- Ziggma

- Posts

- 🗞 Tesla Stock Surges 8%

🗞 Tesla Stock Surges 8%

as the robotaxi launches in Austin 🚗

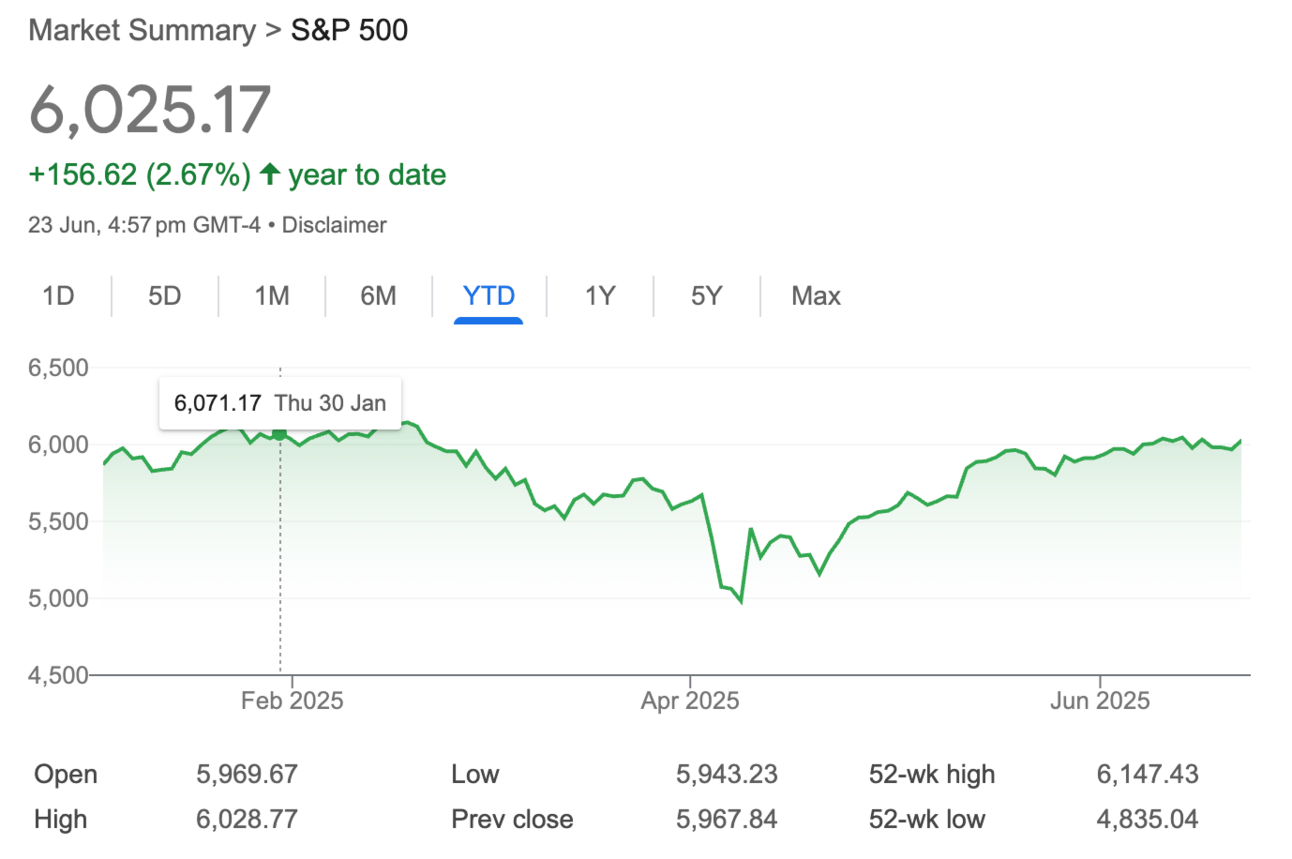

Market Performance

S&P 500: 6,025.17 (+0.96%)

Nasdaq: 19,630.98 (+0.94%)

Dow Jones: 42,581.78 (+0.89%)

Tesla’s Robotaxi is Here (Finally!)

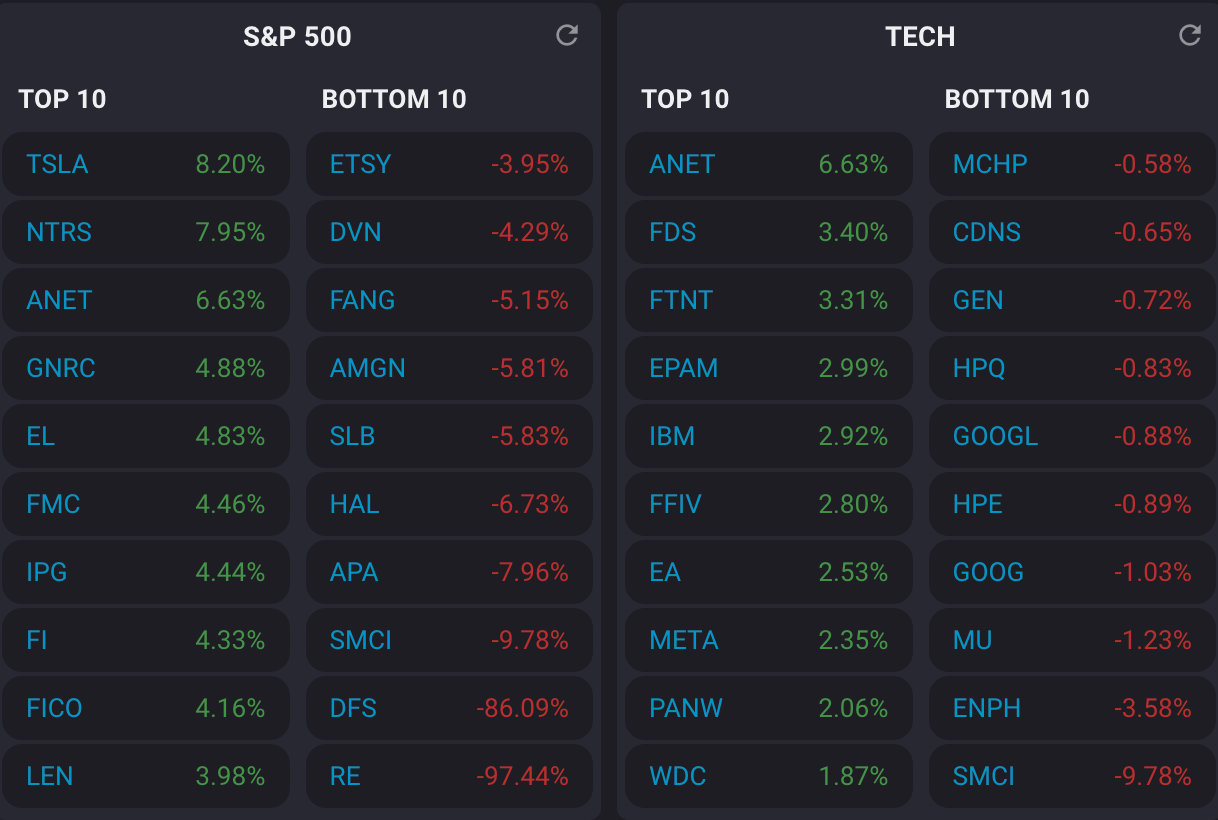

Tesla's (NASDAQ:TSLA) Model Y robotaxi finally hit the road this weekend, sending shares of the electric vehicle maker up 8% on Monday in one of the most significant milestones for autonomous driving in recent years.

The EV giant debuted autonomous rides in Austin, Texas, on Sunday, opening the service to a limited number of riders by invitation only.

CEO Elon Musk charged a flat fee of $4.20 per ride and declared it the "culmination of a decade of hard work" by Tesla's AI software and chip design teams.

While early riders mainly reported positive experiences with "zero issues" across multiple rides, road users and researchers observed some concerning behavior.

A Tesla Model Y robotaxi was spotted traveling the wrong way down a road and braking hard in traffic in response to stationary police vehicles outside its driving path.

The robotaxi launch puts Tesla in direct competition with Alphabet's Waymo, which already delivers over 250,000 commercial driverless rides weekly and has surpassed 10 million total trips.

Chinese competitors, such as Baidu's Apollo Go, have also reported over 11 million trips.

Our Takeaway

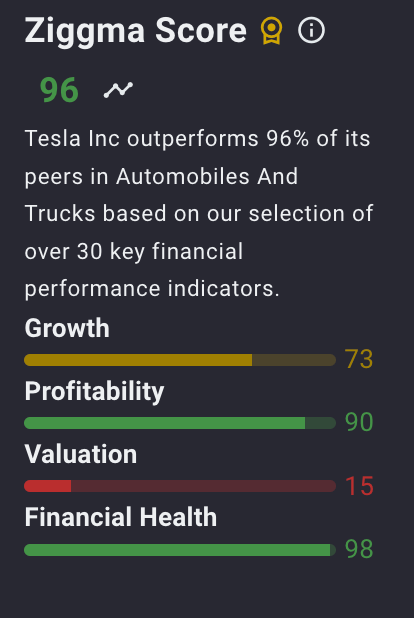

Tesla's robotaxi business marks a critical inflection point for the company's transformation from an electric vehicle (EV) manufacturer to a leader in AI.

While early operational hiccups are expected, the market's 8% response suggests investors are betting big on Tesla's autonomous future.

However, with established competitors already operating at scale, Tesla faces an uphill battle to capture meaningful market share in this rapidly evolving space.

1440: Your Weekly Business Cheat Sheet

Expand your business and finance knowledge with 1440. Get clear, conversational breakdowns of the key concepts in business and finance—no paywalls, no spin. Every Thursday, 1440 delivers deep dives, interactive charts, and rapid market rundowns trusted by 100k+ professionals.

Market Overview

Stocks rose and crude prices tumbled on Monday as investors breathed a sigh of relief that Iran's response to U.S. attacks over the weekend was more restrained than expected.

Iran's armed forces attacked an American base in Qatar after the U.S. hit Iranian nuclear sites, but Qatar intercepted the response with no casualties reported.

This led to a massive sell-off in oil as traders bet crude supply wouldn't be materially disrupted.

West Texas Intermediate futures dropped more than 7% to $68.51 per barrel, falling from overnight highs above $78.

Adding pressure to oil was comments by President Trump, who posted on Truth Social that "everyone" should keep oil prices low, warning that doing otherwise would "play into the hands of the enemy."

Stock futures rose further in extended trading after Trump announced on Truth Social that a ceasefire between Israel and Iran would take effect, declaring "THE CEASEFIRE IS NOW IN EFFECT. PLEASE DO NOT VIOLATE IT!"

The energy sector was the only one to finish in the negative, falling 2.51%, while all other sectors posted gains, led by the consumer discretionary sector (+1.75%).

Headlines You Can't Miss

Cathie Wood's ARK Innovation ETF is "poised for a downside shakeout," according to BTIG analysts.

NATO aims to spend 5% of its GDP on defense amid growing geopolitical tensions.

Tesla robotaxi incidents caught on camera in Austin draw regulators' attention to safety protocols.

Airlines divert and cancel more Middle East flights after Iran attacks U.S. military base.

European stocks open higher amid hopes for an Iran-Israel ceasefire agreement.

Oil prices could spike significantly if Iran were to close the Strait of Hormuz, according to Goldman Sachs' analysis.

Trending Stocks

Northern Trust (NTRS) - Shares surged over 6% after The Wall Street Journal reported that the Bank of New York Mellon approached Northern Trust to express interest in a potential merger between the two custody bank rivals.

The report cautioned that talks might not result in a deal, but the potential combination would create a financial services powerhouse.

WSJ Report🎤: "BNY is considering its next steps, which might include returning to Northern Trust with a formal bid”.

Fiserv (FI) - The financial services firm jumped almost 5% after announcing plans to expand its presence in the stablecoin space.

Fiserv announced it will launch a stablecoin and digital-asset platform for banking clients, striking partnerships with Circle and PayPal to further these efforts.

COO Quote🎤: “Our expanded relationship with PayPal furthers our mission to scale stablecoin-powered payments- leveraging our position at the intersection of banking and commerce to build more efficiency and optionality into the payments ecosystem.”

Novo Nordisk (NVO) - The pharmaceutical stock plummeted more than 5% after disappointing results for its next-generation obesity drug CagriSema suggested no clear advantage over Eli Lilly's Zepbound.

The company also ended its collaboration with Hims & Hers Health, citing concerns over compounding and marketing, which sent Hims shares tumbling 31%.

Management Quote🎤: We will work with telehealth companies to provide direct access to Wegovy that share our commitment to patient safety, and when companies engage in illegal sham compounding that jeopardizes the health of Americans, we will continue to take action."

What’s Next?

Equity markets are showing resilience, with gains in industrials and select tech stocks, such as IBM and Nvidia.

While some economic indicators, such as job growth, remain solid, there are emerging signs of weakening in sales, industrial output, homebuilders’ sentiment, and housing starts. This uneven data mix is causing investors to hesitate and could influence near-term market direction.

Investors are closely monitoring the Fed’s stance following its recent pause on rate hikes. Fed officials hint at possible rate cuts later this year, which could support equities, but inflationary pressures from tariffs and import prices remain a concern.

Ongoing tensions between Iran and Israel remain a significant market risk. Recent measured responses by Iran to U.S. military actions have somewhat eased immediate fears, but investors remain cautious about any escalation that could impact oil prices and market sentiment.

Track upcoming news and earnings with Ziggma to get personalized alerts.

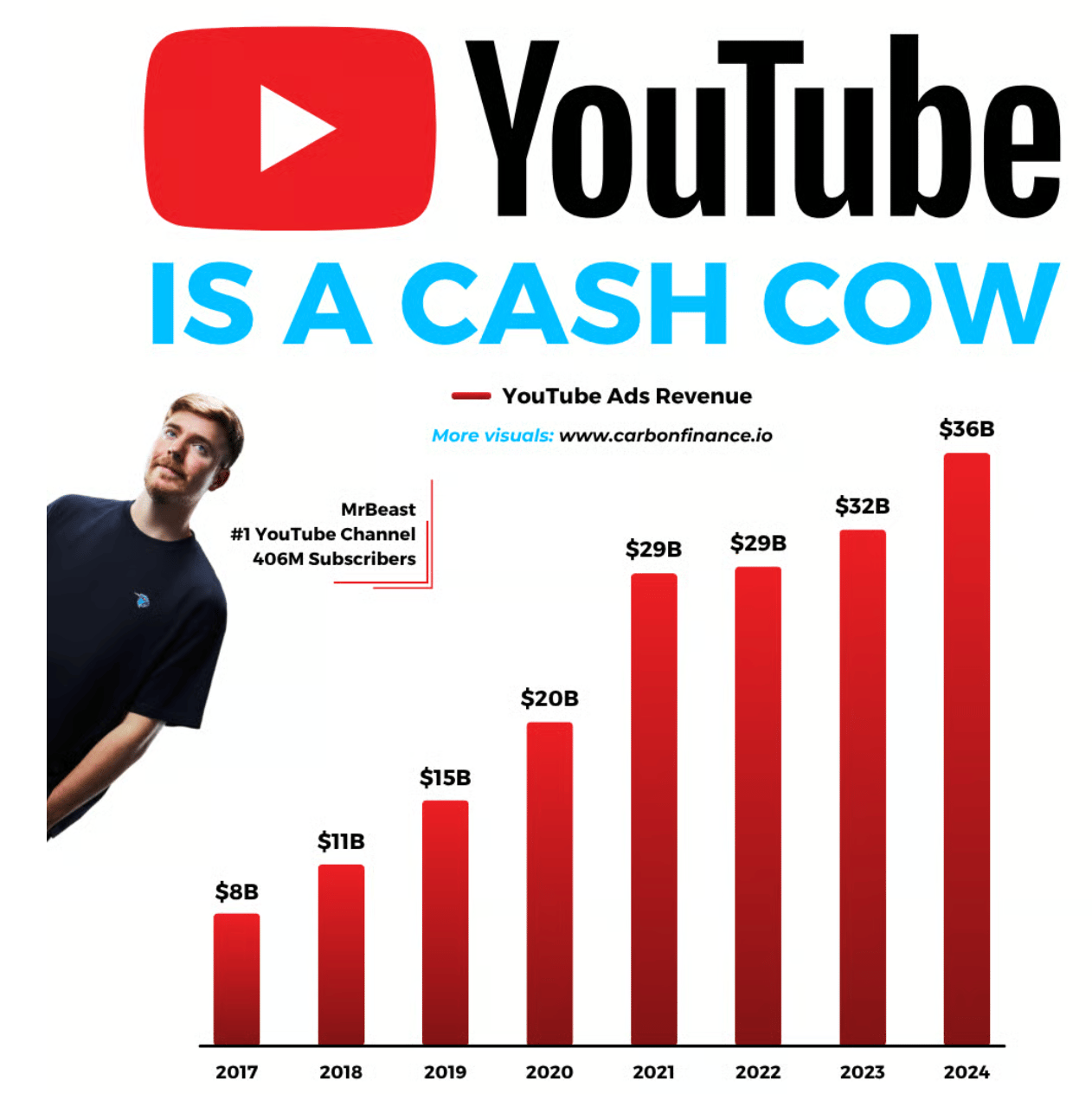

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.