- Ziggma

- Posts

- 💰 TSMC's Blowout Q4

💰 TSMC's Blowout Q4

PLUS: Chip stocks rally

Market Performance

The major averages climbed on Thursday, rebounding from back-to-back losses as chip and bank stocks rallied.

S&P 500: 6,944.47 ⬇️ 0.26%

Nasdaq: 23,530.02 ⬇️ 0.25%

Dow Jones: 49,442.44 ⬇️ 0.60%

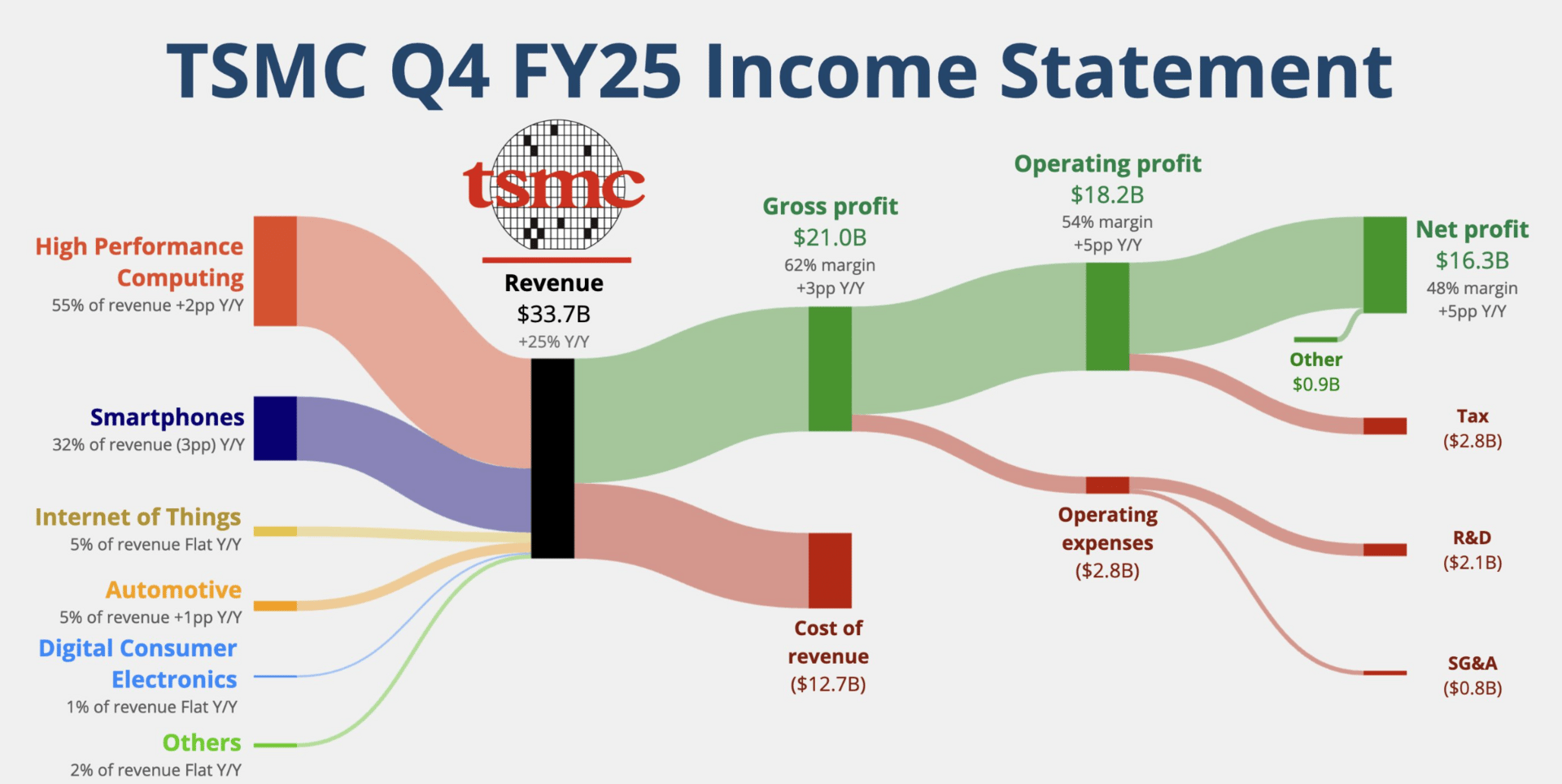

TSMC's Record Quarter Signals AI Boom Isn't Slowing

Taiwan Semiconductor Manufacturing Company (TSMC) just posted a jaw-dropping 35% jump in fourth-quarter profit, crushing analyst expectations and marking its eighth consecutive quarter of year-over-year growth.

But here's the really telling part:

TSMC announced it's ramping up capital spending to between $52 billion and $56 billion in 2026—up from $40.9 billion in 2025.

That's not the behavior of a company worried about an AI bubble.

TSMC produces the advanced chips powering AI systems for giants like Nvidia and AMD, and demand shows no signs of cooling.

The chipmaker's high-performance computing division—which includes AI applications—accounted for 55% of sales last quarter.

Advanced chips (7-nanometer or smaller) now represent 77% of total revenue.

What makes this particularly significant is TSMC's aggressive push into 2-nanometer production.

Smaller nanometers mean faster, more efficient chips—exactly what AI applications demand.

The company is also expanding its Arizona operations with additional land purchases to build multiple fabs, though Chairman C.C. Wei flagged potential tariff risks as a concern heading into 2026.

Our Takeaway

When the world's largest chipmaker increases capital spending by 27% and talks about "very strong" AI demand, that's a powerful signal.

The infrastructure buildout for AI is in full swing, and TSMC sits at the center of it.

➡️ NEW: Original Ziggma Research on Substack: Is Microsoft the Best Long-Term AI Play - For Shareholders and the Climate? 🔖 Read or 🎧 listen to podcast.

Market Overview 📈

Thursday's rally was broad-based, driven by stellar earnings from chipmakers and banks, along with encouraging economic data.

Taiwan Semiconductor's blowout results and massive capital spending plans reassured investors that AI demand remains robust, lifting the VanEck Semiconductor ETF 2% and tech stocks broadly.

Bank stocks surged following strong quarterly results. Goldman Sachs climbed over 4% after its equities trading division posted record revenue, while Morgan Stanley jumped nearly 6% on wealth management strength. Both stocks hit fresh 52-week highs.

Economic data reinforced the positive sentiment.

Jobless claims fell to 198,000—below the 215,000 estimate—with the four-week moving average hitting its lowest level since January 2024.

Manufacturing indices from both New York and Philadelphia surprised to the upside, signaling resilient industrial activity.

A 4% pullback in oil prices provided additional market support, easing inflation concerns.

The rally came after two consecutive losing sessions driven by geopolitical headlines about Greenland and Iran, as well as concerns about the Federal Reserve's independence.

Thursday's rebound suggests investors remain focused on fundamentals rather than political noise.

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Stock Moves Deciphered 📈

🏦 Goldman Sachs (GS)

The investment banking giant surged 4.6% after delivering fourth-quarter earnings that crushed Wall Street expectations.

Goldman reported $14.01 per share in earnings, beating estimates of $11.67, driven by its equities trading division, which posted record revenue.

Overall profit jumped 12% year-over-year, demonstrating the firm's ability to capitalize on robust capital markets activity.

🚀 AST SpaceMobile (ASTS)

The satellite communications company soared to an all-time high following the successful launch of its BlueBird 6 satellite, the largest commercial communications array in low Earth orbit.

This milestone advances AST's mission to deliver 4G/5G broadband directly to standard smartphones without special equipment.

Bank of America raised its price target on the stock, citing the company's progress toward commercial service and potential partnerships with major mobile carriers.

⬇️ Reddit (RDDT)

The social media platform's shares declined sharply after RBC Capital Markets issued a cautious report citing "challenging" feedback from advertising agencies.

Concerns centered on the effectiveness of Reddit's ad platform for small and medium-sized businesses, a critical growth segment.

Adding pressure, competitor Digg announced its relaunch, potentially fragmenting Reddit's user base and advertiser attention. The negative sentiment overshadowed Reddit's strong user engagement metrics.

Headlines You Can't Miss 👀

📱 Spotify raised its U.S. subscription price to $12.99/month from $11.99, lifting shares over 1% as the streaming giant seeks revenue growth.

🏭 Eli Lilly fell 5% after the FDA delayed review of its closely watched weight loss pill under a Trump Administration program, with a decision now expected on April 10.

🤖 Nvidia could rally 30% as AI capex shows no slowdown, according to RBC Capital Markets, which initiated coverage with an outperform rating and $240 price target.

🌐 Broadcom gained 2% after Wells Fargo upgraded the stock to overweight, citing Anthropic's $21 billion order for Google TPUs and potential for 26.5% upside.

🛰️ Hesai Technology maintained a buy rating from Bank of America as the Chinese robotics leader plans to double annual lidar production capacity to over 4 million units in 2026.

🏭 UBS warned investors against complacency, citing the wide gap between Wall Street exuberance and Main Street caution, rich U.S. valuations, and increasing AI-related risks.

📊 Individual investor optimism hit its highest level since November 2024 at 49.5%, raising contrarian concerns that excessive bullishness could reduce available cash for stocks.

Trending Stocks 📊

🛒 Costco Wholesale (COST)

Bernstein reiterated its overweight rating, calling Costco the "ultimate compounder" with sustainable 12-13% earnings-per-share growth and steady return on equity.

The firm's $1,146 price target implies 20% upside, arguing the warehouse giant deserves a premium valuation above its current 46x P/E ratio given its consistent execution and member loyalty.

💸 BlackRock (BLK)

The world's largest asset manager jumped 4% after reporting assets under management surpassed $14 trillion for the first time.

Fourth-quarter earnings of $13.16 per share beat the $12.21 estimate, while revenue of $7.01 billion exceeded the $6.69 billion consensus. Strong inflows across equity and fixed-income products drove the record results.

📈 Asana (ASAN)

Citi upgraded the task management platform to buy from neutral with a $16 price target, representing 40% upside.

The bank cited new CEO Dan Rogers' potential to improve sales and marketing efficiency, along with solid early adoption of Asana's AI Studio workflow builder, which analysts expect to contribute $16 million in annual recurring revenue by fiscal 2027.

What’s Next?

Key market and macro news 👇

💸 PNC Financial Services: This major bank is expected to report its fourth-quarter 2025 earnings before the market opens. Analysts project a 12.2% increase in earnings per share compared to the same quarter last year.

💰State Street Corp. Earnings: State Street, a leading financial services provider, will also release its quarterly earnings. The consensus forecast indicates an 8.46% year-over-year rise in earnings per share, with the company having a history of exceeding expectations.

📊 Inflation and Economic Growth Data: While major inflation data, such as the CPI, were released earlier in the week, the market will still be digesting their implications for future Federal Reserve interest rate decisions. The economic outlook for 2026 suggests slower, but still positive, growth.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.