- Ziggma

- Posts

- 🗞️ Visa's Stablecoin Push

🗞️ Visa's Stablecoin Push

Big Moves Decoded: Tesla, Ford, and more!

Market Performance

S&P 500: 6,800.26 ⬇️ 0.24%

Nasdaq: 23,111.46 ⬆️ 0.23%

Dow Jones: 48,114.26 ⬇️ 0.62%

Visa Goes All-In on Stablecoin Settlement

Visa (V) made a bold move that could reshape how money moves through the financial system.

The payments giant launched USDC stablecoin settlement in the United States, allowing banks and card issuers to settle transactions 24/7 using Circle's dollar-backed digital currency.

Cross River Bank and Lead Bank are already settling with Visa in USDC over the Solana blockchain, with broader U.S. rollout planned through 2026.

The numbers tell the story: Visa's monthly stablecoin settlement volume has already hit a $3.5 billion annualized run rate.

What makes this significant? Traditional settlement operates on a five-day business week schedule.

USDC settlement offers seven-day availability, faster funds movement, and enhanced operational resilience—all without changing anything for consumers swiping their cards.

Visa's also doubling down by partnering with Circle on Arc, a new blockchain explicitly designed for high-volume commercial activity, where Visa will operate a validator node.

Following President Trump's Genius Act legislation in July that established stablecoin rules, major players like PayPal and Mastercard have rushed into the space.

Visa now has over 130 stablecoin-linked card programs across 40+ countries.

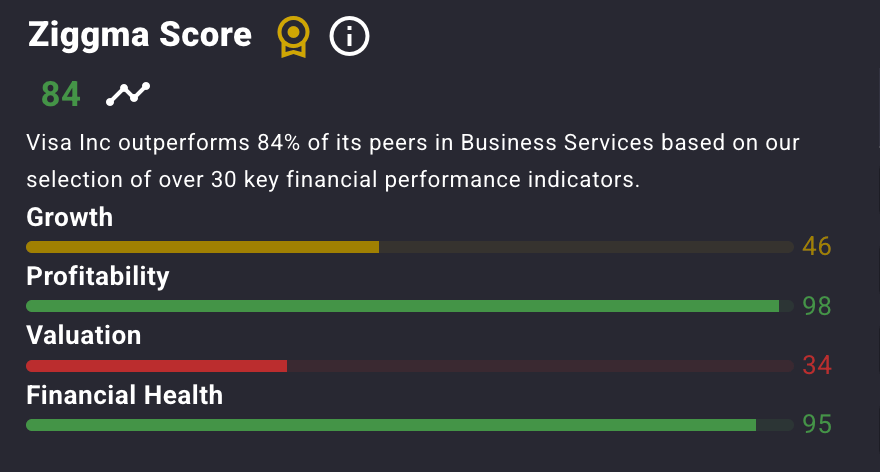

Visa stock has a Ziggma score of 84 and ranks above most peers in terms of profitability and financial health.

The financial services giant has returned close to 340% in the past decade and trades at a steep valuation in December 2025.

Our Takeaway

Visa is positioning itself at the intersection of traditional finance and crypto infrastructure.

While the immediate consumer impact is minimal, this move gives banks modernized treasury operations and could accelerate the adoption of blockchain-based settlement across the broader payments industry.

The real question is whether competitors can keep pace as Visa establishes a first-mover advantage in institutional stablecoin settlement.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Market Overview 📈

Tuesday's mixed session reflected an economy caught between resilience and vulnerability.

The delayed November jobs report showed 64,000 jobs added—beating the 45,000 consensus—but October's revised loss of 105,000 jobs and unemployment rising to 4.6% (above the expected 4.5%) raised concerns about cracks in the labor market.

Despite mixed jobs data, Fed rate-cut odds for January remained unchanged at 24%, signaling the central bank's cautious stance.

"Today's data paints a picture of an economy catching its breath," said Gina Bolvin of Bolvin Wealth Management Group. "Job growth is holding on, but cracks are forming."

Energy stocks dragged markets lower as U.S. crude oil plunged below $55 per barrel—the lowest level since early 2021—amid concerns about oversupply and potential peace agreements in Ukraine. Exxon Mobil and Chevron each fell roughly 2%.

Meanwhile, AI and tech stocks took a breather as investors rotated into defensive sectors.

Broadcom, Oracle, and Microsoft all closed lower on Monday as profit-taking accelerated.

However, analysts view this as healthy market broadening rather than trouble ahead. "It's completely normal for the AI trade to take a breather," noted Eric Diton of The Wealth Alliance.

Stock Moves Deciphered 📈

Comcast (CMCSA)

Shares surged 5.4% on speculation that activist investor interest was driving the move and on the record date for its cable network spinoff, Versant.

High trading volume was driven by investors seeking exposure to the new company and arbitrage opportunities.

The stock was also named a top 2026 pick by Barron's, adding to the bullish momentum.

Humana (HUM)

The health insurer tumbled 6% after announcing a leadership transition in its insurance segment, creating uncertainty among investors.

While the company reaffirmed its full-year earnings guidance, expectations came in slightly below analyst forecasts, putting pressure on the stock.

The stock's decline reflects concerns about execution during the management transition period.

Estée Lauder (EL)

Shares closed 3.3% higher following positive analyst actions. Evercore ISI and Bank of America both issued favorable ratings and increased price targets.

The company's strong third-quarter earnings beat and optimistic guidance for fiscal year 2026 fueled investor confidence, signaling a potential turnaround in the beauty giant's performance.

Headlines You Can't Miss 👀

📊 Southwest Airlines reported its 11th straight positive session—a new record dating back to 1972—following a Barclays upgrade to “overweight”, citing an improved commercial strategy.

🏦 JPMorgan named AT&T a top 2026 stock pick with a $33 price target (36% upside), citing defensible market share gains and $20 billion in planned buybacks through 2027.

✈️ Medline Industries is discussing upsizing its IPO from $5.4 billion to potentially $7 billion, making it one of the biggest listings of the year amid strong investor demand.

🛢️ U.S. crude oil hit $54.98 per barrel—the lowest since February 2021—as traders factor in looming oversupply and a potential Ukraine peace agreement that could affect global energy markets.

📺 Nasdaq has requested SEC approval to extend trading hours to 23 hours during the week, proposing an additional session from 9 p.m. to 4 a.m. ET.

🍔 Kraft Heinz announced former Kellanova CEO Steve Cahillane will lead the company starting January 1, ahead of its planned split into two publicly traded entities in 2026.

🏛️ Atlanta Fed's Bostic revealed he opposed last week's interest rate cut, citing persistently high inflation as a greater risk than a slowing labor market to the economy.

📈 Eight S&P 500 stocks hit all-time highs on Tuesday, including General Motors, Ross Stores, TJX Companies, Delta Air Lines, and Hartford Financial, signaling strength beyond mega-cap tech.

Trending Stocks 📊

Tesla (TSLA)

The rally came after Tesla executives announced over the weekend that the company is testing driverless cars on public roads in Austin with no occupants.

CEO Elon Musk confirmed "testing is underway with no occupants in the car," while Tesla's official account teased that "the fleet will wake up via over-the-air software update" with the cryptic message: "Slowly then all at once."

Ford Motor (F)

Ford announced it expects to record approximately $19.5 billion in special charges related to restructuring its business priorities and pulling back from all-electric vehicle investments.

Most charges will occur in Q4 2025, followed by $5.5 billion in cash charges through 2027. Despite the charges, Ford increased its adjusted EBIT guidance to $7 billion for 2025.

The restructuring includes refocusing on hybrid vehicles rather than pure EVs, canceling next-generation large electric trucks in favor of smaller, more affordable EVs, and rebalancing investments toward core trucks and SUVs.

Pfizer (PFE)

Shares fell after the pharmaceutical giant issued disappointing 2026 earnings guidance of $2.80- $3.00 per share, which missed the consensus estimate of $3.05.

The company reaffirmed its 2025 outlook, but the lower-than-expected 2026 forecast raised concerns about the company's growth trajectory.

The guidance miss suggests ongoing challenges in Pfizer's post-pandemic portfolio transition, as COVID-19 product revenues continue to decline.

Roku (ROKU)

The streaming platform jumped over 4% after Morgan Stanley upgraded the stock to overweight from underweight and increased the price target to $135 from $85 (24% upside).

Analyst Thomas Yeh cited higher conviction that Roku can sustain double-digit platform revenue growth, driven by deepening streaming partnerships, price increases, premium subscription adoption, healthy advertising backdrop, and connected TV industry tailwinds, including political advertising and sports migration.

What’s Next?

Key market and macro news 👇

🚛 FedEx reports on Thursday after the bell; results will provide key insights into holiday shipping demand and e-commerce trends.

🌯 General Mills announces quarterly results this week; focus will be on pricing power amid continued food inflation pressures.

📊 November retail sales data will be released on Wednesday; it is a critical gauge of consumer spending strength entering the holiday season.

🏠 Housing starts and building permits data due Wednesday; indicators of residential construction momentum amid elevated mortgage rates.

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.