- Ziggma

- Posts

- 🗞 Nike's Tariff Headwind

🗞 Nike's Tariff Headwind

Plus: S&P 500 closes at record highs 🚀

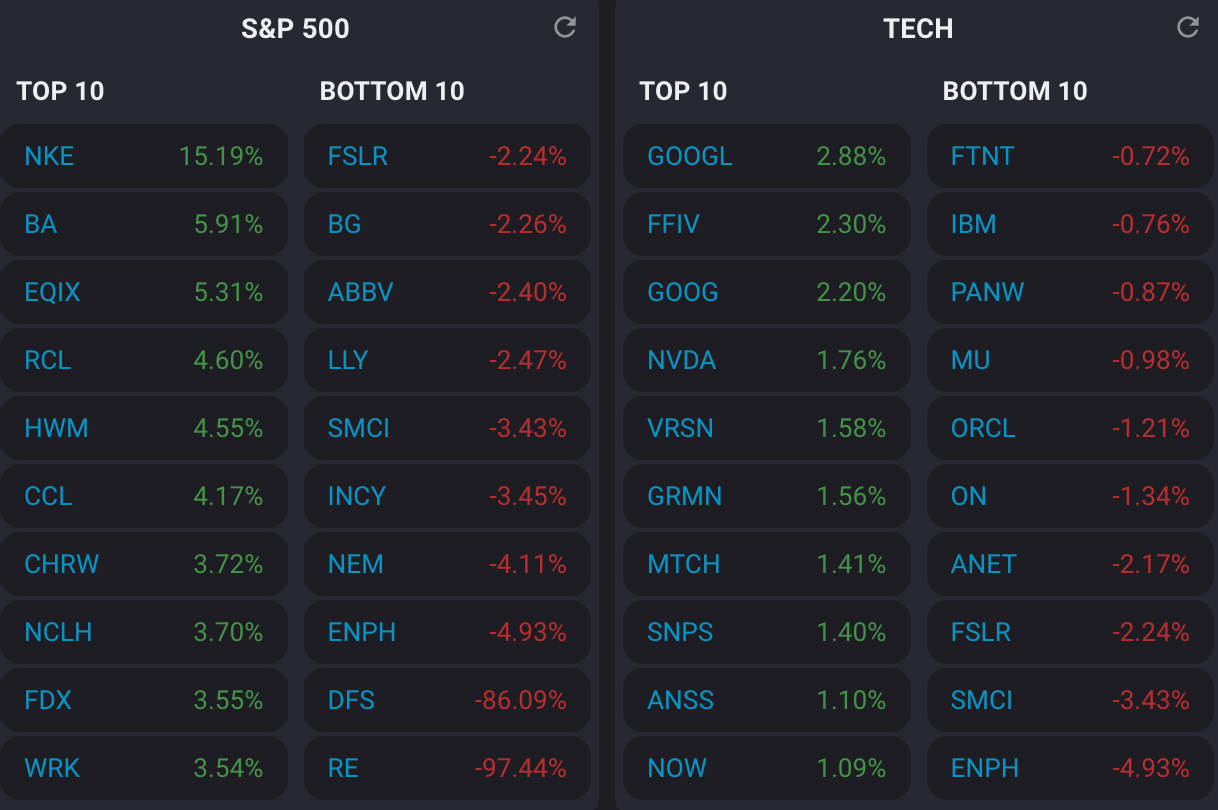

Market Performance

S&P 500: 6,173.07 (+0.52%)

Nasdaq: 20,273.46 (+0.52%)

Dow Jones: 43,819.27(+1.00%)

Nike’s $1 Billion Tariff Cost

Nike (NKE) delivered a reality check about what Trump's tariffs mean for American companies. The sneaker giant reported its biggest financial hit yet from its turnaround plan, with profits plummeting 86% in fiscal Q4.

But here's the kicker 👇

Nike estimates Trump's tariffs will cost them approximately $1 billion in fiscal 2026.

Think about that for a moment. One billion dollars in additional costs for a single company.

Nike's CFO described the tariffs as a "new and meaningful" cost, and the retail giant is scrambling to reduce its China exposure from 16% to the high single digits by next summer.

What makes this striking is that Nike still beat analyst expectations despite this massive headwind.

Nike is "fully committed" to mitigating these costs through supply chain adjustments, factory partnerships, and yes, price increases that consumers will ultimately pay.

Our Takeaway

This is a preview of what's coming for countless American companies. When a company as large and globally diversified as Nike takes a $1 billion tariff hit, it signals that these trade policies will have a meaningful impact on corporate America's bottom line and consumer prices.

Nike's aggressive supply chain pivot away from China shows how tariffs are forcing fundamental business restructuring, not just minor cost adjustments.

Nike’s commitment to "fully mitigate" costs through price increases means consumers will bear this burden.

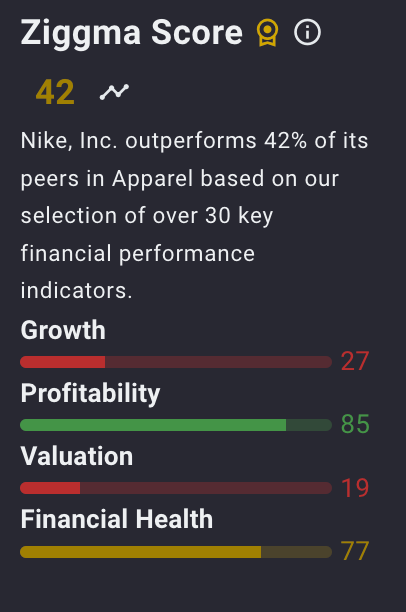

For investors, this highlights the importance of analyzing companies' China exposure and supply chain flexibility when evaluating tariff-sensitive stocks.

Don’t snooze on student loans

June is the sweet spot to start planning how you’ll cover what FAFSA doesn’t.

You’ve got time to compare options, talk it over with a co-signer, and find a private loan that actually fits your life.

Think beyond tuition—the right student loan can cover housing, meal plans, and even your laptop.

View Money’s best student loans list to find a lender, apply in as little as 3 minutes, and start the semester on the right foot.

Market Overview

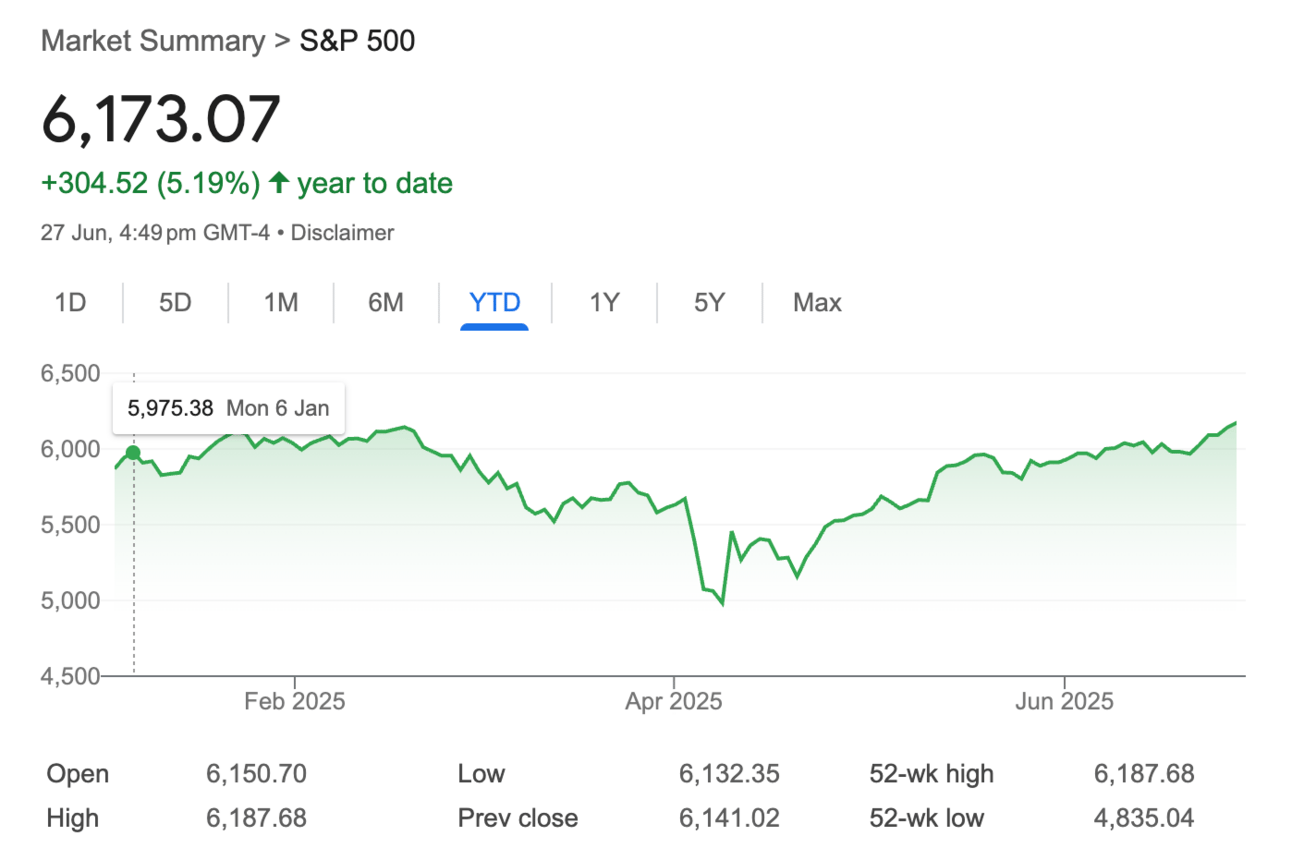

Friday's trading session showcased the market's resilience in navigating an ever-changing trade landscape.

The S&P 500 and Nasdaq both hit fresh records, marking a stunning comeback from April's 18% decline when Trump first implemented severe tariffs.

The day started strong after Commerce Secretary Howard Lutnick announced that a trade framework between the U.S. and China had been finalized, with the administration expecting deals with 10 major trading partners to be finalized imminently.

However, stocks pulled back from session highs when Trump announced the termination of all trade talks with Canada over their digital services tax on American tech firms.

Oil prices provided additional market support, plummeting 12.91% this week, the biggest weekly decline since 2023, as Middle East tensions cooled following the Israel-Iran ceasefire.

Consumer sentiment also improved in June as inflation fears abated, with the University of Michigan survey showing the headline reading rising to 60.7, up 16.3% from May.

The one-year inflation outlook fell to 5%, down 1.6 percentage points, although core PCE inflation came in higher than expected at 2.7% year-over-year, versus the 2.6% estimate.

Headlines You Can't Miss

Coinbase became the S&P 500's best performer this month, up 44% in June amid crypto legislative clarity.

Apple continues to miss out on the tech rally, down 19% year-to-date, while its peers hit record highs.

Uber and Lyft were downgraded by Canaccord Genuity due to concerns about robotaxi disruptions.

Franklin Resources received an upgrade to buy from Goldman Sachs on alternatives traction.

Credit bureau stocks tumbled after FHFA announced full-scale review of all credit agencies.

Power stocks rallied on reports Trump will sign AI executive orders to increase power supply.

Trump loses latest bid to get Central Park Five defamation lawsuit tossed, facing continued legal challenges.

France bets Eutelsat can become Europe's answer to Starlink, though experts remain unconvinced.

Elon Musk rips into 'utterly insane' Trump-backed megabill, creating potential political tensions.

Trending Stocks

Core Scientific (CORZ): The stock surged 2% on reports that AI infrastructure company CoreWeave is in talks to acquire the company.

A transaction could be finalized in the coming weeks, according to sources cited in The Wall Street Journal.

CoreWeave is already Core Scientific's largest tenant, accounting for 590 MW of infrastructure, making this acquisition a strategic fit to secure additional capacity for AI workloads.

Analyst Quote🎤: “The combination makes strategic sense. This deal would allow CoreWeave to vertically integrate its infrastructure and reduce operating expenses. CoreWeave would also be able to use the Core Scientific platform to grow its data center development pipeline”.

Pony.ai (PONY): Shares of the autonomous vehicle company rose nearly 2% after reports that Uber is in talks to help fund an acquisition of Pony.ai's U.S. subsidiary.

This move would represent Uber's deeper push into the autonomous vehicle space as competition intensifies in the robotaxi market.

Analyst Quote🎤: “Any deal with Kalanick would likely be valued under $500 million, given Pony AI has no US revenue yet.”

Tesla (TSLA): Shares of the EV giant were on track for a positive week, up more than 1% week-to-date, following the "successful" launch of its robotaxi service in Austin, Texas.

CEO Elon Musk's announcement sparked investor hopes that Tesla can compete with leaders like Alphabet's Waymo in the autonomous vehicle space, although shares remain down 19% year-to-date.

CEO Quote🎤: “Super congratulations to the @Tesla_AI software & chip design teams on a successful @Robotaxi launch!! Culmination of a decade of hard work. Both the AI chip and software teams were built from scratch within Tesla.”

What’s Next?

July has historically been a strong month for stocks, especially in post-election years, with the S&P 500 often experiencing gains. The last six months of the year have seen gains 15 out of the previous 16 times when the market was already higher in May and June.

Elevated valuations are a concern. The S&P 500 is trading at about 23.3 times forward earnings, reflecting high optimism that may be challenging to sustain without strong economic support.

Key macroeconomic data to watch includes the U.S. nonfarm payrolls report for June, scheduled for release on Thursday, July 3 (early market close day). Economists forecast an increase of about 115,000 jobs, slightly down from May’s 139,000.

Other important data this week includes U.S. PMI surveys, unemployment figures, average hourly earnings, and inflation data from Europe, which could influence market sentiment.

Track upcoming news and earnings with Ziggma to get personalized alerts.

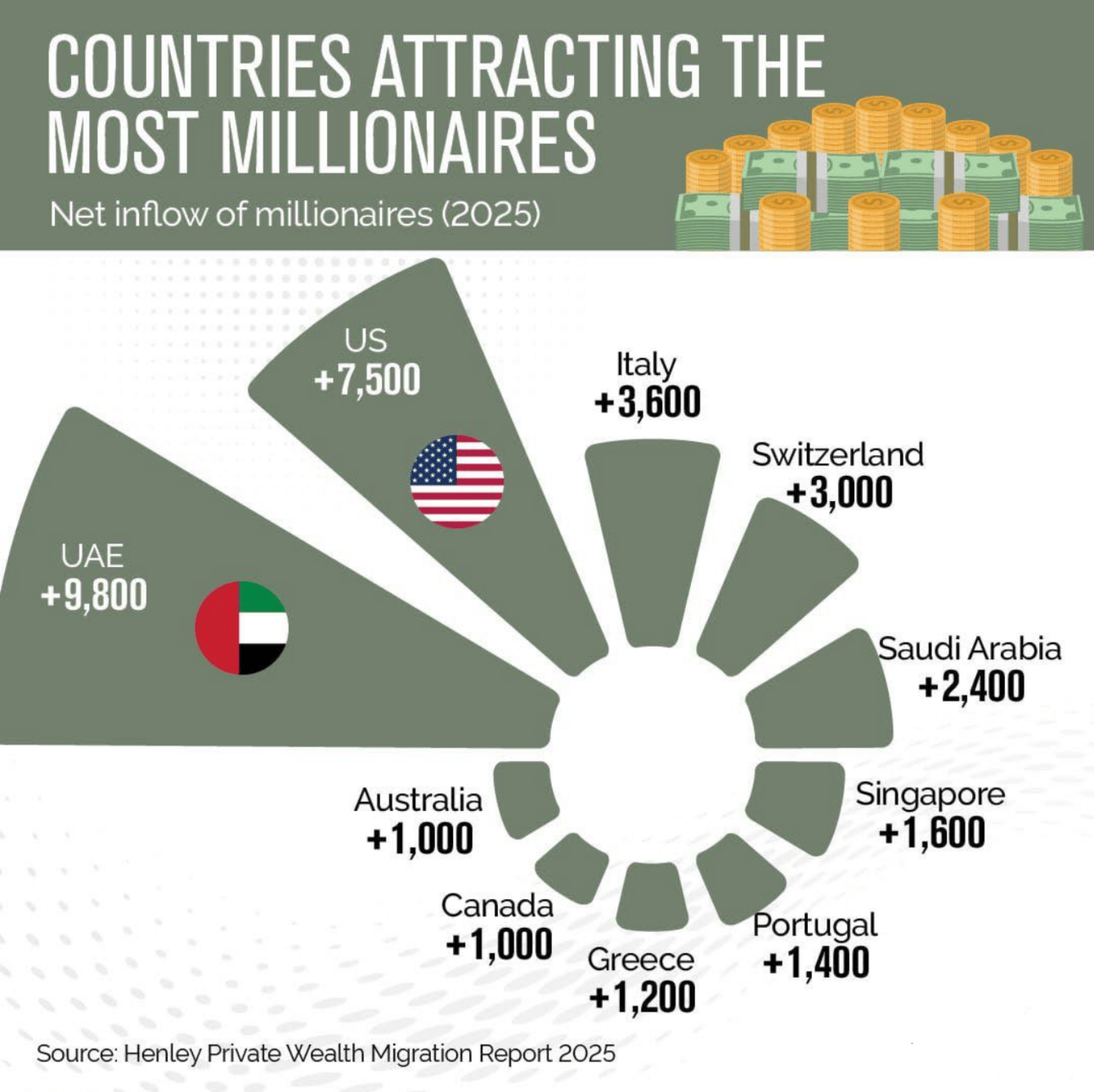

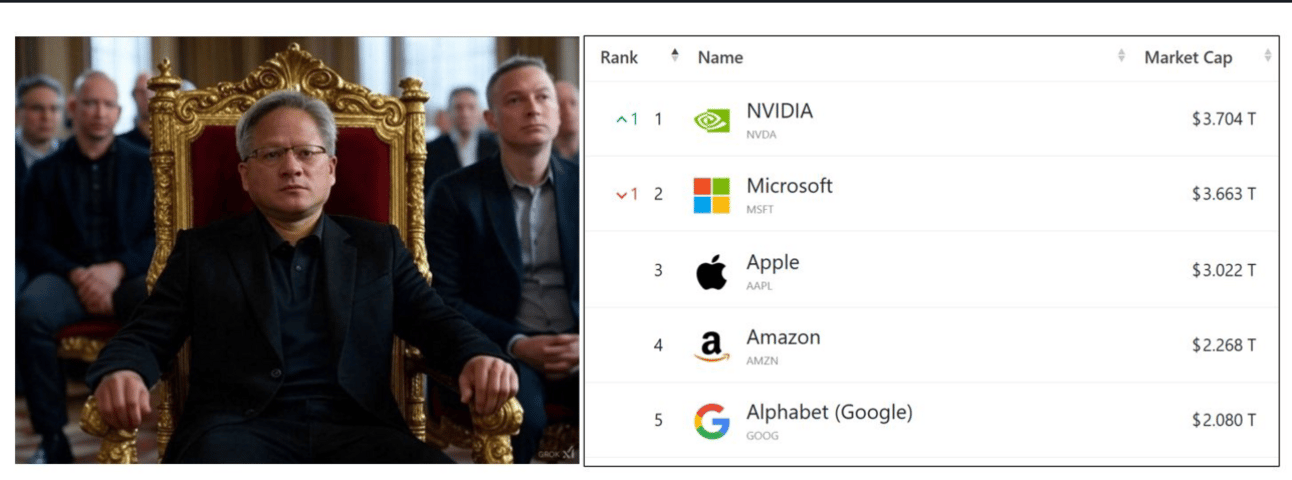

Chart of the Day

Source: Network 18

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.