- Ziggma

- Posts

- ✈️ United Air Takes Off

✈️ United Air Takes Off

PLUS: Moderna continues to surge

Market Performance

S&P 500: 6,875.62 ⬆️ 1.16%

Nasdaq: 23,224.82 ⬆️ 1.18%

Dow Jones: 49,077.23 ⬆️ 1.21%

United Airlines Soars on Record Earnings Forecast

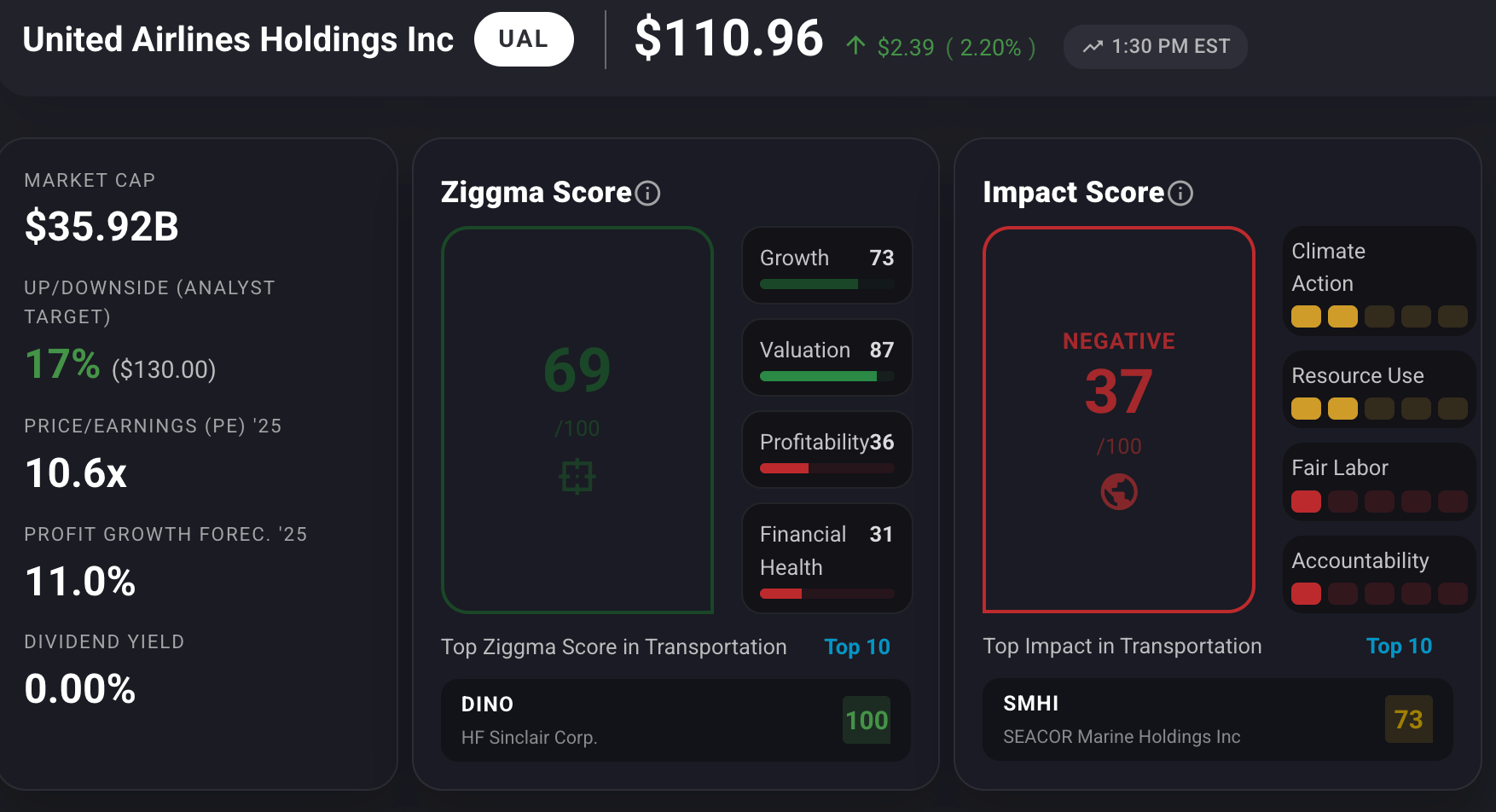

United Airlines (UAL) just announced it expects to generate record earnings in 2026, and the market loved it—shares popped 2.2% yesterday.

The airline is forecasting adjusted earnings per share between $12 and $14 this year, right in line with analyst expectations of $13.16.

What's driving this confidence? Three things: premium seat sales are on fire (up 9% in Q4), business travel is roaring back, and even their no-frills basic economy tickets jumped 7% in the final quarter of 2025.

United isn't alone here—rival Delta has made similar projections, with these two carriers accounting for nearly all U.S. airline industry profits in the first nine months of 2025.

The company beat Q4 expectations, reporting adjusted EPS of $3.10 versus the $2.94 expected, and pulling in $15.4 billion in revenue.

CEO Scott Kirby's growth strategy is clearly resonating, with customers "choosing us," as he put it.

UAL stock has a Ziggma score of 69, ranking higher than peers in valuation and growth.

Our Takeaway

United's bet on premium cabins is paying off handsomely.

While competitors struggle, United and Delta are essentially printing money by focusing on higher-margin passengers willing to pay for comfort.

If this travel demand holds, 2026 could indeed be a record year.

➡️ NEW: Original Ziggma Research on Substack: Is Microsoft the Best Long-Term AI Play - For Shareholders and the Climate? 🔖 Read or 🎧 listen to podcast.

Market Overview 📈

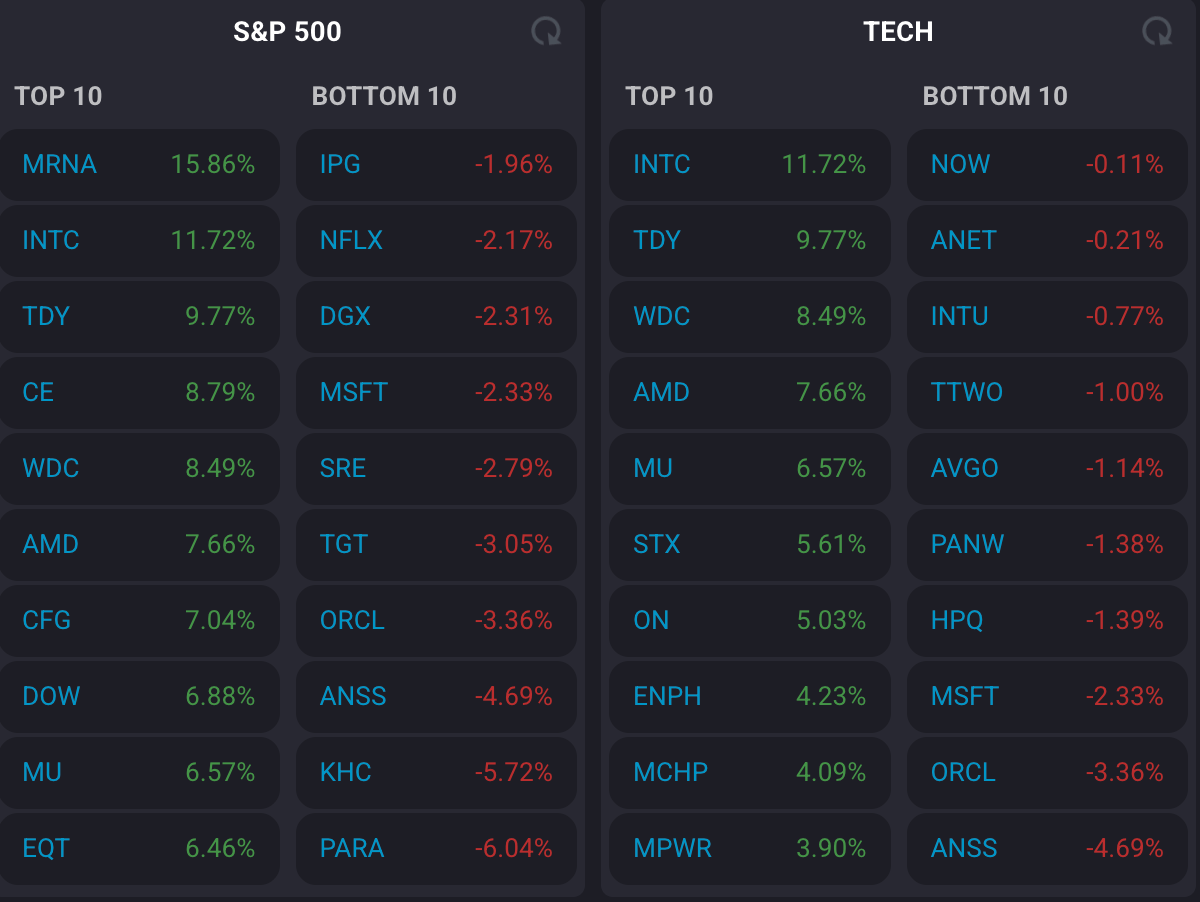

U.S. equities leaped on Wednesday after President Trump called off new European tariffs, saying a deal framework has been reached over Greenland. The rally reversed Tuesday's brutal "sell America" trade that had sent stocks tumbling.

Tech stocks like Nvidia and AMD led the comeback as investors piled back into growth names.

Bank stocks also rose after Trump said he'd ask Congress to implement a proposed 10% credit card cap—an uncertain prospect given lawmaker skepticism.

Citigroup and Capital One each gained roughly 1%.

The reversal came after Trump posted on Truth Social about forming "the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region," announcing he wouldn't impose tariffs scheduled for February 1st.

Treasury Secretary Scott Bessent told reporters the administration was "not concerned" about the prior session's sell-off.

Meanwhile, small caps continued their remarkable run—the Russell 2000 hit an all-time high and has now outperformed the S&P 500 for 13 consecutive days, the longest streak since June 2008.

The index is up more than 8% in 2026, while the S&P 500 sits barely in positive territory.

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Stock Moves Deciphered 📈

🤖 Intel (INTC)

Intel surged 11.72% as investor optimism soared ahead of its earnings report. The rally was fueled by strong anticipated demand for its server chips in the booming AI sector, a recent analyst upgrade, and significant backing from both the U.S. government and industry leader Nvidia, bolstering confidence in its turnaround strategy.

💉 Moderna (MRNA)

Moderna jumped 15.84% following positive long-term data from its cancer vaccine trial with Merck.

The study revealed a sustained 49% reduction in the risk of recurrence or death for high-risk melanoma patients, exciting investors about the potential of its mRNA platform beyond its well-known COVID-19 vaccine.

💰 Teledyne Technologies (TDY)

Teledyne announced record-breaking fourth-quarter financial results, with sales up 7.3% and non-GAAP earnings per share up 14.1%.

The impressive performance, driven by strength in its defense and digital imaging businesses, led to a robust and optimistic forecast for the upcoming year.

🚀 Celanese Corporation (CE)

Celanese shares climbed 8.5% after the chemical company surpassed quarterly earnings expectations, posting $1.34 per share against a forecast of $1.27.

The stock also crossed a key technical indicator—its 200-day moving average—which signaled a bullish trend to investors and contributed to the day's gains.

Headlines You Can't Miss 👀

📊Berkshire set to exit its entire 27.5% stake in Kraft Heinz, underscoring CEO Greg Abel's willingness to move on from Warren Buffett's rare misstep.

🎮 GameStop CEO Ryan Cohen disclosed purchasing 500,000 shares at roughly $21.12, now owning more than 41 million shares, representing a 9.2% stake.

💰 Gold broke a fresh record above $4,800 on Wednesday as investors sought safety amid tariff threats and renewed global trade war concerns.

🏋️ Planet Fitness could see upside as Canaccord raised its price target to $140, citing surveys showing strong January membership sign-ups at geographically diverse locations.

🌍 European lawmakers suspended the EU's July trade deal with the U.S. after Trump's plans to impose 10-25% tariffs on European nations over Greenland.

💎 Broadcom CEO told TD Cowen there's "insatiable" demand for its chips, with clear confidence in meaningful upside to its disclosed backlog figure.

🤖 Deutsche Bank warned the "honeymoon is over" for AI, predicting 2026 will be the most difficult year yet as challenges around accuracy and economics emerge.

⚖️ Supreme Court justices expressed skepticism about Trump's authority to fire Federal Reserve Governor Lisa Cook, with concerns about weakening Fed independence.

Trending Stocks 📊

📺 Netflix (NFLX)

The streaming giant fell 4% after posting underwhelming first-quarter guidance, even though it marginally beat Q4 earnings expectations.

Netflix reported adjusted EPS of $0.56, beating the $0.55 estimate, and revenue of $12.05 billion, exceeding the $11.97 billion estimate. However, first-quarter guidance of $0.76 per share underperformed analyst expectations of $0.81.

The company also reached a fresh milestone of 325 million global paid subscribers.

⬆️ Interactive Brokers (IBKR)

The automated global electronic broker surged by more than 4% after the fintech giant beat expectations.

Interactive Brokers reported adjusted earnings of $0.65 per share for the fourth quarter, exceeding analysts' forecast of $0.59 per share.

🎽 Carter's Inc (CRI)

Shares surged 8.56% after Citi upgraded the children's apparel retailer to buy from neutral, raising its price target to $50 from $34.

Analyst Paul Lejuez cited new CEO Doug Palladini's significant changes as transforming the business trajectory, calling Carter's a "top turnaround story of 2026."

What’s Next?

Key market and macro news 👇

💰 Microsoft Q4 2025 Earnings Report: As a tech bellwether, Microsoft's quarterly results, especially revenue from its cloud computing and AI divisions, will be scrutinized by investors for signs of broader industry health.

🧾 The Department of Labor will release its weekly report on initial jobless claims. This key economic indicator provides insight into the labor market's strength and potential inflationary pressures.

⛽️ Exxon Mobil Investor Day: Management will present its long-term strategy, production forecasts, and capital expenditure plans.

📉 The Bureau of Labor Statistics is expected to release the latest CPI data. This inflation metric is critical as it heavily influences the Federal Reserve's monetary policy decisions.

🚗 Tesla may unveil advancements in its full self-driving technology. Significant breakthroughs or delays could cause high volatility in its stock and among related automotive and tech companies.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.