- Ziggma

- Posts

- 💰 Micron Spikes on AI Demand

💰 Micron Spikes on AI Demand

Big moves explained: Amazon, BigBear, and Kenvue

Market Performance

S&P 500: 6,656.92 ⬇️ 0.55%

Nasdaq: 22,573.47 ⬇️ 0.95%

Dow Jones: 46,292.78 ⬇️ 0.19%

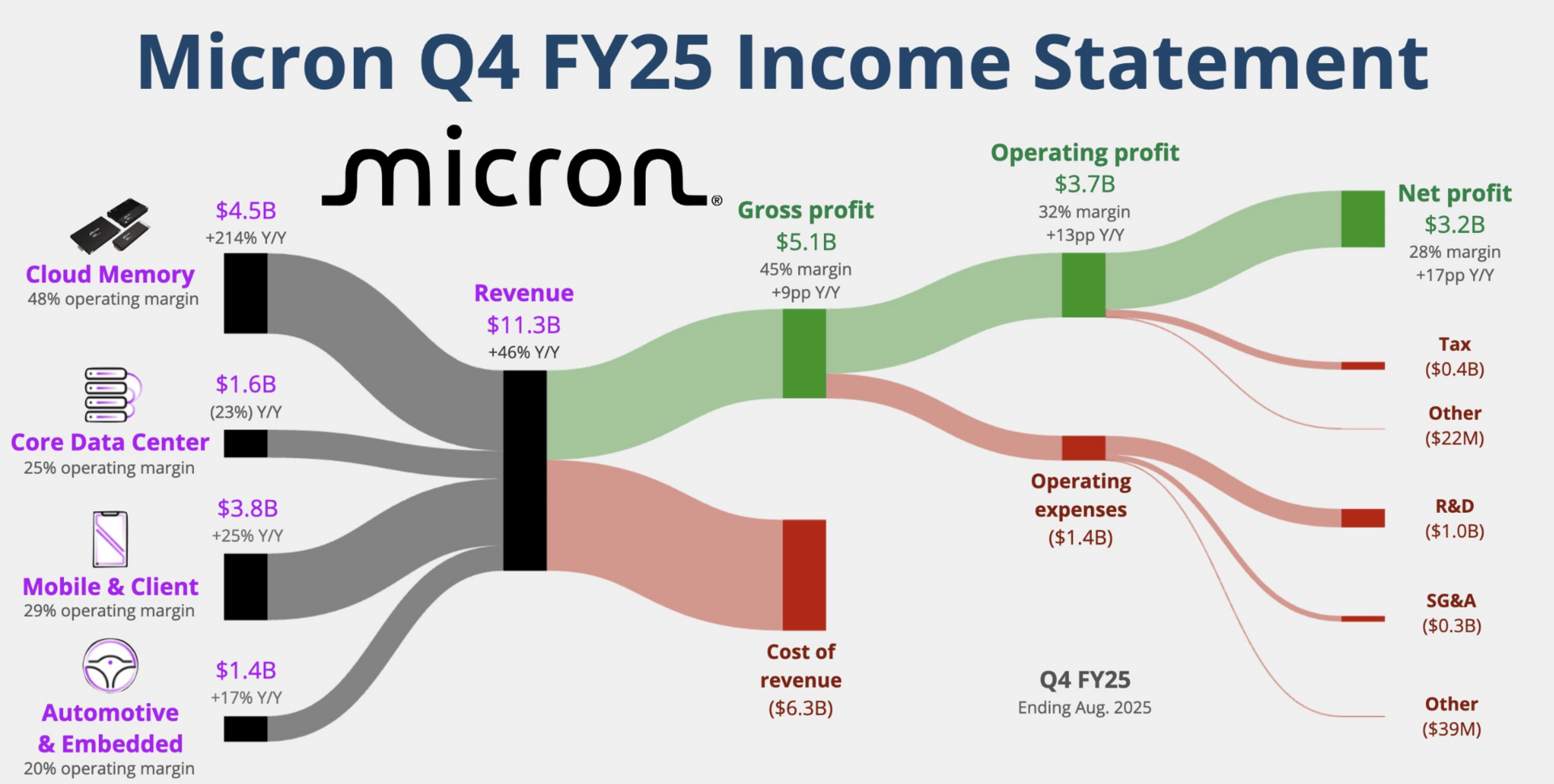

Micron’s AI Memory Goldmine

Micron (MU) delivered a masterclass in riding the AI wave, crushing earnings expectations and forecasting revenue that left Wall Street analysts scrambling to update their models.

The memory chipmaker reported earnings of $3.03 per share, exceeding the estimate of $2.86 per share, with revenue reaching $11.32 billion, also surpassing the estimate of $11.22 billion.

Micron projected revenue of $12.5 billion for the current quarter, surpassing the consensus of $11.94 billion by over $500 million.

The demand for high-bandwidth memory (HBM) chips, which are crucial for AI processing, was the key sales driver.

HBM revenue rose to $2 billion in Q4, which means the product ended fiscal 2025 with an annual run rate of $8 billion.

CEO Sanjay Mehrotra revealed that Micron expects to sell out all HBM production for 2026 within months, with HBM4 pricing "significantly higher" than that of current-generation chips.

Moreover, Micron benefits from its unique position as the only major U.S.-based memory manufacturer.

While competitors scramble for market share, Micron is printing money by supplying the memory that powers Nvidia's AI chips and the entire data center buildout.

Micron currently has a Ziggma Stock Score of 88, and should be on the top of your AI watchlist in September 2025.

Our Takeaway

Micron has positioned itself at the epicenter of the AI infrastructure boom.

With sold-out production through 2026 and premium pricing on next-generation chips, it essentially functions as a toll booth on the AI highway.

Smart money should be paying attention.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Market Overview 📈

The S&P 500 took a breather from its record-breaking run, closing down 0.55% as investors questioned whether the AI rally has gotten ahead of itself.

The pullback came despite hitting fresh intraday highs earlier in the session, with tech giants like Nvidia falling 2.8% after its massive OpenAI investment announcement.

Fed Chair Jerome Powell didn't help sentiment, noting that "equity prices are fairly highly valued" and keeping the path for rate cuts unclear.

The small-cap Russell 2000 managed to hit an all-time high during the session before closing slightly lower, riding on enthusiasm from last week's rate cut.

Adding to market uncertainty, government shutdown risks increased after Trump canceled meetings with Democratic leaders, saying no discussion "could possibly be productive."

Meanwhile, the precious metals rally continued with gold hitting its 37th record close of 2025 and silver reaching levels not seen since 2011.

With the Fed signaling caution on future cuts and energy constraints limiting AI expansion plans, investors are rightfully questioning whether current market levels can be maintained without fundamental improvements in corporate earnings.

Stock Moves Deciphered 📈

BigBear.ai (BBAI) surged after announcing a strategic partnership with the U.S. Navy for AI and analytics capabilities.

The defense-focused AI company capitalized on strong investor enthusiasm for artificial intelligence applications in government and military sectors.

AutoZone (AZO) disappointed investors with its fiscal fourth-quarter results, which fell short of expectations.

The auto parts retailer posted earnings of $48.71 per share versus estimates of $50.73, while revenue of $6.24 billion slightly missed the $6.25 billion forecast.

Despite increased same-store sales, gross margins, and profitability metrics failed to meet Wall Street's targets.

Firefly Aerospace (FLY) stumbled in its first quarterly report since going public, posting a wider loss and lower revenue than expected.

The rocket maker reported a $80.3 million loss compared to $58.7 million last year, while revenue fell to $15.5 million from $21.1 million.

Despite maintaining a $1.1 billion backlog, investors were concerned about the company's near-term financial trajectory.

Headlines You Can't Miss 👀

📊 OECD raises global growth forecast to 3.2% from 2.9%, citing economic resilience across emerging markets.

🏛️ Fed's Bowman warns of being "behind the curve" on addressing labor market weakness, advocates for continued easing.

🇺🇸🇨🇳 U.S.-China presidential meeting likely delayed to 2026, says Ambassador Perdue during a rare visit to Beijing.

⚡ Energy stocks rally as Nvidia's $100 billion OpenAI investment highlights massive power needs for AI infrastructure.

💊 Trump links Tylenol to autism in unproven claims, recommending pregnant women limit acetaminophen use.

🚀 IonQ achieves quantum milestone, successfully converting wavelengths to enable quantum internet over fiber infrastructure.

🏦 Morgan Stanley is preparing to offer crypto trading through the E-Trade platform, partnering with Zerohash for a 2026 launch.

Trending Stocks 📊

Amazon (AMZN) declined 3% amid a broader tech sell-off and growing concerns over its competitive position in the AI race, contributing to underperformance this year.

Kenvue (KVUE) rebounded after recovering from Monday's 7.5% plunge following Trump's unproven claims linking Tylenol to autism, with the company strongly defending its product's safety.

BGM Group (BGM) soared 31.58% in a spectacular rally driven by small-cap enthusiasm and investor excitement around the company's social innovation and housing development initiatives.

What’s Next?

Key earnings and macro news 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

Historically, the weakest week for the S&P 500 based on seasonal patterns.

Rising Treasury yields pose the biggest risk to current rally momentum.

Personal Consumption Expenditures (PCE) inflation data, which is the Fed's preferred inflation measure.

Government shutdown negotiations intensify with the September 30th deadline approaching.

Chart of the Day

Source: App Economy Insights

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.