- Ziggma

- Posts

- 💰 Nike Stuns Wall Street

💰 Nike Stuns Wall Street

Big moves decoded: ETSY, PFE, PAYC

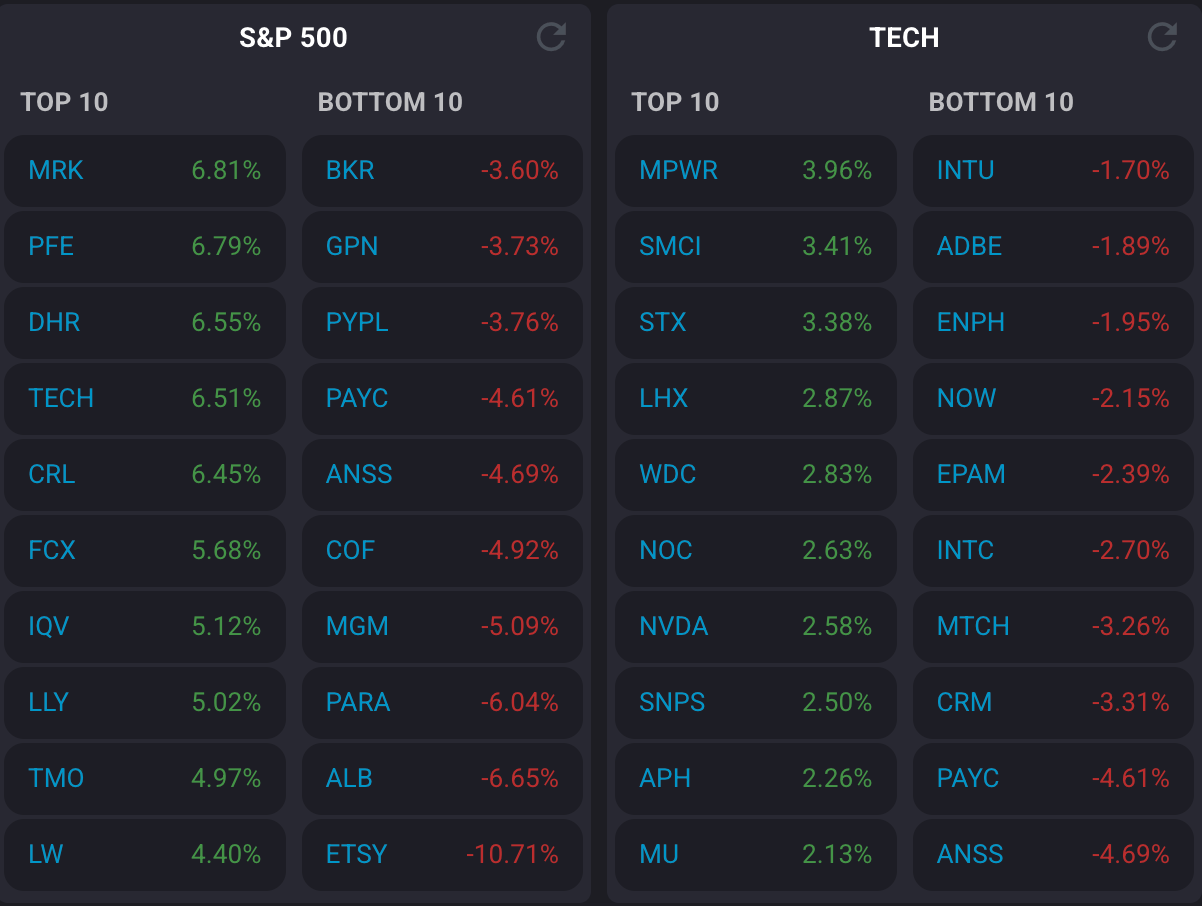

Market Performance

S&P 500: 6,688.46 ⬆️ 0.41%

Nasdaq: 22,660.01 ⬆️ 0.31%

Dow Jones: 46,397.89 ⬆️ 0.18%

Nike’s Bumpy Turnaround Path

Nike (NKE) delivered a pleasant earnings surprise on Tuesday, but don't pop the champagne just yet.

The athletic giant reported earnings per share of $0.49 versus estimates of $0.27 while revenue stood at $11.72 billion, above estimates of $11 billion.

However, Nike expects sales to decline again during the crucial holiday quarter, following an 8% drop last year.

Moreover, tariffs are now expected to cost the company $1.5 billion this fiscal year, up from the $1 billion projected just three months ago.

Notably, CEO Elliott Hill is making progress in three key areas—wholesale, running, and North America—with wholesale revenue up 7% and North American sales climbing 4%.

However, the company's China business declined 9%, Converse's sales dropped 27%, and the direct-to-consumer channel fell 4%. Nike doesn't expect its online business to return to growth all year.

CFO Matt Friend captured the mood perfectly: "Progress will not be linear." Translation: this turnaround is going to take time, and investors need patience.

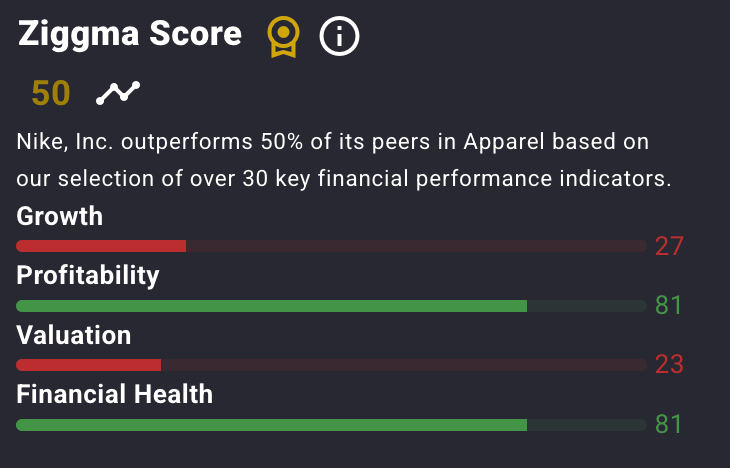

Nike stock currently has a Ziggma Stock Score of 50, and ranks in the bottom half percentile in terms of growth and valuation.

Our Takeaway

Nike's quarter shows why turnarounds are messy. Yes, they beat expectations, but clearing old inventory through discounting is crushing profitability.

The real test comes in Q2 when holiday sales matter most.

With tariff headwinds intensifying and China struggling, Nike's path back to dominance remains uncertain despite early wins in wholesale and North America.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Market Overview 📈

Stocks closed higher on Tuesday as investors shrugged off government shutdown fears to cap an unusually strong September.

The federal government faces a midnight funding deadline, with President Trump calling a shutdown "probably likely" and Speaker Mike Johnson expressing skepticism about avoiding it.

Historically, government shutdowns have had minimal market impact, typically lasting no more than two weeks.

Consumer confidence data disappointed, falling to 94.2 in September, below the 96.0 estimate and the lowest reading since April.

The "present situation" index hit a one-year low, raising concerns about economic momentum heading into Q4.

On the positive side, CoreWeave announced a massive $14.2 billion AI infrastructure deal with Meta, sending its shares up nearly 12%.

The agreement underscores the continued investment boom in artificial intelligence infrastructure, with Nvidia-backed CoreWeave positioning itself as a critical player in the AI cloud computing space.

The potential shutdown could delay Friday's crucial non-farm payrolls report, leaving the Federal Reserve with less data to consider as it heads into its October policy meeting.

Boston Fed President Susan Collins supported recent rate cuts but emphasized the need for a "modestly restrictive policy stance" given persistent inflation risks.

For September overall, the S&P 500 gained over 3%, the Nasdaq jumped 5.6%, and the Dow rose nearly 2%.

Stock Moves Deciphered 📈

Etsy (ETSY) 🛍️

Shares tumbled 11%, surrendering most of Monday's 16% gain following the announcement of the OpenAI partnership.

Despite the pullback, analysts remain bullish on the e-commerce platform's positioning at the "leading edge of agentic commerce."

BTIG's Marvin Fong raised his price target by $9 to $81, citing ChatGPT's scale and the total addressable market unlock from AI-powered shopping.

Pfizer (PFE) 💉

The pharmaceutical giant jumped after CNBC reported an agreement with the Trump administration to lower Medicaid drug prices voluntarily.

In exchange, Pfizer receives a three-year exemption from planned pharmaceutical tariffs and commits to expanding U.S. manufacturing operations. T

The agreement lifted other pharmaceutical stocks, with Eli Lilly rising 5%, Merck rising 7% and Danaher rising 6%.

Paycom (PAYC) 💸

Shares declined by more than 4% following quarterly results that failed to excite investors amid growing concerns about competition from AI-powered solutions.

The payroll and HR software provider faces questions about maintaining market share as integrated commerce platforms incorporate artificial intelligence and automated payment capabilities into broader business management suites.

Headlines You Can't Miss 👀

🚀 Firefly Aerospace rocket booster exploded during preflight testing at its Texas facility, sending shares down 21%.

✂️ Exxon Mobil will cut 2,000 positions worldwide as part of ongoing restructuring, becoming the latest oil company to slash jobs amid crude prices slumping nearly 13% this year below $63 per barrel.

📡 EchoStar rallied 9% on reports of talks to sell wireless spectrum to Verizon, specifically AWS-3 licenses used for 5G wireless connectivity and network expansion.

💰 Wolfspeed shares soared 23% after rocketing nearly 1,700% Monday, completing financial restructuring and emerging from Chapter 11 bankruptcy protection with renewed investor confidence.

💼 Jefferies Financial beat estimates with $1.01 per share on $2.05 billion revenue, reporting a 22% revenue jump and a record investment banking advisory business despite.

💻 Progress Software surged 3%, exceeding Wall Street estimates with adjusted earnings of $1.50 per share on $250 million revenue while raising full-year guidance for AI infrastructure software.

Trending Stocks 📊

Credo (CRDO) 🤖

Shares dipped after the connectivity components maker announced plans to acquire privately-held Hyperlume, which provides microLED-based interconnects for hyperscale and AI-focused data centers.

The acquisition positions Credo to capitalize on the growing demand for advanced optical technologies in artificial intelligence infrastructure.

Vail Resorts (MTN) ⛷️

The ski resort operator's stock dropped after it missed estimates, reporting a quarterly loss of $5.08 per share, compared to the expected loss of $4.73.

Revenue of $271 million also fell short of the $274 million consensus, raising concerns about the company's positioning as it heads into the crucial winter ski season.

UiPath (PATH) 📈

The automation software maker rallied over 8% after announcing strategic partnerships with OpenAI, Snowflake, and Nvidia that will integrate UiPath's technology into their AI capabilities.

The company also unveiled a conversational agent with voice interaction powered by Google's Gemini.

What’s Next?

Key earnings and macro news 👇

💰 Major Earnings Releases: RPM International ($15.12B), Acuity ($10.55B), Conagra Brands ($8.83B), and Cal-Maine Foods ($4.67B) report quarterly earnings before market open.

🏆 Safe-Haven Asset Rally: Gold reaches record highs above $3,875 per ounce while VIX rises to 16.28, reflecting increased market volatility and uncertainty expectations.

📈 IPO Activity Surge: Neptune Insurance Holdings, Rice Acquisition($300M SPAC), Agroz, and Fermi debut on major exchanges, adding new investment opportunities.

👩🏭 Critical Manufacturing Data: ISM Manufacturing PMI release(prior: 48.7) will signal sector health, with employment and new orders indices providing additional economic insights.

💂 Employment Indicators: The ADP National Employment Report (previously 54K jobs) serves as a key preview for official jobs data amid concerns about the government shutdown.

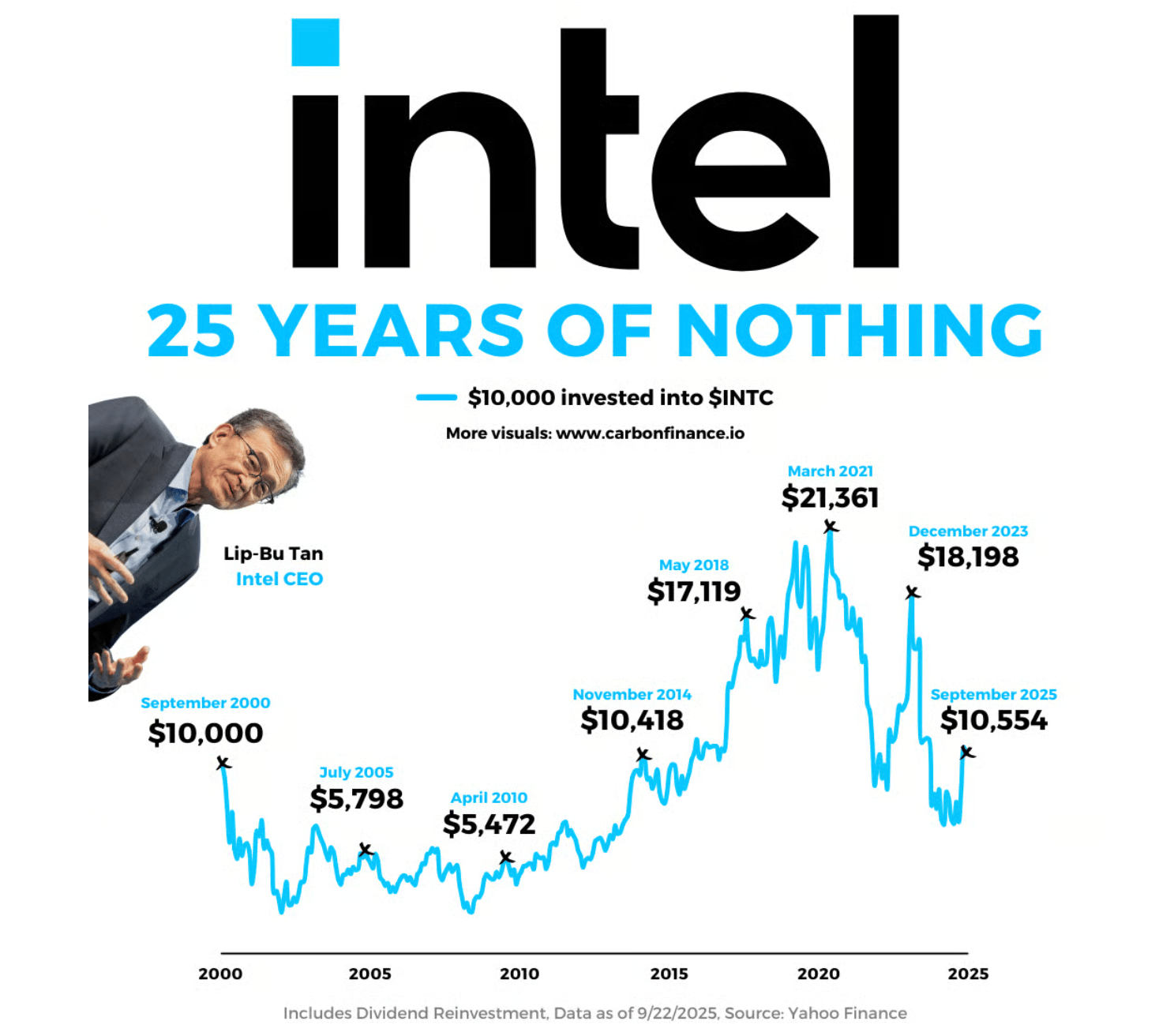

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.