- Ziggma

- Posts

- 🗞️ Qualcomm's AI Chip

🗞️ Qualcomm's AI Chip

Big Moves Decoded: Tesla, KDP, and more

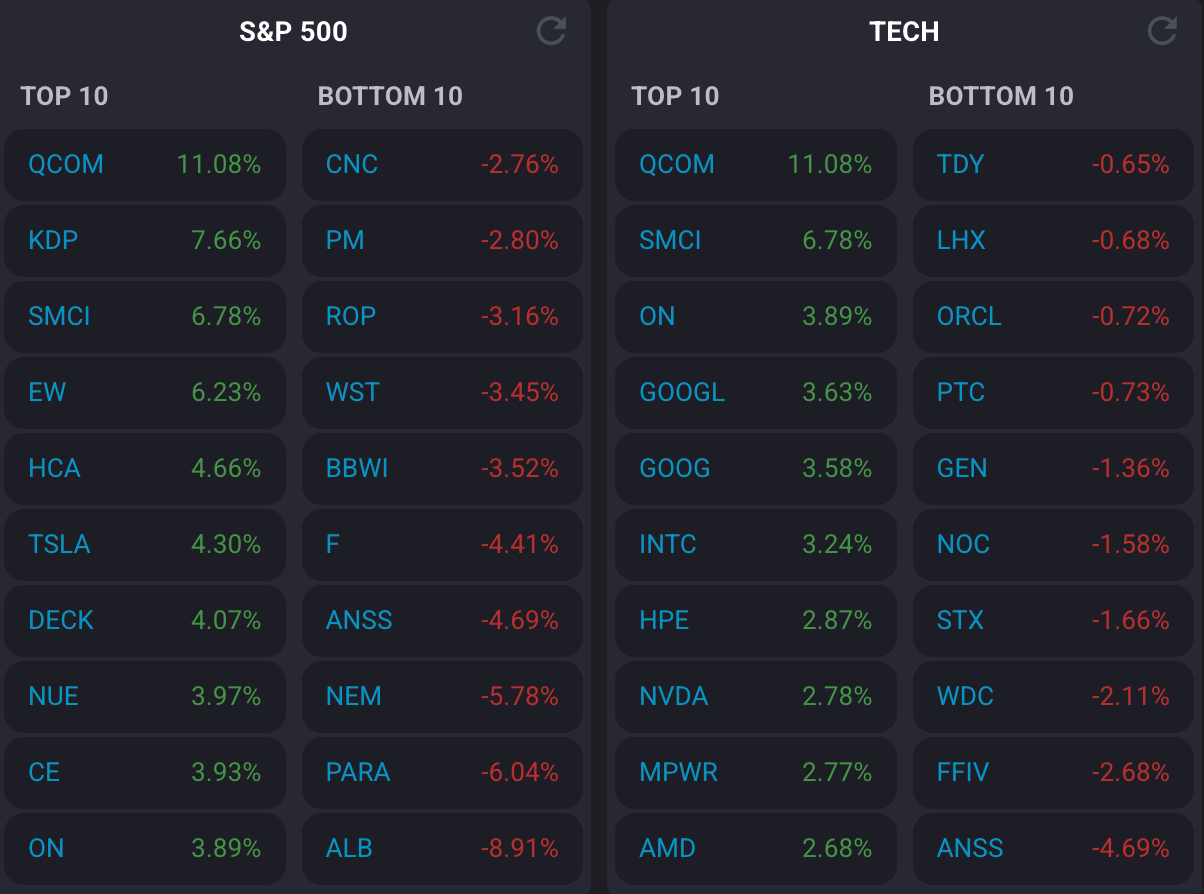

Market Performance

S&P 500: 6,875.16 ⬆️ 1.23%

Nasdaq: 23,637.46 ⬆️ 1.86%

Dow Jones: 47,544.59 ⬆️ 0.71%

Qualcomm Takes on Nvidia and AMD

Qualcomm (QCOM) just announced it's jumping into the data center AI chip market with new accelerator chips set to launch in 2026 and 2027.

The stock soared 11% on Monday, as Qualcomm competes with Nvidia, which has dominated the AI semiconductor space with over 90% market share.

The AI200 (2026) and AI250 (2027) chips represent a significant pivot for Qualcomm, which has historically focused on mobile devices and wireless connectivity rather than massive data centers.

These new chips can fill an entire liquid-cooled server rack and compete directly with Nvidia and AMD's full-rack GPU systems that AI labs need to run their most advanced models.

Qualcomm is leveraging its smartphone chip technology—specifically its Hexagon neural processing units—and scaling them up for data centers.

The company claims its systems will cost less to operate and support more memory (768GB) than current offerings from Nvidia and AMD.

"We first wanted to prove ourselves in other domains, and once we built our strength over there, it was pretty easy for us to go up a notch into the data center level," said Durga Malladi, Qualcomm's general manager for data center and edge.

McKinsey estimates nearly $6.7 trillion will be spent on data center capital expenditures through 2030, with the majority going toward AI chip systems.

Companies like OpenAI are actively seeking alternatives to Nvidia—OpenAI recently announced plans to buy chips from AMD and potentially take a stake in the company.

QCOM stock has a Ziggma score of 90 and ranks in the top percentile for profitability and valuation.

Our Takeaway

Qualcomm's entry signals that the AI chip market is maturing and diversifying.

While Nvidia's first-mover advantage is enormous, the sheer size of the market means there's room for multiple players.

For investors, this competition could actually be healthy—it may drive innovation and prevent monopolistic pricing.

Watch how hyperscalers like Google, Amazon, and Microsoft respond.

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

Market Overview 📈

Stocks surged to new records on Monday as U.S.-China trade tensions cooled dramatically over the weekend.

The breakthrough came from Treasury Secretary Scott Bessent at the ASEAN Summit in Malaysia, who announced a 'very successful framework' for President Trump and President Xi Jinping to discuss on Thursday.

The potential deal includes delaying China's rare earth export restrictions, withdrawing Trump's threatened 100% tariffs set to start on November 1, resuming Chinese purchases of American soybeans, and potentially resolving the TikTok dispute.

"I have a lot of respect for President Xi, and we are going to come away with the deal," Trump said Monday from Air Force One.

Chipmakers, the sector most at risk from China tensions, led the rally. Nvidia and Broadcom both rose more than 2%.

The Russell 2000 small-cap benchmark also hit record highs as investors positioned for continued Fed rate cuts without recession fears.

Investors are now focused on this week's packed calendar: several Magnificent Seven companies, including Alphabet, Amazon, Apple, Meta, and Microsoft, report Q3 earnings, while the Federal Reserve is expected to cut interest rates on Wednesday following last week's cooler-than-expected inflation data.

Stock Moves Deciphered 📈

🚗 Tesla (TSLA) ⬆️ 4.3%

Tesla shares jumped 4.3% on Monday, pacing toward their best day since September 12. The surge came on renewed optimism for the U.S.-China trade deal framework announced over the weekend.

With potential reduced tariffs that have significantly impacted Tesla's manufacturing costs and China operations, investors are betting on improved margins and stronger Chinese sales.

The stock's six-month advance now stands at approximately 61%, far exceeding the S&P 500's 24% gain in the same period.

🥤 Keurig Dr Pepper (KDP) ⬆️ 7.6%

Keurig Dr Pepper shares soared more than 7.6%, heading for their best day since March 2020. The beverage giant crushed third-quarter revenue estimates, posting $4.31 billion versus analyst expectations of $4.15 billion.

The 7UP and Canada Dry parent also raised its full-year revenue growth guidance to the high single-digit percentage range from mid-single digits.

Strong performance across both its beverage concentrates and coffee systems segments, plus the strategic Ghost energy drink acquisition, fueled the beat and the optimistic outlook.

🤖 Super Micro Computer (SMCI) ⬆️ 6.8%

Super Micro Computer shares climbed after Northland Securities upgraded the stock and increased its price target. The positive analyst rating boosted investor confidence, driving the stock price higher.

The upgrade comes as the AI server manufacturer continues to benefit from surging data center demand, though specific details on the new price target and the rationale for the upgrade were not disclosed during Monday's trading session.

Headlines You Can't Miss 👀

🎮 GameStop gained more than 4% after the White House reposted the company's statement that the 'console wars' are over, following Microsoft's announcement that Halo will be available on PlayStation.

💰 Janus Henderson jumped nearly 14% after Bloomberg reported that Nelson Peltz's Trian Fund Management is working with General Catalyst on a buyout offer valuing the asset manager at $7 billion.

🛍️ Five Below received an upgrade to overweight from JPMorgan with a price target raised to $186 from $154, implying 19% upside as the holiday season approaches.

⚡ Fermi saw multiple Wall Street firms initiate coverage at buy ratings with price targets ranging from $27 to $31, citing the AI data center developer's differentiated off-grid power solutions.

📉 Rare earth stocks, including Critical Metals (down 13.7%), USA Rare Earth, and MP Materials, declined sharply as Treasury Secretary Bessent announced China would delay export controls as part of the trade deal.

🌍 Global markets rallied on U.S.-China trade optimism, with Japan's Nikkei 225 breaching 50,000 for the first time (up 2.46%) and South Korea's Kospi rising 2.57%.

Trending Stocks 📊

👚 Lululemon Athletica (LULU) ⬆️ 1.8%

The athletic apparel maker saw shares rise 6% in premarket trading after announcing a strategic partnership with the National Football League and Fanatics.

The collaboration will launch an apparel collection for all 32 NFL teams, marking Lululemon's entry into the massive sports merchandise market and potentially opening a significant new revenue stream.

💊 Edwards Lifesciences (EW) ⬆️ 6.20%

Edwards Lifesciences stock advanced following the announcement of positive clinical trial results for its innovative heart valve technologies.

The promising data from trials involving its SAPIEN and EVOQUE valve systems boosted investor optimism about the company's competitive position in the structural heart market and its future growth prospects.

🤝 Novartis (NVS) ⬇️ 1%

U.S.-listed shares of Novartis shed 1% despite announcing a major acquisition.

The Swiss pharmaceutical giant's $12 billion deal to acquire Avidity Biosciences represents a significant investment in expanding its rare disease and cardiology pipeline, though investors initially weighed the substantial price tag against potential returns.

What’s Next?

Key market and macro news 👇

🏥 UnitedHealth Group (UNH): The nation's largest health insurer reports Q3 earnings with an EPS estimate of $2.81 as it faces scrutiny over healthcare costs, Medicare Advantage enrollment trends, and regulatory pressures.

⚡️ NextEra Energy (NEE): The clean energy giant reports Q3 earnings with $1.02 EPS estimate while announcing a landmark 25-year deal with Google to restart Iowa's Duane Arnold nuclear plant by 2029.

📣 American Tower (AMT): Leading cell tower REIT reports Q3 earnings with $1.65 EPS estimate, offering insights into 5G infrastructure buildout, wireless carrier spending, and international expansion.

🇨🇦 Bank of Canada expected to cut interest rates by 25 basis points, following the Fed's dovish path and signaling coordinated North American monetary easing to support economic growth amid trade uncertainty.

🇨🇳 China releases official NBS manufacturing and services PMI readings, expected to show near-stagnant activity, providing insights into the world's second-largest economy and the global supply chain, which affects US multinational corporations.

🇪🇺 ECB holds monetary policy meeting with no rate changes expected, but commentary on Eurozone economic outlook and inflation trajectory will influence global risk sentiment and dollar strength, affecting US exporters.

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.