- Ziggma

- Posts

- 🗞️ Microsoft Sheds 6%

🗞️ Microsoft Sheds 6%

PLUS: Meta gains 7%

Market Performance

S&P 500: 6,978.03 ⬇️ 0.01%

Nasdaq: 23,857.45 ⬆️ 0.17%

Dow Jones: 49,015.60 ⬆️ 0.02%

Microsoft's Cloud Growth Slowdown Rattles Investors

Microsoft stock is down over 6% in pre-market trading despite beating earnings expectations, as investors focused on decelerating cloud momentum and a concerning revenue concentration risk.

The software giant posted adjusted earnings of $4.14 per share on revenue of $81.27 billion, surpassing analyst estimates.

However, Azure cloud growth of 39% marked a slight deceleration from the prior quarter's 40%.

Moreover, fiscal third-quarter Azure growth guidance of 37-38% fell short of investor hopes for reacceleration.

The real shocker? OpenAI now represents 45% of Microsoft's $625 billion commercial backlog following a massive $250 billion cloud commitment.

"Can OpenAI achieve these financial goals to pay Oracle, Microsoft and many of the providers?" questioned Jefferies analyst Brent Thill, highlighting execution risk.

Microsoft's capital expenditures soared 66% to $37.5 billion, as demand continues to outstrip the supply of AI infrastructure.

The company added nearly one gigawatt of capacity in the quarter alone, yet CEO Satya Nadella acknowledged they're still playing catch-up with customer demand.

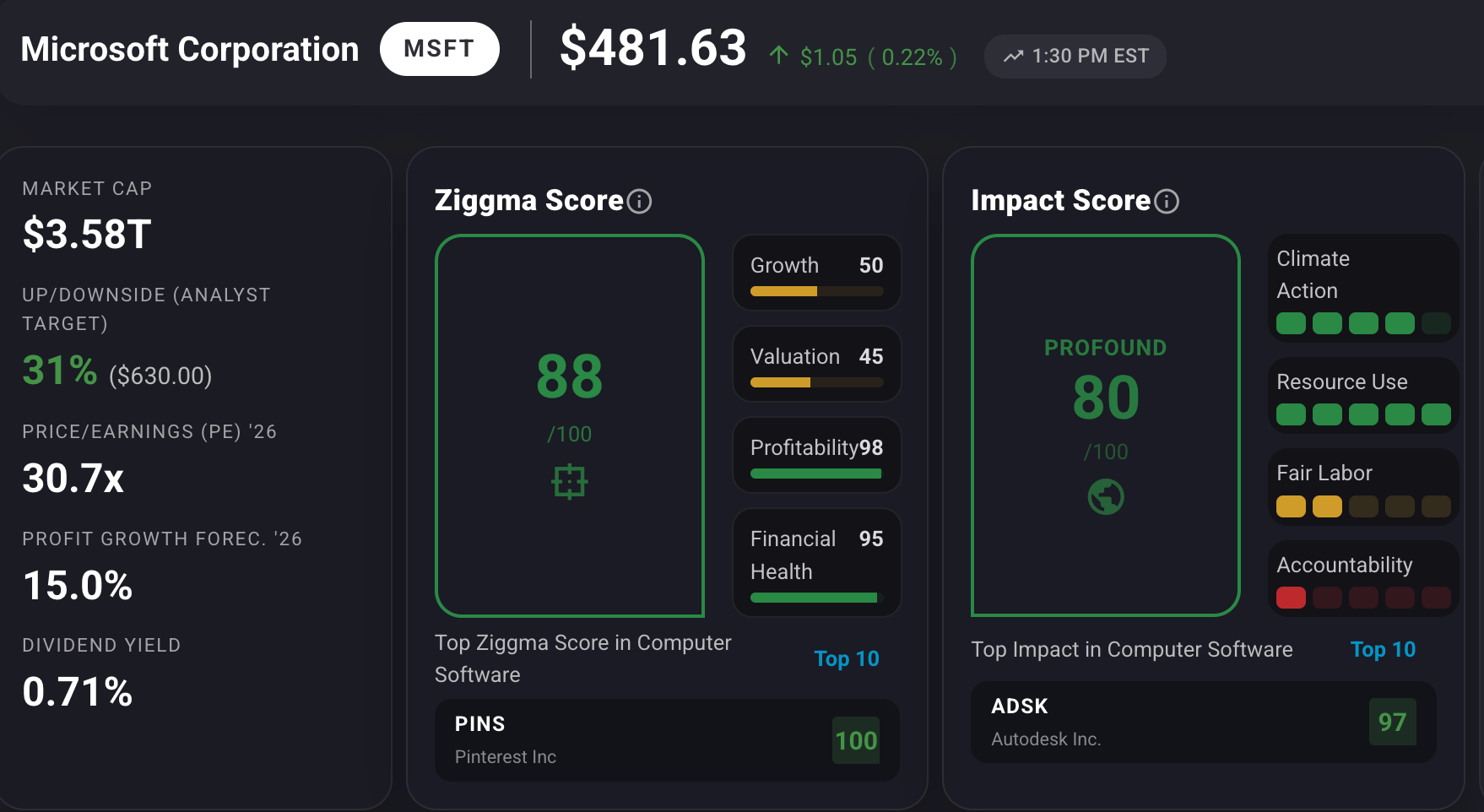

MSFT stock has a Ziggma score of 88 and trails its peers in growth and valuation.

Our Takeaway

Microsoft's reliance on OpenAI is a double-edged sword.

While the partnership drives massive bookings, concentrating nearly half your backlog with one customer—especially a cash-burning AI startup—introduces serious execution risk that could weigh on the stock until OpenAI proves its business model is sustainable.

➡️ FREE ZIGGMA RESEARCH: MercadoLibre (MELI): Latin America’s Fastest-Growing Platform Is Scaling Commerce, Finance, and Positive Environmental Impact 🔖 Read for free on Substack 🎧 Listen to podcast.

Market Overview 📈

The S&P 500 briefly made history on Wednesday, touching 7,000 for the first time before retreating as the Federal Reserve held rates steady and upgraded its economic assessment.

The Fed kept its benchmark rate at 3.5%-3.75%, describing economic activity as "expanding at a solid pace" and noting that unemployment is showing "signs of stabilization."

Fed Chair Jerome Powell's comment that "it's hard to look at the incoming data and say the policy is significantly restrictive" signaled the central bank is comfortable staying on hold through the end of his tenure in May.

Treasury yields climbed following the Fed decision, with the statement's more optimistic tone on economic growth and labor market stabilization suggesting no rush to cut rates.

Portfolio manager Jed Ellerbroek expects the Fed to remain on hold, noting "the ball moves into President Trump's court now" as he prepares to nominate a new Fed chair.

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Stock Moves Deciphered 📈

🚀 Seagate Technology (STX)

Seagate Technology surged 19% after posting stellar fiscal Q2 results that crushed analyst expectations.

The data storage infrastructure company earned $3.11 per share on revenue of $2.83 billion, compared to estimates of $2.81 per share on $2.73 billion in revenue.

CEO Dave Mosley attributed the blockbuster performance to "strong demand for artificial intelligence data storage," as hyperscalers rapidly build out infrastructure.

🛜 F5 Networks (FFIV)

F5 Networks jumped 8% following a strong Q1 earnings report that significantly exceeded Wall Street forecasts.

The networking systems company benefited from surging demand for its application delivery and security solutions, particularly among enterprises adopting multi-cloud and AI-powered architectures.

The company's software revenue continued its impressive trajectory, with subscription-based offerings gaining traction among large enterprise customers.

🚗 Carvana (CVNA)

Carvana shares plummeted 14% after Gotham City Research released a damaging short-seller report alleging the online used-car retailer artificially inflated its earnings.

The report wiped out all of the stock's year-to-date gains and triggered multiple class-action investigations.

Gotham City's report claimed Carvana engaged in accounting irregularities related to vehicle reconditioning costs and loan loss provisions, allegations the company strongly denied.

Headlines You Can't Miss 👀

📈 32 stocks in the S&P 500 traded at new 52-week highs on Wednesday, including Johnson & Johnson, Lam Research, and Micron, reaching all-time highs.

💵 U.S. Dollar Index suffered its worst one-day slide since April, dropping 1.3% after President Trump said he's "comfortable" with the weaker currency.

💻 Texas Instruments jumped 10% after issuing Q1 guidance of $1.22-$1.48 EPS, beating the $1.26 analyst consensus estimate.

🇨🇳 China approved the sale of Nvidia's H200 chips, boosting semiconductor stocks and the VanEck Semiconductor ETF by over 3% in premarket trading.

🏪 BJ's Wholesale Club was downgraded to hold by Jefferies, with its price target slashed to $90 from $120 amid concerns about growth and margin execution.

⚡ UBS reiterates 7,700 year-end S&P 500 target, expecting further Fed rate cuts and broad-based gains driven by AI beneficiaries and healthcare strength.

💰 Treasury Secretary Scott Bessent "absolutely" denied reports that the U.S. would intervene in currency markets to strengthen the yen or manipulate dollar levels.

🌍 Denmark's Prime Minister declared, "The world order as we know it is over" at the Paris forum, addressing Trump's threats over Greenland amid Arctic security concerns.

⚔️ President Trump announced a "massive Armada" heading to Iran, warning the nation to make a nuclear deal or face large-scale U.S. military attack.

🔬 ASML reported record bookings of €13.2 billion with Q1 revenue guidance of €8.55 billion, about 8% above expectations, though shares reversed gains to close down 2%.

Trending Stocks 📊

☕️ Starbucks (SBUX)

Starbucks posted its first U.S. comparable sales growth in two years, rising 4% in Q1 2026, but its shares slipped 0.6% after earnings missed expectations and the full-year outlook was cautious.

Revenue topped estimates, demonstrating CEO Brian Niccol's "Back to Starbucks" turnaround strategy is gaining traction with increased customer traffic and higher visit frequency despite near-term profitability pressures from reinvestment spending.

☀️ First Solar (FSLR)

First Solar shares climbed 6%, extending recent momentum that pushed the stock to a new 52-week high.

The solar panel manufacturer continues to benefit from robust domestic demand driven by Inflation Reduction Act incentives and corporate sustainability commitments, positioning it well for continued growth.

📊 Meta Platforms (META)

Meta shares surged 6% after the social media giant crushed earnings expectations and issued strong forward guidance.

Q4 earnings came in at $8.88 per share on revenue of $59.89 billion, beating estimates of $8.23 per share on $58.59 billion.

More importantly, Meta's Q1 revenue guidance of $53.5-$56.5 billion significantly exceeded the $51.41 billion analyst consensus.

What’s Next?

Key market and macro news 👇

💰 Apple is scheduled to report its quarterly earnings after the market closes. As one of the largest companies in the world, its performance, particularly iPhone sales and forward guidance, will be a major market-moving event.

🧑✈️ U.S. Job Market Data: Recent data indicating a cooling but still resilient job market will be a key factor in the Fed's policy decisions and investor outlook. Any new labor market data released around this time will be closely watched.

⚡️ Ongoing geopolitical risks and their impact on energy prices remain a significant macro factor influencing inflation and market volatility. Any new developments could have an immediate market impact.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.