- Ziggma

- Posts

- 🏛️ One Big Beautiful Bill

🏛️ One Big Beautiful Bill

Plus why Elon hates it so much

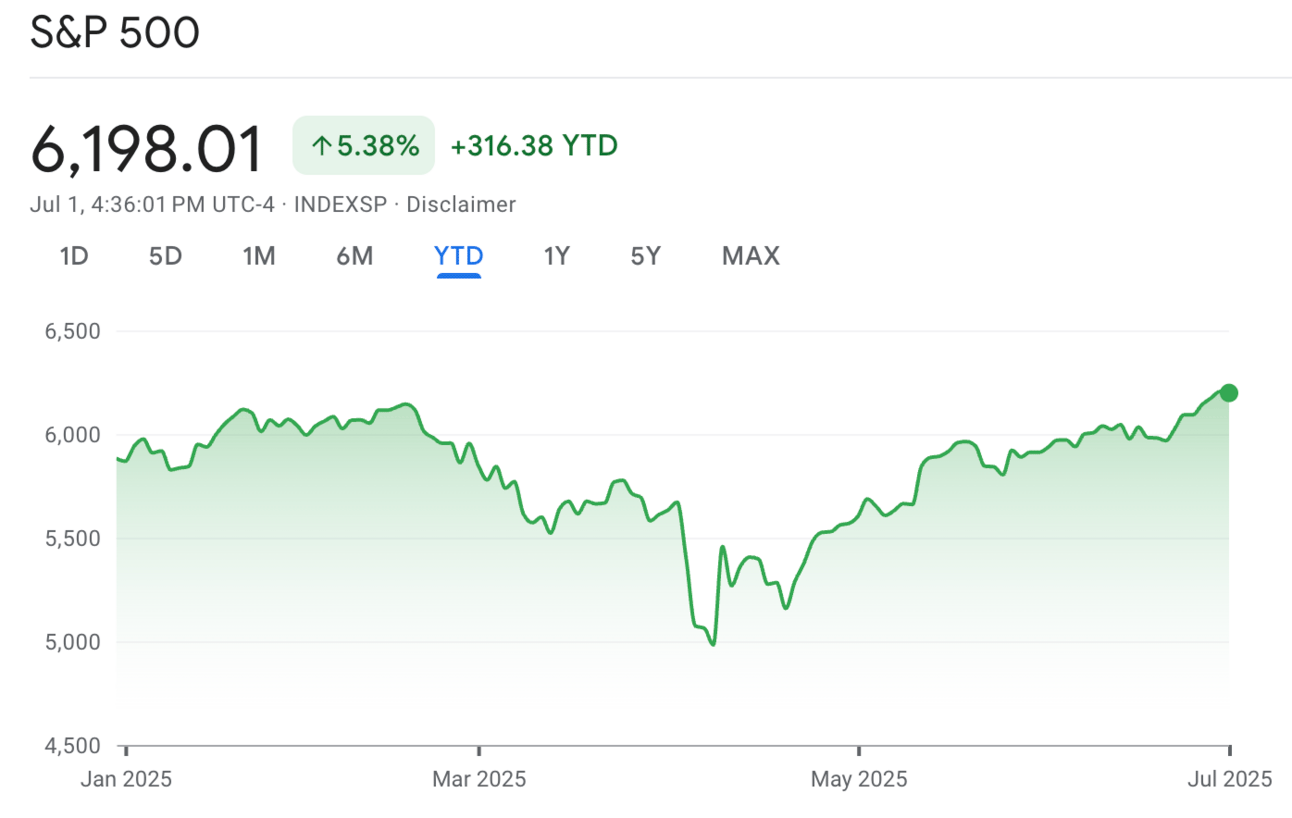

Market Performance

S&P 500: 6,204.95 (-0.11%)

Nasdaq: 20,369.73 (-0.82%)

Dow Jones: 44,094.77 (+0.91%)

The Big Beautiful Bill Moves Forward

The U.S. Senate has approved a $3.3 trillion domestic policy package that fulfills major 2024 campaign pledges.

The bill extends Trump’s first-term tax cuts, increases military spending, and introduces changes to Medicaid and other federal programs.

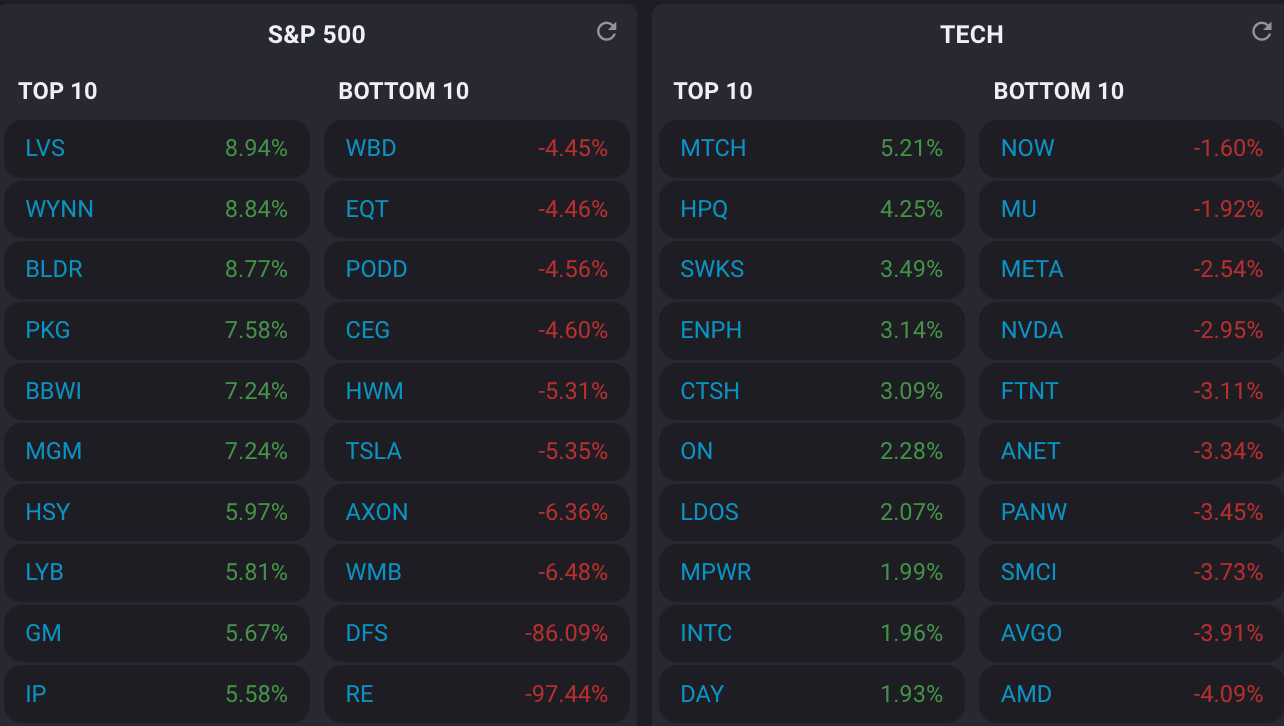

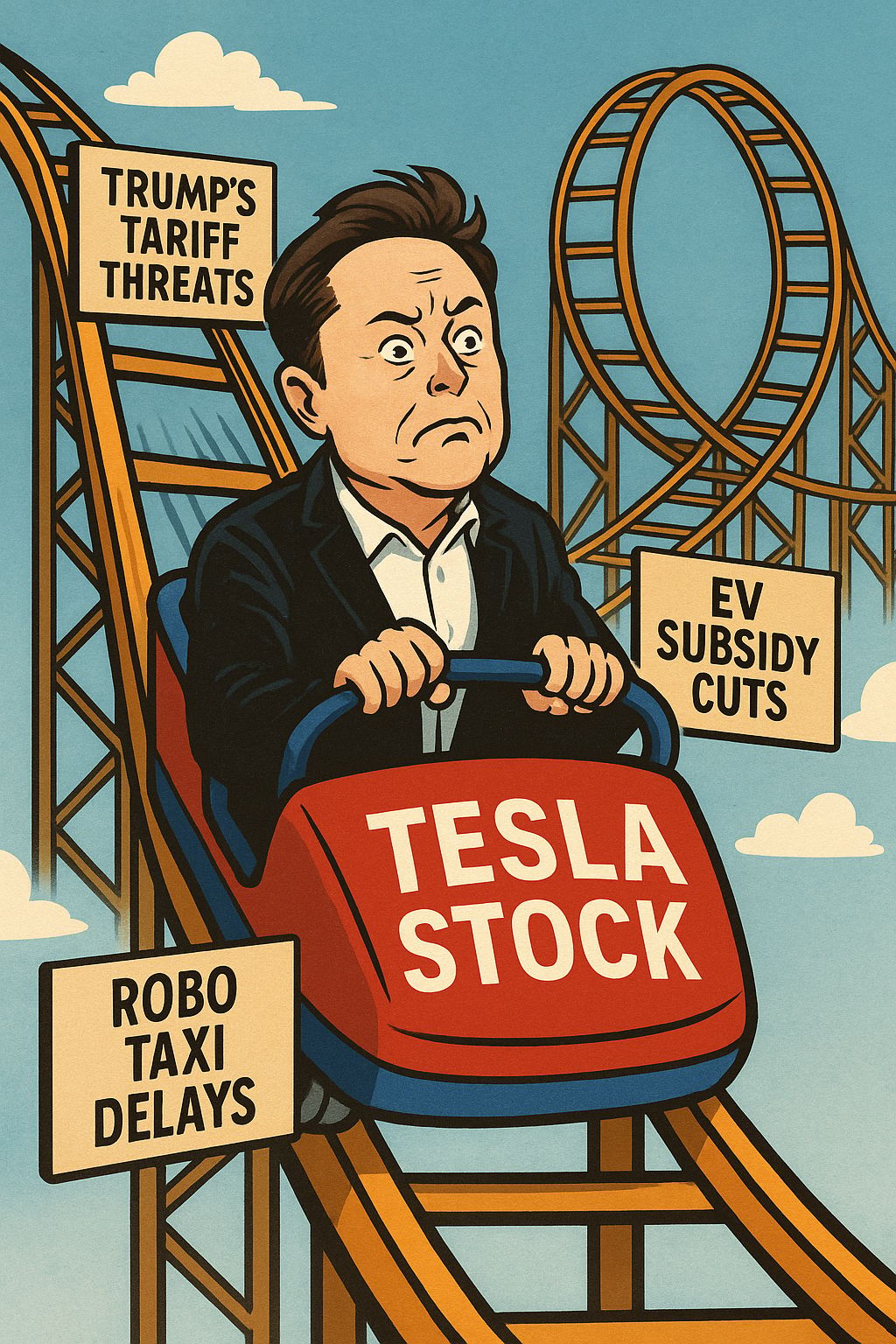

Elon Musk hates the bill and Tesla's stock TSLA dropped over 5% in yesterday’s trading session. Tesla is expected to lose out big time on subsidies. Musk described the bill as “utterly insane and destructive. It gives handouts to industries of the past while severely damaging industries of the future.''

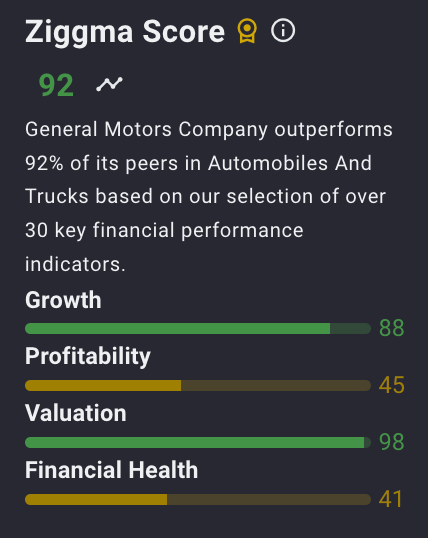

The stock price of its domestic rival GM has risen in recent weeks, potentially driven by the expectation that EV tax credit changes hit premium EV brands harder than mass-market models.

Tesla relies heavily on EV tax credits and consumer incentives to keep its vehicles competitively priced. If those incentives get slashed or capped, Tesla's vehicles could become less affordable for middle-income buyers, or Musk’s Tesla will have to lower profit margins once again.

GM's EV lineup includes more lower-cost mass-market models, which may allow it to compete better on price in a no-subsidy environment than Tesla can.

Our Takeaway

The bill hurting Tesla is relatively good for GM, especially if the EV tax credit changes hit premium EV brands harder than mass-market models.

Valuations between TSLA and GM couldn’t be more different. GM currently trades on a rock-bottom forward P/E ratio of 5.6x whereas TSLA is priced at a mind-boggling forward P/E ratio of 161x. To justify such a valuation, Elon better come through on autonomous driving, at the very least.

If the big beautiful bill gets a pass in Congress, we might see a shift of capital back to automakers with a legacy internal combustion engine business, and away from Tesla.

In any case, Tesla’s current level of valuation is only justifiable if Elon gets everything right over the foreseeable future. Can he?

Hands Down Some Of The Best 0% Interest Credit Cards

Pay no interest until nearly 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

Market Overview

Stocks traded in a narrow range on Tuesday. Investors paused on making additional bets in their portfolios as they awaited June payrolls data from the U.S., due Thursday.

U.S. equity futures edge up slightly this morning.

Investors are keeping a close eye on economic data and trade tensions after Trump said he won’t push back the July 9 deadline for raising tariffs on U.S. trading partners.

Yet, despite the warning, stock markets remain calm, with indexes hovering near record highs. Many believe Trump will stick to his usual pattern: make bold threats, then back down at the last minute.

Headlines You Can't Miss

Trump escalates feud with Musk, threatens Tesla, SpaceX support.

DOGE is pushing the SEC to loosen Wall Street rules around blank-check companies.

Dollar sits at 3-year low in anticipation of Fed easing and federal debt exploding.

Scale AI CEO emphasizes independence after Meta deal

Bezos sells $737 million worth of Amazon shares. No, not to pay for his wedding but as part of a trading plan.

Figma files for US IPO as revenue and profit rise.

KKR to buy Australian Agriculture firm Pro Ten from Aware Super.

Trending Stocks

Constellation Brands (STZ): Constellation brands on Tuesday reported quarterly earnings and revenue that missed analyst estimates as tariffs on aluminum weight on its profitability. Still, the company reiterated its forecast for 2026 showing confidence that it could hit its targets. The company’s stock is down 20% this year, driven by concerns about how tariffs would affect demand for its beer.

CEO Quote🎤: “While we continued to face softer consumer demand largely driven by what we believe to be non-structural socioeconomic factors, our teams remain focused on executing the key initiatives that underpinned the outlook we recently provided for fiscals 2026 to 2028.”

MSC Industrial (MSM): In its fiscal Q3 2025 earnings report, MSC Industrial Direct (NYSE: MSM) announced adjusted earnings per share of $1.74, slightly below the Zacks Consensus Estimate of $1.75. The company's revenue for the quarter was $1.05 billion, missing analysts' expectations of $1.07 billion, attributed to ongoing softness in manufacturing demand.

CEO Quote🎤: "Throughout fiscal 2025, we've been focused on strengthening execution in three critical areas: reenergizing the core customer, maintaining momentum in our high-touch solutions, and optimizing our cost to serve. Our fiscal third quarter results reflect progress across these fronts.”

The Greenbrier Companies (GBX): Shares jumped 13% after hours after the company reported earnings of $60.1m in its fiscal third-quarter. Net profit was up by 30% quarter and quarter. Greenbrier expect for your revenue in the range of $3.15bn to $3.35bn.

CEO Quote🎤: “Our market-leading position demonstrates the progress on our strategic plan to deliver strong performance, reduce cyclicality, and deliver long-term shareholder value.”

What’s Next?

Q2 earnings season kicks off next week with DAL, LEVI, FIZZ reporting.

Over 110 S&P 500 companies issued Q2 guidance, with 51 positive vs. 59 negative.

The estimated Q2 earnings growth of 5% could mark the lowest since Q4 2023

More companies are issuing positive guidance than the 5-year and 10-year averages.

Track upcoming news and earnings on your portfolio companies with Ziggma.

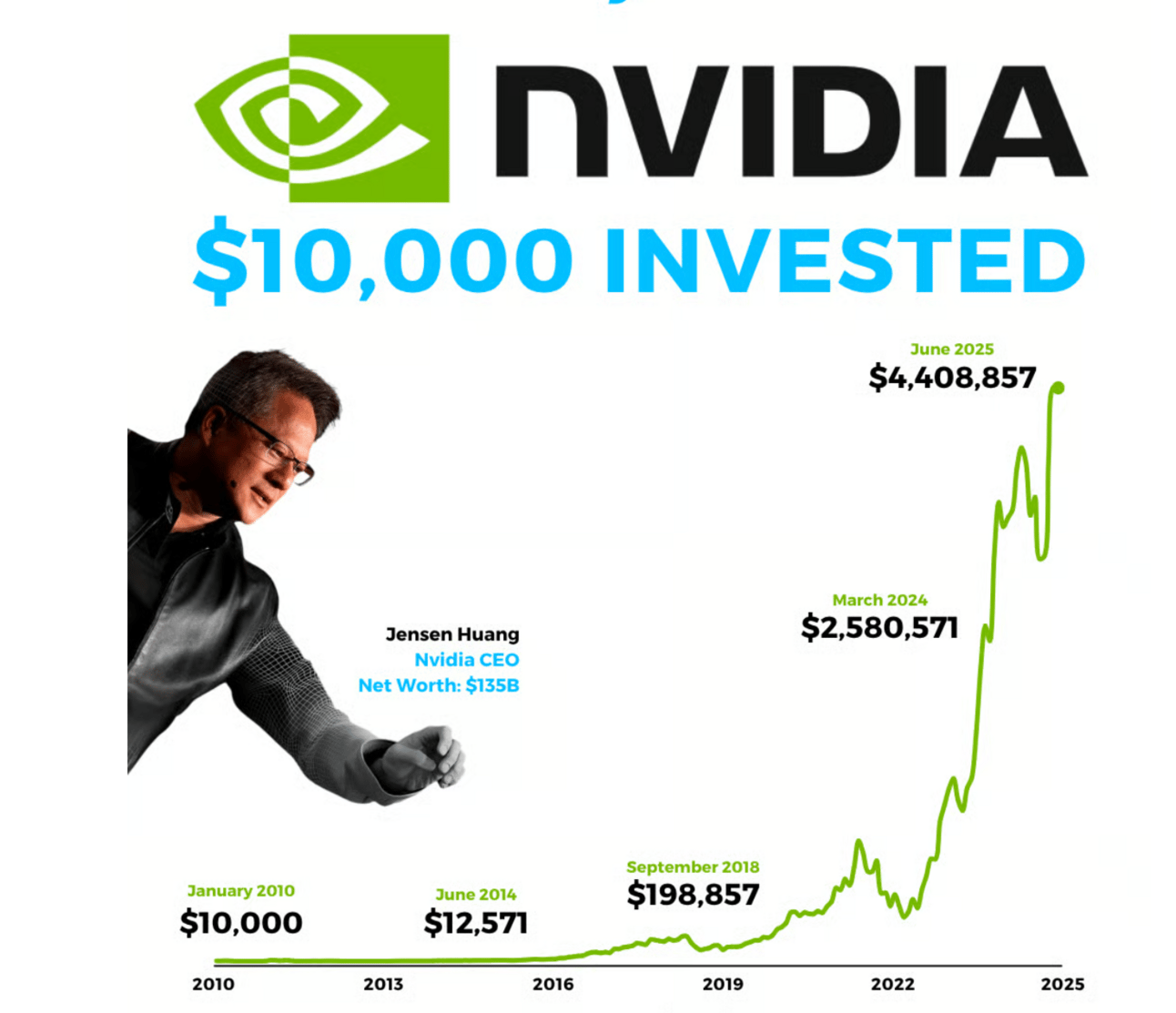

Chart of the Day

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.