- Ziggma

- Posts

- 🗞️ Tesla Tanks (Again!)

🗞️ Tesla Tanks (Again!)

Tesla, CoreWeave, and Netflix

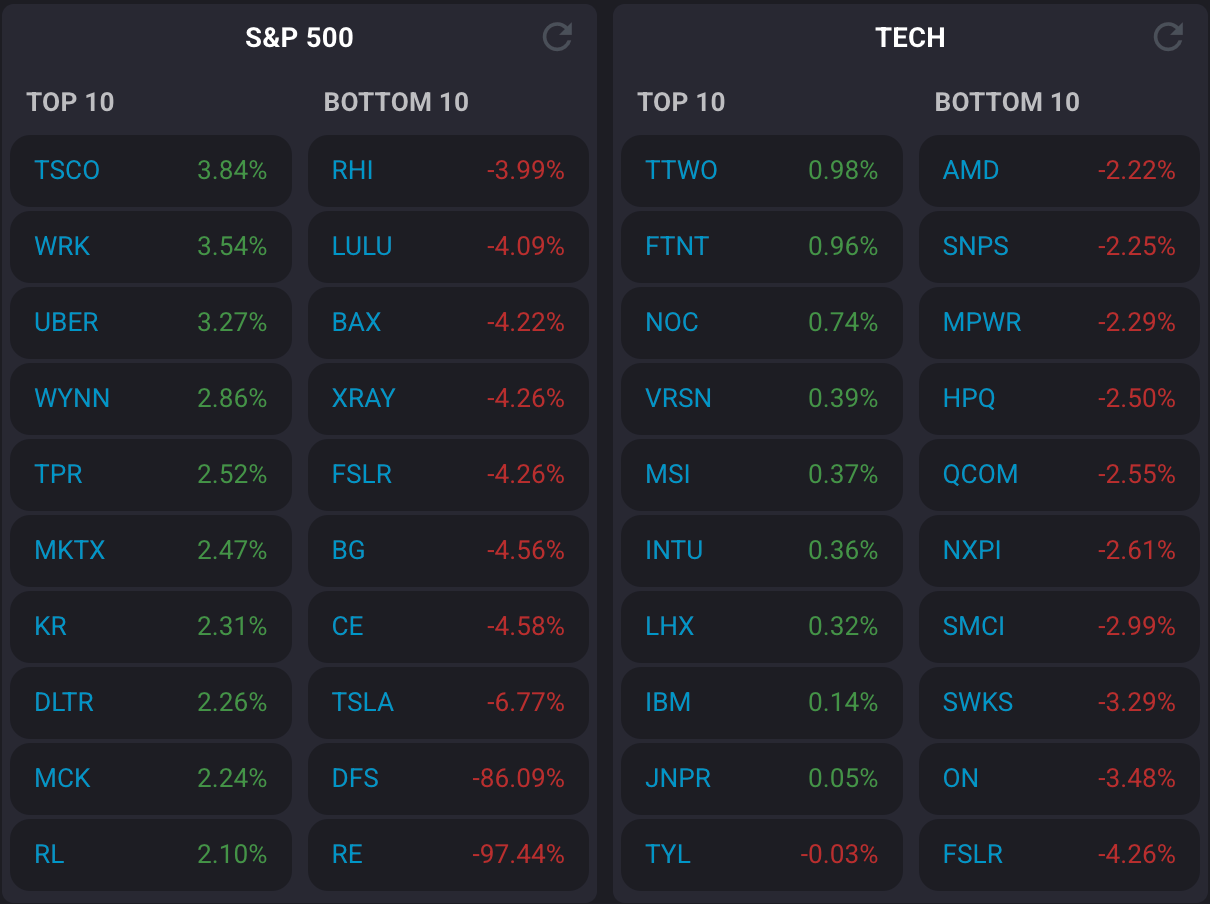

Market Performance

S&P 500: 6,229.98 (-0.79%)

Nasdaq: 20,412.52 (-0.92%)

Dow Jones: 44,406.36 (-0.94%)

Musk’s Political Pivot Drags Tesla Lower

Tesla (TSLA) stock plummeted nearly 7% on Monday, erasing more than $68 billion in market capitalization after CEO Elon Musk announced plans to form a new political party called the "America Party."

The timing couldn't be worse for the electric vehicle giant, which is already grappling with declining deliveries and intensifying competition.

Musk's political ambitions aren't sitting well with investors, who have grown weary of his distractions from Tesla's core business.

The billionaire said his new party would focus on "just 2 or 3 Senate seats and 8 to 10 House districts" to serve as the "deciding vote on contentious laws."

But this latest political venture comes as Tesla reported a 14% year-over-year decline in Q2 deliveries to 384,122 vehicles, the second consecutive quarterly drop.

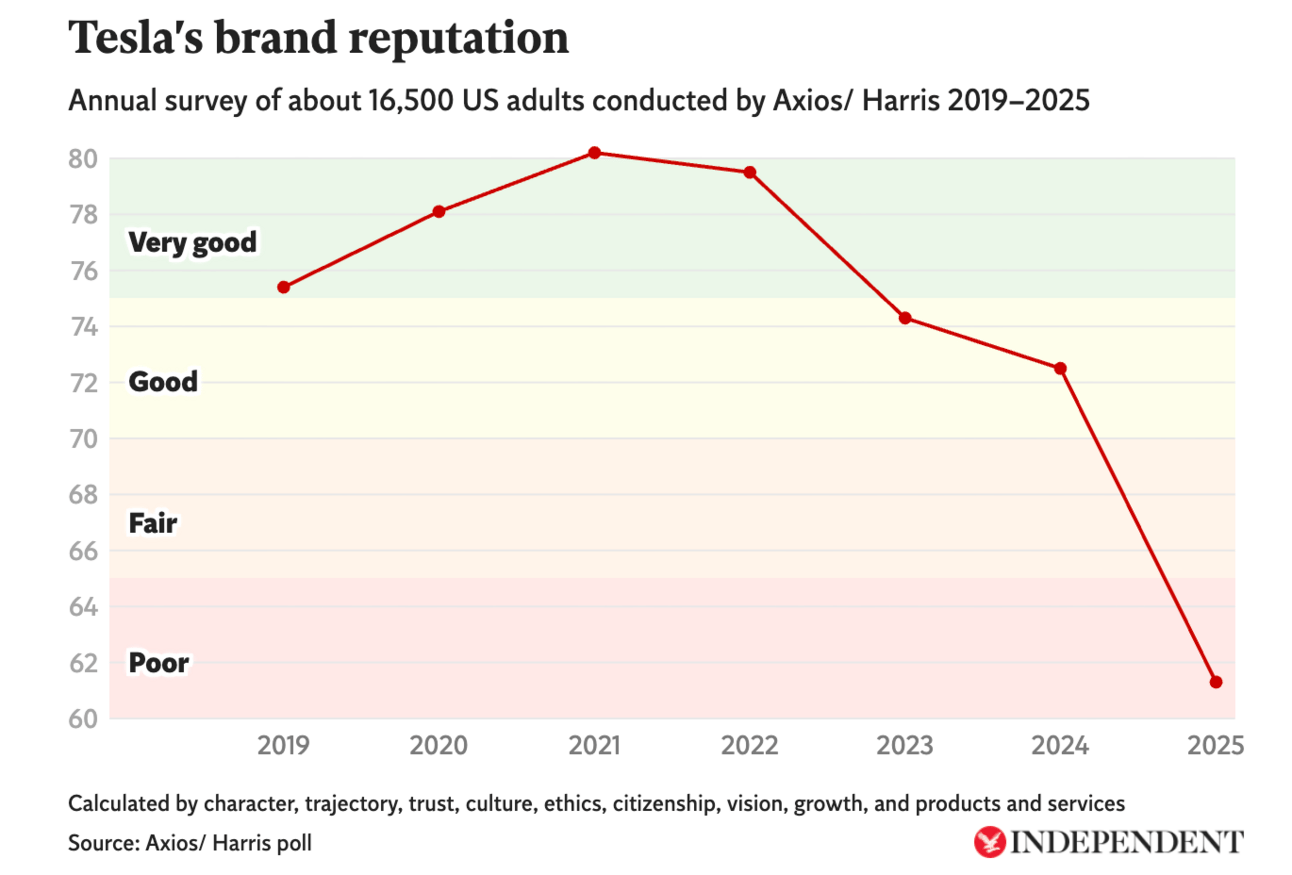

The political backlash is real and measurable. Tesla faces protests across markets, especially in Europe, where Musk's endorsement of Germany's far-right AfD party has damaged the brand.

Meanwhile, his relationship with President Trump has soured, with the president calling Musk's political party move "ridiculous" and saying the Tesla CEO had gone "completely off the rails."

Moreover, Chinese EV makers are offering newer, more affordable models, and Tesla's dominance is clearly under threat.

Additionally, Tesla’s angular Cybertruck has been recalled eight times since its November 2023 launch, highlighting quality control issues at a critical time.

Our Takeaway

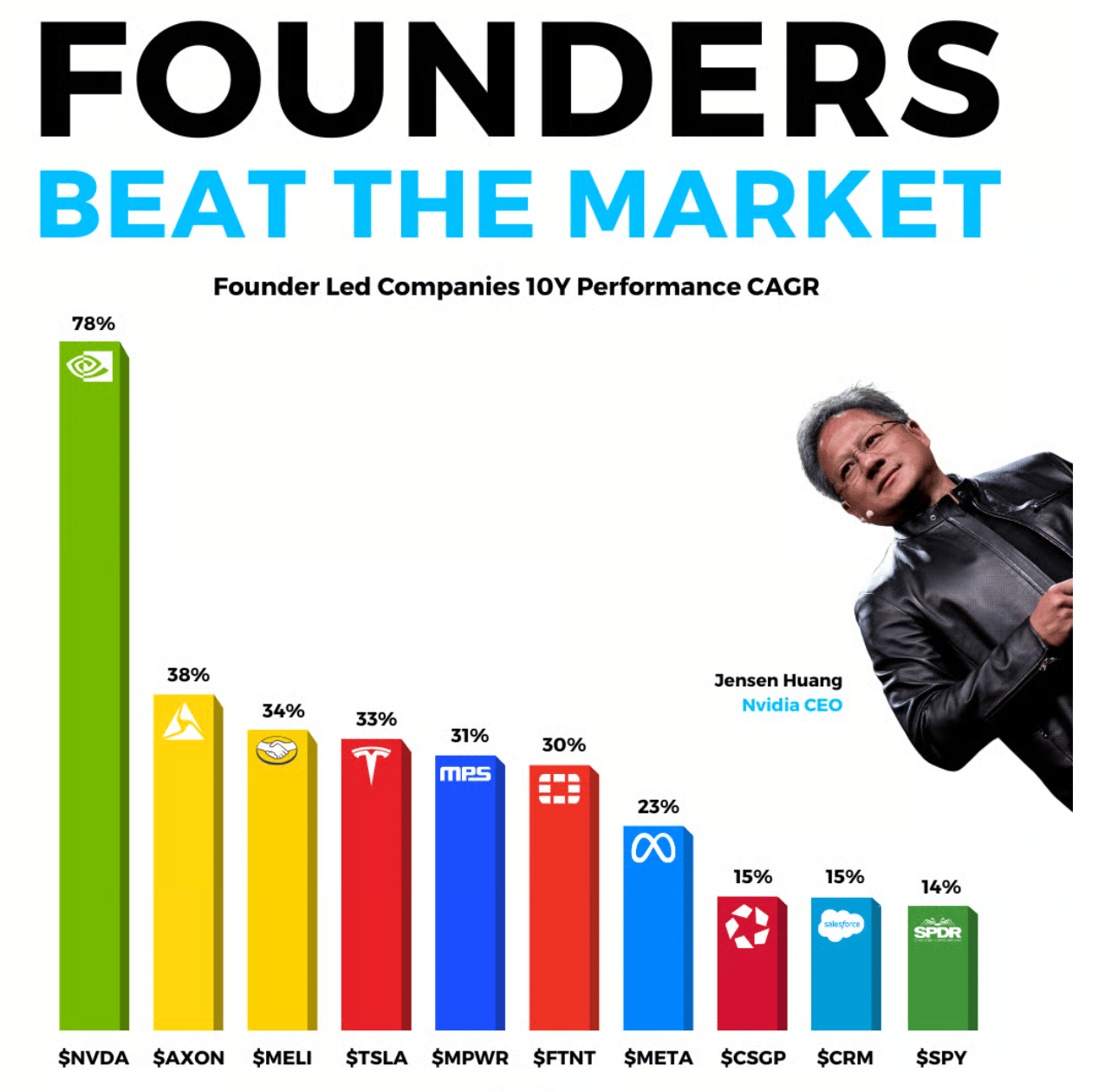

Musk's continued political involvement represents a significant distraction risk for Tesla shareholders.

At a time when the company needs laser focus on execution, product quality, and competitive positioning, having its CEO launch a political party sends precisely the wrong signal.

Tesla's 22% year-to-date decline among megacap tech stocks reflects these concerns, and until Musk refocuses on the business, the stock will likely remain under pressure.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

Market Overview

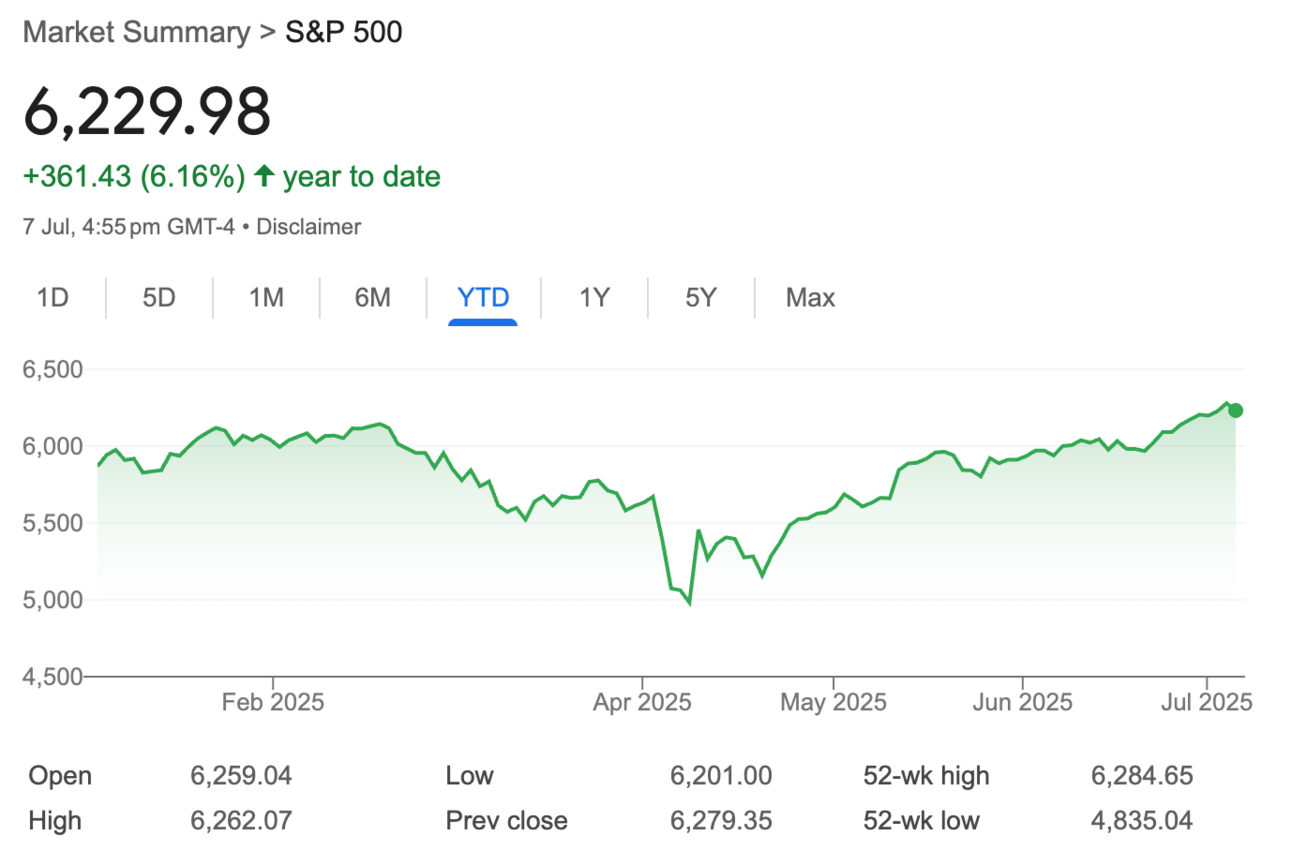

Stock futures are pointing to another challenging session as investors digested President Trump's rapid-fire tariff announcements.

Dow futures fell 99 points, while S&P 500 and Nasdaq futures declined modestly after Monday's broad selloff that saw all major indices drop nearly 1%.

The tariff blitz dominated headlines as Trump announced levies on 14 countries, with rates ranging from 25% to 40% starting August 1.

The affected nations include major trading partners such as Japan and South Korea (25% each), as well as Southeast Asian countries like Malaysia and Myanmar (25% and 40%, respectively).

Trump also extended his "reciprocal" tariff deadline from this week to August 1, providing some temporary relief.

Adding to trade tensions, the president threatened an additional 10% tariff on countries aligning with "anti-American policies" of BRICS nations, a group that includes Brazil, Russia, India, and China.

This announcement came as BRICS members met in Brazil and expressed concerns about the rise of unilateral trade measures.

Despite the uncertainty, many strategists remain optimistic about the market's resilience.

HSBC's Max Kettner noted that lower Treasury yields continue to fuel a "melt-up in risk assets," and suggested that tariff concerns may be overblown.

The upcoming earnings season could provide the catalyst needed to push the S&P 500 beyond current all-time highs, especially if companies demonstrate their ability to navigate the evolving trade landscape.

Headlines You Can't Miss

Royal Caribbean hit new all-time highs dating back to its 1993 IPO as cruise demand remains robust.

Toyota Motor and Honda shares dropped 4% and 3.9% respectively, after Trump announced 25% tariffs on Japan.

IBM gained momentum as Melius Research boosted its price target to $350, citing the strength of its infrastructure software.

Uber reached new all-time highs after Wells Fargo raised its price target to $120 on strong bookings growth.

MGM Resorts fell 2% after Goldman Sachs initiated coverage with a sell rating on free cash flow concerns.

SolarEdge Technologies dropped despite last week's 39% rally as investors questioned the sustainability of solar sector gains.

BlackRock and Citigroup both hit 52-week highs, with Citi reaching levels not seen since 2008.

Treasury Secretary Scott Bessent indicated multiple trade announcements expected in the next 48 hours.

Trending Stocks

CoreWeave (CRWV): The AI hyperscaler fell 4% after announcing an all-stock acquisition of Core Scientific for approximately $9 billion.

The deal combines CoreWeave's AI computing platform with Core Scientific's data center infrastructure, creating a formidable competitor in the AI hosting space.

The transaction is expected to close in the fourth quarter of 2025, pending regulatory approval.

CEO Quote🎤: “This acquisition accelerates our strategy to deploy AI and HPC workloads at scale. Verticalizing the ownership of Core Scientific’s high-performance data center infrastructure enables CoreWeave to significantly enhance operating efficiency and de-risk our future expansion, solidifying our growth trajectory.”

Netflix (NFLX): Seaport Research downgraded the streaming giant to “neutral” from “buy”, citing valuation concerns ahead of its July 17 earnings release.

The stock has surged by over 45% this year, and analysts believe the rally has outpaced the fundamentals. Seaport noted that execution risks related to advertising, content aggregation, and international expansion require time to materialize.

Analyst Quote🎤: “We believe that plenty of the long-term opportunity set is factored into the shares at this price, and the company needs time to execute against the expectations in advertising, aggregating, launching experiences, and expanding share again.”

Wells Fargo (WFC): Raymond James downgraded the bank to Market Perform from Strong Buy, arguing that the recent rally following the removal of its asset cap has run its course.

Shares have climbed more than 10% since the Federal Reserve lifted the growth restrictions in June, reaching levels that now fully reflect the bank's improved prospects.

Analyst Quote🎤: “Raymond James maintains its bullish outlook on Wells Fargo’s growth prospects and continued profitability improvement, but believes the upside to earnings estimates is now appropriately reflected in the premium valuation.”

What’s Next?

Trade Developments: Treasury Secretary Bessent promises multiple trade announcements over the next 48 hours.

Federal Reserve: Bank of America maintains base case of zero rate cuts this year amid concerns about inflation.

Tariff Implementation: The August 1 deadline looms for new tariffs on 14 countries ranging from 25% to 40%.

BRICS Response: Additional 10% tariffs threatened for countries aligning with BRICS policies.

Tesla Earnings: The company reports its Q2 financial results on July 23, after the market closes.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.