- Ziggma

- Posts

- 💰 Oracle's TikTok Windfall

💰 Oracle's TikTok Windfall

PLUS: Gold hits a fresh record high

Market Performance

S&P 500: 6,606.76 ⬇️ 0.13%

Nasdaq: 22,333.96 ⬇️ 0.07%

Dow Jones: 45,757.90 ⬇️ 0.27%

A TikTok Sale Is Imminent

Oracle (ORCL) emerged as a winner in the long-awaited TikTok framework deal, sending shares soaring by 1.5%.

The cloud infrastructure giant will maintain its existing cloud computing agreement with TikTok and join an investor consortium, gaining roughly 80% ownership of the platform's U.S. operations.

Oracle is positioning itself as the go-to infrastructure partner for politically sensitive tech assets.

Treasury Secretary Scott Bessent revealed that Trump's willingness to let TikTok "go dark" was the key negotiating leverage that forced China's hand.

The deal, expected to close within 30-45 days, includes Oracle alongside Silver Lake and Andreessen Horowitz.

While the investment size remains modest, Oracle's strategic value extends far beyond the check it writes.

As geopolitical tensions reshape the tech landscape, Oracle is emerging as the trusted American alternative for companies seeking to navigate U.S. national security concerns.

Oracle has a Ziggma score of 53, ranking it in the bottom half percentile for growth and valuation. However, these metrics should improve given the tech giant’s widening playbook.

Our Takeaway

Oracle's 85% year-to-date gain reflects its transformation from a legacy database company to a critical infrastructure player in the new AI-driven economy.

This TikTok partnership validates that thesis.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Market Overview 📈

Stocks edged lower on Tuesday as investors took profits ahead of the Federal Reserve's highly anticipated rate decision.

The S&P 500 managed to close above 6,600 for the first time despite the modest decline, highlighting the market's underlying strength.

The Fed's two-day meeting, which kicked off Tuesday, has traders pricing in a 100% probability of at least a 25-basis-point rate cut – the first since December.

What matters more is Fed Chair Jerome Powell's guidance on future cuts and whether the central bank signals one or two additional cuts before the end of the year.

Trade negotiations continue to provide market support, with Treasury Secretary Bessent expressing optimism about ongoing U.S.-China discussions.

The positive momentum from Monday's trade talks helped push the S&P 500 above the psychological 6,600 level, even as political tensions remain elevated with new Fed Governor Stephen Miran joining the board just in time for this week's rate decision.

Stock Moves Deciphered 📈

Steel Dynamics (STLD) rose over 6% as it continues to benefit from domestic infrastructure spending and trade protection measures.

The company's diversified operations across steel production and metals recycling position it well, as manufacturing activity shows signs of stabilizing despite global headwinds.

Eli Lilly (LLY) rose 2% after announcing a $5 billion manufacturing facility in Virginia for targeted cancer drugs.

This marks the first of four planned U.S. plants, totaling $27 billion in domestic investments, which reinforces Lilly's commitment to American manufacturing amid ongoing supply chain concerns.

Hershey (HSY) gained momentum following a double upgrade from Goldman Sachs, which cited improving market share trends and strong brand innovation.

Goldman's bullish stance reflects Hershey's ability to navigate commodity cost pressures while maintaining competitive positioning through product development and strategic marketing initiatives.

Headlines You Can't Miss 👀

📈 Webtoon Entertainment surged 31% after striking a digital comic platform deal with Disney and selling a 2% equity stake.

🏭 Emerson Electric dropped 4.5% after management warned Q4 orders will likely hit the low end of guidance due to European and Chinese weakness.

💊 Hims & Hers Health fell 7% following an FDA warning letter about "false or misleading" claims regarding compounded semaglutide products.

🚗 Nio jumped 2% after UBS upgraded shares to buy, citing strengthened operations following $1 billion equity offering

🥇 Gold hit a record high of $3,699.37 as investors positioned for Fed rate cuts and geopolitical uncertainty.

🏦 Citi remains Wells Fargo's top Big Bank stock with a price target raised to $125, implying 25% upside potential.

🏢 Prologis has been upgraded to a buy by Bank of America, as industrial leasing demand shows signs of recovery.

Trending Stocks 📊

Estée Lauder (EL) advanced on positive analyst ratings and a dividend announcement, showcasing resilience in a challenging retail environment.

The company's ability to maintain shareholder returns while investing in growth initiatives signals management confidence in the premium beauty segment's long-term prospects despite current market volatility.

Dave & Buster's (PLAY) plunged 17% after missing Q2 expectations with $0.40 per share versus $0.91 expected.

Revenue of $557.4 million fell short of $562.8 million consensus, highlighting challenges in the competitive entertainment sector.

Oscar Health (OSCR) dropped 4% after announcing $350 million convertible notes offering.

Proceeds will fund AI initiatives and reduce customer care costs, although concerns about dilution weigh on near-term sentiment.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

🏦 Fed rate decision Wednesday with Powell press conference

🛍️ Retail sales data showing a 0.6% August gain, topping the 0.3% forecast

💸 Consumer price index up 0.4% monthly, with annual inflation at 2.9%

📞 Trump-Xi call scheduled for Friday to discuss TikTok framework details

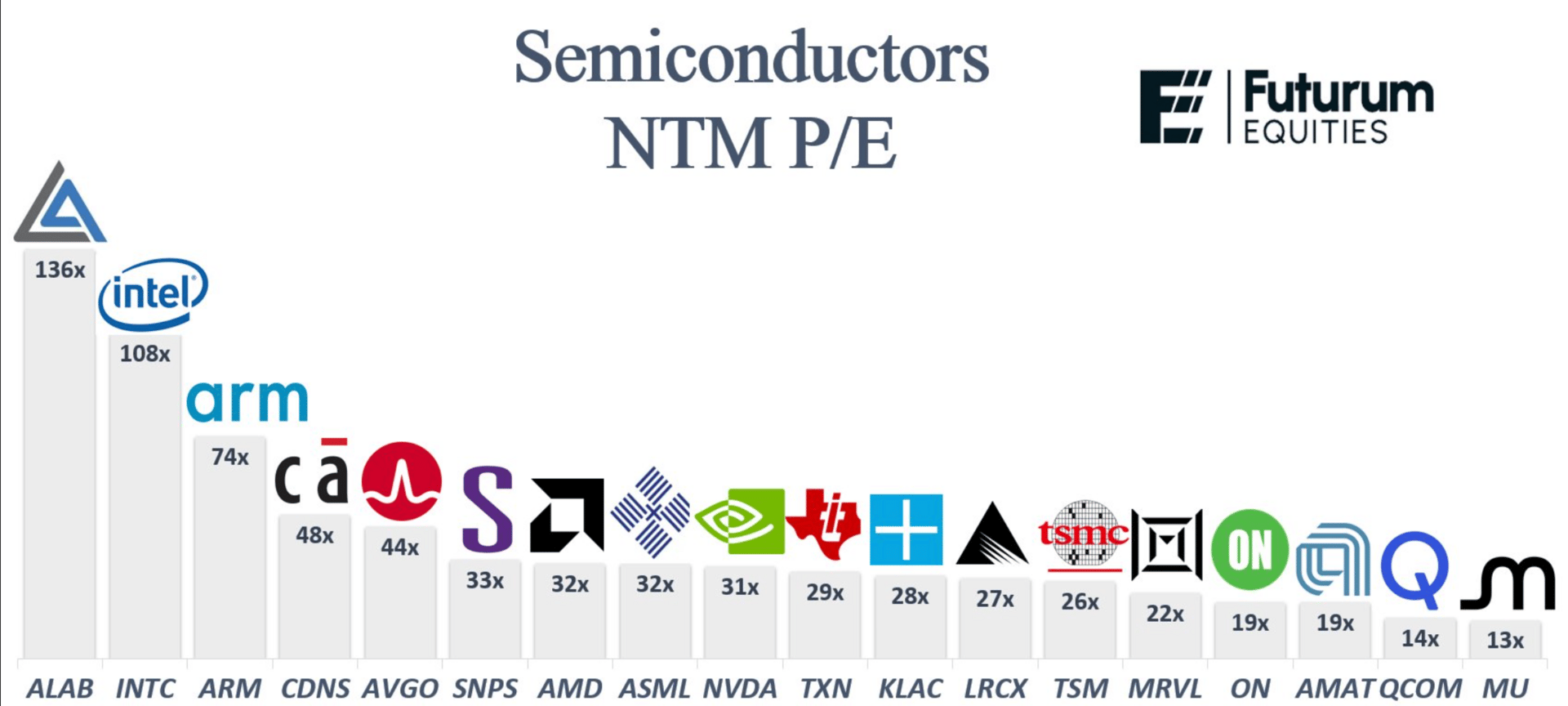

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.