- Ziggma

- Posts

- 🗞️ SoftBank Invests in Intel

🗞️ SoftBank Invests in Intel

PLUS: Why is Meta stock falling?

Market Performance

S&P 500: 6,449.15 (⬇️ 0.01% )

Nasdaq: 21,629.77 (⬆️ 0.03%)

Dow Jones: 44,911.82 (⬇️ 0.08%)

SoftBank Throws $2 Billion at Intel

SoftBank just made a bold $2 billion investment in Intel, paying $23 per share for the struggling chipmaker that's been hemorrhaging value.

But here's the real kicker 👇

The Trump administration is reportedly considering taking a 10% government stake in Intel, potentially converting its $10.9 billion in CHIPS Act grants into equity.

Intel is America's only advanced chip manufacturer, making it a critical national security asset.

While Intel's foundry business has yet to secure major customers despite massive spending, SoftBank's vote of confidence signals something bigger is brewing.

The timing is telling. SoftBank founder Masayoshi Son has been making strategic AI and semiconductor plays, from owning Arm Holdings to backing OpenAI.

His Intel bet suggests he sees potential in America's chip manufacturing revival, especially with government backing.

We can see that Intel stock has a Ziggma score of 21, and ranks in the bottom percentile in terms of growth.

Our Takeaway

Intel's transformation from Silicon Valley legend to government-backed national champion reflects how geopolitics now drives tech investments.

SoftBank's move validates Intel's strategic importance, but the real test remains landing that elusive foundry customer.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Market Overview

Markets ended virtually flat on Monday as traders digested a winning week while preparing for key retail earnings and Fed Chair Powell's Jackson Hole speech.

The crypto selloff weighed on sentiment, with Bitcoin retreating from record highs above $124,000 to around $115,000, triggering over $500 million in forced liquidations.

Investor focus shifts to retail earnings from Home Depot, Lowe's, Walmart, and Target for consumer health insights.

Wells Fargo strategists warned that retailer results will likely reflect tariff concerns and economic slowdown fears, potentially stalling the recent equity rally.

Fed funds futures show 83% odds of September rate cuts as central bankers gather at Jackson Hole.

Small-cap stocks outperformed last week on rate cut bets, while concerns about elevated valuations and moderating job growth persist heading into the year's second half.

Stock Moves Deciphered 📈

Target (TGT) – Evercore ISI added the retailer to its tactical outperform list, driving shares up 3%. The firm expects this week's earnings could beat expectations, potentially triggering a "relief rally."

Meta Platforms (META) – Shares of the social media giant fell nearly 3% on reports of planning its fourth AI operations overhaul in six months, raising questions about strategic direction consistency.

Duolingo (DUOL) – The digital language platform stock popped 12% following KeyBanc's upgrade to overweight with $460 price target, citing new products and viral marketing as growth catalysts.

Headlines You Can't Miss

Soho House surges 15% on $2.7 billion privatization deal at $9 per share.

Trump-Zelenskyy talks pave the way for Ukraine security guarantees without a ceasefire deal.

Japan's Nikkei hits an all-time high of 43,714.31, led by consumer cyclicals.

India to slash GST on small cars to 18% from 28%, boosting the auto sector.

Fed's Jackson Hole symposium awaited for rate policy clues this week.

Trending Stocks

Palo Alto Networks (PANW) – The cybersecurity giant jumped almost 5% in pre-market trading after quarterly results topped Wall Street estimates and issued better-than-expected guidance for Q1 and full year.

The strong performance comes weeks after announcing plans to acquire Israeli identity security provider CyberArk for $25 billion, its largest deal ever, signaling aggressive expansion in the identity security space.

CEO Quote🎤: “We exited fiscal year 2025 with an acceleration in RPO, and surpassed the $10 billion revenue run-rate milestone, positioning ourselves well for sustained growth ahead."

TeraWulf (WULF) – Shares rallied more than 10% as Google increased its stake in the Bitcoin miner and datacenter company to 14% from 8%. Google will provide up to $1.4 billion in additional backstop funding to support TeraWulf's data center campus expansion in New York, bringing Google's total commitment to approximately $3.2 billion.

Analyst Quote🎤: “Google will provide an incremental $1.4 billion backstop to support project-related debt financing, and in exchange will receive warrants to buy 32.5 million shares of TeraWulf.”

Novo Nordisk (NVO) – Shares rose over 4% after the FDA approved Wegovy to treat metabolic dysfunction-associated steatohepatitis (MASH) in adults with moderate-to-advanced liver fibrosis. With an estimated 22 million Americans living with MASH, this approval significantly expands Wegovy's addressable market beyond weight management.

Management Quote🎤: “MASH represents a significant health burden, with one in three people with overweight or obesity worldwide affected. In the US alone, around 22 million people are estimated to live with MASH.”

What’s Next?

Key Earnings 👇

Home Depot (HD): Q2 revenue forecast at $45.3 billion vs. $43.17 billion last year. Adjusted earnings are expected to grow from $4.6 per share to $4.69 per share.

Medtronic (MDT): Q2 revenue forecast at $8.37 billion vs. $7.92 billion last year. Adjusted earnings are expected to remain static at $1.23 per share.

Amer Sports (AS): Q2 revenue forecast at $1.18 billion vs. $994 million last year. Adjusted earnings are expected to narrow from $0.05 per share to $0.03 per share.

Track upcoming news and earnings on your portfolio companies with Ziggma.

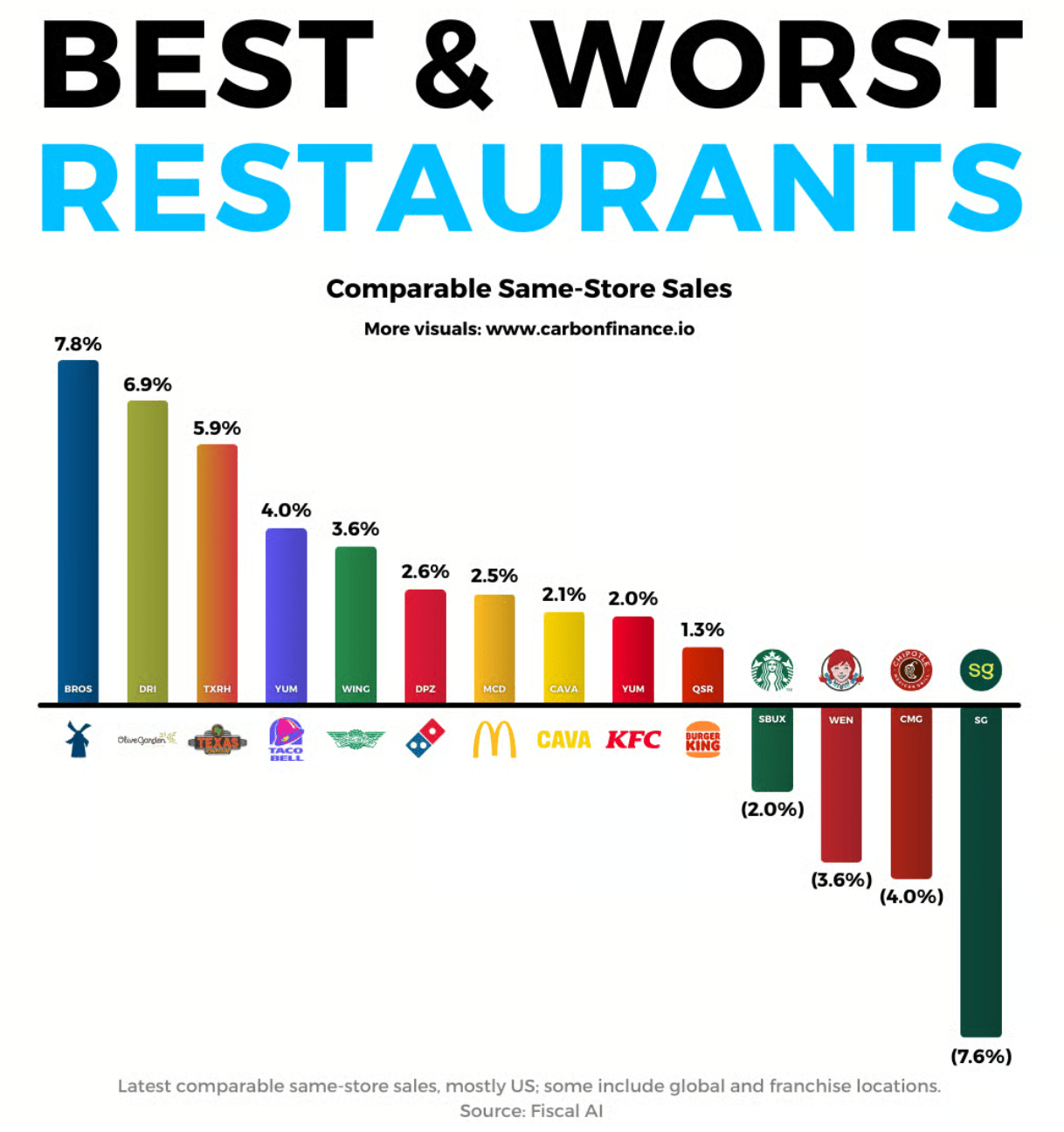

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.