- Ziggma

- Posts

- 💰 Uber's Widening Moat

💰 Uber's Widening Moat

Big moves decoded: ETSY, HOOD, and WDC

Market Performance

S&P 500: 6,661.21 ⬆️ 0.26%

Nasdaq: 22,591.15 ⬆️ 0.48%

Dow Jones: 46,316.07 ⬆️ 0.15%

Uber Takes Aim at Grocery Delivery

Uber Technologies (UBER) is making serious moves in grocery and retail delivery, projecting an annual run rate of $12.5 billion in non-restaurant gross bookings by year-end, 25% higher than its May forecast of $10 billion.

This acceleration signals Uber's determination to compete head-on with Instacart, DoorDash, and Amazon in the lucrative grocery space.

The delivery segment now contributes nearly half of Uber's total gross bookings and has been growing faster than its core rideshare business for three consecutive quarters.

CEO Dara Khosrowshahi attributes this momentum to "robust growth" in grocery and retail orders. However, he acknowledges substantial room for expansion as 75% of Uber's rideshare customers haven't tried ordering groceries through the app.

To capture this opportunity, Uber added 1,000 new retail partners this year, including Aldi, Sephora, Best Buy, and Dollar General.

The company is also launching weekly discounts on fresh produce and dairy products across eight countries, while introducing features such as live order editing and intelligent product substitution.

Uber stock currently has a Ziggma Stock Score of 44, and ranks in the bottom half percentile in terms of growth, profitability, and valuation.

Our Takeaway

Uber's grocery push is about survival in a market dominated by Amazon and Walmart.

With peak Sunday evening demand and expanded partnerships, Uber is building the infrastructure to become a weekly habit, not just a last-minute solution.

The real test? Converting its massive rideshare base into regular grocery customers before competitors lock in market share.

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Market Overview 📈

Wall Street regained momentum on Monday as the S&P 500, Nasdaq, and Dow all closed higher, recovering from last week's concerns about AI-driven trading.

Technology stocks led the rebound, with AI chip darling Nvidia climbing approximately 2% after questions about energy infrastructure for AI projects pressured shares last week.

Other AI beneficiaries, such as AMD and Micron Technology, added over 1% and 4%, respectively.

The broader rally received support from surging M&A activity, as Electronic Arts announced a $55 billion take-private deal, pushing U.S. mergers and acquisitions past $1 trillion year-to-date—up 29% from last year, according to Goldman Sachs.

Meanwhile, investors remained focused on the looming government funding deadline this week, with concerns that a shutdown could delay the release of critical economic data.

Despite historical precedent showing minimal market impact from shutdowns, sentiment could suffer if data delays muddy the Federal Reserve's interest rate outlook heading into October's policy meeting.

Stock Moves Deciphered 📈

Etsy (ETSY) 🛍️

Etsy shares surged nearly 16% and hit a fresh 52-week high after OpenAI announced Instant Checkout, a feature allowing ChatGPT users to purchase products directly through the AI chatbot.

Etsy will be the initial partner for this payment integration, representing a significant expansion of the marketplace's distribution channel.

Western Digital (WDC) 💿

Western Digital surged 9% as analysts raised their price targets, citing explosive demand for AI-driven data storage solutions.

The company's hard disk drives have become essential infrastructure for AI model training and large-scale data centers, creating a multi-year growth runway.

CSX (CSX) 🚞

CSX rose over 5% after naming Steve Angel as chief executive, replacing Joe Hinrichs in a management shake-up following pressure from activist investor Ancora Holdings.

The railroad operator has faced criticism over declining operational efficiency, with activists pushing for improved performance metrics and consideration of strategic mergers and acquisitions (M&A) opportunities as the rail industry consolidates.

Headlines You Can't Miss 👀

🎮 Electronic Arts announced a $55 billion take-private deal with PIF, Silver Lake, and Affinity Partners, boosting shares 4.5% on strong M&A momentum.

☁️ Alibaba surged to a 52-week high after Morgan Stanley raised its price target to $200, citing accelerating cloud revenue and AI model advancements.

🌿 Cannabis stocks rallied sharply as President Trump endorsed cannabinoid use for seniors, with the AdvisorShares Pure U.S. Cannabis ETF soaring 25%.

🏡 Pending home sales unexpectedly rose 4% in August as mortgage rates declined to 6.58%, signaling improving housing market conditions.

⚡ Coal stocks jumped after the Trump administration unveiled a $625 million investment plan to upgrade and recommission coal power plants nationwide.

🎬 Trump announced 100% tariffs on foreign-made movies to protect U.S. film production, pressuring shares of Warner Bros Discovery and Comcast.

🤖 Oklo rebounded nearly 6% after Barclays initiated coverage with an "overweight" rating and a $146 price target, citing its potential in nuclear energy.

⚠️ Government shutdown looms as funding deadline approaches, with Labor Department warning it won't release jobs data if operations are suspended this week.

Trending Stocks 📊

🚀 Robinhood (HOOD): Robinhood skyrocketed 12% to an all-time high, driven by surging cryptocurrency trading revenues and its inclusion in the S&P 500, with analyst upgrades citing sustainable diversification and improved profitability.

📉 Novo Nordisk (NVO): The Danish pharmaceutical giant faces mounting competitive pressure in the GLP-1 obesity treatment market, with Morgan Stanley downgrading to underweight, citing slowing prescription growth and narrowing patent exclusivity.

🤖 Lam Research (LRCX): The semiconductor equipment manufacturer climbed 3% following Deutsche Bank's upgrade to buy, citing improving wafer fabrication equipment outlook and valuation in line with peers.

What’s Next?

Key earnings and macro news 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

Nike (NKE), a consumer spending bellwether, is scheduled to report its quarterly results today.

Paychex (PAYX), an indicator of small business health, is scheduled to report earnings this Tuesday before the market opens.

Government funding deadline on Tuesday at midnight suggests potential shutdown could delay Friday's jobs report.

Manufacturing PMI figures expected to show continued expansion.

Chart of the Day

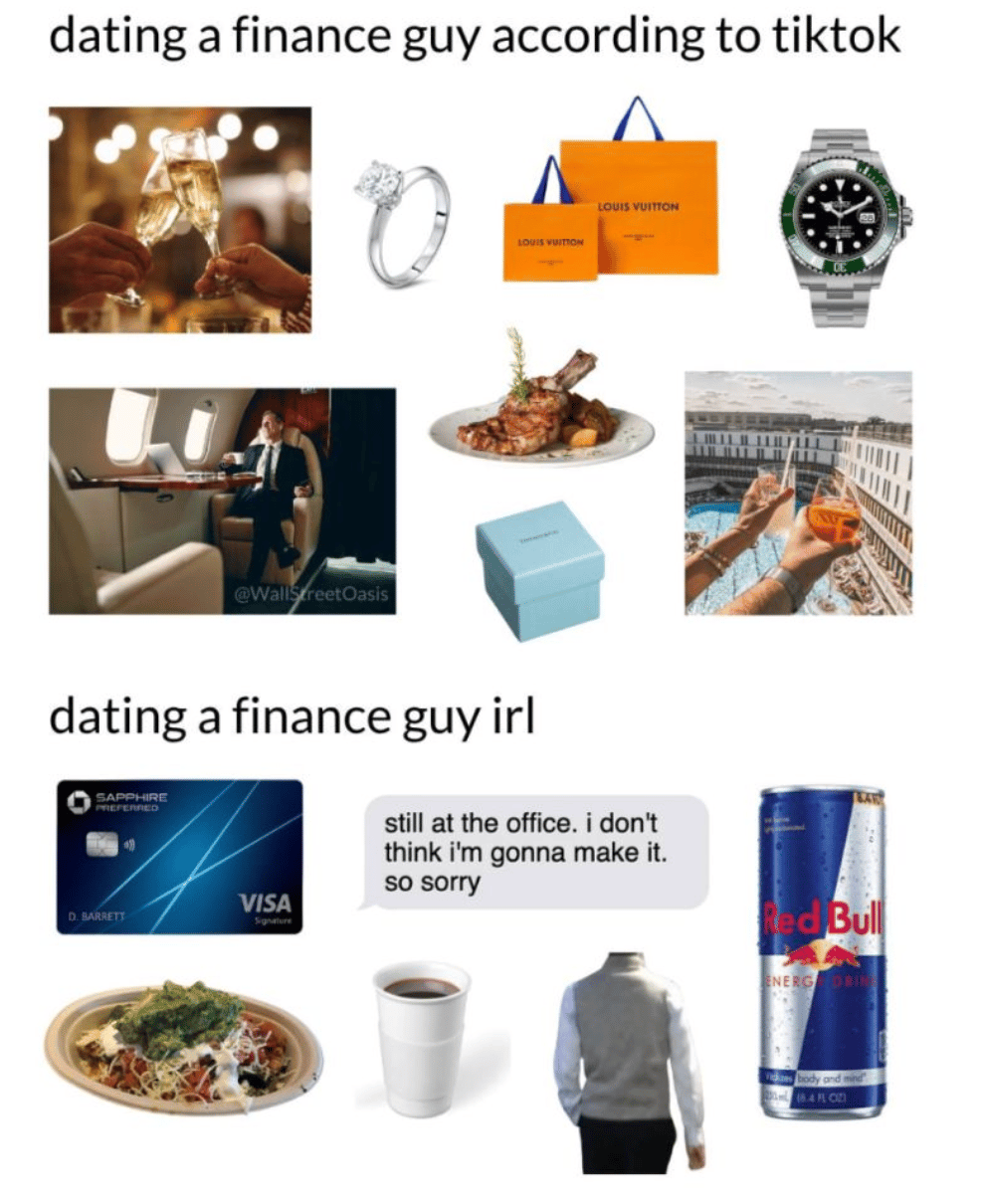

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.