- Ziggma

- Posts

- 🗞️ SoftBank Exits Nvidia

🗞️ SoftBank Exits Nvidia

Big Moves Decoded: CRWV, RKLB, and more!

Market Performance

S&P 500: 6,846.61 ⬆️ 0.21%

Nasdaq: 23,468.30 ⬇️ 0.25%

Dow Jones: 47,927.96 ⬆️ 1.18%

SoftBank Offloads Stake in Nvidia

SoftBank made a bold move that sent shockwaves through the tech world. The Japanese conglomerate sold its entire Nvidia (NVDA) stake—all 32.1 million shares—for $5.83 billion in October.

However, SoftBank is doubling down on AI, not backing away.

The company is redirecting this capital, along with proceeds from a partial stake sale in T-Mobile ($9.17 billion) and an Arm margin loan, to fund its massive $22.5 billion investment in OpenAI and other strategic projects, such as ABB's acquisition of its robotics unit.

SoftBank's Vision Fund reported a staggering $19 billion gain in fiscal Q2, primarily driven by its OpenAI position, which recently touched a $500 billion valuation.

Following its latest investment, SoftBank's ownership in the ChatGPT maker will jump from 4% to 11%.

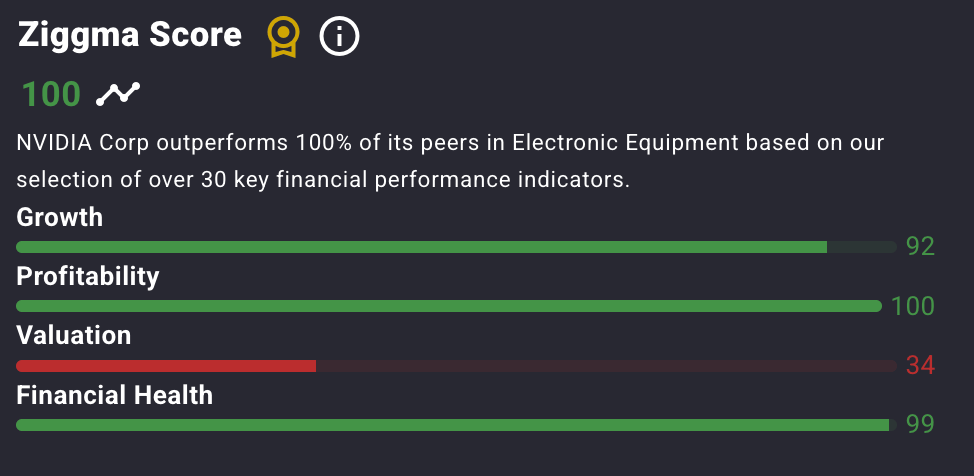

Nvidia stock has a Ziggma score of 100 and ranks highly in terms of profitability, growth, and financial health.

However, the chip giant, which has seen a 1,130% increase in the last three years, trades at a lofty valuation.

Our Takeaway

SoftBank is betting that owning a larger stake in OpenAI will deliver better returns than holding Nvidia stock.

With the Vision Fund's explosive gains and OpenAI's soaring valuation, they're making a calculated pivot toward the AI application layer rather than just the infrastructure.

Nvidia shares dipped 2% on the news, but the company's fundamentals remain strong.

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

Shares remain $0.81 until Nov 20, then the price changes.

👉 Invest in RAD Intel before the next share-price move.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Market Overview 📈

Tuesday delivered a tale of two markets as investors engaged in a dramatic rotation away from expensive tech stocks toward value-oriented blue chips.

The Dow Jones Industrial Average surged to a fresh closing record, powered by healthcare giants Merck, Amgen, and Johnson & Johnson.

Meanwhile, the AI trade faced headwinds. CoreWeave's disappointing guidance triggered a 16% plunge, dragging down AI-linked names including Micron (-5%), Oracle (-2%), and Palantir (-1%).

The Technology Select Sector SPDR fund declined by roughly 1% as investors questioned the stretched valuations in the sector.

"These tech companies are cash flow machines and terrific companies, but the starting point does matter," noted Bill Fitzpatrick of Logan Capital Management, highlighting that valuation concerns are driving investors toward quality value plays that have been "left behind" in the bull market.

Adding to the cautious sentiment, ADP revealed a troubling labor market signal: private sector job creation averaged negative 11,250 positions per week for the four weeks ended October 25, contrasting sharply with earlier positive data and suggesting emerging weakness.

The market found some relief on Monday night as the Senate passed a bill to end the record-breaking government shutdown, sending it to the House.

The deal funds operations through January and guarantees back pay for federal workers, though concerns about political dysfunction persist.

Stock Moves Deciphered 📈

💉 Viatris (VTRS)

Viatris surged 10% as investors rotated into defensive healthcare names amid tech sector volatility.

The pharmaceutical company's strong third-quarter earnings, as reported on November 6, combined with positive guidance and a presentation at the UBS Global Healthcare Conference, reinforced confidence in its operational trajectory and pipeline strength.

🛍️ Etsy (ETSY)

Etsy climbed 6%, rebounding from post-earnings weakness following its third-quarter report and the announcement of its new CEO.

A new holiday marketing campaign aimed at driving seasonal sales momentum, coupled with Barclays raising its price target on the e-commerce platform, helped restore investor enthusiasm about growth prospects despite leadership changes.

🚛 FedEx (FDX)

FedEx jumped 5.5% after delivering exceptionally strong guidance for its fiscal second quarter.

Management projected earnings will surpass both prior-year results and analyst expectations, easing concerns about holiday season demand.

The confident outlook indicates that operational improvements and pricing power are gaining traction across the logistics giant's network.

🩻 DexCom (DXCM)

DexCom gained 6%, recovering from recent pressure related to class-action lawsuits.

The medical device maker's strong third-quarter earnings beat, raised full-year revenue guidance, and significant insider buying from top executives demonstrated management's conviction.

The continuous glucose monitoring leader continues gaining market share in the diabetes technology space.

Headlines You Can't Miss 👀

🏛️ Senate passed shutdown bill Monday night (60-40 vote), funding government through January and guaranteeing federal worker back pay; now heads to House.

🤖 Michael Burry accused hyperscalers of artificially inflating earnings by understating depreciation on AI chips, using aggressive assumptions of a 2-3 year product cycle.

🚀 AMD CEO Lisa Su projected 35% annual revenue growth over the next three to five years, given that the AI data center business is expected to grow 80% annually.

✈️ Flight disruptions will persist even after government reopens, airlines warn, as air traffic controllers missed second paycheck and staffing shortages worsen.

🇨🇳 China plans validated-end user system to block rare earth exports to U.S. military-linked firms while allowing civilian exports, per Wall Street Journal report.

👻 Ghost job postings are plaguing the labor market, as job openings outnumber actual hires by 2.2 million per month since early 2024, according to BLS data.

🥇 Wells Fargo forecasts gold will reach $4,500-$4,700 per troy ounce by the end of 2026, citing government debt concerns and robust central bank demand.

Trending Stocks 📊

🤖 CoreWeave (CRWV)

CoreWeave shares fell 16% after the company revealed data center supply constraints.

The AI infrastructure provider lowered full-year revenue guidance to $5.05-$5.15 billion (vs. $5.29B expected), citing limited availability of powered-shell data centers despite posting strong Q3 results with 134% year-over-year revenue growth.

🍿Paramount Skydance (PSKY)

Paramount surged on aggressive cost-cutting plans.

The media company announced an additional $1 billion in savings (beyond the $2 billion merger target), as well as new layoffs and price increases for Paramount+ starting in Q1 2026.

This signals management's commitment to profitability amid the challenges of the streaming industry.

🚀 Rocket Lab (RKLB)

Rocket Lab fell by over 1% despite crushing earnings expectations.

The space company reported a loss of $0.03 per share, compared to the anticipated loss of $0.10, with Q3 revenue of $155 million exceeding the $152 million estimate.

Strong Q4 guidance also failed to boost sentiment toward the aerospace manufacturer.

What’s Next?

Key market and macro news 👇

💰 Tech earnings continue as investors await guidance on AI spending and margin trends.

💸 Retail sector reports will provide crucial indicators of holiday season demand ahead of Black Friday.

✈️ Transdigm Group (TDG): The aerospace and defense company is expected to report its quarterly earnings before the market opens.

🎤 GlobalFoundries (GFS): The semiconductor manufacturing company will release its quarterly earnings, which could provide insights into the health of the tech sector.

📊 The U.S. Consumer Price Index (CPI) data for October will be released. This key inflation indicator could influence the Federal Reserve's monetary policy decisions.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.