Market Performance

S&P 500: 6,705.12 ⬆️ 1.55%

Nasdaq: 22,872.01 ⬆️ 2.69%

Dow Jones: 46,448.27 ⬆️ 0.44%

Novo Nordisk's Alzheimer's Gamble Fails

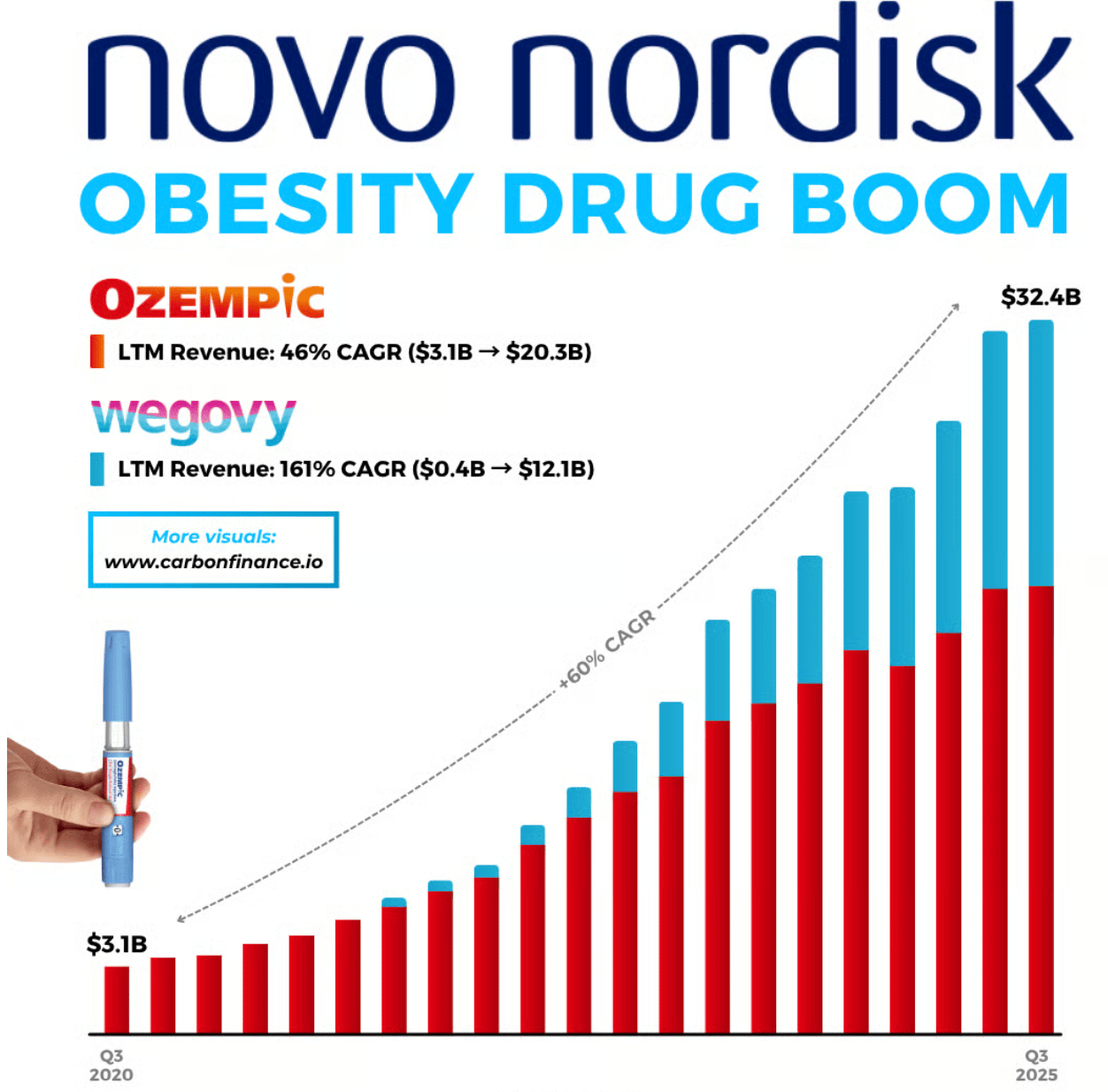

Novo Nordisk (NVO) shares plummeted to a four-year low on Monday after its highly anticipated Alzheimer's trial missed its primary endpoint.

The Danish drugmaker tested whether semaglutide—the blockbuster ingredient in Ozempic and Wegovy—could slow cognitive decline by at least 20%, but despite improvements in disease biomarkers, it failed to delay progression.

This was always a long shot. Analysts called it a "lottery ticket," and the company acknowledged the low likelihood of success.

But investors had hoped for a catalyst to revive Novo's battered stock, which has already halved this year amid guidance cuts and fierce competition from Eli Lilly.

The setback highlights Alzheimer's treatment challenges—current drugs like Lilly's Kisunla only slow progression by about a third and carry severe side effects.

Meanwhile, Lilly just became the first pharmaceutical company to hit a $1 trillion market cap, underscoring Novo's struggles despite Ozempic's four-year head start.

Our Takeaway

This failure removes a near-term upside catalyst for Novo, which is already battling market share losses to Lilly and cheaper compounders in the U.S.

New CEO Mike Doustdar's focus on core obesity and diabetes businesses makes sense—chasing moonshots isn't working.

Join Derek Jeter and Adam Levine

They’re both investors in AMASS Brands. And you can join them. Why invest? Their rapid growth spans everything from organic wine to protein seltzers. So with consumers prioritizing health in the $900B beverage market, it’s no surprise AMASS earned $80M+ already, including 1,000% year-over-year growth. They even reserved the Nasdaq ticker $AMSS. Become an AMASS shareholder and secure limited-time bonus stock by Dec. 4.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

Market Overview 📈

Markets rebounded strongly on Monday, powered by renewed optimism in artificial intelligence stocks, notably Alphabet.

The tech giant surged 6.3% after unveiling its upgraded Gemini 3 AI model, sparking enthusiasm across the AI trade.

The rally built on Friday's momentum, with New York Fed President John Williams signaling room for further rate cuts, leaving the door open for a December move.

Traders now assign nearly 70% probability to a quarter-point cut at the Fed's December 10 meeting, up from 44% a week earlier.

However, investors remain wary of elevated valuations in AI stocks, and with Thanksgiving trading volumes expected to thin, volatility could pick up.

San Francisco Fed President Mary Daly echoed Williams' dovish tone, citing labor market risks and describing the economy as "very vulnerable."

Any upcoming economic data signaling stagflation could exacerbate market jitters in this low-volume environment.

Stock Moves Deciphered 📈

🤖 Broadcom (AVGO)

Broadcom shares rallied 11.1% on Monday as investors poured back into AI-related semiconductor plays.

The chipmaker is benefiting from its position as one of the biggest suppliers of application-specific chips (ASICs) for hyperscalers, notably Google.

As Alphabet's AI momentum builds with Gemini 3, Broadcom's ASIC business—which helps design and manufacture Google's tensor processing units (TPUs)—is positioned as a key derivative play.

The stock is up 60% year-to-date and posted its best day since April 9, making it the top performer in the Technology Select Sector SPDR fund.

🛳️ Carnival Corporation (CCL)

Carnival stock tanked over 5% as the broader travel and leisure sector faced headwinds from economic uncertainty and thin holiday trading volumes.

Investors should watch for Q4 earnings updates from major cruise operators as they navigate seasonal demand patterns heading into 2026.

🚗 Copart (CPRT)

Copart hit a new 52-week low on Monday, trading at levels not seen since April 2023. The used-vehicle auction platform faces pressure from softening used-car demand and challenging market conditions in the automotive sector.

With concerns mounting around consumer spending and credit markets, Copart's stock weakness reflects broader worries about the health of the vehicle resale market.

Headlines You Can't Miss 👀

📊 Fed's preferred inflation gauge (September PCE) will be released Dec. 5, four days before the central bank's next policy meeting.

💊 Eli Lilly shares rose 0.8% as Novo Nordisk's failed Alzheimer's trial reinforced Lilly's dominance in dementia treatments with Kisunla.

🏥 Oscar Health surged nearly 20%, Centene rose 9%, and Molina Healthcare gained 6% after reports that the White House will extend ACA subsidies for two years.

🚗 Tesla shares added 2.2% after CEO Elon Musk announced the company is close to finalizing its A15 AI chip and starting work on A16.

🛒 Alibaba's U.S.-listed shares jumped 4% following news that its AI app Qwen reached 10 million downloads within its first week of launch.

📈 Deutsche Bank set its 2026 S&P 500 target at 8,000, citing rapid AI investment and adoption as key drivers for another strong year ahead.

📉 Evercore ISI raised its S&P 500 forecast to 7,750 for 2026, with EPS expectations lifted to $296 from $287, driven by AI spending and fiscal stimulus.

🔬 Biogen shares rose 2.6% following Novo Nordisk's Alzheimer's trial failure, reinforcing Leqembi as a leading treatment option despite its side-effect risks.

Trending Stocks 📊

⬇️ Grindr (GRND)

The LGBTQ+-focused dating app plunged 12% after its special committee ended engagement on a take-private proposal, citing uncertainty around financing.

The stock had surged in October when major shareholders offered $18 per share.

🥩 Tyson Foods (TSN)

Tyson Foods shares surged 6.6% following the announcement of a primary beef plant closure in Nebraska.

Analysts view this as a strategic move to improve profitability by reducing processing overcapacity and easing competition for cattle, which is expected to support industry margins going forward.

🚙 Carvana (CVNA)

Carvana surged 6.8% after Wedbush upgraded the online used-car dealer to outperform with a $400 price target, implying 29% upside.

Despite a recent 13% pullback, analysts see recovery potential as credit market concerns ease.

What’s Next?

Key market and macro news 👇

🛍️ Alibaba Group reports Q2 2026 earnings before market open with EPS estimate of $5.78

💻 Dell Technologies to report fiscal Q3 earnings after market close with EPS estimate of $2.48. Investors will closely watch AI server demand and trends in enterprise technology spending.

📊 Producer Price Index (PPI) data for September will show wholesale inflation trends with the prior final demand reading of 2.6% year-over-year, a critical Fed indicator.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.