The extended six-week government shutdown, which ended Wednesday evening when President Trump signed a funding bill through January, left the Fed flying blind without crucial jobs and inflation data.

White House press secretary Karoline Leavitt suggested that some October reports may never be released, although most economists expect a minimal impact on GDP.

Meanwhile, the 30-year Treasury yield climbed to levels not seen since October 2023, putting pressure on an economy already strained by universal tariffs.

Bitcoin plunged to $98,073—its lowest level since May—despite recent approvals for crypto ETFs.

Stock Moves Deciphered 📈

🛜 Cisco Systems (CSCO)

Cisco shares surged over 4% after the networking giant reported adjusted earnings of $1.00 per share on revenue of $14.88 billion, topping analyst estimates of $0.98 and $14.77 billion, respectively.

The company secured a massive $1.3 billion in AI-related orders, demonstrating that AI-driven demand for networking equipment is accelerating rather than slowing down.

🎢 Walt Disney Company (DIS)

Disney shares tumbled nearly 8% following mixed fiscal fourth-quarter results that disappointed investors.

While the media giant beat earnings expectations with adjusted EPS of $1.11 versus estimates of $1.05, revenue came in light at $22.46 billion compared to the $22.75 billion consensus.

The revenue miss highlighted a persistent challenge: gains from Disney's growing streaming business were entirely offset by ongoing declines in its legacy linear television operations

🧪 Dow (DOW)

Dow shares advanced after receiving an analyst upgrade from Goldman Sachs, which raised its price target on the chemical manufacturer.

The upgrade emphasized Dow's renewed strategic focus on generating cash flow and improving operational efficiency.

Headlines You Can't Miss 👀

🤖 Elon Musk's xAI raises $15 billion in a massive funding round, bringing total capital raised to $25 billion at a $200 billion valuation, with funds earmarked for GPU infrastructure.

🥊 TKO Group Holdings partners with Polymarket in a multiyear deal, making UFC the first sports organization to integrate real-time prediction markets into live combat sports events.

💰 Cash App unveils plans to support stablecoin transfers starting early next year, joining the broader stablecoin boom as JPMorgan forecasts the market could hit $750 billion.

🪙 Spot XRP ETF debuts in the U.S. through Canary Capital, offering investors direct exposure to the Ripple-linked cryptocurrency as regulators warm up to digital assets.

🏋️ Planet Fitness jumps 3% after issuing strong guidance for fiscal years 2026-2028, projecting new club unit growth of 6-7% and mid-teens EBITDA expansion.

🥗 Sweetgreen rallies nearly 11% after co-founder Nicolas Jammet purchased approximately $1 million worth of stock, despite shares being down over 80% year-to-date.

📦 Sealed Air surges 17% on reports that private equity firm Clayton Dubilier & Rice is considering an acquisition to take the packaging company private.

🏪 Dillard's climbs 10% after reporting third-quarter revenue of $1.49 billion, beating estimates of $1.43 billion, with comparable store sales up 3%.

Trending Stocks 📊

🚗 Lyft (LYFT)

Loop Capital upgraded its outlook on Lyft, raising the price target to $31 from $20—implying 29% upside from yesterday’s close.

The firm maintained its buy rating, citing favorable business fundamentals as it heads into 2026.

Analyst Rob Sanderson highlighted that secular trends remain strong, demand trends are solid, and Lyft is competing effectively on product and service levels while steadily improving margins.

🚀 Firefly Aerospace (FLY)

Firefly Aerospace shares rallied 17% after the Texas-based aerospace company reported a narrower-than-expected adjusted loss while exceeding revenue expectations.

More importantly, the company raised its fiscal year 2025 revenue guidance to a range of $150 million to $158 million, substantially higher than the prior analyst consensus of $136 million, signaling accelerating momentum in the commercial space launch market.

🤑 Flutter Entertainment (FLUT)

Flutter Entertainment, the world's largest sports betting and gambling company and owner of FanDuel, saw shares decline 14% despite posting a significant earnings beat.

The company missed revenue expectations and cut its full-year guidance, citing a winning streak among gamblers that impacted profitability.

Flutter separately announced the upcoming December launch of FanDuel Predicts, a new prediction markets app, as it seeks to diversify its product offerings.

What’s Next?

Key market and macro news 👇

📊 The October 2025 PPI data will be released, providing a key inflation indicator that could heavily influence the Federal Reserve’s upcoming interest rate decisions.

👩💼 The release of continuing jobless claims and the 4-week average will offer insights into the health of the labor market, a crucial factor for the Fed.

🏦 Speeches by FOMC members Bostic, Schmid, and Logan will be closely watched for clues about the future direction of monetary policy and interest rates.

🤝 A new trade agreement with Argentina, which reduces tariffs on goods such as beef and coffee, could impact commodity prices and benefit specific sectors of the U.S. economy.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.