- Ziggma

- Posts

- 🗞 Tesla vs. Xiaomi

🗞 Tesla vs. Xiaomi

The EV battle intensifies 🚗

Market Performance

S&P 500: 6,141.02 (+0.80%)

Nasdaq: 20,167.91 (+0.97%)

Dow Jones: 43,386.84 (+0.94%)

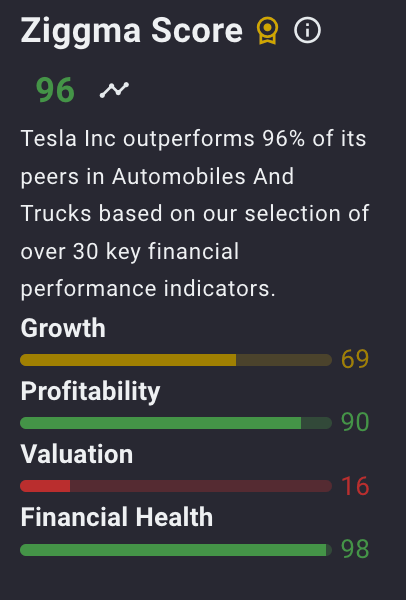

Xiaomi Takes on Tesla

Here's something that should get Tesla (TSLA) investors' attention.

Chinese smartphone giant Xiaomi just launched its YU7 SUV at 253,500 yuan ($35,322), deliberately undercutting Tesla's Model Y by 10,000 yuan in China.

But this isn't just about price competition. Xiaomi is claiming superiority on nearly every metric except driver assistance, boasting a 760-kilometer driving range versus Tesla's 719 kilometers.

The market response was immediate and telling. Within three minutes of pre-sales opening Thursday night, Xiaomi received over 200,000 orders.

Citi expects the YU7 to achieve monthly sales of 30,000 units, potentially reaching 300,000-360,000 units annually once momentum builds.

This matters because China is Tesla's second-largest market, and the Model Y has been a key driver of growth in this market.

Xiaomi's aggressive pricing strategy mirrors what we've seen with BYD, the Chinese automaker that already surpassed Tesla in global EV sales last year.

With features like Apple CarPlay integration and AI-powered controls, Xiaomi is positioning itself as a premium alternative at a discount price.

The broader implication? The Chinese EV market is becoming increasingly crowded with well-funded competitors who can match or exceed Tesla's technology while undercutting on price.

This could pressure Tesla's margins globally as the company faces the choice between defending market share or protecting profitability.

Our Takeaway

Tesla's dominance in China is under serious threat.

Xiaomi's impressive pre-order numbers and superior range claims signal that Chinese consumers are ready to embrace local alternatives.

For Tesla, this means either cutting prices further (hurting margins) or losing market share in a critical growth market.

Hands Down Some Of The Best 0% Interest Credit Cards

Pay no interest until nearly 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

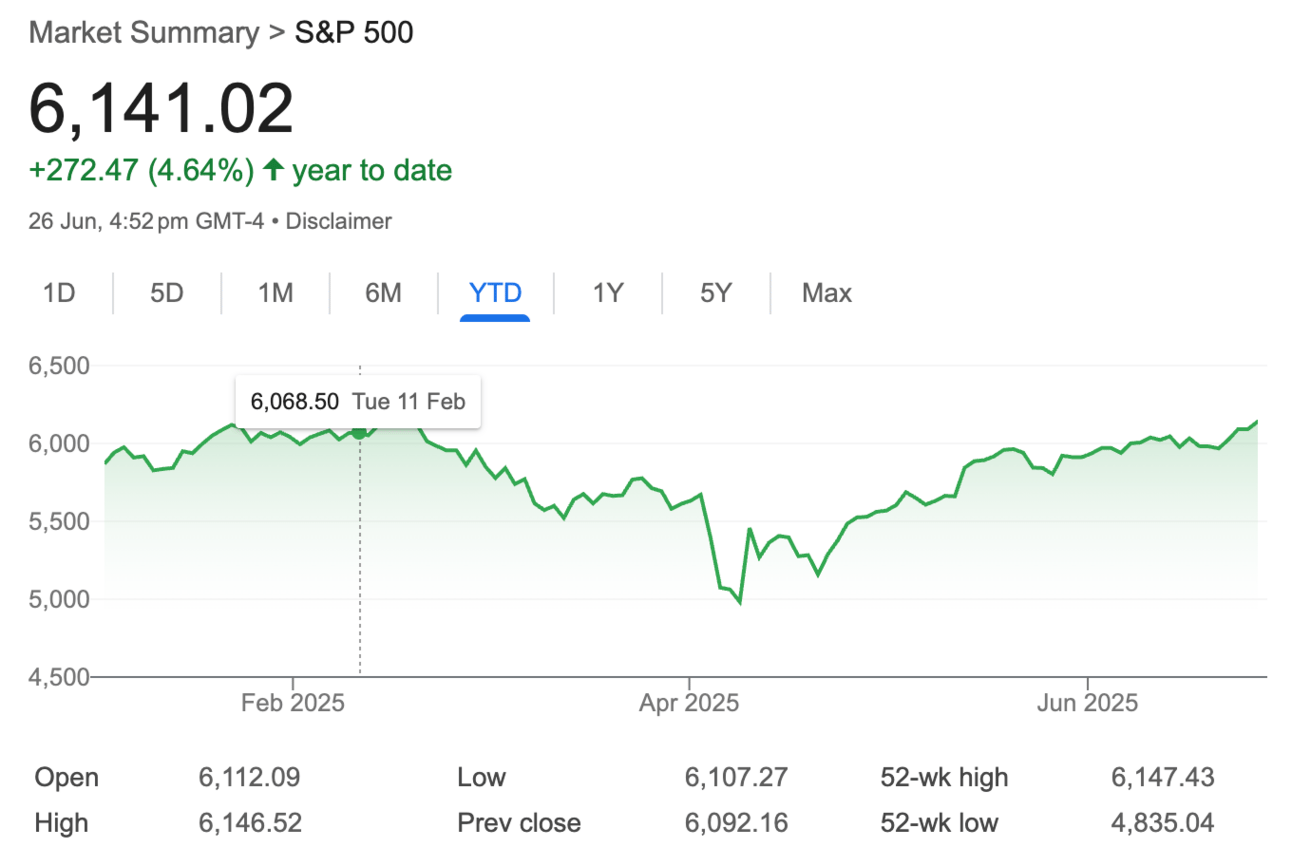

Market Overview

The S&P 500 finished Thursday just whiskers away from a new record and sitting only 0.9% below its all-time high set in February.

The stunning comeback from April lows gained momentum after White House spokesperson Karoline Leavitt downplayed July tariff deadlines, calling them "not critical" and suggesting they could be extended.

S&P 500 futures traded near flat as investors await Friday's inflation data, with the broad index having climbed more than 27% from its April lows.

The tech-heavy Nasdaq also surged to within striking distance of records, gaining nearly 1% Thursday and jumping more than 3% for the week.

Strong corporate earnings, a stable labor market, and renewed optimism for AI have fueled the rally.

Initial jobless claims fell to 236,000 for the week ending June 21, below the 244,000 consensus estimate, providing another sign of economic stability.

Durable goods orders soared 16.4% in May, though first-quarter GDP was revised down to a 0.5% annualized decline.

Tech giants led the charge with Nvidia touching fresh all-time highs, up nearly 80% since April lows, as concerns about Chinese competition and slowing AI spending proved unfounded.

Geopolitical risks have also eased with the Israel-Iran ceasefire holding and oil prices retreating after initial surges.

Headlines You Can't Miss

Defense stocks hit fresh highs with the iShares Aerospace & Defense ETF reaching all-time levels as smaller players outperform.

Circle resumed post-IPO rally, jumping 12% after brief pullback amid crypto regulation speculation.

Core Scientific soared 36% on reports of potential acquisition talks with AI company CoreWeave, validating the value of its mining infrastructure.

Dollar Index fell to three-year lows amid reports that Trump may nominate Jerome Powell's Fed replacement as early as fall.

The Russell 2000 approaches a key breakout level of 2,170, according to Wolfe Research, which is currently trading around 2,172.

Bitcoin ETFs saw $3.5 billion in monthly inflows despite Bitcoin price rising only 2%, suggesting institutional demand is offset by whale selling.

Microsoft, seeing results from OpenAI's monetization efforts with "increasingly apparent" returns on AI investments, according to Morgan Stanley.

Citi upgraded Truist Financial to buy from neutral, citing "too much value on table to ignore" with target price raised to $55.

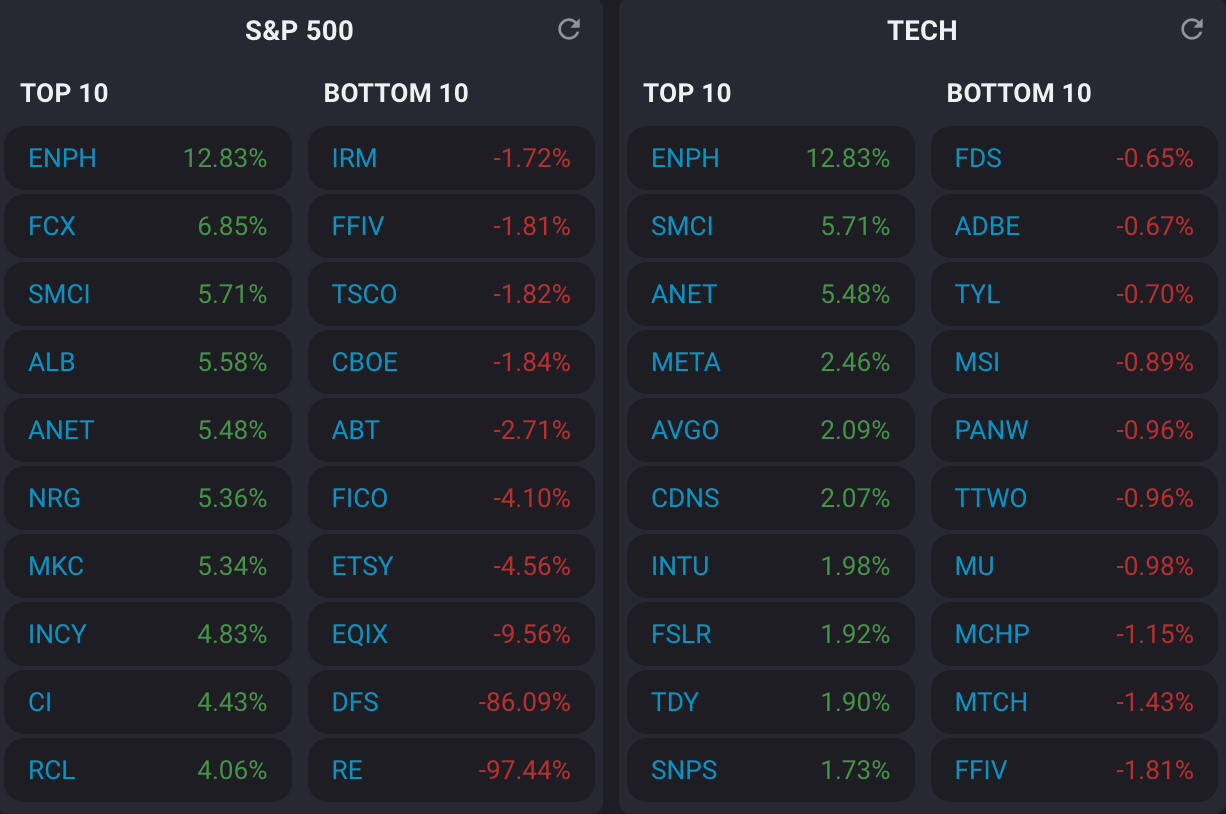

Trending Stocks

Micron Technology (MU)

The memory chipmaker surged 4% in after-hours trading after crushing Q3 expectations.

Micron reported adjusted earnings of $1.91 per share on $9.30 billion revenue, well above consensus estimates of $1.60 per share and $8.87 billion.

The company's Q4 guidance also exceeded expectations, signaling continued strength in memory demand.

Key CEO Quote🎤: Micron is making “disciplined investments to build on our technology leadership and manufacturing excellence to satisfy growing AI-driven memory demand.”

Kinross Gold (KGC)

Shares rose over 2% Thursday after Jefferies upgraded the gold miner to buy from hold, raising the price target to $18 (17.6% upside).

Analyst Fahad Tariq cited the company's "impressive FCF yield in 2025/26" that sets it apart from senior gold peers and allows for increased buybacks.

Key Analyst Quote🎤: “The main reason we are upgrading KGC is because of its impressive FCF yield in 2025/26, which sets it apart from its senior gold peers and allows for increased buybacks.”

McCormick (MKC)

The spice company gained over 4% after Q2 earnings beat expectations. McCormick earned 69 cents per share excluding items, topping the 66-cent consensus estimate.

The strong results reflect resilient demand for food products despite economic headwinds.

Key CEO Quote🎤: Our continued volume-driven performance and share gains across core categories reflect the success of our prioritized investments in the areas that are driving the greatest value and will sustain our momentum for the remainder of 2025 and beyond.

What’s Next?

Personal consumption expenditures (PCE) inflation data is due Friday, which is the Fed's preferred inflation gauge.

Consumer confidence and sentiment readings next week could signal spending trends.

The second-quarter earnings season begins mid-July with major banks reporting first.

Senate vote on tax bill ahead of the July 4 Independence Day target.

July 9 tariff deadline decision following White House comments about potential extension.

Fed policy speculation grows ahead of July meeting with Powell replacement rumors.

Track upcoming news and earnings with Ziggma to get personalized alerts.

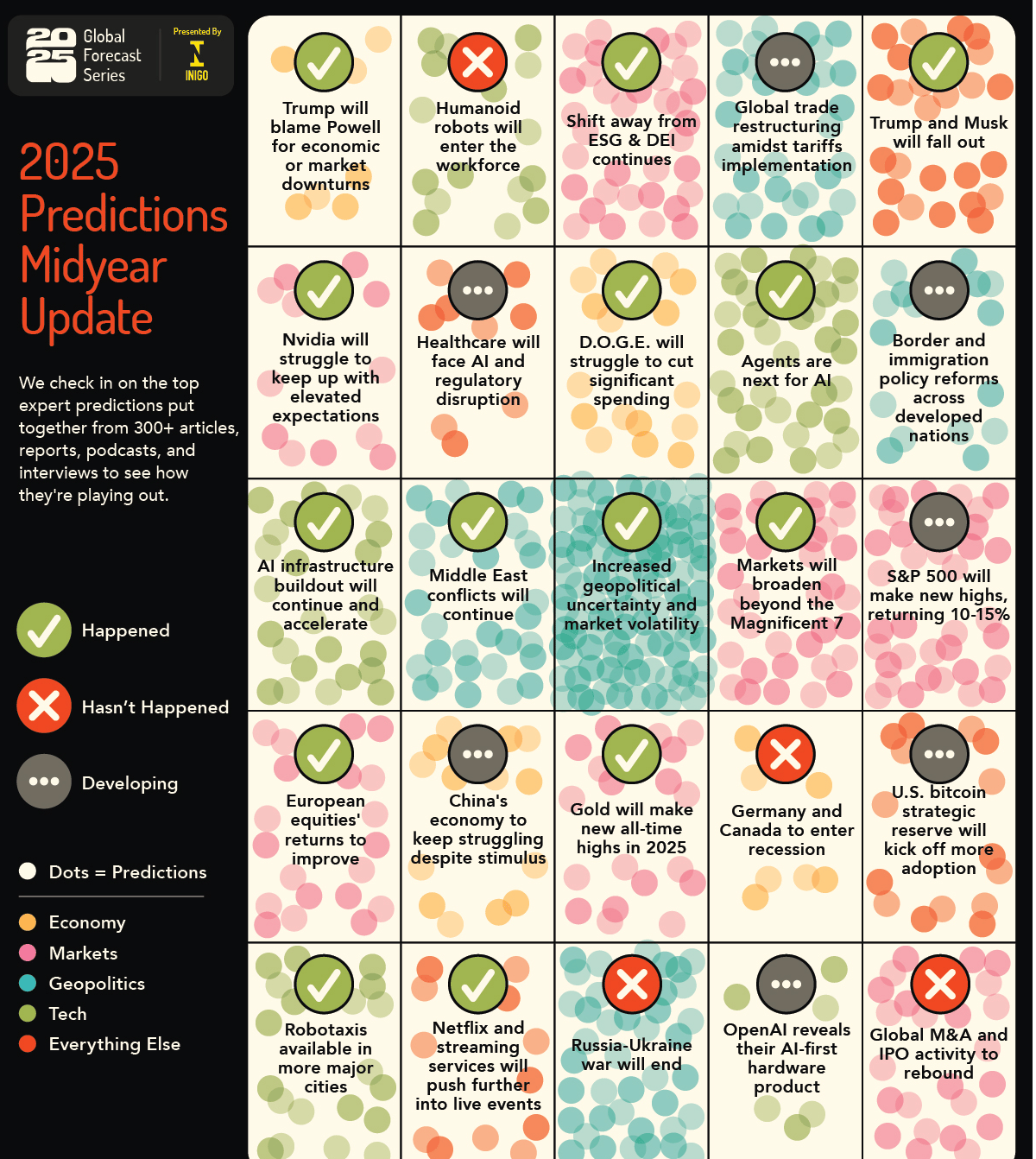

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.