- Ziggma

- Posts

- 🗞️ Nvidia 🤝 Nokia

🗞️ Nvidia 🤝 Nokia

Big Moves Decoded: PayPal, UPS, and more!

Market Performance

S&P 500: 6,890.89 ⬆️ 0.23%

Nasdaq: 23,827.49 ⬆️ 0.80%

Dow Jones: 47,706.37 ⬆️ 0.34%

Nvidia Invests $1 Billion in Nokia

Nvidia (NVDA) disclosed a $1 billion stake in Nokia, marking the chipmaker's latest strategic partnership as it cements its position at the center of the AI infrastructure buildout.

Nokia's shares soared 22% on the news, which includes a groundbreaking collaboration to develop next-generation 6G cellular technology.

The partnership focuses on AI-RAN (AI Radio Access Network) systems, which will enable mobile operators to run AI workloads directly on network infrastructure.

Nokia will adapt its 5G and 6G software to run on Nvidia's chips, transforming telecommunications networks into distributed AI computing platforms.

T-Mobile will begin field trials in 2026 to validate this technology's potential to support everything from generative AI applications to future devices such as AR glasses and autonomous drones.

This move represents more than just another equity investment for Nvidia—it's about controlling the entire AI infrastructure stack from data center to edge.

The AI-RAN market alone could exceed $200 billion by 2030, according to analyst firm Omdia.

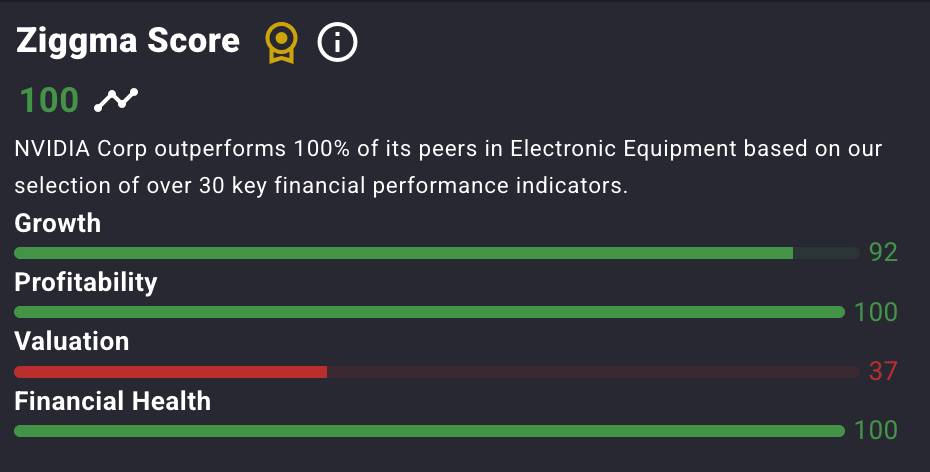

Nvidia stock has a Ziggma score of 100 and ranks in the top percentile for profitability, financial health, and growth.

Our Takeaway

Nvidia continues to position itself across the AI ecosystem strategically.

For telecom operators, this partnership offers a critical path to monetize their network assets in the AI era.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Market Overview 📈

Stocks reached fresh all-time highs on Tuesday as investors leaned heavily into AI-related names ahead of the Federal Reserve's anticipated interest rate decision on Wednesday.

The AI trade dominated market momentum, with Nvidia's 5% surge and Microsoft and Apple both crossing the $4 trillion market cap threshold, driving gains across major indices.

The Fed is widely expected to deliver its second consecutive 0.25% rate cut, bringing the federal funds rate to 3.75%-4%.

However, investors are closely watching Fed Chair Jerome Powell's commentary for signals about a potential December cut.

The central bank faces a complex backdrop: strong corporate earnings but elevated valuations, cooling inflation but lingering tariff uncertainties, and divergent economic data complicated by the recent government shutdown.

Earnings season continues to impress, with 83% of reporting S&P 500 companies beating expectations.

This week brings results from several "Magnificent Seven" tech giants—including Microsoft, Alphabet, Amazon, and Meta—collectively representing about 25% of the S&P 500's total value.

Meanwhile, US-China trade talks are progressing, with President Trump and President Xi Jinping set to meet on Thursday to discuss a potential framework that could reduce some Chinese tariffs in exchange for restrictions on fentanyl precursor chemicals.

Stock Moves Deciphered 📈

💊 Regeneron Pharmaceuticals (REGN)

Regeneron surged 12% after the biotechnology company's Q3 results were powered by strong demand for its flagship drugs, Dupixent, used to treat asthma and eczema, and EYLEA HD, its eye disease treatment.

The robust sales growth demonstrates Regeneron's ability to maintain pricing power and market share in competitive therapeutic areas, reinforcing investor confidence in the durability and growth trajectory of its product portfolio.

📊 MSCI (MSCI)

MSCI stock climbed almost 9% after the analytics and index provider delivered third-quarter earnings that surpassed profit expectations.

The company benefited from strong growth in recurring subscription revenue and asset-based fees, which provide stable, predictable cash flows.

📦 United Parcel Service (UPS)

UPS stock surged 8% after crushing Q3 expectations with adjusted earnings of $1.74 per share versus the $1.30 consensus and revenue of $21.4 billion, beating estimates of $20.83 billion.

The logistics giant also unveiled aggressive cost-cutting measures, revealing it has eliminated 34,000 positions—exceeding its previous target of 20,000 job cuts.

💸 PayPal Holdings (PYPL)

PayPal shares rallied 4% after securing a landmark partnership with OpenAI, making it the first payments wallet embedded directly into ChatGPT.

Starting in 2026, PayPal's hundreds of millions of users will be able to make purchases through the AI platform, while merchants can list their inventory on ChatGPT.

The company also reported strong Q3 earnings of $1.34 per share, topping the $1.20 consensus, and announced its first-ever quarterly dividend of $0.14 per share.

Headlines You Can't Miss 👀

📱 Apple and Microsoft both crossed the $4 trillion market cap milestone, though they still trail Nvidia's $4.6 trillion valuation as the world's most valuable company.

🤝 Skyworks Solutions agreed to acquire rival Qorvo in a $22 billion all-stock-and-cash deal, with Skyworks shares jumping 19% and Qorvo surging 17% on the combination.

🏠 Wayfair shares popped 23% after third-quarter earnings of $0.70 per share crushed the $0.43 per share estimate on revenue of $3.12 billion versus the $3.02 billion consensus.

⚡ Cameco stock soared 23% after the uranium provider joined Westinghouse Electric and Brookfield Asset Management in an $80 billion nuclear reactor construction deal with the U.S. government.

📊 Consumer confidence fell to 94.6 in October from 95.6 in September, marking the lowest level since April amid ongoing economic uncertainty and elevated prices.

💼 Amazon announced sweeping layoffs affecting up to 30,000 corporate employees, representing the e-commerce giant's largest workforce reduction in its history, ahead of Thursday's earnings report.

🌐 Securitize, the real-world assets platform powering BlackRock's tokenized money market fund, will go public via a SPAC merger at a $1.25 billion pre-money valuation.

📈 ADP reported that private-sector employers added an average of 14,250 jobs per week over the past four weeks, a turnaround from September's negative numbers.

Trending Stocks 📊

👕 VF Corporation (VFC)

VF Corp experienced volatility after reporting mixed results. The apparel company behind brands like Vans and The North Face beat quarterly earnings and revenue expectations, demonstrating operational improvements.

However, management issued surprisingly weak forward revenue guidance, creating uncertainty about the company's turnaround timeline and dampening investor enthusiasm despite the earnings beat.

🔒 F5 Networks (FFIV)

F5 shares dropped over 7% despite posting strong fourth-quarter results that exceeded both earnings and revenue estimates.

The cybersecurity company warned investors to expect "near-term disruption to sales cycles" following a system breach earlier this month caused by state-backed Chinese hackers.

The weak first-quarter guidance and security concerns overshadowed the solid quarterly performance.

🤖 Zebra Technologies (ZBRA)

Zebra Technologies shares fell 12% despite beating third-quarter earnings and revenue expectations.

The enterprise technology company's disappointing fourth-quarter outlook, excluding the impact of a recent acquisition, spooked investors concerned about underlying business momentum.

The weak guidance suggests potential headwinds in its core barcode-scanning and mobile-computing markets, despite strong current-quarter results.

What’s Next?

Key market and macro news 👇

🏦 The Federal Reserve will conclude its two-day FOMC meeting with a highly anticipated interest rate announcement.

📊 Key economic data will be released, including the advance report on the U.S. trade balance in goods and the latest consumer confidence figures, which will offer insights into the economy's health.

🇨🇳 Ongoing U.S.-China trade discussions will be in focus, with a meeting between President Trump and President Xi Jinping scheduled for the following day, potentially influencing market sentiment and specific sectors.

🎤 A wave of earnings reports from Dow components and other major corporations will be released before the market opens, including industrial giant Caterpillar, aerospace leader Boeing, and telecommunications firm Verizon.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.