- Ziggma

- Posts

- Oracle Slips On Lower Cloud Margins

Oracle Slips On Lower Cloud Margins

Big moves decoded: PayPal, Ford, and AMD

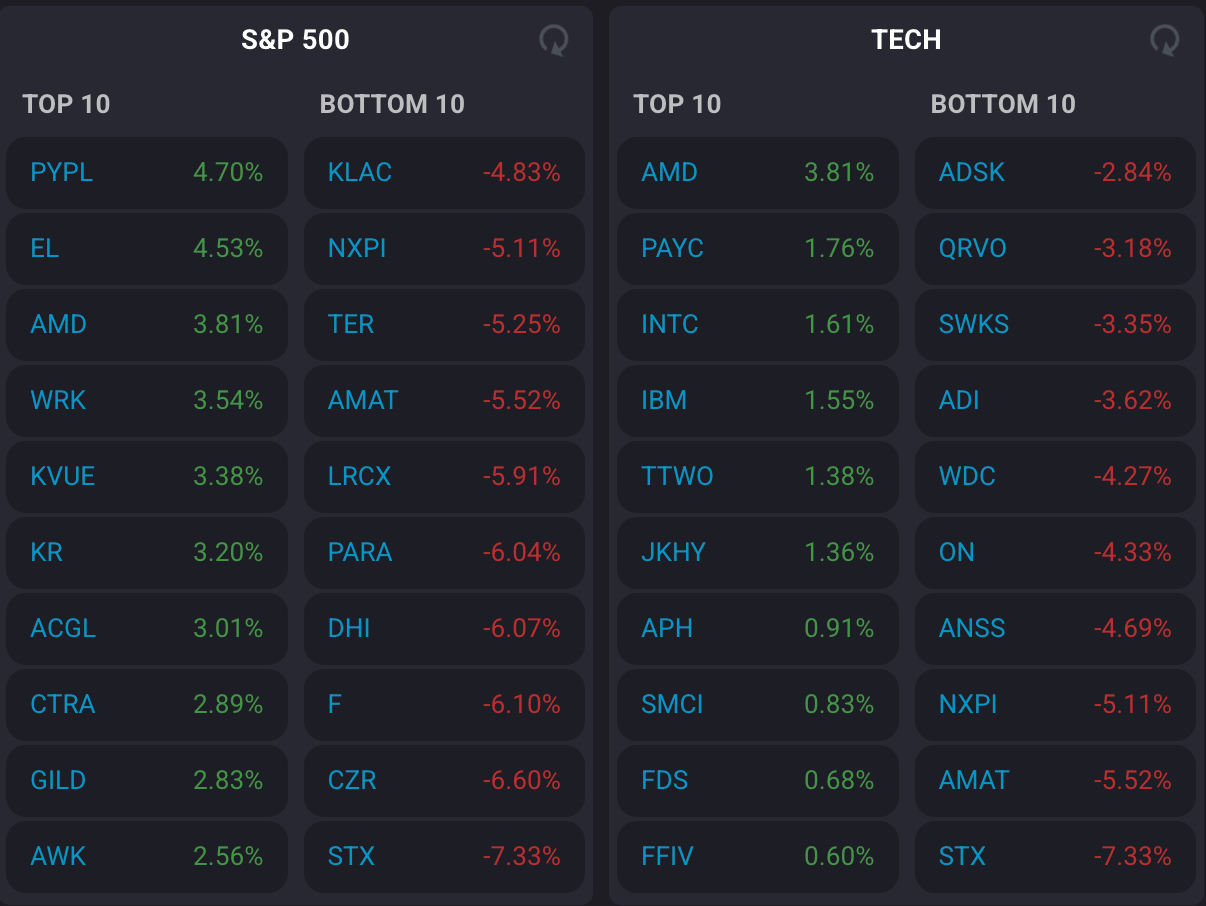

Market Performance

S&P 500: 6,714.59 ⬇️ 0.38%

Nasdaq: 22,788.36 ⬇️ 0.67%

Dow Jones: 46,602.98 ⬇️ 0.20%

Oracle Slips On Lower Cloud Margins

Oracle's (ORCL) stock tumbled nearly 3% on Tuesday after The Information dropped a bombshell report revealing the company's ambitious AI cloud business might be burning cash faster than anyone expected.

Oracle generated roughly $900 million in cloud revenue from renting Nvidia chips during the three months ending in August, but only pocketed about $125 million in gross profit—a razor-thin 14% margin.

Compare that to Oracle's typical 70% gross margin across its broader business, and you can see why investors hit the panic button.

Oracle is apparently losing "considerable" money on smaller chip rental deals, both for new and older GPUs.

This is happening despite Oracle's bold September forecast, which projects cloud infrastructure revenue to surge from $10 billion in 2025 to $144 billion by 2030, a staggering 1,340% increase, primarily driven by its role in OpenAI's Stargate project.

Nvidia's chips are expensive, and Oracle's aggressive pricing strategy to win cloud contracts may be undermining profitability.

The company's overall gross margin has already dropped to 67.3%, the lowest level in over a year.

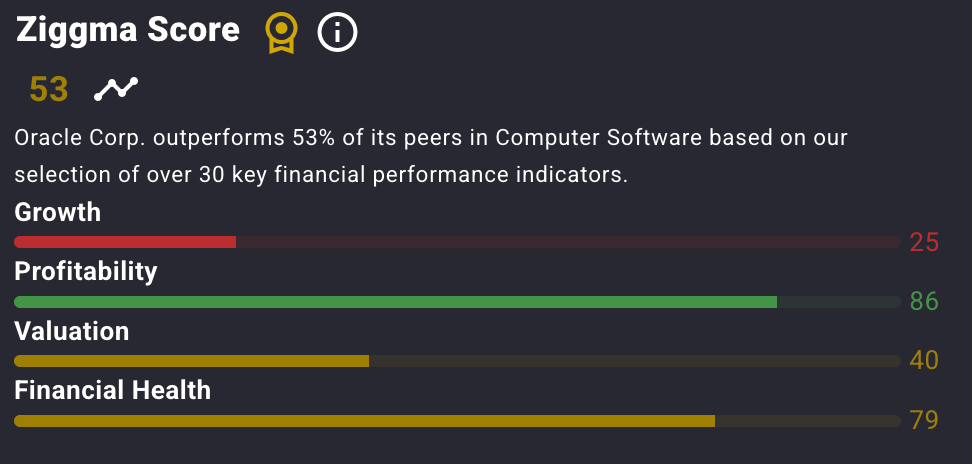

ORCL stock currently has a Ziggma Stock Score of 53, ranking in the top half percentile in terms of profitability and financial health.

Our Takeaway

Oracle's transformation into an AI powerhouse faces a critical test: can it scale its cloud ambitions without sacrificing margins?

While the Stargate partnership and massive backlog signal strong demand, investors are now questioning whether Oracle can turn AI enthusiasm into sustainable profits.

The road from $10 billion to $144 billion in cloud revenue looks bumpier than expected.

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

Market Overview 📈

The S&P 500 struggled on Tuesday, ending a seven-day winning streak as tech stocks retreated and the government shutdown in Washington entered its second week with no resolution in sight.

Oracle's profitability concerns sent ripples through the tech sector, with investors questioning the return on massive investments in AI infrastructure.

Meanwhile, the government shutdown continues to create economic uncertainty. The Senate failed for a fifth time to pass a House funding bill, with partisan gridlock showing no signs of breaking.

The impasse is delaying critical economic data releases and leaving federal workers unpaid, including TSA agents, air traffic controllers, and potentially 1.3 million active-duty military members if the shutdown extends past mid-October.

Adding to market anxiety, investors fled to safe-haven assets as uncertainty around fiscal deficits and trade policy intensified.

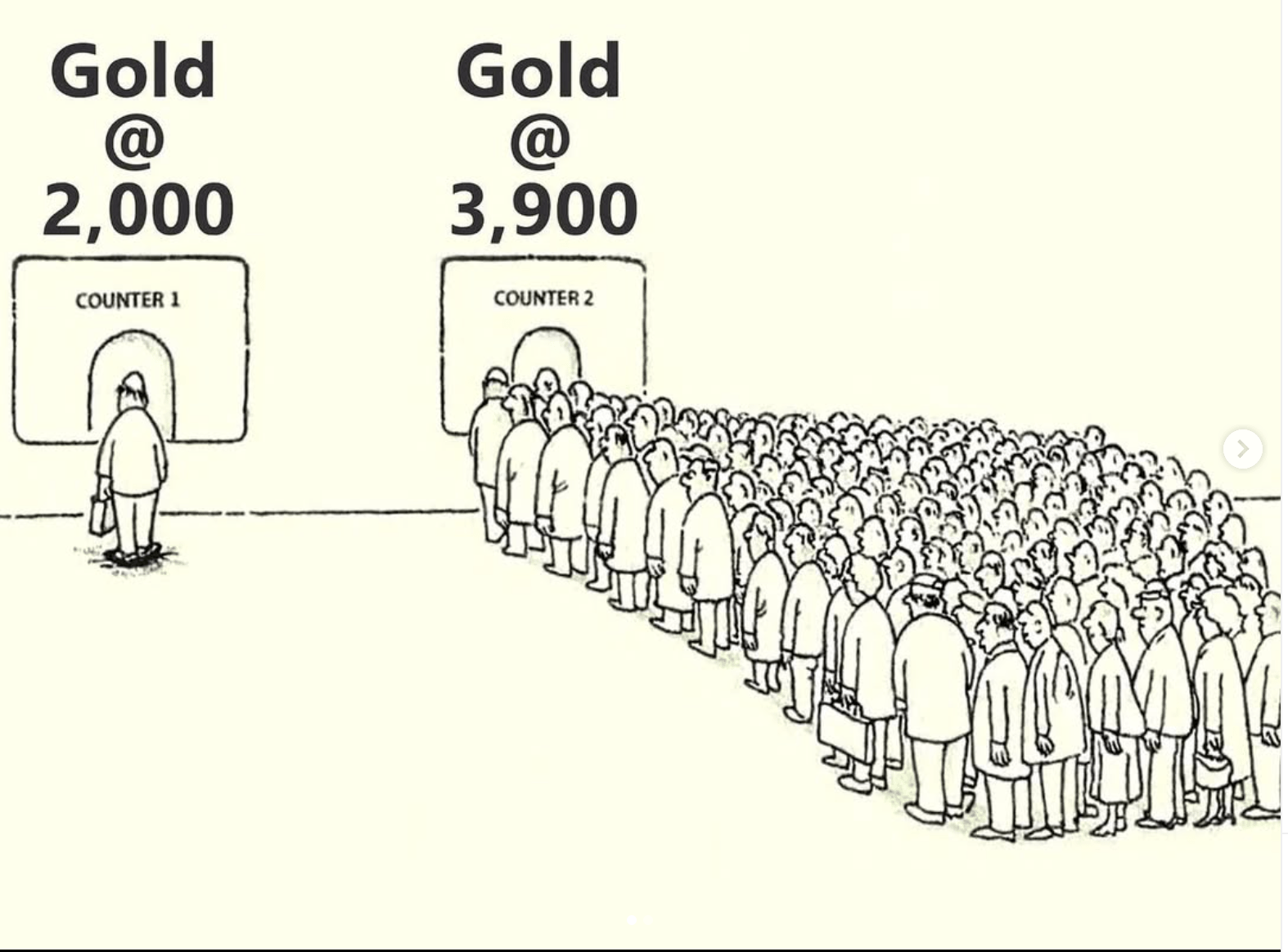

Gold futures surged past $4,000 per ounce for the first time ever, up more than 50% this year, signaling deep concern about government stability and inflation.

The 10-year Treasury failed to rally despite the turmoil, suggesting investors are worried about America's mounting debt burden.

President Trump's comments about discussing tariffs with Canadian Prime Minister Mark Carney further clouded the trade outlook, keeping investors on edge.

Stock Moves Deciphered 📈

💸 PayPal (PYPL)

PayPal shares gained on Tuesday following the launch of a new advertising platform designed specifically for small businesses.

This strategic expansion into the retail media space represents a potentially significant new revenue stream for the payments giant.

The move positions PayPal to monetize its vast merchant network by helping small businesses reach consumers directly through targeted advertising, diversifying beyond traditional transaction fees.

🤖 Advanced Micro Devices (AMD)

AMD shares surged to an all-time high on Tuesday, extending gains following the announcement of a major partnership with OpenAI to supply AI chips.

This deal positions AMD as a serious challenger to NVIDIA's dominance in the AI accelerator market and validates the company's data center GPU strategy.

The OpenAI partnership could represent billions in future revenue as global AI infrastructure spending accelerates.

💄Estée Lauder (EL)

Estée Lauder shares rallied more than 3% on Tuesday, outperforming both the broader market and beauty sector competitors.

The company's aggressive expansion strategy in high-growth emerging markets is resonating with investors, who see significant runway for premium beauty products in developing economies.

This geographic diversification could help offset weakness in mature markets and drive above-average growth.

Headlines You Can't Miss 👀

📊 Ray Dalio recommends a 15% portfolio allocation to gold as the precious metal hits all-time highs above $4,000, calling it an "excellent diversifier" when traditional assets struggle.

🏛️ Government shutdown enters Day 7 with no resolution as Senate fails for fifth time to pass funding bill; active-duty military pay at risk if impasse continues past October 15.

⚡ Utility stocks hit new all-time highs for three consecutive days, with sector up 8.9% over past month led by Constellation Energy (+19%) and NextEra (+12%).

🥇 Gold futures cross $4,000/ounce milestone for the first time ever, surging 50%+ year-to-date as investors seek safety amid government dysfunction and fiscal deficit concerns.

🇨🇦 Trump signals tariff discussions with Canada's PM Carney despite existing 35% levy on Canadian imports, saying "we're competing for the same business."

📉 JPMorgan downgrades four consumer finance stocks (OneMain, Synchrony Financial, SLM, Essent), citing a slowing labor market and elevated loss rates in the K-shaped economy.

🪖 White House takes 10% stake in Trilogy Metals with $35.6 million investment to unlock domestic copper and critical minerals in Alaska's Ambler mining district.

📊 Atlanta Fed's Bostic says businesses drop 'catastrophic' tariff scenarios from outlook, though tough outcomes remain on the table and consumers are showing spending caution.

Trending Stocks 📊

🚗 Ford Motor (F)

Ford shares dropped on Tuesday following news of a fire at a key aluminum supplier's plant.

The incident raised immediate concerns about potential production disruptions for critical vehicles, including the highly profitable F-150 pickup truck.

Any extended supply chain interruption could impact Ford's earnings just as the automaker navigates an already challenging environment of elevated costs and shifting consumer demand toward electric vehicles.

🍺 Constellation Brands (STZ)

Constellation Brands shares rose more than 3% in premarket trading after the Modelo owner topped Wall Street expectations with Q1 earnings of $3.63 per share on revenue of $2.48 billion.

The company reaffirmed full-year guidance despite macroeconomic headwinds and aluminum tariff pressures that compressed margins.

⛏️ Trilogy Metals (TMQ)

U.S.-listed shares of minerals explorer Trilogy Metals exploded more than 211% after the White House announced a $35.6 million investment for a 10% stake.

The partnership aims to unlock domestic copper and critical mineral supplies in Alaska's Ambler mining district as part of national resource security initiatives.

What’s Next?

Key market and macro news 👇

🛢️EIA Petroleum Status Report: The Energy Information Administration will release its weekly report on crude oil inventories. This data can significantly influence oil prices and energy sector stocks.

🎤 Federal Reserve Speeches: Several Fed officials, including Vice Chair Barr and regional presidents Goolsbee, Kashkari, and Logan, are scheduled to speak, potentially providing insight into future monetary policy.

🏦 U.S. Government Shutdown: The ongoing federal government shutdown continues to create market uncertainty, delaying key economic data releases and raising concerns about its impact on economic growth.

💸 10-Year Treasury Note Auction: The U.S. Treasury will auction 10-year notes, with the results providing a gauge of investor demand for government debt and influencing interest rate expectations.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.