- Ziggma

- Posts

- 🗞 Nvidia Surges to Record High

🗞 Nvidia Surges to Record High

to become the most valuable company

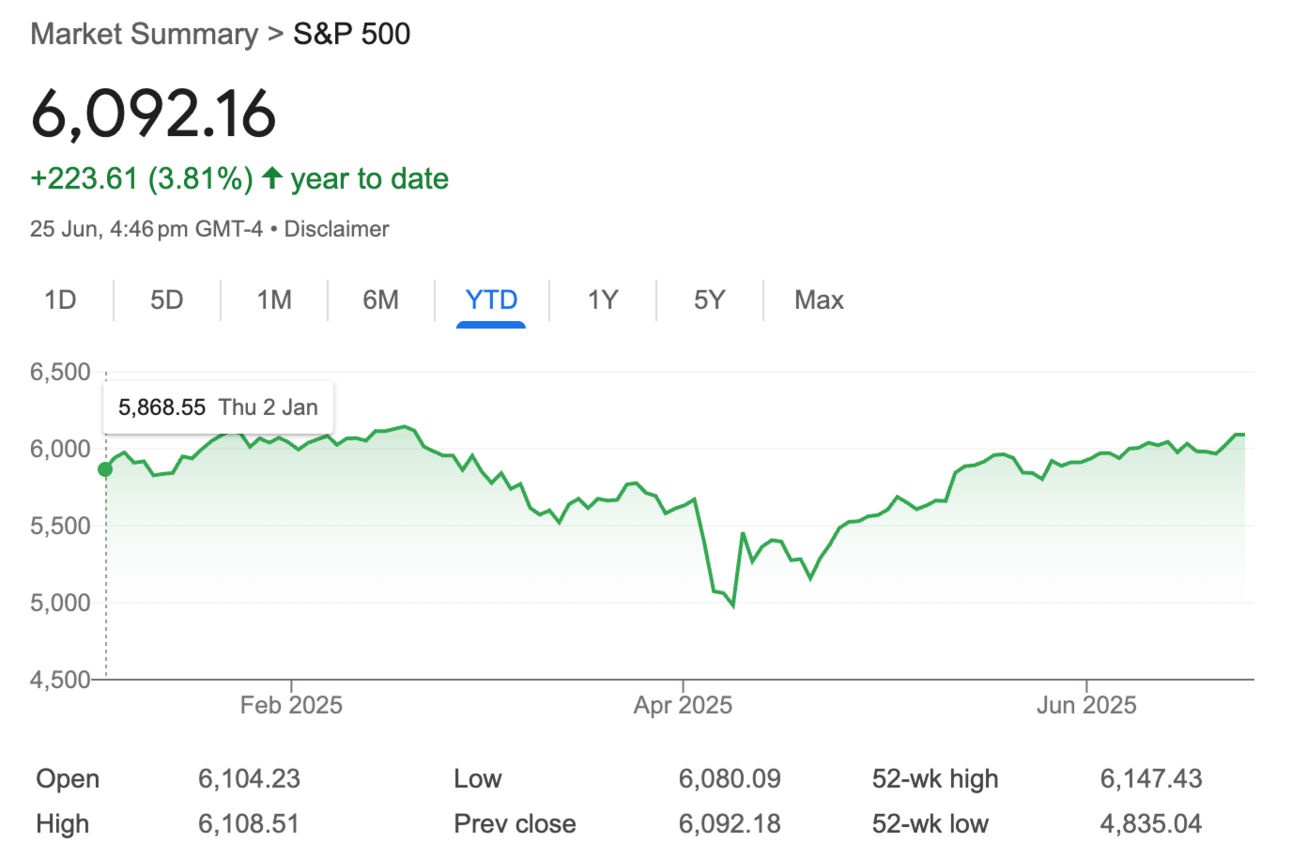

Market Performance

S&P 500: 6,092.16 (flat, -0.01%)

Nasdaq: 19,973.55 (+0.31)

Dow Jones: 42,982.43 (-0.25%)

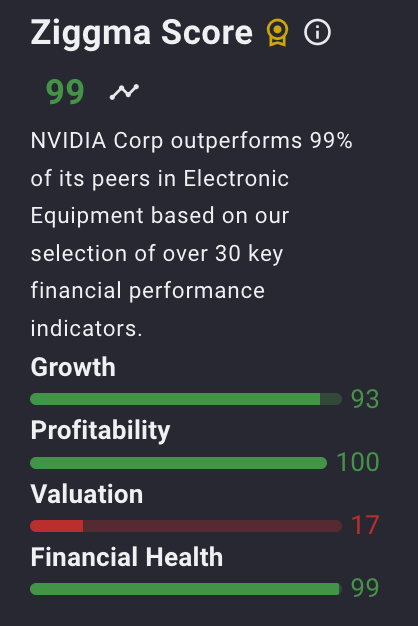

Nvidia’s AI Dominance Overcomes China Headwinds

Here's something that might surprise you: Nvidia (NVDA) just became the world's most valuable company despite losing an $8 billion market overnight.

The AI chipmaker's stock surged 4.3% to a record closing high of $154.31, pushing its market value to $3.77 trillion and narrowly edging out Microsoft for the top spot.

This milestone comes even after CEO Jensen Huang bluntly stated that "the $50 billion China market is effectively closed to U.S. industry" due to export restrictions.

What makes this rally remarkable? Nvidia had to write off $4.5 billion in inventory when the Trump administration's new rules cut off sales of their H20 AI processor, explicitly designed for the Chinese market.

Yet investors are betting that the company's AI dominance will more than compensate for this massive loss.

The market is voting with confidence that Nvidia's stranglehold on AI infrastructure, ranging from data center GPUs to robotics platforms, will drive the next wave of technological transformation.

As Huang put it at yesterday's shareholder meeting, they've "stopped thinking of ourselves as a chip company long ago."

Our Takeaway

This isn't just about one stock hitting a new high; it's validation that the AI revolution is powerful enough to overcome geopolitical headwinds.

When a company can lose access to the world's second-largest economy and still become the most valuable company on Earth, that tells you everything about the unstoppable force of artificial intelligence.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Market Overview

Stock futures pointed higher on Thursday morning as the S&P 500 hovers less than 1% below its February record high.

S&P 500 futures rose 0.21%, Nasdaq 100 futures climbed 0.31%, and Dow futures added 72 points.

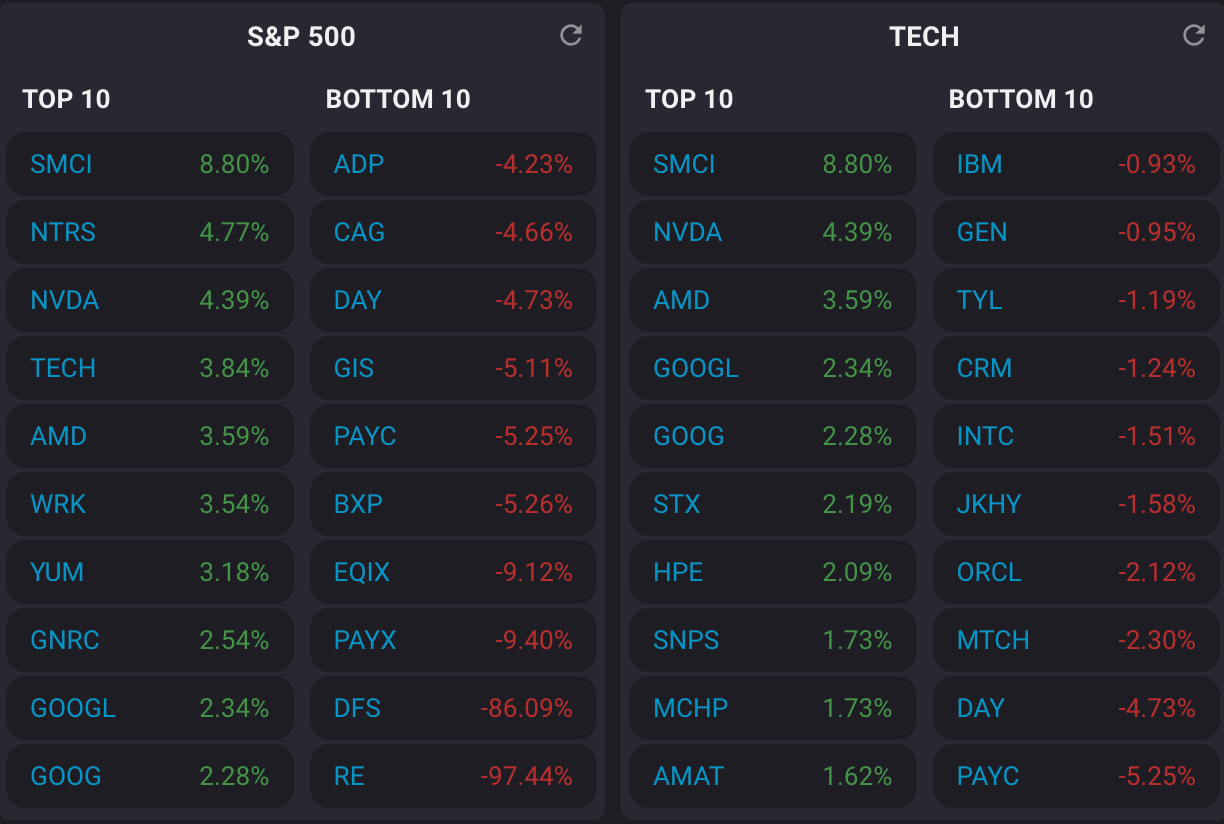

Wednesday's trading session showcased the market's cautious optimism, with the S&P 500 finishing flat while tech stocks led gains.

The Nasdaq's advance was driven by AI darlings, including Nvidia, Alphabet (+2.3%), and AMD (+3.6%), while the Dow's 106-point decline reflected a rotation away from traditional industrial names.

Market momentum has been supported by easing Middle East tensions after President Trump announced an Israel-Iran ceasefire, though both sides have accused each other of violations.

The truce has helped calm energy markets and reduced geopolitical risk premiums. However, concerns about inflation are mounting ahead of Friday's PCE data.

Fed Chair Jerome Powell warned that the preferred inflation measure could rise to 2.3% in May, up from April's 2.1% reading.

Powell stressed the central bank's commitment to controlling inflation, despite the "uncertain" effects of Trump's tariffs, which some analysts believe could pressure both bonds and equities in the second half of 2025.

Headlines You Can't Miss

The tech sector rally is standing on thin legs, according to charts expert Carter Worth.

Mastercard joins stablecoin consortium, enables support for PayPal and Fiserv tokens.

Focus on diversification as the market may be discounting the impact of tariffs, says Morgan Stanley

Flagstar shares fall as investors weigh real estate impact of New York election.

BP jumps after reporting it is in early-stage takeover talks with Shell.

The market will remain ‘narrow’ and highly concentrated, says JPMorgan.

Microsoft, Netflix among stocks hitting new all-time highs.

Bumble shares rally after the company announces job cuts.

Trending Stocks

Stellantis (STLA) - Shares gained 3% after Jefferies upgraded the stock to buy from hold with a $13.20 price target, implying 38% upside.

Analyst Philippe Houchois cited the new CEO, Antonio Filosa's, turnaround plan and encouraging market share data.

Key analyst quote🎤: “Reversing years of share loss takes time, but data looks encouraging. From new platforms to alliances with Chinese companies, STLA has laid foundations for global relevance.”

FedEx (FDX) - The package delivery giant fell 3.3% despite beating Q4 expectations with $6.07 EPS on $22.22B revenue versus estimates of $5.84 and $21.79B respectively.

Weakness stemmed from the disappointing current quarter guidance of $3.40-$4.00 EPS, which fell below the $4.05 analyst consensus, raising concerns about shipping demand trends.

Key CEO quote 🎤: “We will continue to leverage the unique scale and flexibility of our global network to support our customers as the demand environment evolves.”

AeroVironment (AVAV) - The drone maker surged over 20% to record highs after crushing Q4 earnings with $1.61 EPS on $275M revenue versus estimates of $1.39 and $242M.

The defense contractor received an additional boost after CNBC's Jim Cramer referred to it as the next "Palantir of hardware," highlighting its potential in the expanding military drone market.

Key CEO quote 🎤: “AeroVironment finished out fiscal year 2025 with a remarkable fourth quarter, which included record revenue, significantly higher profits and a robust backlog nearly double that from fiscal year 2024.”

What’s Next?

Key Earnings Reports

Track upcoming news and earnings with Ziggma to get personalized alerts.

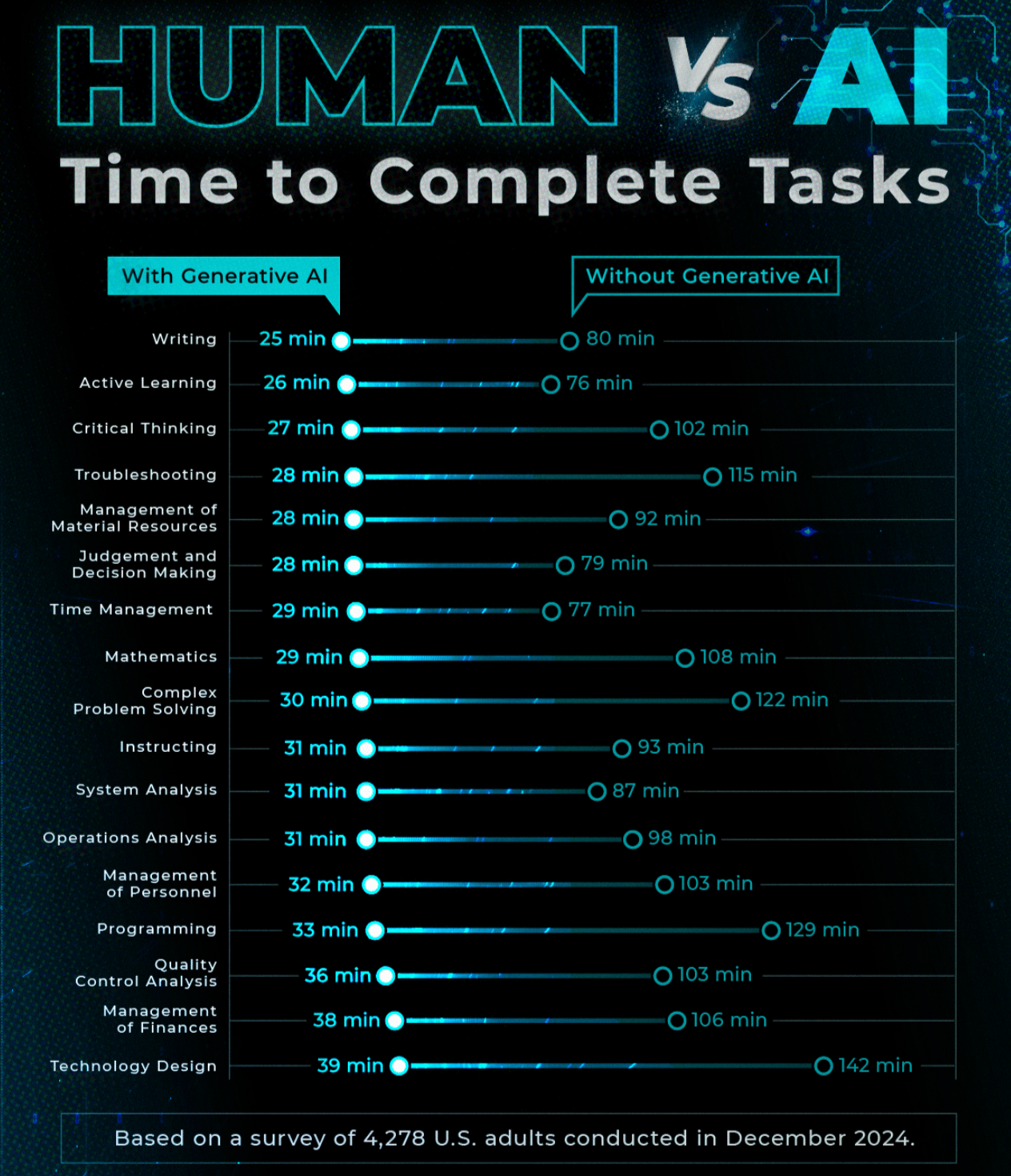

Chart of the Day

Source: Visual Capitalist

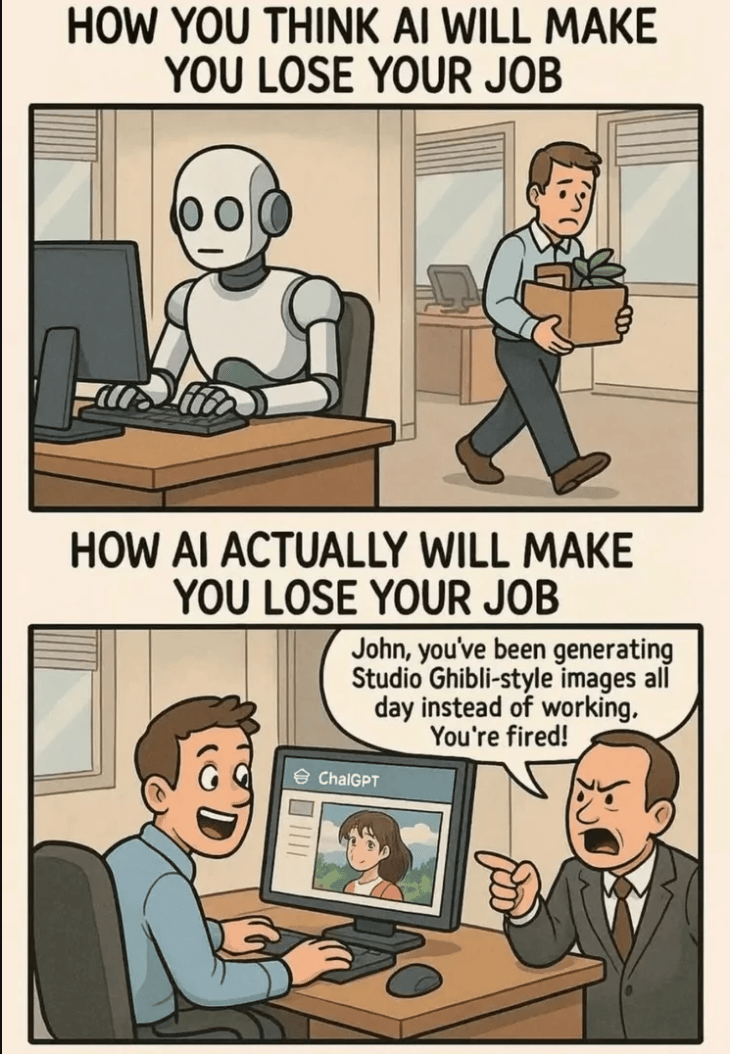

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.