- Ziggma

- Posts

- 🗞️ Target Misses the Mark

🗞️ Target Misses the Mark

PLUS: Tech sell-off continues

Market Performance

S&P 500: 6,395.78 (⬇️ 0.24%)

Nasdaq: 21,172.86 (⬇️ 0.67%)

Dow Jones: 44,938.31 (⬆️ 0.04%)

Target’s Leadership Shakeup Overshadows Earnings Beat

Target (TGT) delivered a surprise earnings beat on Wednesday, but investors weren't buying the good news.

Shares plummeted over 6% despite topping Wall Street expectations for both earnings ($2.05 vs $2.03 expected) and revenue ($25.21 billion vs $24.93 billion expected).

The real story? CEO Brian Cornell is stepping down in February after leading the retailer through some of its most challenging years.

His replacement, Michael Fiddelke, inherits a company that's been stuck in neutral as annual sales have been stagnant for four years, and shares are down 60% from their 2021 peaks.

In the quarter ended in July, Target's comparable sales dropped 1.9%, customer transactions fell 1.3%, and even the average transaction size declined 0.6%. That's a trifecta of retail weakness that no earnings beat can mask.

Fiddelke's three-point turnaround plan includes restoring Target's design edge, fixing customer experience, and leveraging technology, which sounds reasonable on paper.

But with higher tariffs looming (Target imports half its merchandise), the ending of its Ulta Beauty partnership, and continued traffic declines, the new CEO faces an uphill battle.

We can see that while Target stock is cheap, it has a Ziggma score of 51, and ranks in the bottom percentile in terms of valuation.

Our Takeaway

Target's earnings beat feels like putting lipstick on a pig. The fundamentals show a retailer losing its competitive edge just as tariffs threaten to squeeze margins further.

This leadership change might be necessary, but it won't fix Target's profound identity crisis overnight.

Invest Alongside Kyrie Irving and Travis Kelce

A new media network is giving pro athletes ownership of their content…and they’re inviting fans, too.

That network is PlayersTV.

It’s the first sports media company backed by over 50 legendary athletes including:

Kyrie Irving

Chris Paul

Dwyane Wade

Travis Kelce

Ken Griffey Jr.

And more

PlayersTV is a platform where athletes can tell their own stories, show fans more of who they really are, and connect in a whole new way.

And here’s the kicker: It’s not just athlete-owned—it’s fan-owned, too.

PlayersTV has the potential to reach 300M+ homes and devices through platforms like Amazon, Samsung, and Sling.

And for a limited time, you can invest and become an owner alongside the athletes.

2,200+ fan-investors are already backing PlayersTV. Want in?

This is a paid advertisement for PlayersTV Regulation CF offering. Please read the offering circular at https://invest.playerstv.com/

Market Overview

Wednesday's mixed session reflected investor uncertainty as tech stocks continued their recent slide while Fed meeting minutes added another layer of complexity.

The S&P 500's fourth consecutive day of losses was driven primarily by heavyweight technology names taking a breather after their massive run-up since April.

Nvidia, AMD, Broadcom, and Palantir all declined as investors questioned stretched valuations in the AI trade.

Even mega-cap darlings Apple, Amazon, Alphabet, and Meta couldn't escape the selling pressure.

The Fed minutes from July revealed policymakers split on inflation versus employment risks, with most still seeing inflation as the bigger threat.

However, a couple of officials flagged employment concerns as more pressing. This comes ahead of Jerome Powell's Friday remarks, which traders will scrutinize for rate cut clues.

Fed funds futures show over 80% odds of a September rate cut, but any hawkish tone from Powell could pressure tech stocks further.

As BMO's Carol Schleif noted, elevated rates remain a structural headwind for the tech sector, making Friday's speech crucial for near-term direction.

Stock Moves Deciphered 📈

Intel (INTC) – Shares tumbled 7% on reports that the Trump administration is considering taking equity stakes in chipmakers receiving CHIPS Act funding.

The potential government ownership structure adds uncertainty to Intel's turnaround story just as the company navigates operational challenges and a CEO transition.

Palantir (PLTR) – The AI software provider extended its losing streak to six consecutive sessions, falling another 1% and becoming the S&P 500's worst performer this week with 12% losses.

Investors are taking profits after the stock hit all-time highs following strong earnings earlier this month.

UnitedHealth (UNH) – Despite Morgan Stanley's cautionary note about a "prolonged turnaround story," shares have surged 11% over the past week as notable investors including Warren Buffett's Berkshire Hathaway scoop up shares.

The stock remains down 40% year-to-date, presenting potential value opportunities.

Headlines You Can't Miss

JPMorgan Chase to acquire $19 billion Apple Card portfolio from Goldman Sachs in strategic win-win deal.

Hertz shares jump 9.5% on Amazon Autos partnership for pre-owned vehicle sales platform.

Avis Budget was downgraded to underperform by Bank of America, citing unfavorable fundamentals and macro conditions.

TJX Companies surges 4.5% on earnings beat with $1.10 EPS vs $1.01 expected.

La-Z-Boy plunges 21% after-hours on weak Q1 earnings of 47¢ vs 53¢ expected.

Toll Brothers edges down 1.6% despite beating Q3 expectations on luxury home demand.

Fed minutes show a split on dual mandate risks, with the majority favoring inflation concerns.

Trump administration considers equity stakes in chipmakers receiving CHIPS Act funding.

Trending Stocks

Analog Devices (ADI) – The semiconductor company gained 3% after delivering an earnings and revenue beat while raising fourth-quarter guidance.

Despite broader chip sector weakness, Analog Devices stood out as one of the few tech winners, demonstrating resilient demand in its core markets and effective execution.

CEO Quote🎤: "The company's relentless focus on cutting-edge innovation positions us to capitalize on the growth of the intelligent physical edge. In addition, our diverse and resilient business model enables ADI to navigate various market conditions and consistently create long-term value for our shareholders.

Medtronic (MDT) – Shares popped 4% on better-than-expected guidance that showed reduced tariff impact.

The medical device giant now expects fiscal 2026 tariff headwinds of $185M, down from the previous $200M-$250M range, while lifting non-GAAP earnings guidance to $5.60-$5.66 per share.

CEO Quote🎤: “We delivered another consistent quarter of mid-single digit organic revenue growth, with broad strength from several innovative product categories, including Pulsed Field Ablation, Transcatheter Valves, Neuromodulation, Diabetes, and Leadless Pacing.”

Estée Lauder (EL) – Shares fell 3% after the beauty company provided disappointing fiscal 2026 guidance with adjusted earnings of $1.90-$2.10 per share below the $2.20 consensus.

The company also expects tariff-related headwinds to impact profitability by approximately $100 million for fiscal 2026.

CEO Quote🎤: “Despite continued volatility in the external environment, we embarked on fiscal 2026 with signs of momentum and confidence in our outlook to deliver organic sales growth this year after three years of declines and to begin rebuilding operating profitability in pursuit of a solid double-digit adjusted operating margin over the next few years.”

What’s Next?

Key Earnings 👇

Walmart (WMT): Q2 revenue forecast at $174.38 billion vs. $167.77 billion last year. Adjusted earnings are expected to grow from $0.67 per share to $0.74 per share.

Nordson (NDSN): Q2 revenue forecast at $767.15 million vs. $744.48 million last year. Adjusted earnings are expected to grow from $2.78 per share to $2.90 per share.

Coty (COTY): Q2 revenue forecast at $1.62 billion vs. $1.67 billion last year. Adjusted earnings are expected to grow from $0.15 per share to $0.18 per share.

Track upcoming news and earnings on your portfolio companies with Ziggma.

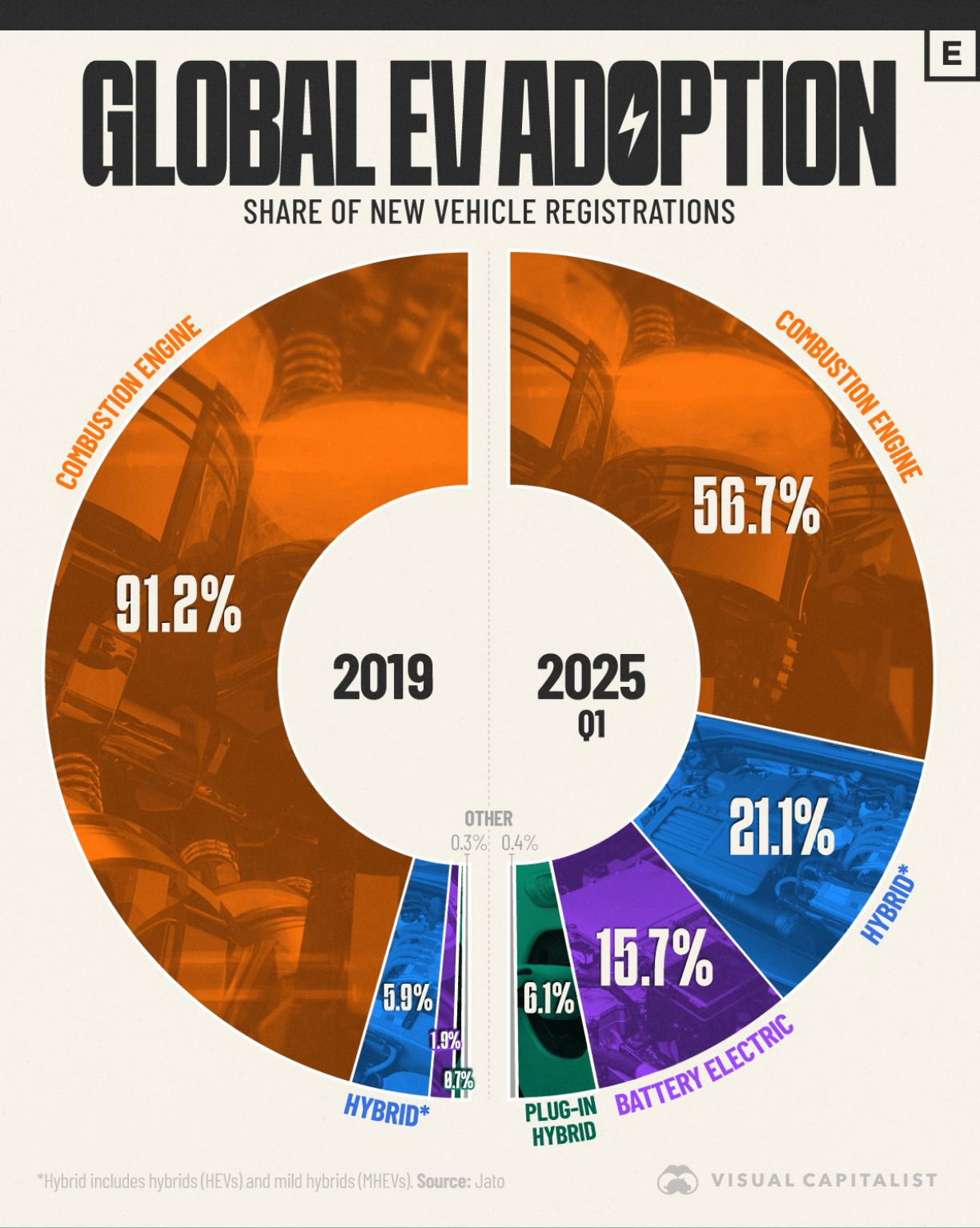

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.