Market Performance

S&P 500: 6,204.95 (+0.52%)

Nasdaq: 20,369.73 (+0.47%)

Dow Jones: 44,094.77 (+0.63%)

Meta’s AI Shopping Spree

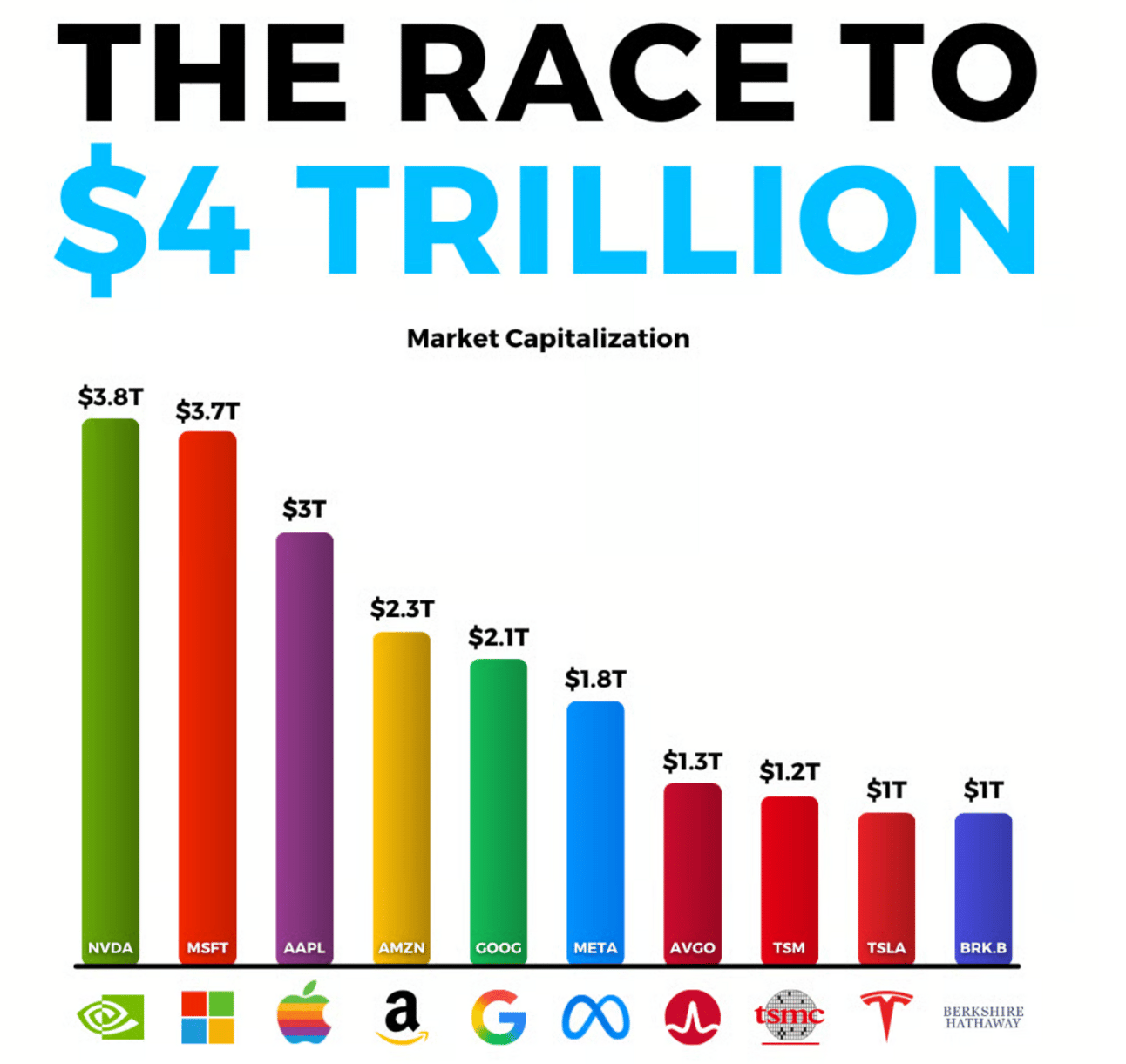

Meta (META) stock soared to a record high of $747.90 on Monday, cementing investor confidence in Mark Zuckerberg's audacious AI strategy.

The stock surge came as the company officially launched its new Superintelligence Labs (MSL), signaling that Wall Street believes Meta's aggressive talent acquisition approach is working.

Zuckerberg isn't just throwing money at the AI talent problem; he's rewriting the playbook entirely.

The CEO has personally assembled what Silicon Valley insiders call "the list," a curated roster of the world's top AI researchers, offering up to $100 million in signing bonuses to poach them from competitors like OpenAI and Google.

Zuckerberg has been personally reaching out to candidates, poring over research papers, and maintaining a WhatsApp group called "Recruiting Party" with senior executives.

Meta has just recruited Scale AI's former CEO, Alexandr Wang, and ex-GitHub CEO Nat Friedman to lead MSL, along with a dozen other top-tier AI researchers from OpenAI, Google, and Anthropic.

Our Takeaway

Meta's record-breaking stock price validates the market's belief that talent acquisition is the new competitive moat in the AI industry.

While $100 million signing bonuses may seem astronomical, Meta's $14.3 billion investment in Scale AI and subsequent stock rally suggest that investors view this as money well spent.

The real test isn't whether Meta can afford these hires. It's whether this talent can deliver the "personal superintelligence for everyone" that Zuckerberg promises.

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

Market Overview

Stocks closed Monday with fresh record highs as investors celebrated Canada's decision to rescind its digital services tax, easing trade tensions with the U.S.

The move came after President Trump threatened to "terminate ALL discussions on Trade with Canada" on Friday, creating uncertainty about future trade relationships.

U.S. equity futures remained relatively flat, with investors now focused on Trump's 90-day tariff reprieve set to expire next week.

Treasury Secretary Scott Bessent indicated that while some countries are "negotiating in good faith," tariffs could still "spring back" to April 2 levels for non-compliant nations. The broader market showed resilience despite ongoing trade uncertainties.

Goldman Sachs moved up its Federal Reserve rate-cut forecast to September, citing smaller-than-expected tariff effects and stronger disinflationary forces.

The firm now expects three quarter-point cuts through December, projecting a terminal rate of 3% to 3.25%.

Market breadth improved significantly, with all three major indices posting solid gains for the second quarter—the S&P 500 up 10.6%, Nasdaq rising nearly 18%, and the Dow adding almost 5%.

Headlines You Can't Miss

Stablecoin issuer Circle applies for a national bank charter.

JPMorgan data shows Chase customer spending growth slowing to 2% in June from 2.3% in May.

Moderna shares surge on positive late-stage flu vaccine trial results opening path for approval.

Hewlett-Packard Enterprise rallies 14% after DOJ settles lawsuit over $14B Juniper acquisition.

BitMine Immersion soars 500% on $250M ether buying strategy and Tom Lee appointment.

Core Scientific gains on reported CoreWeave acquisition talks, validating the value of its mining infrastructure.

Coinbase becomes the best-performing S&P 500 stock in June with a 43% monthly gain.

Atlanta Fed's Bostic says inflation outlook won't be clear by July for clarity on rate decision.

Trending Stocks

Robinhood (HOOD): Shares jumped 10% to fresh 52-week highs after announcing an array of new crypto-related offerings. The brokerage app provider launched tokenized U.S. stocks and ETFs in Europe while introducing crypto-staking services in the U.S. The move positions Robinhood to capitalize on growing institutional and retail demand for crypto exposure beyond traditional trading.

CEO Quote🎤: “When we talk about mass adoption. This is what it looks like. A product people use — without needing to know how it works.”

Cava (CAVA): The fast-casual restaurant chain surged 9% without a clear catalyst, though the stock remains down 25% year-to-date despite Monday's rally. Cava has gained only 8% over the past 12 months, suggesting investors may be positioning for potential turnaround momentum ahead of upcoming earnings results.

CEO Quote🎤: "In spite of economic uncertainty and challenging weather, CAVA’s first quarter results demonstrate the continued strength of our category-defining brand. We have now surpassed a billion dollars in revenue – a milestone that is a testament to Mediterranean becoming the next large scale cultural cuisine category, a category we have firmly established our leadership in.”

Cohen & Steers (CNS): Shares dropped 4% after Bank of America initiated coverage with an underperform rating and $67 price target, implying 14% downside. The alternative asset manager faces headwinds from challenging market conditions for real estate investment trusts and infrastructure investments.

Analyst Quote🎤: “The firm foresees low 0%-1% organic growth over the next three years for the asset manager after adjusting for reinvested distributions and sees significant cyclical headwinds facing the real estate industry, partly driven by elevated interest rates.”

What’s Next?

Q2 earnings season kicks off next week.

Over 110 S&P 500 companies issued Q2 guidance, with 51 positive vs. 59 negative.

The estimated Q2 earnings growth of 5% could mark the lowest since Q4 2023

More companies are issuing positive guidance than the 5-year and 10-year averages.

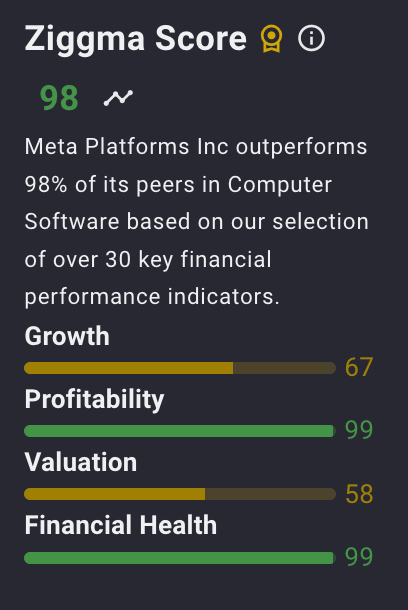

Track upcoming news and earnings with Ziggma to get personalized alerts.

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.