- Ziggma

- Posts

- 🗞️ Tesla Tanks Almost 4%

🗞️ Tesla Tanks Almost 4%

Big Moves Decoded: NFLX, TXN, and more!

Market Performance

S&P 500: 6,699.40 ⬇️ 0.53%

Nasdaq: 22,990.54 ⬇️ 0.93%

Dow Jones: 46,590.41 ⬇️ 0.71%

Tesla’s Tanks Despite Earnings Beat

Tesla (TSLA) reported its first revenue growth in three quarters on Wednesday, but the celebration was short-lived as shares tumbled nearly 4% after earnings missed analyst expectations.

The electric vehicle giant posted third-quarter revenue of $28.10 billion, crushing estimates of $26.37 billion with a 12% year-over-year increase.

Net income plunged 37% to $1.37 billion as operating expenses surged 50%, driven by artificial intelligence investments and research and development projects.

The quarter ended just as federal EV tax credits expired under President Trump's spending bill, prompting consumers to rush and pull sales forward before the incentive disappeared.

Meanwhile, automotive regulatory credit revenue fell 44% to just $417 million.

Tesla's European sales continue to struggle, hampered by consumer backlash against CEO Elon Musk's political activism and intensifying competition from Volkswagen and BYD.

The company's Full Self-Driving adoption remains underwhelming, with only 12% of Tesla's fleet subscribing to the FSD Supervised system.

Musk expects Cybercab production to begin in Q2 of 2026 and plans to operate robotaxi services in eight to ten metro areas by year's end, with safety drivers initially removed from Austin operations.

The EV maker also revealed it's building first-generation production lines for its humanoid Optimus robots, expecting to show V3 in Q1 2026.

Notably, Tesla's energy generation and storage business surged 44% to $3.42 billion, now representing about a quarter of overall revenue.

The company's Megapack products are finding strong demand, including from Musk's AI startup xAI.

Despite the return to growth, Tesla faces headwinds from higher tariffs, expired tax credits, and execution challenges on its futuristic projects.

While deliveries hit a record 497,099 vehicles in Q3, year-to-date numbers remain down 6% compared to 2024.

Tesla stock has a Ziggma score of 19, and ranks in the top percentile for profitability and financial health.

Our Takeaway

Tesla is at a crossroads. It is managing to grow revenue, but profitability is taking a hit as it pours capital into moonshot projects like robotaxis, humanoid robots, and AI.

The energy business is a real revenue driver, but the core automotive unit faces mounting pressure from policy headwinds and European weakness.

Investors must decide whether they are purchasing a car company or a technology platform. The answer will determine whether that 9% year-to-date gain continues.

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

Market Overview 📈

U.S. equities stumbled on Wednesday as escalating U.S.-China trade tensions combined with disappointing earnings to drag major indices lower.

Treasury Secretary Scott Bessent confirmed the White House is weighing export curbs on China for products made with U.S. software, following President Trump's announcement of export restrictions on critical software set for November 1.

The semiconductor sector bore the brunt of the selling pressure after Texas Instruments delivered weak fourth-quarter guidance alongside its earnings report.

The ripple effect hit the entire chip space, with On Semiconductor down nearly 6%, AMD falling over 3%, and Micron declining about 2%.

The broader VanEck Semiconductor ETF shed 2% on the day.

Small-cap stocks felt the pain most acutely, with the Russell 2000 tumbling 2% compared to the S&P 500's sub-1% decline.

The sell-off was severe enough to push both the S&P 500 and Nasdaq into negative territory for October, down 0.2% and 0.3% respectively, for the month.

Despite the daily decline, more than three-quarters of S&P 500 companies reporting this earnings season have beaten expectations, according to FactSet.

However, as Macquarie's Thierry Wizman noted, investors remain concerned about forward guidance from management as the earnings season expands across more sectors.

Stock Moves Deciphered 📈

🖥️ Netflix (NFLX) ⬇️ 10%

The streaming giant reported earnings per share of $5.87, falling well short of the $6.97 consensus estimate.

A one-time tax expense exceeding $600 million stemming from a Brazilian Supreme Court ruling on cross-border payments tax.

This unexpected hit dragged operating income down to $3.24 billion versus consensus expectations of $3.6 billion.

Revenue rose 17% to $11.51 billion and met expectations, while the company forecast another 17% year-over-year revenue increase for Q4, driven by pricing adjustments and continued membership and ad revenue growth.

👨⚕️Intuitive Surgical (ISRG) ⬆️ +14%

Intuitive Surgical was Wednesday's standout winner, with shares rocketing 14% after the robotic surgery systems maker crushed third-quarter expectations.

The company posted adjusted earnings per share of $2.40 on revenue of $2.51 billion, handily beating analyst estimates of $1.98 per share and $2.4 billion in revenue.

The stellar performance was driven by robust demand for da Vinci robotic surgery systems, which continue to gain adoption across hospitals and surgical centers worldwide.

Management's confidence showed through in their decision to raise the full-year procedure growth forecast to 17-17.5%, up from the previous range of 15.5-17%.

🛢️ Halliburton (HAL) ⬆️ 4.2%

Companies in the energy sector experienced a surge in share prices following Donald Trump's imposition of additional sanctions on Russian oil firms.

As one of the world's largest oilfield services companies, Halliburton's performance typically tracks broader trends in oil and gas exploration and production activity.

The company's exposure to both international and North American markets provides diversification, though it also means sensitivity to regional dynamics, including U.S. shale activity levels and international project development.

Headlines You Can't Miss 👀

📦 Amazon's robot warehouses could deliver $2-4 billion in annual cost savings by 2027, Morgan Stanley estimates, with plans for 40 next-gen robotics facilities.

🚗 Volkswagen warned of temporary production outages, citing China's export restrictions on semiconductors made by Nexperia, potentially disrupting European auto manufacturing.

🍩 Krispy Kreme soared 8.6% as meme stock frenzy continued, following a 14% surge Tuesday alongside Beyond Meat and other speculative names.

🎲 DraftKings jumped 3.2% after announcing the acquisition of predictions platform Railbird, expanding its sports betting ecosystem.

🏦 Western Alliance gained over 3% on better-than-expected Q3 earnings with EPS of $2.28 versus $2.09 estimates, though loss provisions exceeded expectations at $80 million.

🪆 Mattel dropped 3% after reporting weaker Q3 results with lower North American sales, posting $1.74 billion in revenue versus $1.83 billion in estimates.

⚠️ Fitch Ratings warned of mounting risk from U.S. regional banks' exposure to non-bank financial institutions, which reached $1.2 trillion, representing 10% of total bank loans, up from just 3% in 2015.

Trending Stocks 📊

🤖 Texas Instruments (TXN) | ⬇️ 5.6%

Texas Instruments shares fell sharply after the semiconductor giant issued disappointing fourth-quarter guidance that overshadowed solid third-quarter results.

The company guided Q4 revenue to a $4.4 billion midpoint versus analyst estimates of $4.52 billion, while earnings per share guidance of $1.26 also missed expectations.

The weak outlook signals that the long-awaited chip industry recovery may be further delayed than investors hoped, pressuring the entire semiconductor sector.

🏗️ Avery Dennison (AVY) ⬆️ 7.4%

The materials science and manufacturing company benefited from positive investor reaction to its quarterly results and news of an expanded collaboration with Walmart on RFID technology aimed at improving freshness tracking and operational efficiency.

The partnership highlights growing adoption of intelligent labeling solutions in retail operations, positioning Avery Dennison to capitalize on the digital transformation of supply chain management.

🎤 Teledyne Technologies (TDY) ⬇️ 5%

Teledyne Technologies fell despite reporting third-quarter results that beat analyst expectations.

The company delivered revenue of $1.54 billion and earnings per share of $5.57, topping the $5.50 estimate, while revenue grew a healthy 6.7% year-over-year.

However, weak fourth-quarter EPS guidance disappointed investors and overshadowed the solid quarterly performance.

Management raised the full-year adjusted EPS forecast slightly, but not enough to offset concerns about Q4 momentum.

What’s Next?

Key market and macro news 👇

💰 Major Earnings Reports: Several influential companies are expected to release their quarterly earnings reports, including T-Mobile, Blackstone, and Ford.

💸 Tesla Earnings Aftermath: Following its earnings report on October 22, the market will continue to digest Tesla's performance and outlook. Any surprises could lead to volatility in the tech sector and broader market.

📊 U.S. Economic Data Releases: Key economic indicators, including Unemployment Claims and Existing Home Sales, are scheduled for release.

👀 Global Economic Outlook: The International Monetary Fund (IMF) and other financial institutions have projected a global growth slowdown for 2025.

📉 Flash Manufacturing & Services PMI: Purchasing Managers' Index (PMI) data for the U.S. and Eurozone will be released on October 24, providing a timely indicator of economic momentum in the manufacturing and services sectors.

Chart of the Day

Source: App Economy Insights

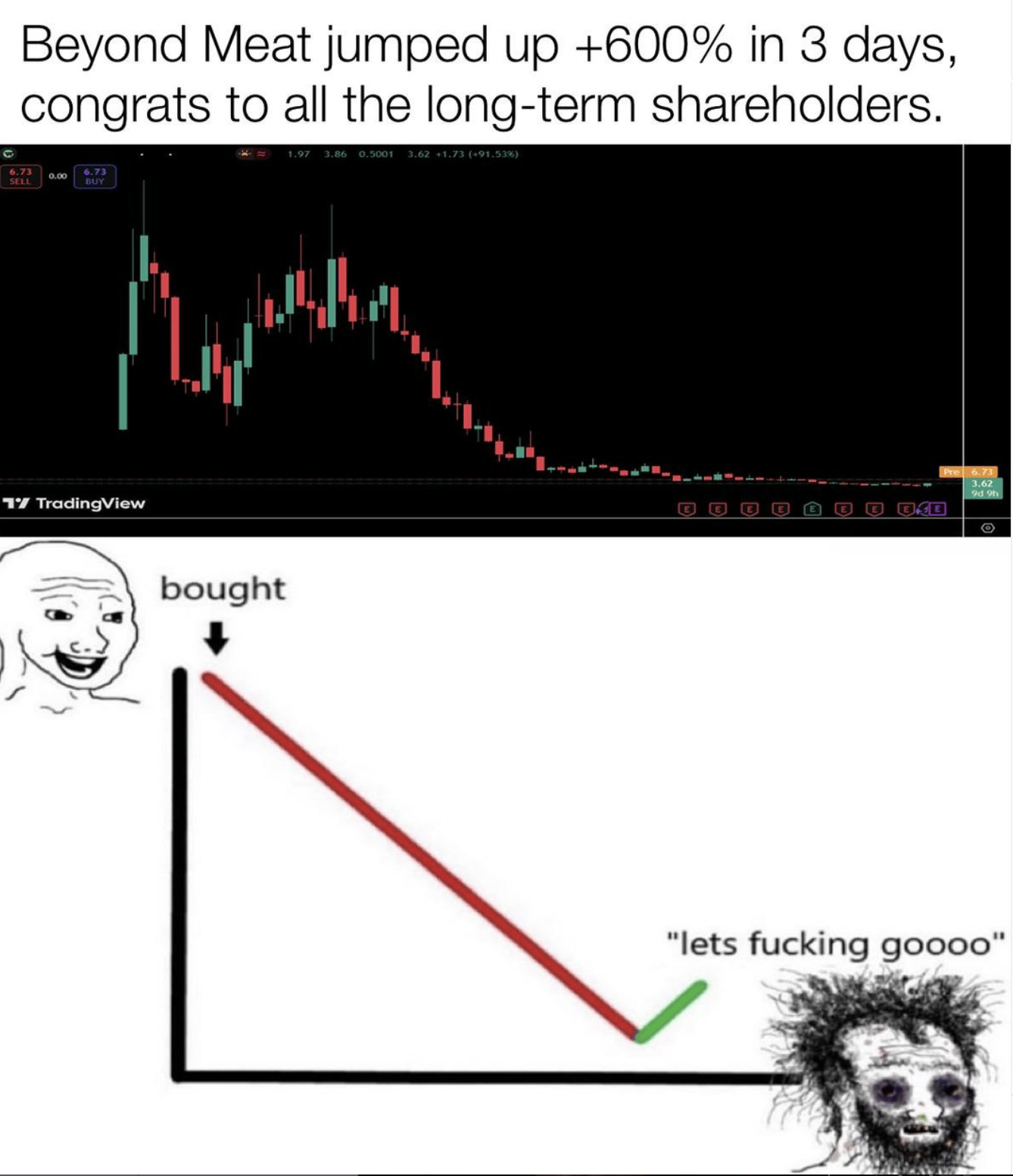

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.