- Ziggma

- Posts

- 🗞️ Walmart Inks Deal With OpenAI

🗞️ Walmart Inks Deal With OpenAI

Big Moves Decoded: BG, AMD, and PLD

Market Performance

S&P 500: 6,671.06 ⬆️ 0.40%

Nasdaq: 22,670.08 ⬆️ 0.70%

Dow Jones: 46,253.31 ⬇️ 0.04%

Walmart Partners With OpenAI

Walmart (WMT) is rewriting the retail playbook by integrating shopping directly into ChatGPT through OpenAI's new Instant Checkout feature.

Soon, customers can chat about what they need, whether it's meal planning, household restocking, or gift ideas, and purchase items without leaving the conversation.

This marks a fundamental shift from traditional search-bar shopping to what Walmart CEO Doug McMillon calls "agentic commerce": AI that learns, predicts, and anticipates needs before customers do.

The move positions Walmart ahead of the curve as consumers increasingly turn to AI chatbots for shopping inspiration and deals.

While financial terms weren't disclosed, OpenAI will charge Walmart transaction fees, creating a new revenue stream for the AI company.

Walmart already uses AI throughout its operations—cutting fashion production timelines by 18 weeks and customer care resolution times by 40%.

WMT stock surged nearly 5% Tuesday, hitting a 52-week high as investors recognized this partnership's potential to capture the next generation of shoppers.

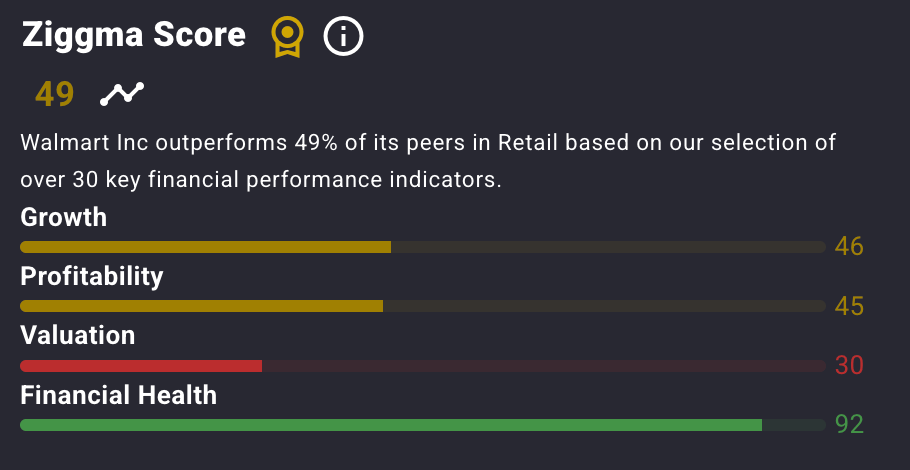

WMT stock has a Ziggma score of 49, as it trails peers across metrics such as growth, profitability, and valuation.

Our Takeaway

Walmart is fundamentally reimagining how people shop.

By meeting customers where they already are (ChatGPT) and removing friction from purchasing, Walmart strengthens its competitive moat against Amazon and other retailers.

This "chat and buy" model could become the new standard for e-commerce.

Myth: Pet insurance doesn’t cover everything

Many pet owners worry that insurance won’t cover everything, especially routine care or pre-existing conditions. While that’s true in many cases, most insurers now offer wellness add-ons for preventive care like vaccines, dental cleanings, and check-ups, giving you more complete coverage. View Money’s pet insurance list to find plans for as low as $10 a month.

Market Overview 📈

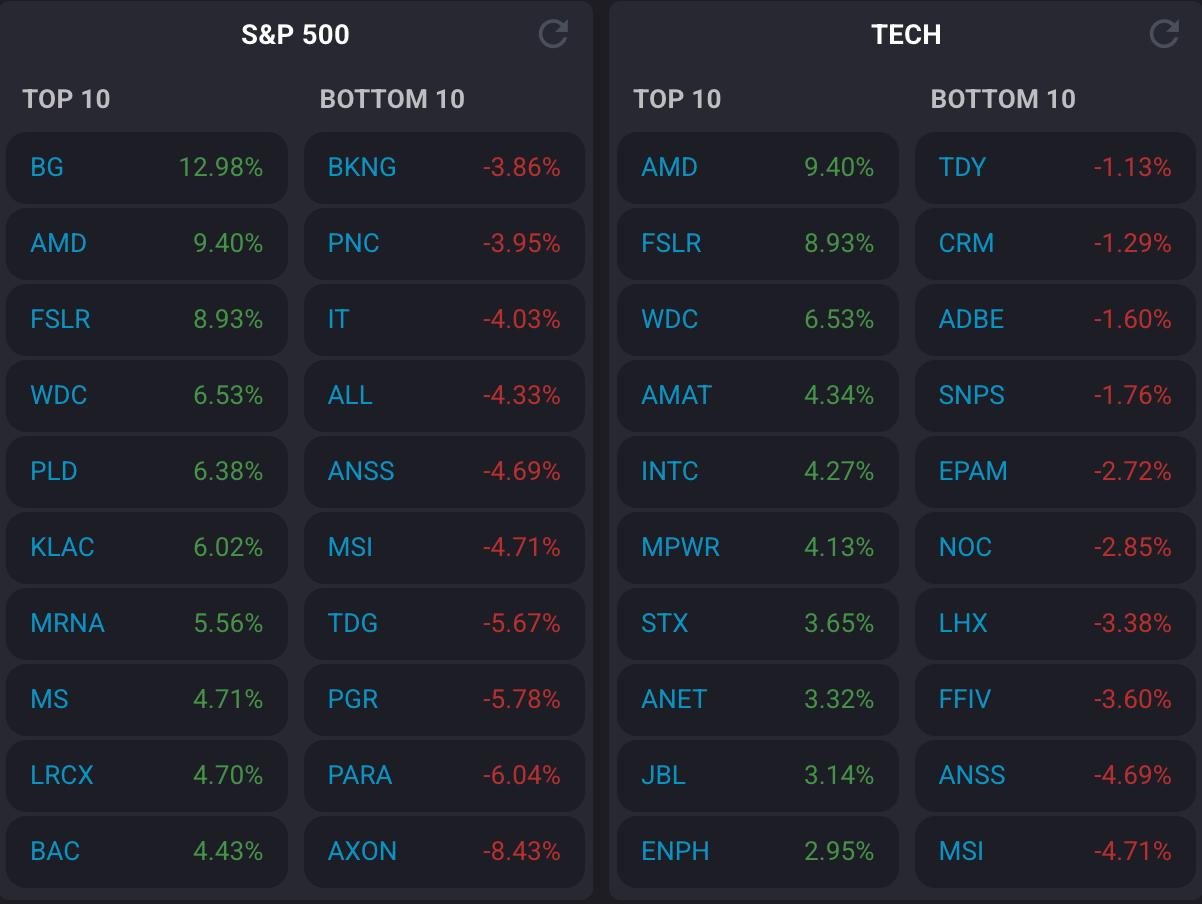

Wednesday's session delivered a classic tale of two halves. The S&P 500 initially surged 1.2% on blockbuster bank earnings from Morgan Stanley and Bank of America, only to surrender most gains by day's end as trade war jitters resurfaced.

Yet the specter of escalating U.S.-China tensions kept investors on edge.

President Trump threatened China with an additional 100% tariff and a cooking oil embargo in retaliation for Beijing's refusal to buy U.S. soybeans and its strict export controls on rare earth minerals.

Treasury Secretary Scott Bessent made clear the administration won't back down: "We won't negotiate because the stock market is going down."

The Cboe Volatility Index (VIX) jumped to 20.6, its highest since late May, reflecting persistent uncertainty.

Adding to the chaos, the three-week government shutdown has halted critical economic data releases, leaving traders flying blind.

Despite the turbulence, strong earnings and a potential Fed rate cut are keeping optimism alive—for now.

Stock Moves Deciphered 📈

🌾 Bunge Global (BG)

Bunge shares surged 13% after President Trump threatened to impose an embargo on Chinese cooking oil.

The company, one of the world's largest soybean processors and cooking oil producers, stands to benefit massively if the U.S. cuts off Chinese cooking oil imports.

🤖 Advanced Micro Devices (AMD)

AMD surged on news that Oracle plans to deploy 50,000 of its next-generation MI300 AI chips in a massive data center buildout.

The deal, part of Oracle's $40 billion chip purchase for OpenAI's U.S. infrastructure, validates AMD's growing competitiveness against Nvidia in the AI chip market.

The company also announced plans to sell ZT Systems' server-manufacturing business for $3 billion, allowing AMD to focus on its core chip design business while maintaining crucial data center relationships.

🏭 Prologis (PLD)

Prologis posted strong third-quarter 2025 earnings that exceeded analyst expectations, driving shares higher.

The industrial real estate giant reported robust leasing activity across its global portfolio of logistics facilities, benefiting from continued e-commerce growth and supply chain modernization.

Strategic advances in Prologis's energy infrastructure and data center businesses also contributed to investor enthusiasm.

Headlines You Can't Miss 👀

🍕 Papa John's International soared 11% on reports that Apollo Global Management offered $64/share to take the pizza chain private.

⚫ Sable Offshore tumbled 23% after a California judge ruled against the company in a dispute over the Santa Ynez oil project.

💎 BlackRock hit all-time highs after Evercore ISI raised its price target to $1,300, citing strong Q3 results with $171B in inflows and 10% organic base fee growth.

🏭 New York Manufacturing Index surged to 10.7 in October (vs. -1.8 expected), jumping 19.4 points as factory activity, hiring, and optimism all accelerated.

💼 Treasury Secretary Scott Bessent announced the Trump administration will set price floors across industries to combat China's market manipulation, particularly in rare earths.

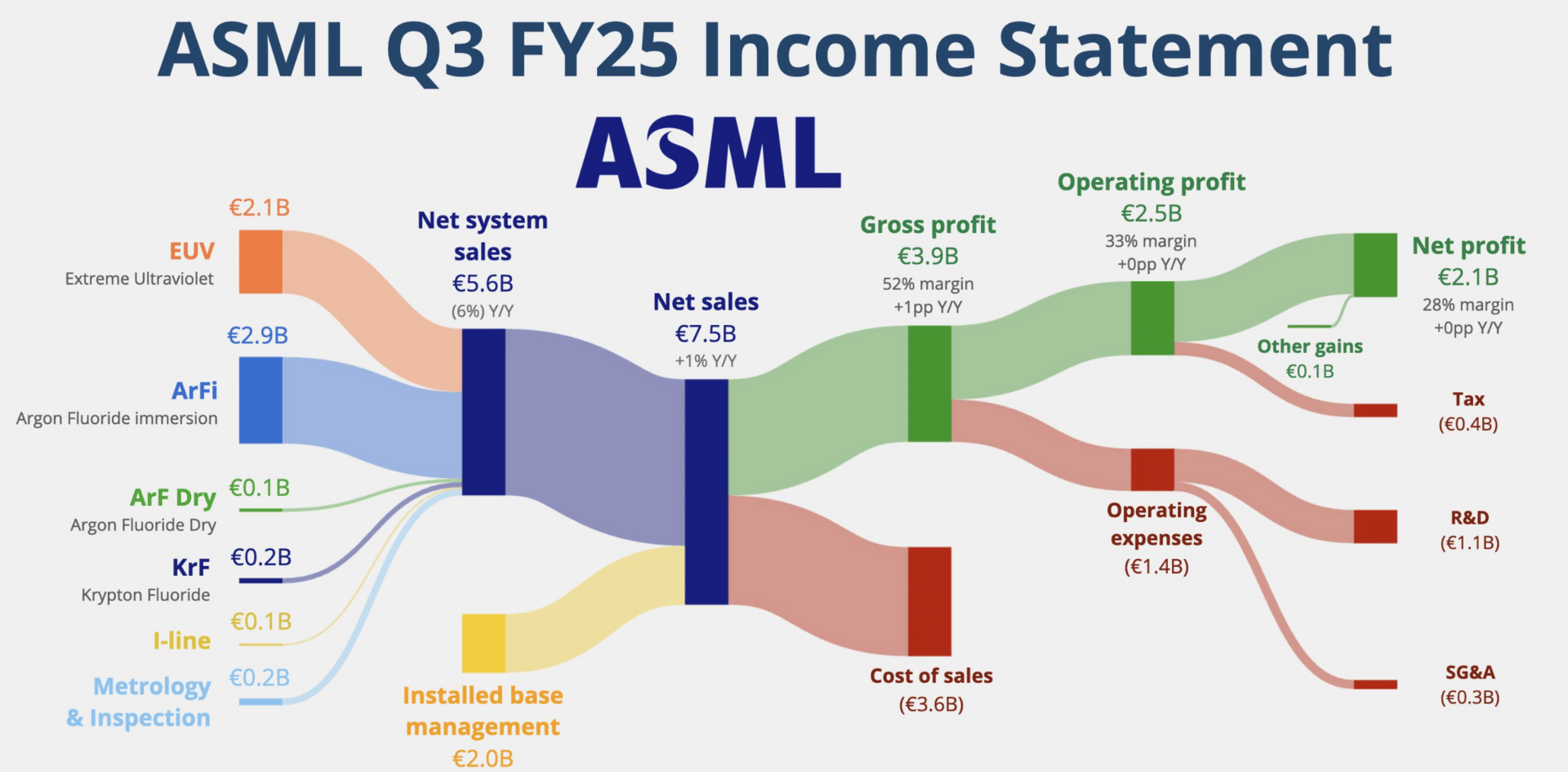

🔧 ASML shares jumped 4% after the chipmaker equipment manufacturer projected 2026 sales would exceed 2025 levels, citing AI's growing value in their product roadmap.

🏢 Lockheed Martin and Northrop Grumman fell 1% and 3% respectively, after Treasury Secretary Bessent suggested Trump might pressure defense companies to reduce share buybacks.

Trending Stocks 📊

💳 Morgan Stanley (MS)

Morgan Stanley rallied 4.7% after crushing third-quarter expectations with earnings of $2.80 per share on revenue of $18.22 billion—well above the $2.10 per share and $16.7 billion analysts anticipated.

Strong performance across investment banking and wealth management drove the beat, signaling robust client activity despite market volatility.

CEO Ted Pick emphasized the firm's diversified business model, noting strength in both advisory services and trading revenues as key contributors to the quarter's success.

💰 Bank of America (BAC)

Bank of America shares climbed 4.4% following a stellar earnings beat, reporting $1.06 per share on revenue of $28.24 billion versus expectations of $0.95 per share on $27.5 billion.

Investment banking revenue proved to be the standout driver, reflecting strong deal-making activity and robust capital markets performance.

The bank's broad-based strength across consumer banking, wealth management, and trading operations underscores the resilience of the U.S. financial system.

🛒 Dollar Tree (DLTR)

Dollar Tree shares popped after the discount retailer projected "high-teens percentage" earnings per share growth for fiscal 2026, exceeding the 15% growth analysts currently expect.

The upbeat guidance signals management's confidence in the company's ability to capitalize on value-conscious consumers amid an uncertain economic environment.

What’s Next?

Key market and macro news 👇

💸 Taiwan Semiconductor Manufacturing Company Earnings: TSM, a major chip manufacturer, is expected to report its third-quarter earnings, which could impact the broader tech sector.

🏦 Bank of New York Mellon Earnings: The bank's earnings report will be watched for insights into the health of the financial sector.

📊 Producer Price Index (PPI) Data: The Bureau of Labor Statistics is scheduled to release the Producer Price Index (PPI) data, which will provide insight into inflation at the wholesale level.

🛍️ Retail Sales Data: The Census Bureau will release retail sales data for September, a key indicator of consumer spending and the overall health of the economy.

🧑✈️Unemployment Claims: The Department of Labor will release the weekly initial jobless claims report, which can influence investor sentiment regarding the labor market.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.