- Ziggma

- Posts

- 🗞️ Netflix Tanks Post Earnings Miss

🗞️ Netflix Tanks Post Earnings Miss

Big Moves Decoded: GM, HAL, and WBD

Market Performance

S&P 500: 6,735.13 ⬆️ 1.07%

Nasdaq: 22,990.54 ⬆️ 1.37%

Dow Jones: 46,706.58 ⬆️ 1.12%

Netflix Sinks on Earnings Miss

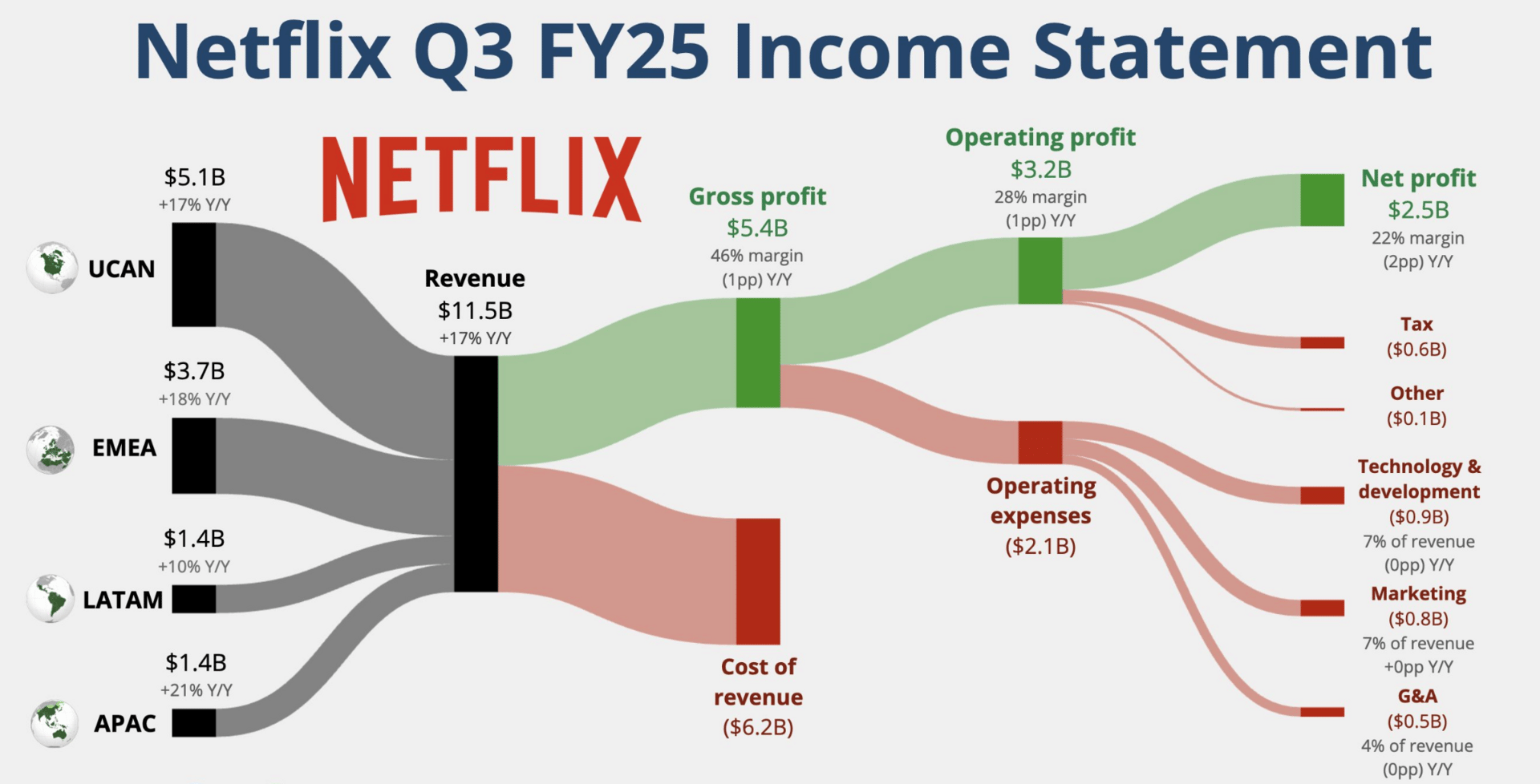

Shares of Netflix (NFLX) fell around 7% after the company posted a third-quarter earnings miss, citing an ongoing dispute with Brazilian tax authorities for the weaker-than-estimated results.

The streamer stated that the specific expense, resulting from a 10% tax on certain payments made by Brazilian entities to operations outside the country, was not previously included in its forecast.

Netflix decided to charge the impact to its third quarter after it became reasonably likely that Netflix would lose a legal challenge over whether it would be assessed the tax.

Revenue for Netflix's third quarter rose 17%, in line with analyst expectations, boosted by membership growth, pricing adjustments, and increased ad revenue.

For the fourth quarter, Netflix expects revenue to rise 17% year over year as those trends continue.

The company reported third-quarter net income of $2.55 billion, or $5.87 per share, compared to $2.36 billion, or $5.40, in the same quarter a year prior.

However, analysts had expected earnings per share of $6.97, making this a significant miss.

For the full year, Netflix is projecting $45.1 billion in revenue, a 16% jump from the year prior.

The company altered its operating margin forecast for the year to 29% instead of the prior projection of 30%, citing the Brazilian tax matter.

Netflix did post its best ad sales quarter ever during the period, with co-CEO Greg Peters noting that the company is on track to more than double ad revenue this year.

The streaming giant is also capitalizing on the massive success of "KPop Demon Hunters," which has become Netflix's most-watched film with more than 325 million views.

Netflix stock has a Ziggma score of 88, and ranks in the top percentile for profitability and financial health.

Our Takeaway

The Brazilian tax issue is a one-time charge that the company explicitly stated won't have a material impact in the future.

More importantly, the underlying metrics tell a compelling story: 17% revenue growth, record ad sales, and continued membership expansion.

As legacy media companies like Warner Bros. Discovery undergo strategic reviews and potential sales, Netflix remains dominant in the streaming landscape.

The "KPop Demon Hunters" phenomenon demonstrates Netflix's unmatched ability to create global cultural moments that drive engagement and advertising revenue.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Market Overview 📈

The Dow Jones Industrial Average notched a record-setting session on Tuesday, boosted by strong earnings reports from companies like Coca-Cola and 3M.

At the same time, the S&P 500 remained relatively unchanged, and the Nasdaq lagged on tech weakness.

Tech stocks took a hit during Tuesday's session after President Trump sparked uncertainty about his expected meeting next week with Chinese President Xi Jinping, saying "Maybe it won't happen."

This weighed on semiconductor names, with Alphabet and Broadcom each falling around 2%, while AI darling Nvidia pulled back nearly 1%.

Tech investors are counting on friendlier relations with China to lower tariff rates and keep the semiconductor industry out of the crossfire.

The market's positive sentiment is also propped up by anticipation of another quarter percentage point rate cut at the Federal Reserve's late October meeting.

Consumer price index data due Friday is expected to provide clues on the state of inflation, which could influence the central bank's upcoming decision.

More than three-quarters of S&P 500 companies that have reported results so far have beaten expectations, according to FactSet data, signaling a strong start to earnings season.

Stock Moves Deciphered 📈

🚙 General Motors (GM) | +14.86%

GM stock soared after it reported an adjusted earnings of $2.80 per share on revenue of $48.59 billion in Q3, crushing analyst estimates of $2.31 per share on revenue of $45.27 billion.

GM also raised its full-year profit guidance and said it expects next year's results to surpass 2025's performance.

The Detroit automaker also lowered its estimated impact from President Trump's tariffs for the year.

🏭 3M (MMM) | +7.66%

3M's stock gained after the industrial conglomerate posted solid organic growth in Q3 of 2025.

The performance signals that the company's restructuring efforts and focus on high-margin businesses are paying off.

Fellow old economy stocks showed similar strength, indicating renewed investor confidence in traditional industrial names despite the broader market's focus on technology.

⚡️ Halliburton (HAL) | +11.58%

The energy services giant's better-than-expected margins and cost-cutting measures drove investor confidence despite a slight year-over-year revenue dip.

The strong results come as the oil and gas services sector continues to benefit from sustained energy demand and disciplined capital allocation.

Halliburton's ability to maintain margin strength in a challenging pricing environment demonstrates the company's operational efficiency and market positioning.

Headlines You Can't Miss 👀

📈 Ralph Lauren, American Express, Quest Diagnostics, Laboratory Corp, GE Aerospace, Jacobs Solutions, and Raytheon Technologies all traded at new all-time highs on Tuesday.

🏦 Zions Bancorp rose 2% after Q3 earnings climbed to $221 million ($1.48/share), beating estimates despite disclosure of $60 million in faulty loans last week.

🍎 Apple received price target increases from Goldman Sachs (to $279) and Wells Fargo ahead of its earnings report, with analysts expecting beats on revenue and earnings.

🇯🇵 iShares MSCI Japan ETF fell 1% after Sanae Takaichi won the lower House vote to become Japan's first woman prime minister, receiving 237 votes in the 465-seat chamber.

🏨 Hilton Worldwide earnings will kick off Q3 reporting for hospitality stocks, with Bernstein warning of continued RevPAR growth deceleration and cautioning investors heading into Q4.

🌏 U.S.-Australia critical minerals deal signed, with China responding that resource-rich nations should play "a proactive role" in safeguarding supply chain security and stability.

📊 The September CPI report due Friday faces scrutiny amid the ongoing government shutdown, with investors questioning data quality and what accommodations were made for limited BLS staffing.

Trending Stocks 📊

📺 Warner Bros. Discovery (WBD) | +11%

Warner Bros. Discovery shares surged to a three-year high after the media conglomerate announced it is open to a sale.

The news of a strategic review and unsolicited acquisition interest excited investors, with Netflix reportedly among interested buyers, even as the company proceeds with plans to split into two separate entities.

🥤 Coca-Cola (KO) | +4.10%

Coca-Cola shares rose after the beverage giant reported fiscal third-quarter results that beat Wall Street estimates.

The company earned 82 cents per share, adjusted, on revenue of $12.41 billion, surpassing analyst expectations of 78 cents per share on revenue of $12.39 billion.

🛩️ Raytheon Technologies (RTX) | +8%

Raytheon Technologies traded at new all-time high levels dating back through its history to the 1920s, joining eight other S&P 500 stocks that hit new all-time highs on Tuesday, signaling broad-based strength across multiple sectors beyond technology.

What’s Next?

Key market and macro news 👇

🚗 Tesla reports Q3 earnings with expectations of $0.55 EPS and $26.6 billion revenue. As a market bellwether, results will significantly influence tech sector sentiment and broader market direction.

🏦 Fed Governor Barr speaks on financial inclusion, and markets will scrutinize his comments for clues on monetary policy direction, interest rate outlook, and the Fed's economic assessment.

🎤 SAP reports Q3 earnings with analysts expecting 40.7% YoY EPS growth to $1.73. Strong results could boost confidence in the enterprise software sector and validate continued corporate technology spending trends.

🛢️ EIA Petroleum Status Report: With oil prices elevated and supply concerns ongoing, the report will influence energy stocks and inflation expectations significantly.

📊 IMF World Economic Outlook Impact: The IMF's recently released dim global growth forecast (3.2% for 2025) continues influencing market sentiment.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.