- Ziggma

- Posts

- 💰 Moderna's Mighty Surge

💰 Moderna's Mighty Surge

PLUS: Chip stocks rally

Market Performance

S&P 500: 6,940.01 ⬇️ 0.06%

Nasdaq: 23,515.39 ⬇️ 0.06%

Dow Jones: 49,359.33 ⬇️ 0.17%

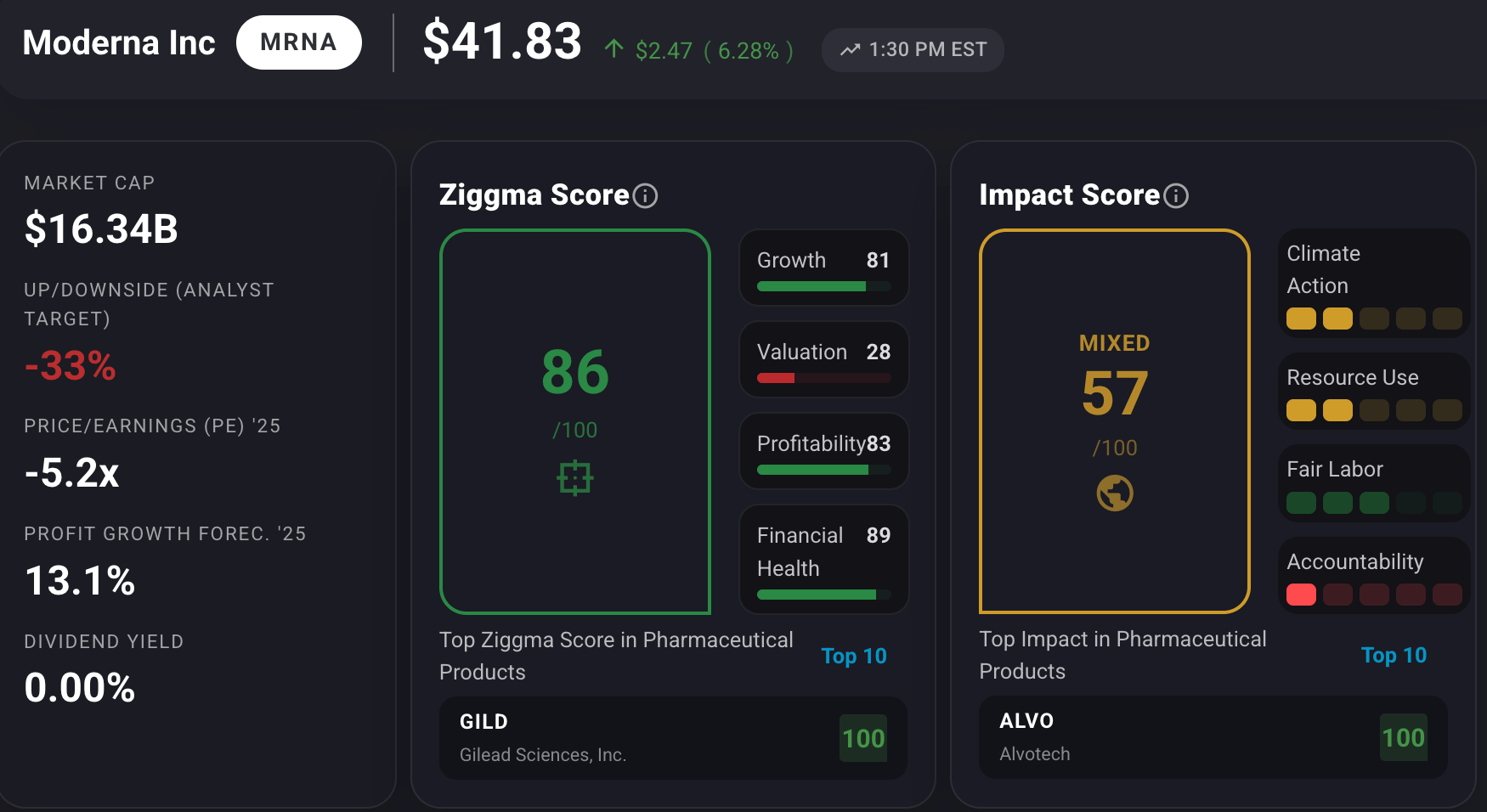

Moderna's Path to Profitability

Moderna's (MRNA) stock jumped 13% in the past week after the biotech company delivered a roadmap that has investors buzzing about a potential turnaround.

The company announced preliminary 2025 revenues of $1.9 billion—beating its own guidance—and projected 10% revenue growth for 2026 while slashing operating expenses.

Here's what's particularly interesting:

Moderna ended 2025 with $8.1 billion in cash, well above expectations, thanks to a strategic $1.5 billion loan facility.

Management is doubling down on its 2028 breakeven target, a crucial milestone for a company that's been burning through cash.

The real catalyst? Regulatory filings for its seasonal flu vaccine, mRNA-1010, have now been submitted across major markets.

If approved, this could diversify Moderna beyond COVID-19 and validate its mRNA platform for seasonal vaccines.

The company is also advancing Intismeran autogene, a personalized cancer therapy developed with Merck, targeting a 2027 commercial launch.

With over 30 pipeline candidates and late-stage data expected for RSV and norovirus vaccines this year, Moderna is betting big that its mRNA technology can become a multi-indication platform rather than a one-hit wonder.

Our Takeaway

Moderna's aggressive cost-cutting and pipeline expansion signal a transition from pandemic windfall to a sustainable biotech player.

The 2026 guidance shows discipline, but execution on vaccine approvals and cancer therapy trials will determine if this rally has legs. For investors, the next 18 months are make-or-break.

➡️ NEW: Original Ziggma Research on Substack: Is Microsoft the Best Long-Term AI Play - For Shareholders and the Climate? 🔖 Read or 🎧 listen to podcast.

Market Overview 📈

The markets closed Friday in the red as traders digested President Trump's comments about Federal Reserve leadership and escalating geopolitical tensions.

The primary driver of market anxiety was Trump's suggestion that he wants to keep Kevin Hassett as National Economic Council Director rather than appointing him as Fed Chair.

Prediction markets immediately shifted, with former Fed Governor Kevin Warsh now leading the race to replace Jerome Powell, whose term expires in May.

Wall Street views Hassett as more market-friendly and willing to keep rates lower, so this pivot rattled investors concerned about Fed independence.

Adding to the uncertainty, Trump floated the possibility of imposing tariffs on countries that don't support the U.S. acquisition of Greenland, raising geopolitical risk premiums.

Meanwhile, bank stocks weakened despite strong earnings as concerns persisted around Trump's proposed cap on credit card interest rates—JPMorgan Chase and Bank of America each fell 5% for the week.

Chip stocks provided the week's bright spot. Taiwan Semiconductor's blowout Q4 report and a new U.S.-Taiwan trade agreement—which includes at least $250 billion in American chip production investments—lifted semiconductor names.

However, even this positive catalyst couldn't overcome broader market jitters about Fed leadership and policy unpredictability.

Better prompts. Better AI output.

AI gets smarter when your input is complete. Wispr Flow helps you think out loud and capture full context by voice, then turns that speech into a clean, structured prompt you can paste into ChatGPT, Claude, or any assistant. No more chopping up thoughts into typed paragraphs. Preserve constraints, examples, edge cases, and tone by speaking them once. The result is faster iteration, more precise outputs, and less time re-prompting. Try Wispr Flow for AI or see a 30-second demo.

Stock Moves Deciphered 📈

🚀 Super Micro Computer (SMCI)

Super Micro Computer rallied sharply on Friday, riding the wave of optimism in chip stocks following Taiwan Semiconductor's stellar earnings report.

TSMC's announcement of ambitious 2026 capital expenditure plans renewed investor confidence across the AI server ecosystem, where SMCI plays a critical role.

🏦 PNC Financial Services (PNC)

PNC shares climbed after delivering a strong Q4 earnings beat and record full-year revenue. The bank reported $5.96 billion in revenue versus the $5.89 billion consensus, while earnings of $4.88 per share crushed the $4.22 forecast.

Management's guidance for roughly 11% total revenue growth by the end of 2026—well above the 8.7% analyst estimate—reinforced confidence in the bank's growth trajectory.

🔋 Constellation Energy (CEG)

Constellation Energy tumbled nearly 10% following the Trump administration's announcement of a new electricity pricing plan for the PJM region.

The proposed price caps on existing power sources created immediate uncertainty about the company's profitability, particularly for its nuclear fleet.

While new construction projects could benefit from the policy, the market was focused on near-term margin pressure from capped prices on current-generation assets.

⚡️ Quanta Services (PWR)

Quanta Services hit a fresh 52-week high, driven by a record backlog in grid services and new contracts in the energy transition sector.

The company is benefiting from the massive infrastructure buildout required to support AI data centers and the broader electrification trend.

💸 Trimble (TRMB)

Trimble shares fell sharply due to heavy insider selling that spooked investors ahead of the company's Q4 2025 earnings report.

The large volume of shares sold by company insiders created negative sentiment and triggered technical selling pressure.

Headlines You Can't Miss 👀

📊 Russell 2000 posted its 11th straight session of outperforming the S&P 500—the longest streak since 2008—climbing over 8% year-to-date.

🏦 Regions Financial dropped nearly 3% after reporting disappointing Q4 earnings of 57 cents per share, missing the $0.61 forecast by analysts.

🛒 Dollar Tree received a tactical outperform rating from Evercore ISI with a $165 price target, citing strong execution on multi-price merchandising strategies.

⚡ GE Vernova and Bloom Energy each surged about 6% as the Trump administration pushes tech companies to fund new power plants for energy-intensive data centers.

🚗 Nio was upgraded to outperform by Macquarie, with analysts highlighting its Battery-as-a-Service model as a key competitive advantage against rising lithium costs.

🍔 Dave & Buster's jumped after Benchmark upgraded shares to buy with a $30 price target, anticipating the company's first positive same-store sales in 13 quarters.

🛢️ ConocoPhillips was downgraded to underperform by Bank of America, citing an oil breakeven price of $53—materially higher than peers—and uncompetitive cash flow yields.

🚢 J.B. Hunt Transport Services fell 4% in extended trading after reporting a 2% decline in Q4 revenue driven by soft demand across end markets.

Trending Stocks 📊

🤖 Nvidia (NVDA)

Jefferies reiterated its buy rating on Nvidia and raised its price target to $275 from $250, implying 47% upside from current levels.

Analyst Blayne Curtis highlighted the strong ramp of Nvidia's Blackwell chip and the upcoming Rubin platform as key growth drivers.

💊 Novo Nordisk (NVO)

Novo Nordisk shares jumped over 9% after strong first-week sales data for its oral weight loss treatment.

Evercore ISI analyst Umer Raffat reported that the oral version accounted for approximately 1.3% of all Wegovy prescriptions in its inaugural week—remarkably strong for a holiday launch period.

✈️ Delta Air Lines (DAL)

Bank of America maintained its buy rating on Delta despite the airline issuing more conservative 2026 guidance of $6.50-$7.50 per share, below the Street consensus of $7.30.

Following a call with CFO Dan Janki, analysts emphasized that Delta's structural advantages—including its premium revenue focus, strong cash generation, low leverage, and diversified revenue streams from loyalty and maintenance services—justify continued bullish sentiment.

What’s Next?

Key market and macro news 👇

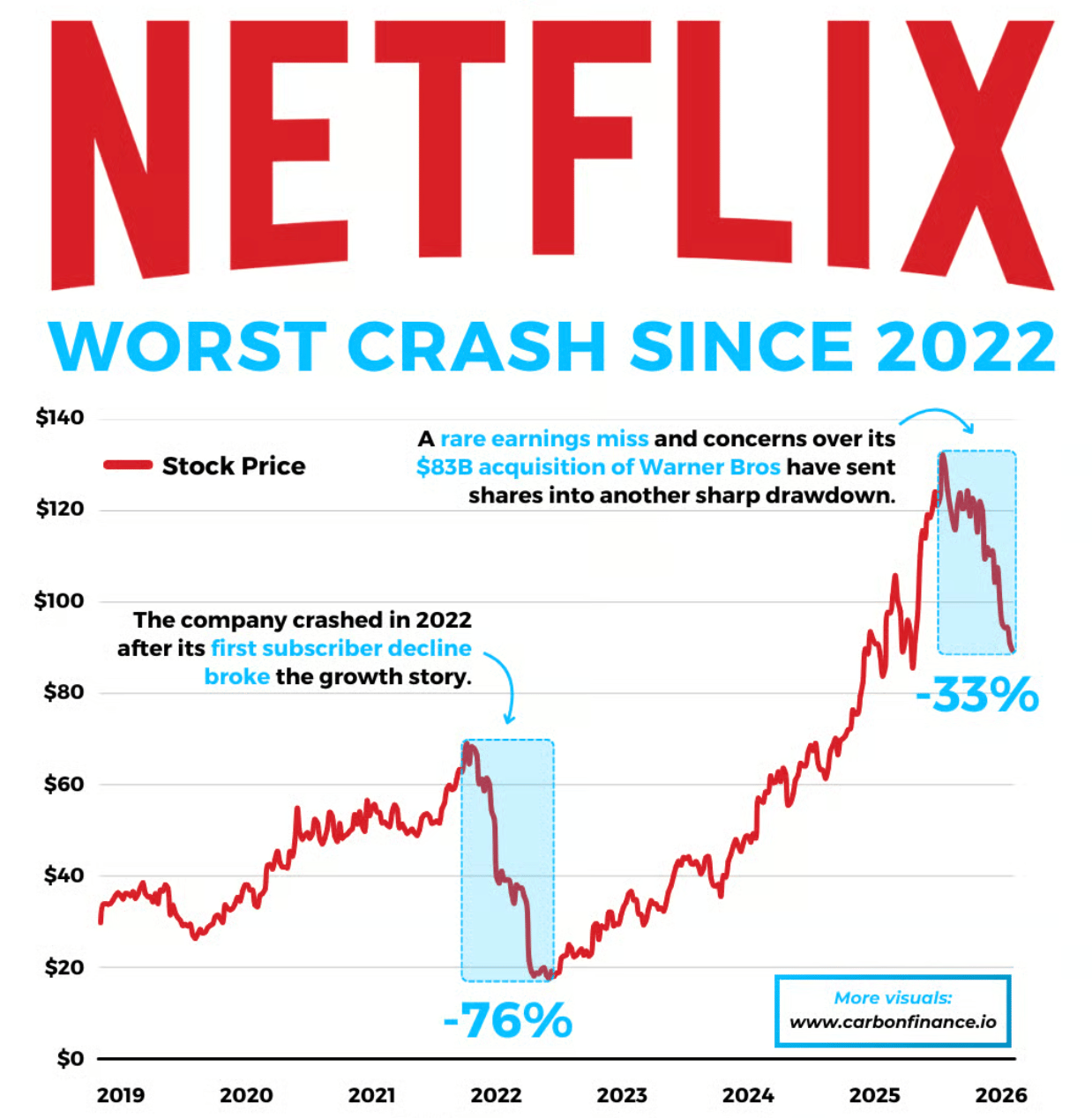

📊 Netflix: The streaming giant is scheduled to release its fourth-quarter 2025 earnings. Investors will be watching for subscriber growth, revenue, and any updates on its content strategy and competition.

🎤 Interactive Brokers: The electronic brokerage firm will report its fourth-quarter 2025 results. The report will provide insight into trading volumes and the health of the retail investor.

🏡 D.R. Horton: As a major homebuilder, D.R. Horton's first-quarter 2026 earnings will offer a look into the housing market's health, including demand and construction trends.

💸 PNC Financial Services: This major bank is expected to report its fourth-quarter 2025 earnings before the market opens. Analysts project a 12.2% increase in earnings per share compared to the same quarter last year.

🇬🇱 Trump's Greenland Purchase Offer: A reported $700 billion offer from President Trump to purchase Greenland would create significant geopolitical and economic uncertainty, likely causing broad market volatility and currency fluctuations.

🇪🇺 European Market Reaction to U.S. Tariff Threats: European stock markets have already reacted negatively to President Trump's tariff threats. Continued tensions could weigh on U.S. markets.

Chart of the Day

Source: Carbon Finance

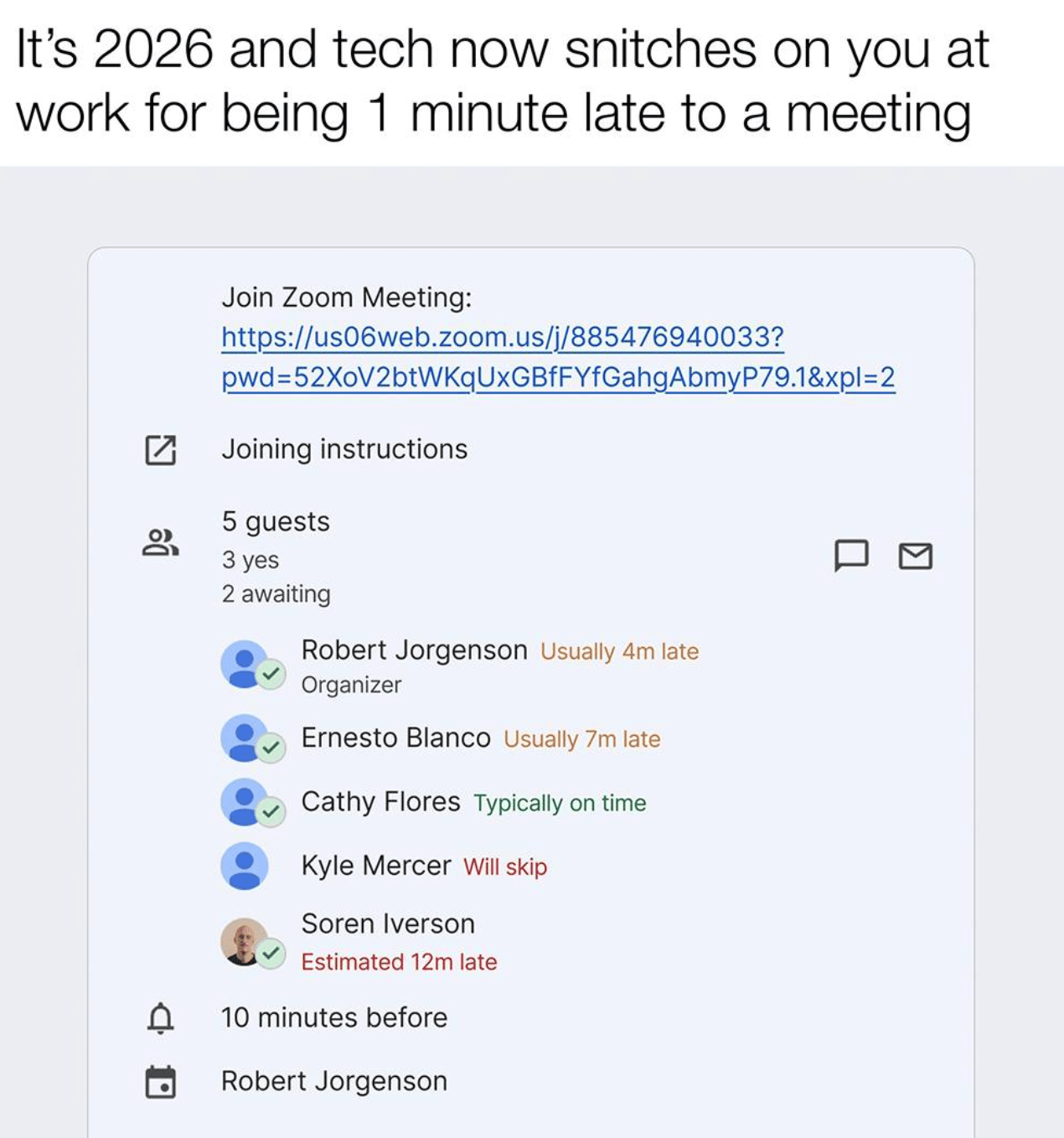

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.