- Ziggma

- Posts

- Nvidia Continues to Surge

Nvidia Continues to Surge

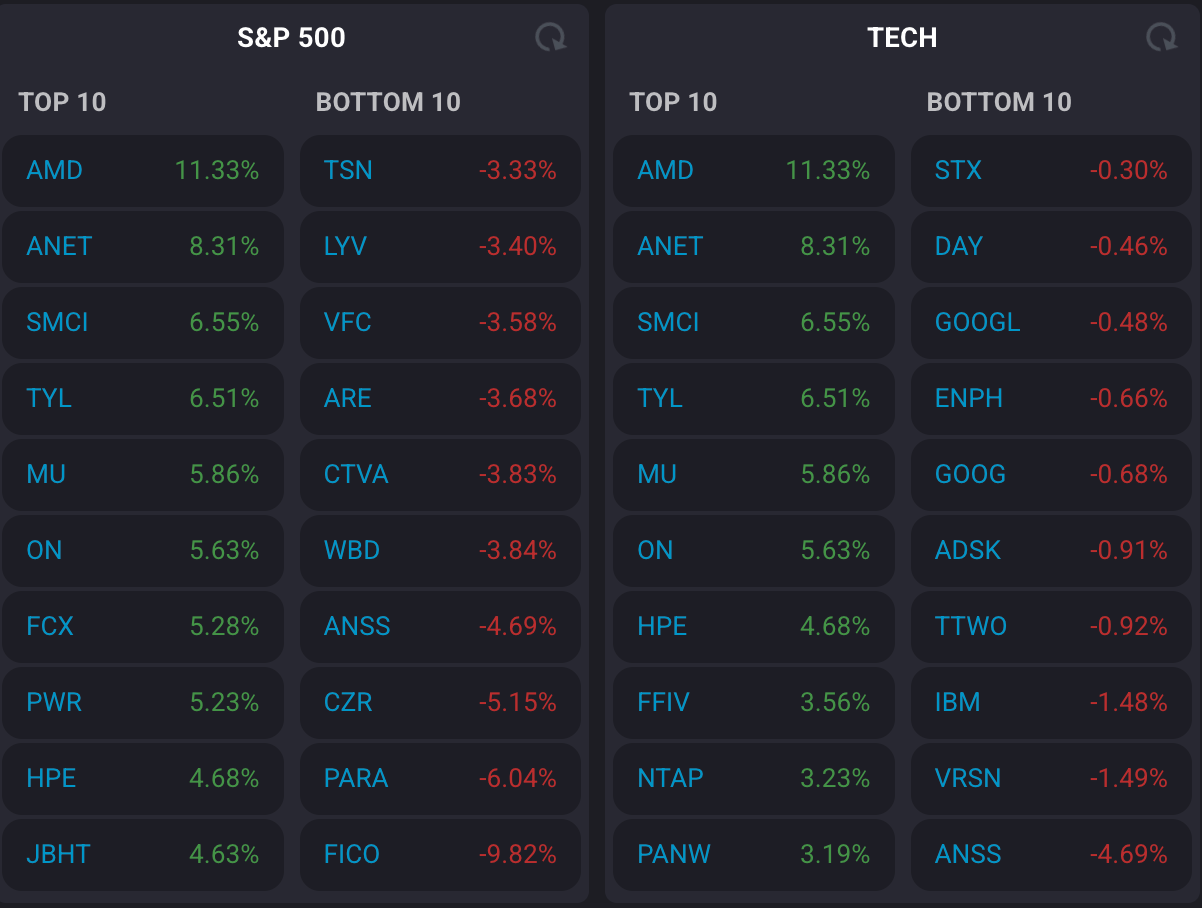

Big moves decoded: AMD, ANET, and AST

Market Performance

S&P 500: 6,753.72 ⬆️ 0.58%

Nasdaq: 23,043.38 ⬆️ 1.12%

Dow Jones: 46,601.78 ⬇️ 0.01%

Nvidia’s AI Demand Surge

Nvidia (NVDA) CEO Jensen Huang delivered a remarkably bullish message on Wednesday, declaring that demand for AI computing has surged substantially over the past six months.

Speaking on CNBC's "Squawk Box," Huang emphasized that AI models are evolving beyond simple question-answering capabilities to complex reasoning, driving exponential growth in both computing requirements and user adoption.

"We now have two exponentials happening at the same time," Huang explained, noting that while AI reasoning models consume more computing power, their impressive results are driving exponential growth in demand.

The CEO characterized current market conditions as "the beginning of a new buildout, beginning of a new industrial revolution," with Nvidia's most advanced Blackwell GPU seeing robust demand.

Huang also expressed surprise at AMD's decision to offer OpenAI potential 10% ownership in exchange for a multibillion-dollar chip purchase commitment.

"I'm surprised that they would give away 10% of the company before they even built it," he remarked, calling the arrangement "imaginative" and "clever."

Despite this competitive move, Nvidia shares rose 2% on Wednesday, helping drive the Nasdaq to record highs.

The CEO addressed infrastructure concerns head-on, advocating for data centers to generate their own power through natural gas and eventually nuclear energy rather than relying on the electric grid.

He warned that China is "way ahead on energy" infrastructure for AI, suggesting the U.S. is "not far ahead" in the broader AI race.

Huang confirmed Nvidia's participation in Elon Musk's xAI funding round, stating he's "super excited" about the opportunity and wishes he could invest more.

"Almost everything that Elon is part of, you really want to be part of as well," he added.

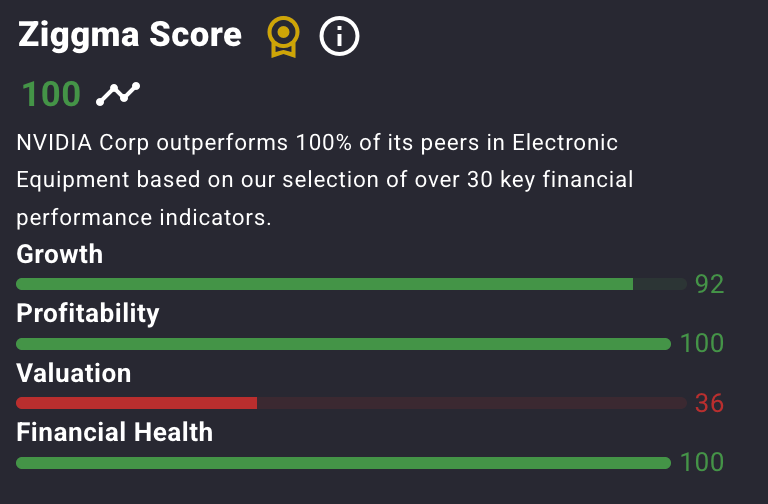

NVDA stock currently has a Ziggma Stock Score of 100, ranking in the top percentile in terms of profitability, growth, and financial health.

Our Takeaway

Nvidia's confidence signals that the AI infrastructure buildout remains in the early innings, despite stretched valuations.

The power generation challenge represents both a bottleneck and an opportunity, while AMD's aggressive partnership with OpenAI suggests intensifying competition that could ultimately benefit the entire ecosystem through innovation and capacity expansion.

Free email without sacrificing your privacy

Gmail is free, but you pay with your data. Proton Mail is different.

We don’t scan your messages. We don’t sell your behavior. We don’t follow you across the internet.

Proton Mail gives you full-featured, private email without surveillance or creepy profiling. It’s email that respects your time, your attention, and your boundaries.

Email doesn’t have to cost your privacy.

Market Overview 📈

The S&P 500 and Nasdaq Composite achieved new all-time intraday and closing highs on Wednesday, rebounding from concerns about the sustainability of the AI trade following Oracle's recent weakness.

Stocks showed minimal reaction to minutes from the Federal Reserve's September meeting, which revealed a divided Fed on future rate cuts.

The minutes showed officials were near-unanimous on lowering rates due to labor market weakness, but split on whether there should be two or three total reductions this year.

The current government shutdown entered its eighth day on Wednesday, with the Senate rejecting dueling stopgap funding bills for the sixth time.

While the stoppage has had little impact on equities thus far, it poses a greater risk to sentiment the longer it continues, given its potential economic implications.

President Trump suggested that not all furloughed federal workers will receive back pay, and active-duty military members might miss their October 15 paycheck.

Stock Moves Deciphered 📈

Arista Networks (ANET) 📈 +8.31%

The networking equipment provider surged on multiple analyst upgrades and strong positioning in AI data center infrastructure.

With a 46.7% EBIT margin and a 64.2% gross margin, Arista demonstrates exceptional profitability while capitalizing on the exponential demand for AI networking.

The company's switching and routing solutions are becoming essential infrastructure as hyperscalers build massive GPU clusters requiring ultra-low latency interconnects.

Advanced Micro Devices (AMD) 🚀 +11% (up 43% for the week)

AMD shares soared following the announcement of the OpenAI partnership, with the chipmaker committing to supply 6 gigawatts worth of chips over multiple years, including the forthcoming MI450 series.

OpenAI will receive warrants for up to 160 million AMD shares with vesting milestones based on deployment volume and AMD's share price, potentially giving OpenAI roughly 10% ownership.

This landmark deal fundamentally challenges Nvidia's dominance in AI chips and validates AMD's multi-year investment in data center GPU technology.

Super Micro Computer (SMCI) ⚡ +6.55%

The server manufacturer surged as investors recognized its role as a key OEM partner for AMD's new GPU systems.

Super Micro's ability to rapidly design and ship AI-optimized computing platforms featuring both AMD and Nvidia GPUs positions the company to capture significant market share as enterprises and cloud providers race to deploy next-generation infrastructure.

The stock benefited from spillover enthusiasm around the AMD-OpenAI announcement.

Headlines You Can't Miss 👀

📈 Bank of America upgrades the health care sector to overweight after two years underweight, citing attractive valuations and moderating wage pressures from AI implementation.

⚠️ Bank of England warns of 'sharp market correction' risk from stretched AI-related equity valuations and increasing market concentration in technology companies.

🤝 TopBuild to acquire Specialty Products and Insulation for $1 billion in cash, expanding its North American fabrication footprint and customer value proposition.

💰 Confluent shares jump 9% after Reuters reports the data infrastructure company is considering a sale following takeover interest from private equity and tech firms.

📉 Jefferies stock tumbles 7% on reports BlackRock may pull investment from fund exposed to bankrupt auto parts supplier First Brands Group.

💼 Citi downgrades CH Robinson Worldwide to neutral despite raising price target to $148, citing limited EPS upside after strong AI-driven performance.

📊 Bank of America data shows September job growth slowed to 0.5% year-over-year, the weakest pace in months, though top earner wages jumped 4%.

🚀 Sixteen stocks in S&P 500 hit all-time highs including Take-Two Interactive, Ralph Lauren, Monster Beverage, Northrop Grumman, and Palo Alto Networks.

Trending Stocks 📊

Joby Aviation (JOBY) ✈️ -8.14%

The electric air taxi maker's stock price plunged after announcing a common stock offering of 30.5 million shares priced at $16.85 each, generating approximately $513.9 million in gross proceeds.

The company plans to use proceeds for commercial operations, certification, manufacturing efforts, and general corporate purposes as it prepares to launch its air taxi service in the U.S. next year.

Rocket Lab (RKLB) 🚀 +6.18%

Shares of the end-to-end space company jumped after announcing a multi-launch deal with Institute for Q-shu Pioneers of Space (iQPS), including three dedicated Electron rocket missions from New Zealand no earlier than 2026.

This brings Rocket Lab's total upcoming launches with iQPS to seven missions.

AST SpaceMobile (ASTS) 📡 +8.63%

The satellite communications company surged after announcing a partnership with Verizon to provide direct-to-device cellular service from space beginning in 2026.

This deal expands an existing partnership and brings space-based connectivity to Verizon's mobile customers, marking a significant milestone in the commercialization of satellite-to-phone technology.

What’s Next?

Key market and macro news 👇

🥤 PepsiCo (PEP) Earnings Report: The beverage and snack giant will report its Q3 2025 earnings before the market opens, with its performance and outlook serving as a key indicator of consumer spending.

✈️ Delta Air Lines (DAL) Earnings Report: The major airline will release its Q3 2025 earnings, offering insights into travel demand and the health of the transportation sector as a whole.

👖Levi Strauss & Co. (LEVI) Earnings Report: The iconic apparel company will report its Q3 2025 earnings after the market closes, with its results reflecting consumer discretionary spending trends and the state of the retail environment.

🧑💻 Initial Jobless Claims Data Release: The weekly jobless claims report will be released, providing a timely indicator of the labor market's health and influencing expectations for the broader economy.

📊 Wholesale Inventories Data: The release of wholesale inventories data will offer insights into business spending and demand, providing a snapshot of economic activity and potential inflationary pressures.

🌎 Global Economic Data Releases: A variety of international economic data, including trade balances and inflation reports from several countries, will provide context for the global economic environment and potential international market spillovers.

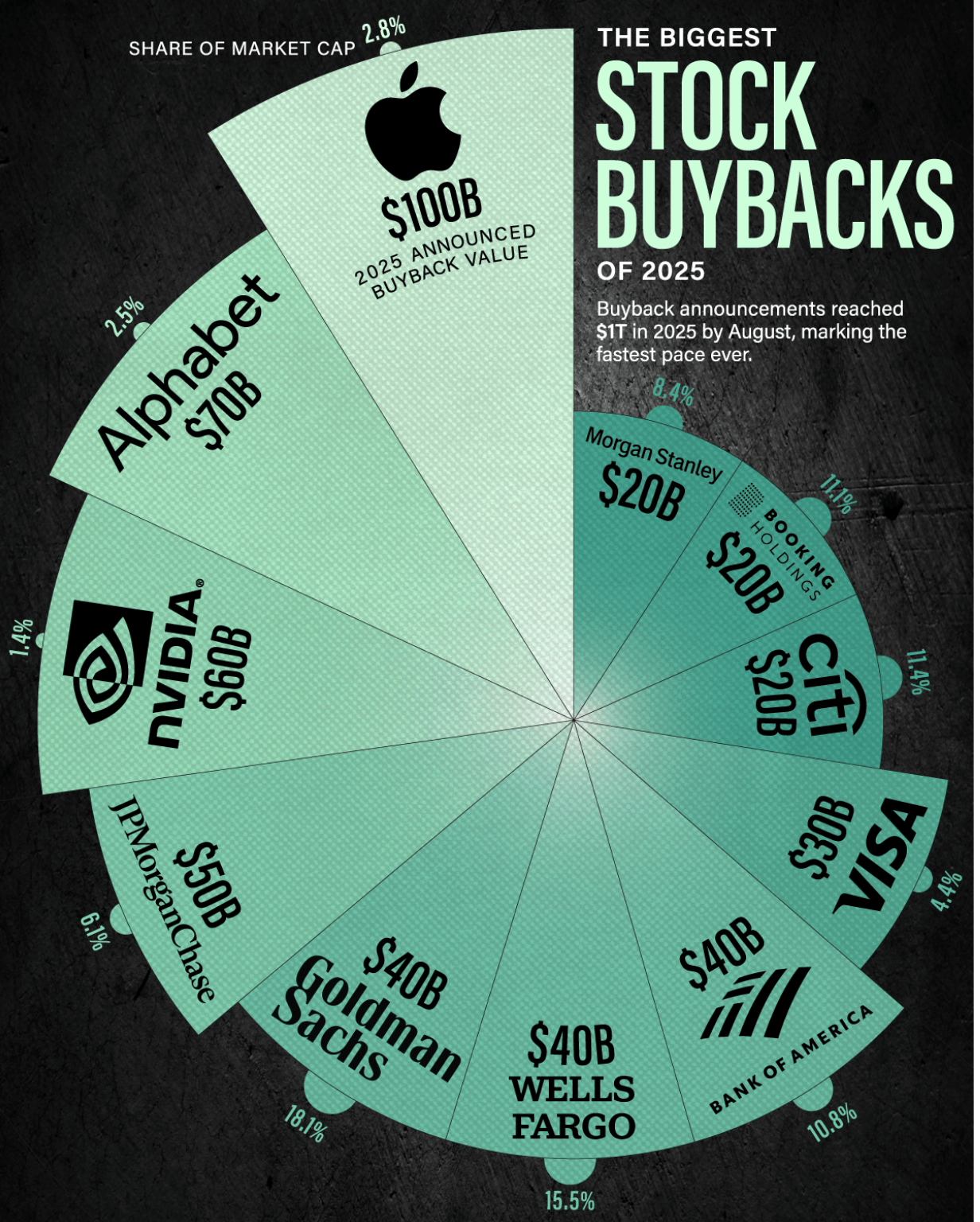

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.