- Ziggma

- Posts

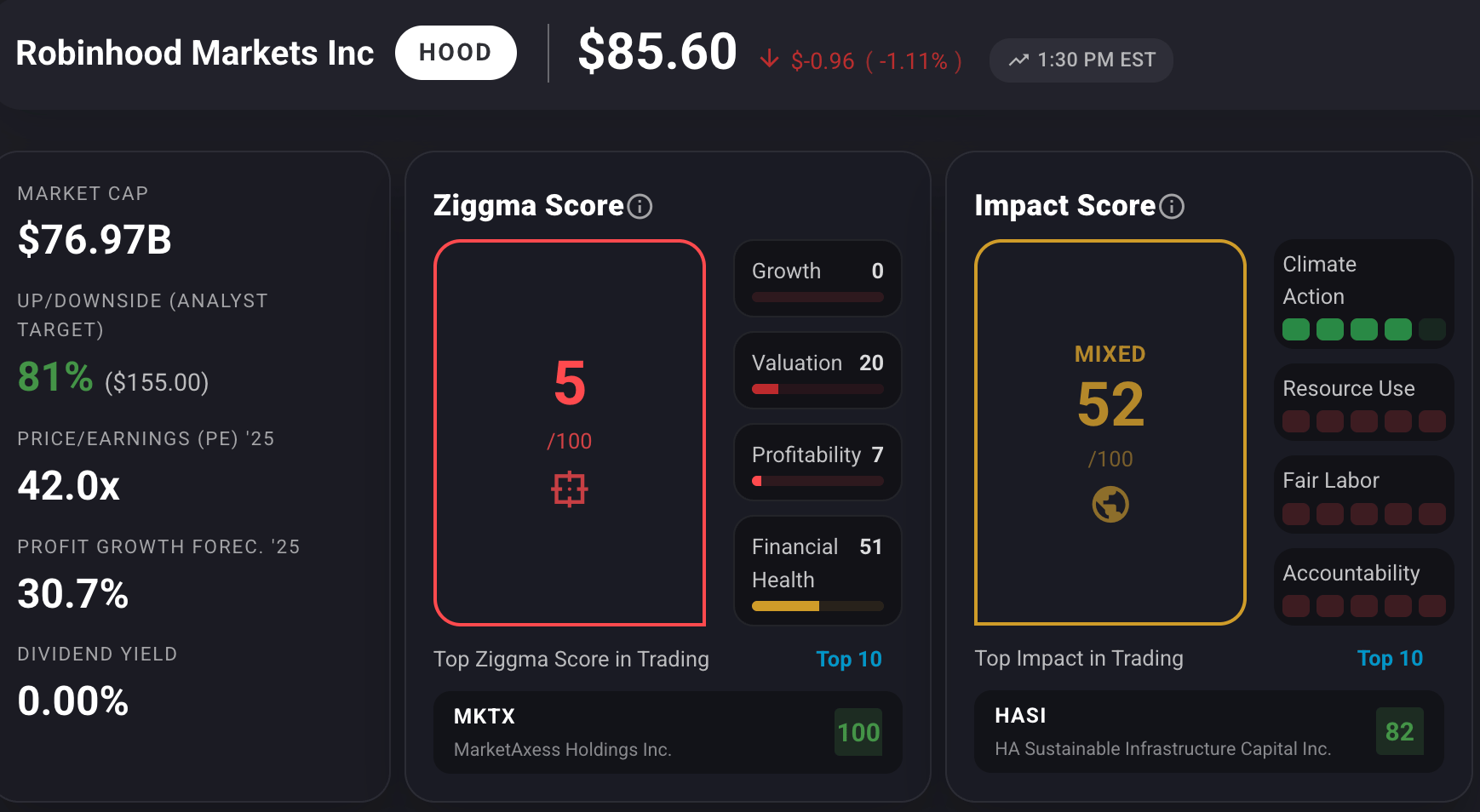

- ₿ Robinhood Tanks on Crypto Slump

₿ Robinhood Tanks on Crypto Slump

PLUS: Spotify surges 15%

Market Performance

S&P 500: 6,941.81 ⬇️ 0.33%

Nasdaq: 23,102.47 ⬆️ 0.59%

Dow Jones: 50,188.14 ⬆️ 0.10%

Robinhood's Growth Engine Sputters

Platforms built on high engagement can feel it first when enthusiasm starts to fade. That was the story behind Robinhood's (HOOD) latest fourth quarter 2025 financial results.

The company's earnings call on Tuesday highlighted a business grappling with two simultaneous slowdowns.

Crypto trading volumes, once a powerful engine of growth, have cooled.

At the same time, retail equity and options trading activity have declined as individual investors pull back amid market volatility, higher interest rates, and competing demands on household capital.

The company reported Q4 earnings per share of $0.66, beating the $0.63 consensus, but sales of $1.28 billion missed the $1.35 billion consensus.

The revenue shortfall was largely driven by a 38% year-over-year decline in crypto trading revenue and weaker-than-expected options revenue.

Despite the headline miss, Robinhood's underlying metrics showed strategic progress. Gold subscribers reached 4.2 million by year-end (over 15% of funded customers), with subscription revenues rising 70% to $331 million.

For 2025 as a whole, the company delivered record revenues of $4.5 billion and net deposits of $68.1 billion.

Our Takeaway

Robinhood's challenge isn't survival—it's maturation. The retail trading frenzy has cooled, and competition from modernized traditional brokerages and fintech peers is intensifying.

The company's push into prediction markets, AI-driven efficiency (75% of support cases now AI-resolved), and recurring Gold subscriptions show strategic evolution.

But with shares down 26% year-to-date and falling 7% in after-hours trading, investors want proof that diversification can offset cyclical weakness in crypto.

➡️ FREE ZIGGMA RESEARCH: Nvidia (NVDA Stock): 60%+ Earnings Growth, AI Dominance, and a Profound Impact Edge 🔖 Read for free on Substack 🎧 Listen to podcast

Market Overview 📈

The S&P 500 slipped on Tuesday as investors reacted to weaker-than-expected retail sales data and grew concerned about artificial intelligence's threat to the financial sector.

December retail sales came in flat, missing the 0.4% monthly gain economists had expected.

This disappointing data weighed on retail stocks, with Costco falling over 2% and Walmart declining more than 1%.

The weak consumer spending report raised questions about the resilience of lower- and middle-income households heading into 2026.

Financial stocks took a particularly hard hit after fintech platform Altruist launched a new AI-powered tax planning tool.

LPL Financial stock declined 8.3%, while Charles Schwab dropped 7.4% and Morgan Stanley dipped more than 2%.

The sell-off reflected growing fears that AI automation could disrupt traditional advisory business models.

Despite the broader market weakness, the Dow Jones Industrial Average managed to notch its third consecutive intraday record and closed at a fresh high of 50,188.14.

The index's resilience came as investors rotated into sectors perceived as more insulated from AI disruption, including materials and utilities.

On the monetary policy front, Federal Reserve officials expressed caution about further rate cuts.

Dallas Fed President Lorie Logan suggested the central bank may already be at a neutral rate, while Cleveland Fed President Beth Hammack advocated holding rates steady "for quite some time" given persistently high inflation.

AI in HR? It’s happening now.

Deel's free 2026 trends report cuts through all the hype and lays out what HR teams can really expect in 2026. You’ll learn about the shifts happening now, the skill gaps you can't ignore, and resilience strategies that aren't just buzzwords. Plus you’ll get a practical toolkit that helps you implement it all without another costly and time-consuming transformation project.

Stock Moves Deciphered 📈

🏥 CVS Health (CVS)

The retail pharmacy chain's stock slipped 3% after maintaining its 2026 revenue guidance of at least $400 billion, falling short of the $409.77 billion analysts expected.

CVS also lowered its full-year cash from operations guidance to at least $9 billion from $10 billion, versus the $10.59 billion consensus.

However, the company's fourth-quarter earnings and revenue beat analysts' estimates.

📈 Charles Schwab (SCHW)

Schwab's stock dropped 7.4% as growing fears emerged that artificial intelligence could disrupt the traditional financial advisory business model.

The decline was triggered by fintech platform Altruist's announcement of a new AI-powered tax-planning tool, raising concerns that automation could replace human financial advisors across the wealth management industry.

🏨 Marriott International (MAR)

Marriott shares surged 8.50% after the hotel giant reported fourth-quarter earnings and revenue that beat analyst expectations.

The strong performance was driven by continued momentum in international travel and a positive outlook for 2026.

However, the company noted a 1% decline in U.S. and Canada occupancy due to the government shutdown, while overseas occupancy rose 1%.

Headlines You Can't Miss 👀

📱 Taiwan Semiconductor Manufacturing posted its highest monthly revenue ever, with January revenue soaring 37% year-over-year to NT$401.3 billion.

💊 DuPont De Nemours posted Q4 adjusted earnings of $0.46 per share, beating the $0.43 consensus, with upbeat full-year guidance driving shares up 2%.

🎮 Take-Two Interactive Software was upgraded to strong buy by Raymond James at a $285 price target, suggesting 39% upside after AI-driven sell-off fears.

🎯 Unity Software received an upgrade to outperform from Oppenheimer with a $38 target, citing favorable risk/reward and accelerating revenue growth ahead.

🥩 Texas Roadhouse was downgraded to “Hold” by Truist, with analysts warning that beef price inflation will persist through 2027, threatening restaurant margins.

📱 Qualcomm was downgraded to underweight by Morgan Stanley due to concerns that a severe memory shortage will impact handset volumes and put pressure on market share.

📊 61 S&P 500 stocks hit new 52-week highs, including Verizon (highest since July 2022), Hilton Worldwide (all-time high), and Caterpillar (highest since 1929).

🏦 Federal Reserve officials signaled rates may hold steady for an extended period, with Dallas Fed's Logan suggesting current policy may already be at neutral.

Trending Stocks 📊

🥤Coca-Cola (KO)

Shares fell more than 1.5% after posting mixed quarterly results, with revenues missing expectations for the first time in five years.

The beverage giant's concentrate sales in North America rose just 1%, significantly lagging behind those in other regions.

For 2026, Coca-Cola projects organic revenue growth of 4-5% and comparable EPS growth of 7-8%.

🎵 Spotify (SPOT)

The music streaming platform's stock popped 15% after reporting strong user growth and beating earnings expectations.

Spotify added more users than anticipated and expanded features in new markets, demonstrating the platform's continued momentum in global expansion despite increasing competition in the streaming space.

📉 Upwork (UPWK)

Shares of the freelancer marketplace tumbled 19% after disclosing active clients fell to 785,000 at year-end from 832,000 the prior year—a 6% decline.

The company's Q1 2026 revenue guidance of $192-197 million missed the $201 million consensus, raising concerns about growth prospects despite year-over-year revenue increases.

What’s Next?

Key market and macro news 👇

🛜 Cisco Systems Q2 Earnings: Technology giant reports quarterly results before the market opens. With a $341B market cap, an earnings surprise could impact semiconductor and networking sector sentiment broadly across the technology index.

🍔 McDonald's Q4 Earnings: Fast-food leader reports fourth-quarter results with $3.05 EPS estimate. Consumer-discretionary strength or weakness signals broader retail health; the stock trades at a $233B market cap, affecting consumer-sector indices.

📵 T-Mobile Q4 Earnings: Telecommunications company reports $2.06 EPS estimate with $224B market cap. Data on wireless subscriber growth and pricing power influence telecom sector valuations and the outlook for consumer spending for investors.

🛍️ Shopify Q4 Earnings: E-commerce platform reports results with $0.51 EPS estimate and $166B market cap. Guidance on merchant activity and platform growth directly impacts the performance and sentiment of the technology and retail infrastructure sector.

📊 Employment Situation Report - Bureau of Labor Statistics releases January jobs data. Nonfarm payrolls, the unemployment rate, and wage growth figures are critical to expectations of Fed policy and to overall economic health assessments.

💸 Consumer Price Index - Inflation data scheduled for release on February 13. Core and headline inflation readings directly influence expectations of Federal Reserve rate decisions and bond market yields across all maturities.

💰 Real Earnings Report - Wage growth adjusted for inflation will be released on February 13. Real earnings data indicate trends in consumer purchasing power and potential inflationary pressures that affect equity valuations and economic growth forecasts.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.