- Ziggma

- Posts

- 🗞️ Nvidia Climbs to $4 Trillion

🗞️ Nvidia Climbs to $4 Trillion

Nvidia, Starbucks, and T-Mobile

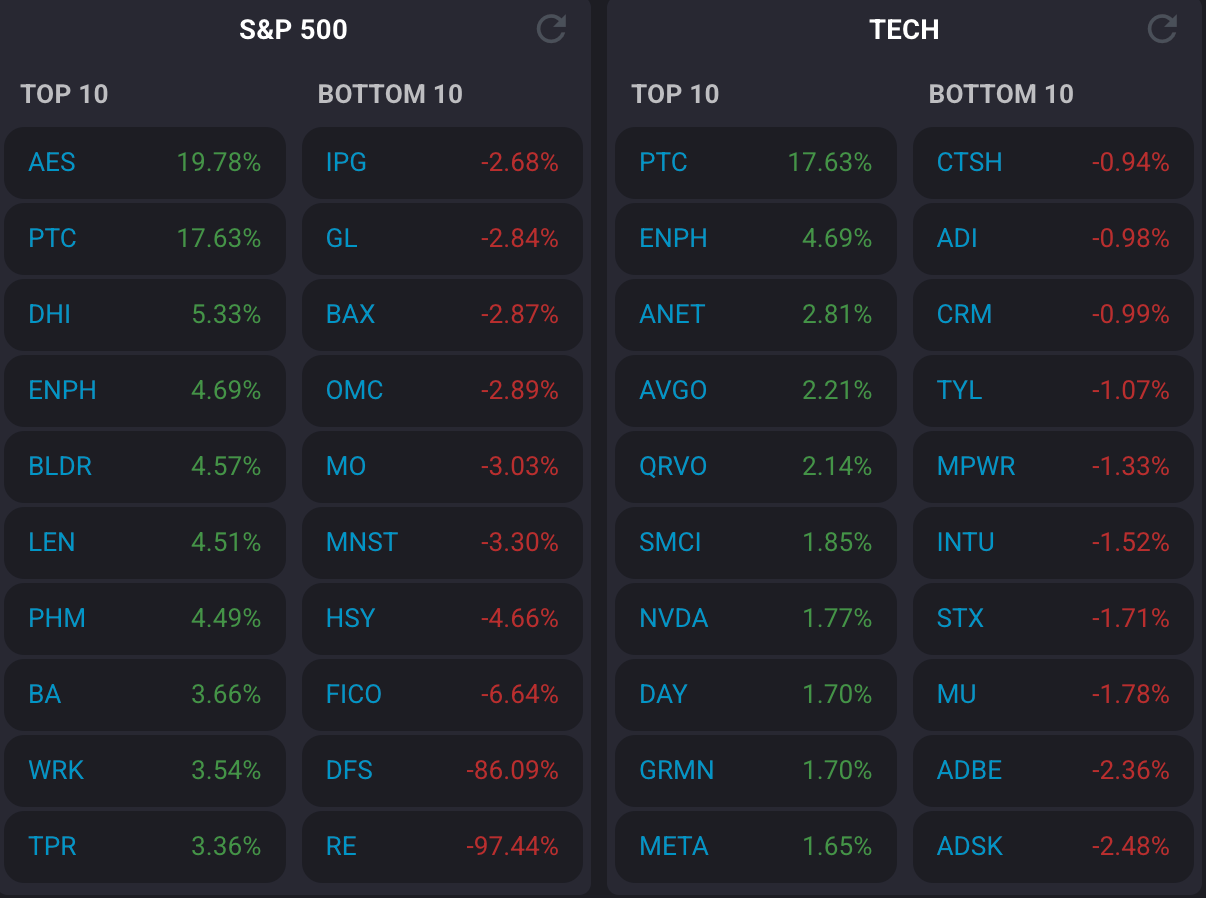

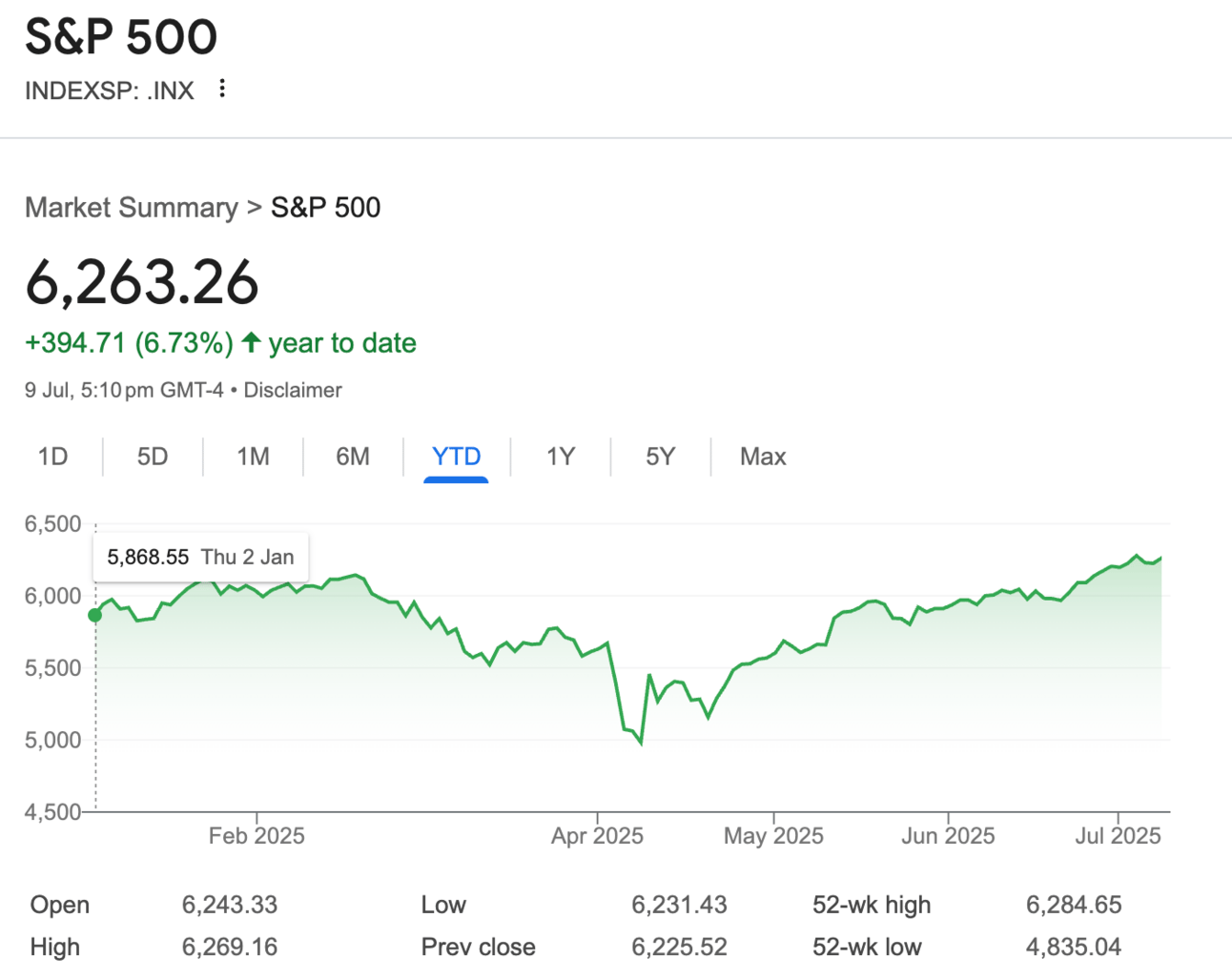

Market Performance

S&P 500: 6,263.26 (+0.61%)

Nasdaq: 20,611.34 (+0.94%)

Dow Jones: 44,458.30 (+0.49%)

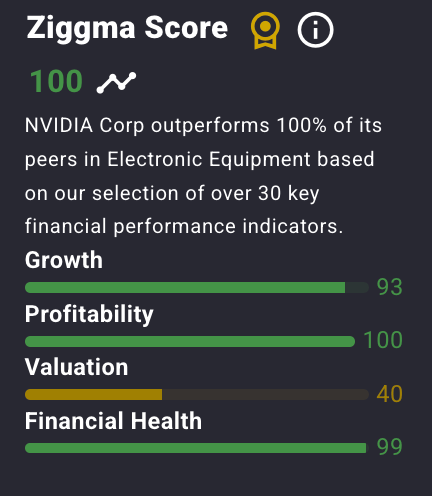

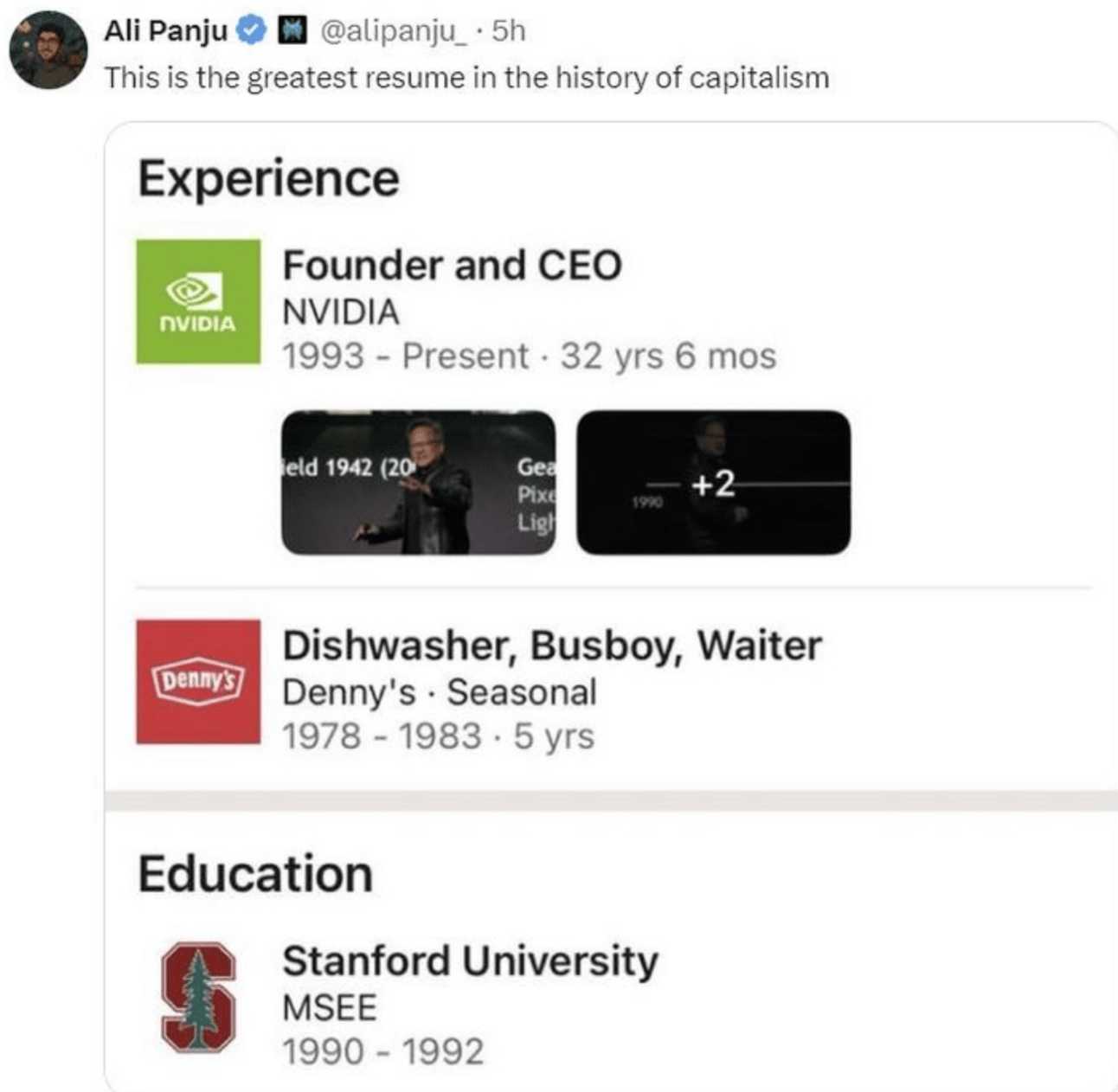

Nvidia Makes History

Here's something that will be talked about for years to come 👇

Nvidia (NVDA) briefly crossed the $4 trillion market capitalization threshold on Wednesday, becoming the first publicly traded company in history to achieve this milestone.

While the stock ended the day up 1.8% with a market cap of $3.97 trillion, the intraday achievement marks a stunning validation of the AI revolution's transformative power.

This California-based chipmaker, founded in 1993, has seen its market value explode fifteenfold over the past five years.

The company first hit $1 trillion in June 2023, reached $2 trillion in February 2024, and crossed $3 trillion just last June. That's three trillion-dollar milestones in barely over a year.

Nvidia is now worth more than the stock markets of Canada and Mexico combined, and exceeds all publicly listed companies in the UK.

The chip maker accounts for 7.3% of the S&P 500 index.

Our Takeaway

While geopolitical tensions and chip curbs have created headwinds, Nvidia's dominance in AI hardware remains unchallenged.

However, with customers like Amazon, Microsoft, and Alphabet facing pressure to rein in AI spending, and competitors like AMD developing lower-cost alternatives, Nvidia's growth trajectory faces real tests ahead.

Market Overview

Wednesday's session showcased the market's resilience as investors largely shrugged off President Trump's latest tariff announcements.

The tech-heavy Nasdaq hit a fresh record close, driven by renewed appetite for artificial intelligence stocks, while the S&P 500 and Dow posted the first winning sessions in three days.

Trump escalated his tariff campaign by sending letters to at least six more countries, including the Philippines and Iraq, announcing rates ranging from 20% to 40% set to begin on August 1.

This followed earlier announcements affecting 14 other nations, plus a 50% levy on copper imports and threats of up to 200% tariffs on pharmaceuticals.

Despite these developments, the VanEck Semiconductor ETF reached a new all-time high as investors continued to bet on the momentum of AI.

Copper prices eased 2% after hitting record highs Tuesday, while Treasury futures moved little despite ongoing concerns about the federal deficit.

Stock futures remained nearly flat in after-hours trading, suggesting the market's calm demeanor may persist into Thursday's session.

Headlines You Can't Miss

Merck to acquire Verona Pharma for $10 billion to expand respiratory treatment portfolio.

Alphabet's Waymo has reached the 10 million robotaxi trips milestone in autonomous driving.

Regeneron will acquire 23andMe for $256 million to gain access to its genetic data capabilities.

Blackstone will acquire TXNM Energy in $11.5 billion deal in infrastructure investment.

AMD will sell ZT Systems' server-manufacturing business for $3 billion to focus on core operations.

Apple supplier Foxconn will invest $1.5 billion in its India unit to diversify manufacturing.

Treasury Secretary Bessent pushed to delay the tariff deadline to August 1 for trade negotiations.

Fed officials split on rate cut timing amid tariff inflation concerns per June meeting minutes.

Bitcoin hits new record high of $112,052, boosted by Nvidia rally and institutional adoption.

Copper prices surge to record levels on 50% tariff announcement affecting infrastructure costs.

Trending Stocks

T-Mobile (TMUS): KeyBanc downgraded T-Mobile to underweight with a $200 price target, citing limited upside potential versus expectations.

The firm expects free cash flow growth to slow due to increased capital spending and higher cash taxes, while the stock trades at a meaningful premium to its peers.

Despite the downgrade, T-Mobile remains a dominant force in 5G deployment and continues to gain market share from competitors.

Analyst Quote🎤: “[W]e think that T-Mobile is unlikely to show much upside vs. expectations.”

Bloomberg reported that Brookfield Asset Management and BlackRock's Global Infrastructure Partners are studying the company after its stock lost about half its value over the past two years. AES supplies renewable power to major tech companies building AI data centers.

Analyst Quote🎤: “The company is exploring options, including a potential sale amid takeover interest. Infrastructure investors, including BlackRock's Global Infrastructure Partners unit and Brookfield Asset Management, have been studying AES after the company's shares lost about half their value over the past two years."

Starbucks (SBUX): Starbucks jumped nearly 2% after CNBC reported that Starbucks China has drawn bids for a potential stake sale valuing the subsidiary at up to $10 billion.

The coffee giant continues to navigate challenging conditions in its key Chinese market while maintaining strong performance in North America.

The potential stake sale could help Starbucks focus resources on domestic growth initiatives.

Key Quote🎤: “We see significant long-term potential in China and are evaluating the best ways to capture the future growth opportunities. We are looking for a strategic partner with like-minded values who shares our vision to provide a premium coffeehouse experience.”

What’s Next?

Jobless claims data for the week ending July 5 is due Thursday morning. Economists expect an increase of 2,000 to 235,000 from the previous week.

Back-to-school shopping season will test consumer response to tariff-induced price hikes.

Corporate earnings growth is expected to recover above 6% entering 2026.

Federal Reserve officials' commentary on inflation and the timing of rate cuts.

Progress in trade negotiations with the EU, India, and other major partners.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.