- Ziggma

- Posts

- 💰 Netflix's All-Cash $83B Bid

💰 Netflix's All-Cash $83B Bid

PLUS: Tech sell-off continues

Market Performance

S&P 500: 6,926.60 ⬇️ 0.53%

Nasdaq: 23,471.75 ⬇️ 1.00%

Dow Jones: 49,149.63 ⬇️ 0.09%

Netflix Shifts Gears

Netflix (NFLX) is reportedly preparing to switch its Warner Bros. Discovery acquisition to an all-cash offer, abandoning its original $83 billion stock-and-cash proposal.

The streaming giant is looking to accelerate the deal timeline and fend off Paramount Skydance's aggressive $108.4 billion hostile bid.

The move is strategic brilliance. By going all-cash at $27.75 per share, Netflix could move the shareholder vote from spring to as early as late February.

That's critical when you're racing against Paramount, which has Larry Ellison's $40 billion personal guarantee backing its offer.

If successful, Netflix would control Warner Bros. studios—home to Harry Potter, Superman, and Batman franchises—plus HBO's premium content, including Game of Thrones and Succession.

We're talking about control of nearly half the streaming market.

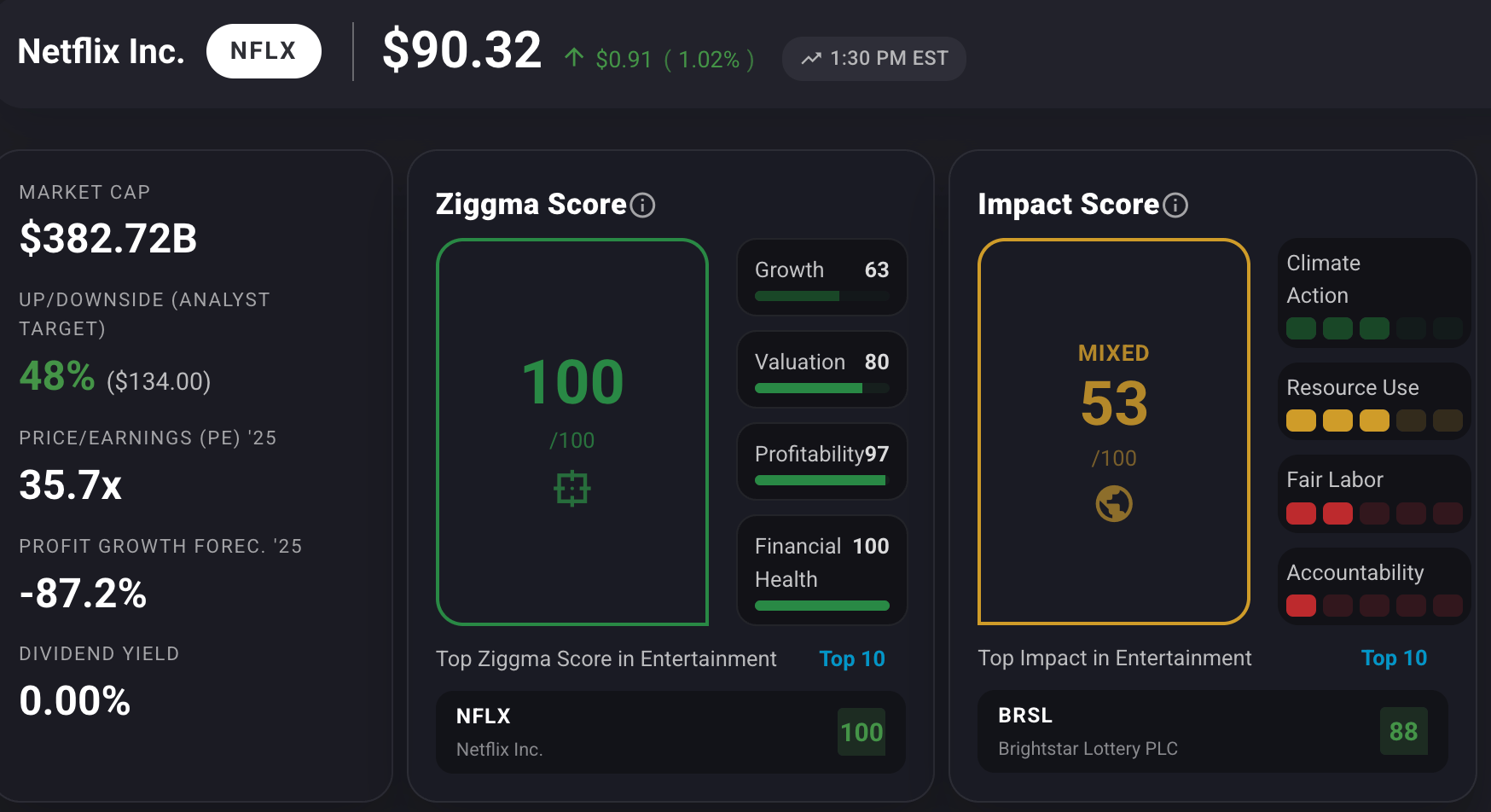

Netflix stock has a Ziggma score of 100 and ranks in the top percentile for valuation, profitability, and financial health.

Our Takeaway

Netflix is betting that speed and certainty will win over WBD shareholders, even if Paramount's bid appears higher on paper.

The risk? Regulatory scrutiny over such massive market concentration could derail the entire deal.

Market Overview 📈

Stocks retreated for a second consecutive session as tech weakness dragged down the broader market and geopolitical tensions simmered.

Chip stocks took the biggest hit after Reuters reported Chinese customs authorities advised agents that Nvidia's H200 chips cannot enter the country, sending Broadcom down 4% and Nvidia and Micron each falling over 1%.

Bank stocks struggled despite mostly beating earnings estimates, as traders questioned whether results were strong enough to justify valuations near record highs.

Adding pressure, the delayed November economic data came in hotter than expected.

The producer price index raised concerns that core PCE inflation might run above Fed targets, complicating the central bank's rate-cut timeline.

Tom Graff, CIO at Facet, warned:

"If you translate this PPI number into what core PCE will look like, I think it's going to come in a little hot.”

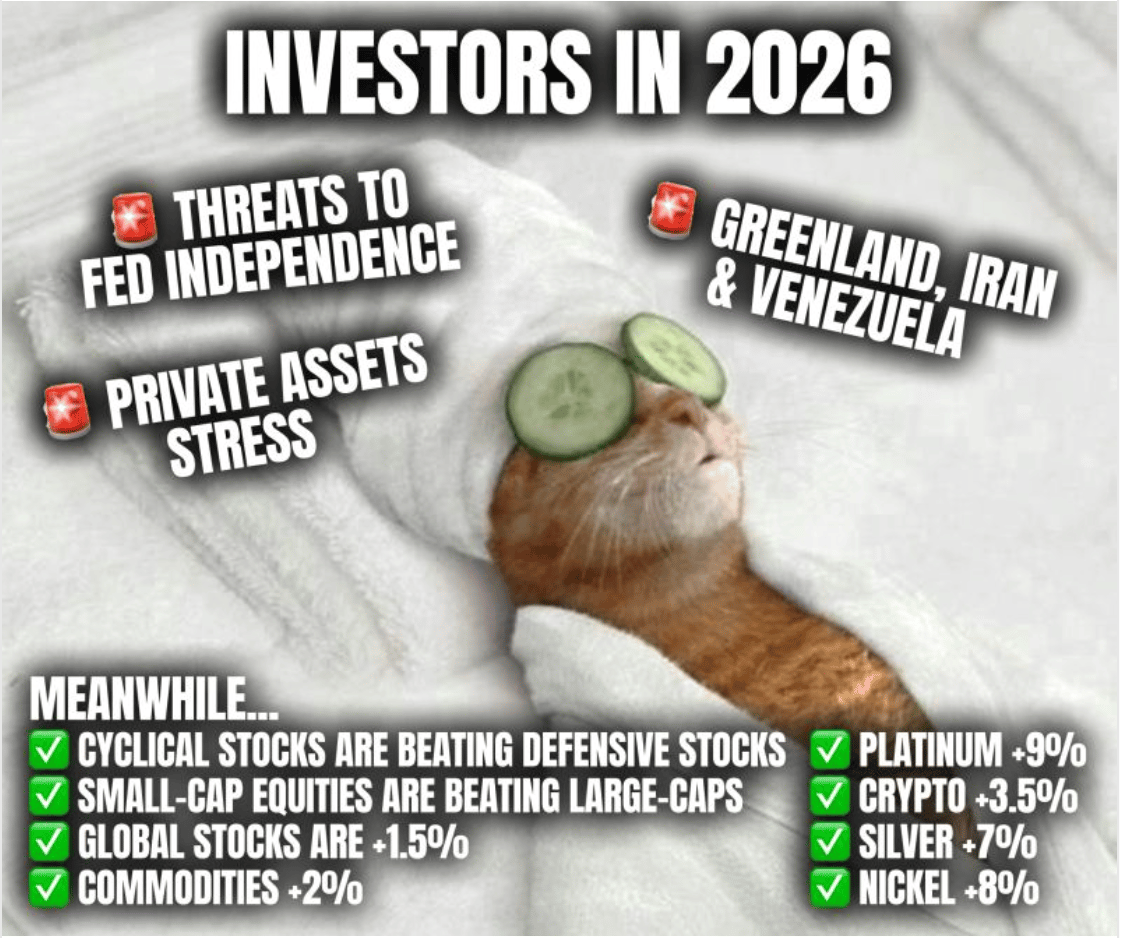

Meanwhile, concerns about Federal Reserve independence intensified as the Justice Department's criminal investigation into Chair Jerome Powell continued, with global central bankers coming to his defense.

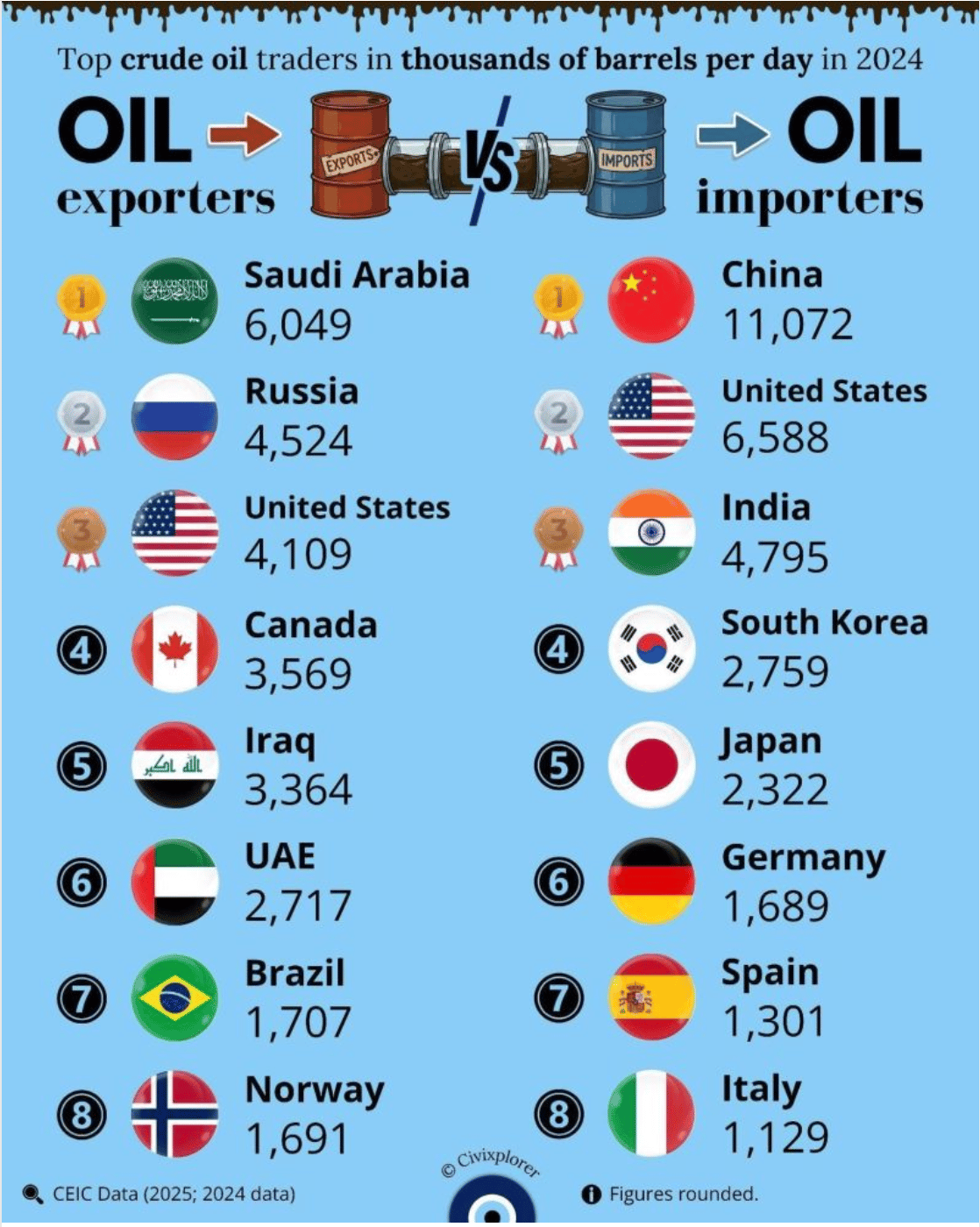

Geopolitical uncertainty added to market jitters, with oil prices volatile amid tensions over Iran and meetings in the Trump administration over Greenland's future status.

Stock Moves Deciphered 📈

🧪 LyondellBasell Industries (LYB)

LyondellBasell surged over 6% after Citigroup removed its 90-day downside catalyst watch, signaling renewed confidence in the chemical company.

The positive analyst action, combined with a bullish outlook for the U.S. plastics market—projected to expand 36% by 2033—propelled the stock yesterday.

🏡 Airbnb (ABNB)

Airbnb declined by over 5% after data showed a 6% drop in international tourism to the U.S. in 2025.

Despite global travel spending reaching record levels, fewer visitors from key markets like Canada and Europe raised concerns about the company's domestic growth prospects.

The tourism decline comes at a critical time as the short-term rental platform navigates increased regulatory pressures in major cities and heightened competition in the vacation rental space.

🏦 Bank of America (BAC)

Bank of America initially edged higher but closed down 3.78% despite beating fourth-quarter estimates, with earnings of $0.98 per share on revenue of $28.53 billion, surpassing analyst expectations of $0.96 and $27.94 billion, respectively.

Stronger-than-anticipated net interest income drove the beat, but traders deemed the results insufficient to justify valuations near record highs.

The stock joined broader bank weakness following Trump's credit card interest rate reform proposals announced Friday, contributing to a nearly 6% weekly decline.

Headlines You Can't Miss 👀

📈 Exxon Mobil hit an all-time high as energy stocks rallied, with the State Street Energy Select Sector SPDR ETF reaching its highest level since December 2024.

⚖️ Supreme Court again delayed ruling on Trump's tariff authority under the International Emergency Economic Powers Act, prolonging uncertainty over the duties.

🏠 Federal Housing Finance Authority Director Bill Pulte told WSJ the Trump administration is studying homebuilder stock buybacks, sending D.R. Horton and Lennar shares lower.

🔒 Chinese government instructed domestic firms to stop using Israeli and American cybersecurity software, pressuring Check Point Software, Palo Alto Networks, and Fortinet shares 2-3%.

💰 Gold prices surged to around $4,633 per ounce while silver broke above $90 for the first time, driven by "resource nationalism" as the U.S. and China compete for critical resources.

🇪🇺 European stocks hit a record high with the pan-European Stoxx 600 climbing 0.3%, outperforming U.S. markets amid optimism despite geopolitical uncertainties.

🎯 29 S&P 500 stocks traded at new 52-week highs, including Ross Stores (an all-time high since its 1985 IPO), Johnson & Johnson, and Lockheed Martin.

📊 Minneapolis Fed President Neel Kashkari expressed concern that further interest-rate cuts could exacerbate inflation, despite recession-like spending among lower-income families.

Trending Stocks 📊

💸 Wells Fargo (WFC)

Wells Fargo tumbled over 1.5% despite beating fourth-quarter earnings estimates, as revenue of $21.29 billion missed the $21.65 billion consensus.

Net interest income of $12.3 billion also fell short of expectations, raising concerns about future margin pressure from anticipated Federal Reserve rate cuts in 2026.

The bank has now declined almost 7% for the week, joining other major banks in suffering losses following President Trump's call for credit card interest rate reform that could impact profitability.

🚌 Trip (TCOM)

Trip.com plunged 4% after Reuters reported Chinese market regulators launched an investigation into the travel website.

The probe adds regulatory pressure to China's largest online travel agency at a time when the company has been benefiting from rebounding domestic and international travel demand in Asia.

🚗 Rivian (RIVN)

Rivian shares fell after UBS downgraded the electric vehicle manufacturer to sell from neutral, arguing recent gains have pushed the valuation too high.

Despite raising its price target to $15 from $13, analyst Joseph Spak believes the stock's risk-reward ratio now appears unfavorable after shares rallied significantly in recent sessions.

🧾 Intuit (INTU)

Intuit dropped nearly 5% following a series of analyst downgrades that questioned the financial software company's 2026 outlook.

Goldman Sachs initiated coverage with a neutral rating while Wells Fargo downgraded to equal weight, citing difficult year-over-year comparisons after a strong 2025 and concerns over weaker forward guidance for the tax preparation and accounting software leader.

What’s Next?

Key market and macro news 👇

🏦 Morgan Stanley reports Q4 2025 earnings consensus EPS forecast of $2.41, representing 8.56% year-over-year growth.

🎤 Goldman Sachs releases Q4 results before market open with consensus EPS of $11.77, down 1.51% year-over-year. As a major investment banking powerhouse, results will signal the health of capital markets, M&A activity, and trading revenues during the quarter.

💰 BlackRock reports Q4 earnings with a consensus EPS forecast of $12.41, up 4.02% year-over-year. As the world's largest asset manager, BlackRock's earnings reflect asset management trends, ETF flows, and wealth management performance, which in turn affect the broader financial sector.

👩💼 Initial jobless claims data will be released today, providing critical indicators of labor market health. Expectations suggest continued labor market stability, with claims levels indicating employment trends that influence Federal Reserve policy considerations and economic outlook.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.