- Ziggma

- Posts

- 🗞 Meta's Massive AI Push

🗞 Meta's Massive AI Push

Plus: Chaos grips Wall Street

Market Performance

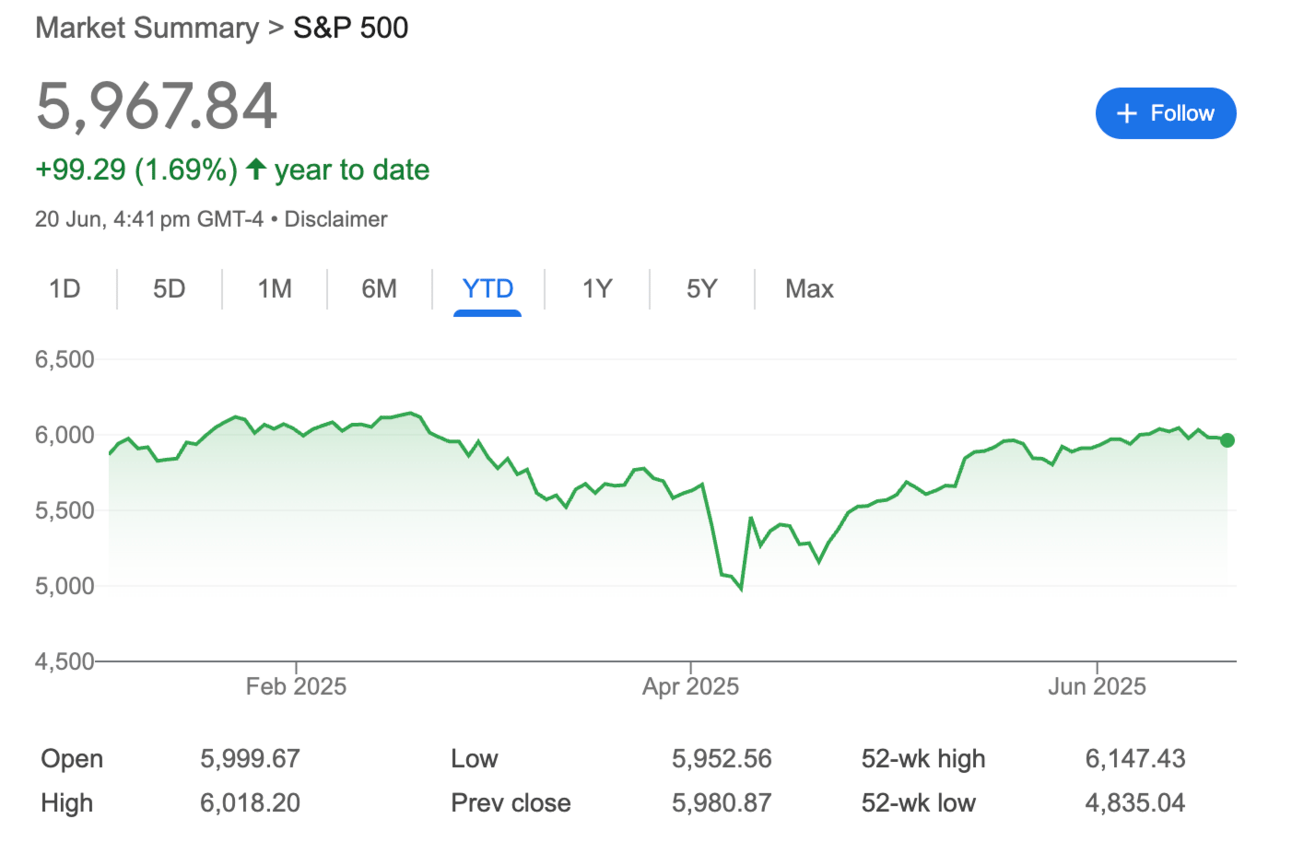

S&P 500: 5,967.84 (-0.22%)

Nasdaq: 19,447.41 (-0.51%)

Dow Jones: 42,206.82 (+0.083%)

Meta’s AI Shopping Spree

When Mark Zuckerberg feels the heat, he opens his wallet – and boy, is he feeling it now.

Following a $14.3 billion investment in Scale AI and the hiring of its founder Alexandr Wang, Meta (NASDAQ:META) is now set to bring on former GitHub CEO Nat Friedman and Safe Superintelligence co-CEO Daniel Gross.

This comes after Meta's failed attempts to acquire both Safe Superintelligence (launched by OpenAI co-founder Ilya Sutskever) and Perplexity AI, valued at $14 billion.

The desperation is real. Meta's latest Llama 4 AI models were, by most accounts, an "absolute failure" compared to the successful rollout of Llama 3.

OpenAI's Sam Altman revealed that Meta is offering signing bonuses of up to $100 million to poach AI talent, an unprecedented move in tech recruiting.

Our Takeaway

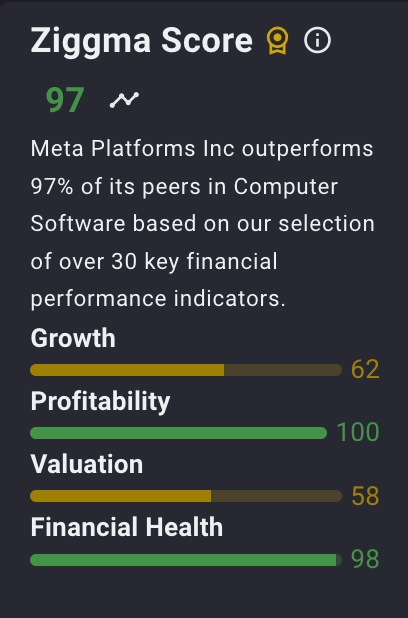

Zuckerberg's AI spending spree signals both opportunity and risk. While his track record with Instagram ($1B) and WhatsApp ($19B) suggests he knows when to make bold bets, the current AI arms race is different.

Success isn't guaranteed by spending alone, and Meta's open-source Llama approach faces tough competition from Google, OpenAI, and Anthropic.

The market is giving him the benefit of the doubt for now (shares up 17% this year), but the pressure is mounting to deliver meaningful AI breakthroughs that justify these massive investments.

Could you afford $3,500 to remove a chew toy?

From $3,500 to remove a chew toy, to $7,000 for a hip replacement, keeping your pets healthy is getting more and more expensive. Fortunately, pet insurance can help offset these rising costs. Pet insurance can cover eligible accidents and illnesses with up to 90% reimbursement. Get your buddy covered today with plans starting at just $10 a month.

Market Overview

Stock futures are down in pre-market after the United States entered Israel's war against Iran over the weekend, striking three nuclear sites and escalating Middle East tensions significantly.

Dow futures fell 109 points (0.3%), while S&P 500 and Nasdaq 100 futures dropped 0.3% and 0.4%, respectively.

The surprise U.S. attacks on Iranian sites in Fordo, Isfahan, and Natanz caught investors off guard, who expected more diplomatic solutions.

Oil prices spiked dramatically, with U.S. crude jumping 3.8% to nearly $77 per barrel Sunday night.

Energy strategists warn that if Iran retaliates by closing the Strait of Hormuz, oil could surge above $100 per barrel, creating multiple economic headwinds.

The escalation adds another layer of uncertainty to markets already grappling with Trump's trade wars and Federal Reserve policy decisions.

Despite Fed Governor Christopher Waller suggesting that rate cuts could come as early as July, geopolitical risks are now overshadowing the optimism surrounding monetary policy.

Bitcoin fell below $99,000 for the first time in over a month, as crypto markets became the first to react to the geopolitical tensions, with over $1 billion in positions liquidated during a 24-hour span.

Headlines You Can't Miss

Circle extends rally after Senate passes landmark stablecoin bill, gaining 18% Friday and 77% for the week.

JPMorgan reiterates an overweight rating on Cisco with a $73 price target, citing security transformation opportunities.

Swiss National Bank cuts rates to zero as inflation turns negative, potentially paving the way for negative real rates in Europe.

The Philadelphia Fed manufacturing survey came in worse than expected at -4, versus an estimated -2, indicating continued regional weakness.

UK retail sales tumbled 2.7% in May, far worse than the 0.5% decline economists predicted.

Ether ETFs experienced their sixth consecutive week of inflows, following a weak first-year performance, with a total of $3.9 billion amassed.

Taiwan Semiconductor shares fall 2% on reports U.S. may revoke technology waivers for chipmakers operating in China.

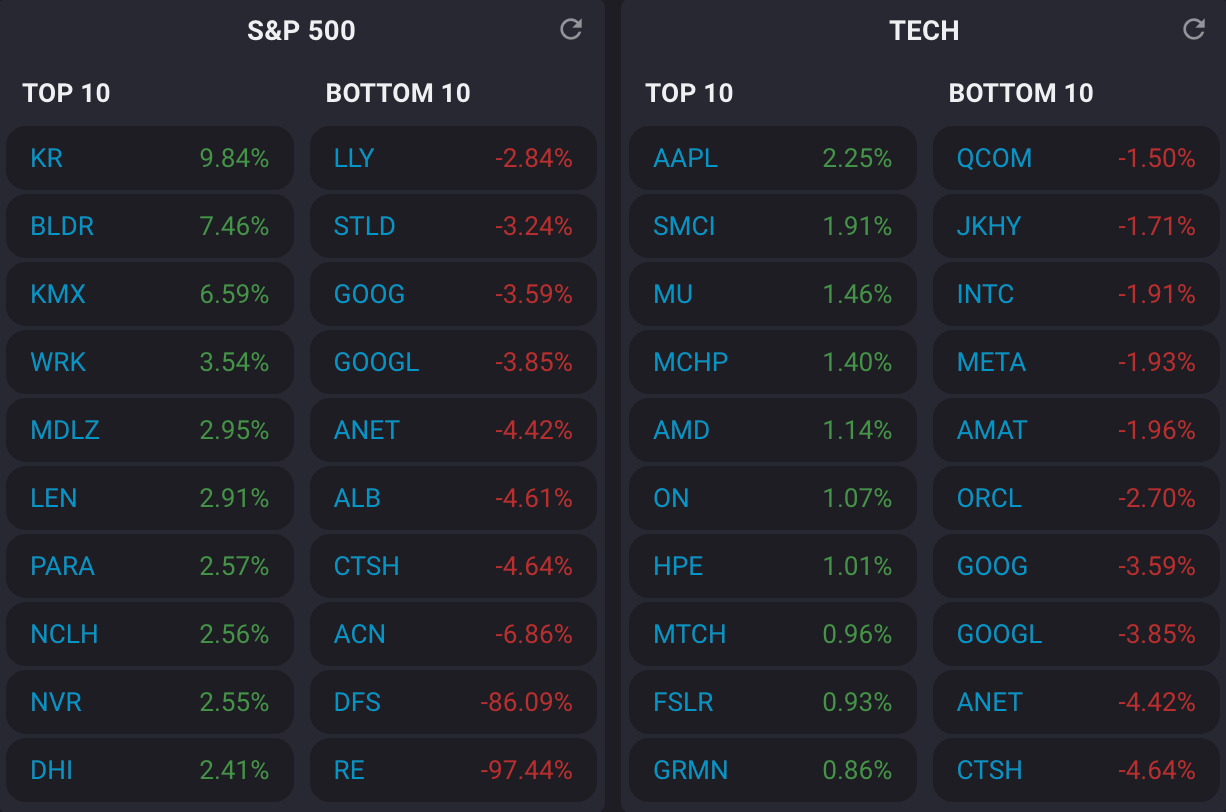

Trending Stocks

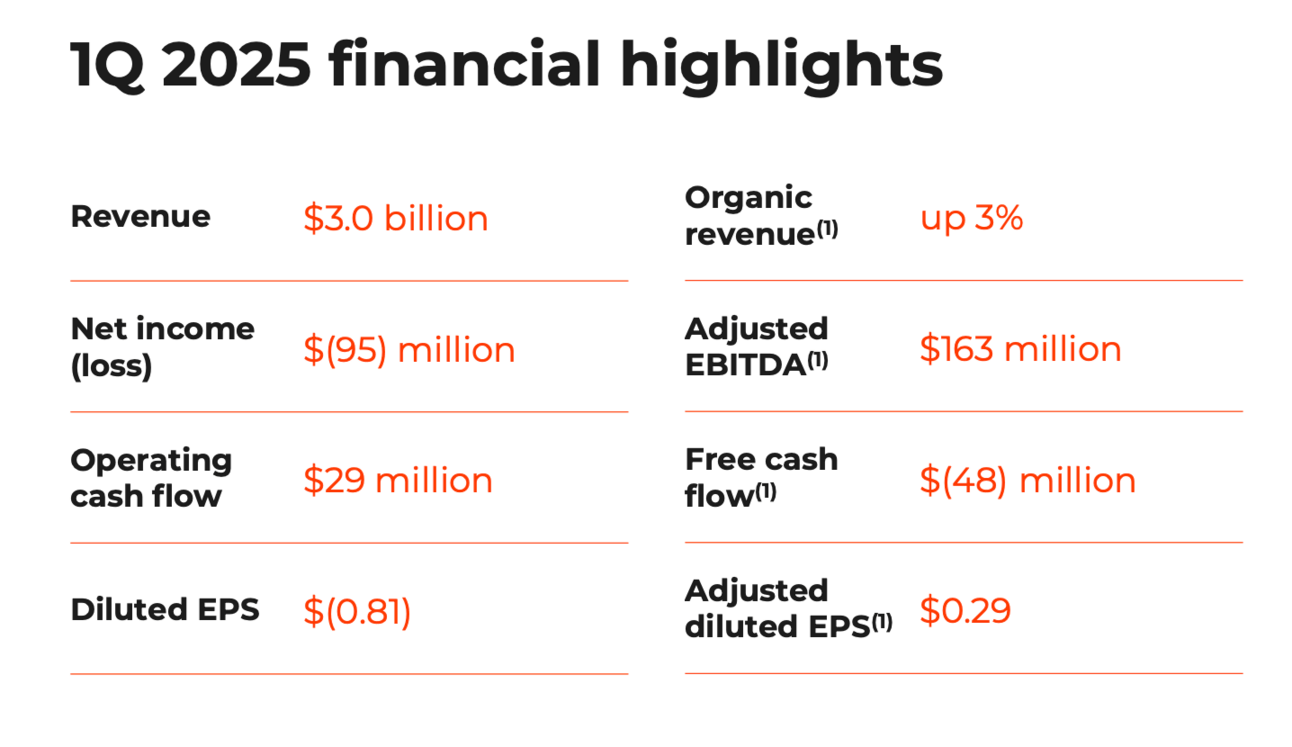

GXO Logistics (NYSE:GXO) – Shares surged 11% after the supply chain management firm raised its full-year EBITDA outlook to $860-880 million and appointed Patrick Kelleher as CEO effective August 19. The logistics sector continues to benefit from e-commerce growth and supply chain optimization trends.

CEO Quote🎤: "We signed $228 million of new business wins and our sales pipeline of $2.5 billion, excluding Wincanton, stands at its highest level in three years. We’ve finalized a landmark deal with England’s National Health Service Supply Chain. This is our largest-ever contract and carries a total lifetime value of about $2.5 billion.”

CarMax (NYSE:KMX) – The used car retailer jumped 6% after crushing Q1 expectations with earnings of $1.38 per share (vs $1.16 expected) on revenue of $7.55 billion (vs $7.52 billion expected). Despite ongoing concerns about auto tariffs, CarMax demonstrated resilient demand in the used vehicle market.

CEO Quote🎤: “Our associates, stores, technology, and digital capabilities, all seamlessly tied together, enable us to provide the most customer-centric car buying and selling experience. This is a key differentiator in a very large and fragmented market that positions us to continue to drive sales, gain market share, and deliver significant year-over-year earnings growth for years to come.”.

GMS (NYSE:GMS)– The specialty building products stock rocketed 26% as a bidding war erupted between QXO ($95.20 per share offer) and Home Depot (undisclosed private offer). The competition highlights the consolidation trend in building materials as companies seek supply chain advantages.

CEO Quote🎤: “If you choose not to engage ... we are prepared to take our offer directly to GMS’s shareholders, who we’re confident will find the offer attractive.

What’s Next?

Energy stocks may react to changes in crude oil inventory, with recent API and EIA data showing significant draws in crude oil stocks, which could support oil prices.

Fed Chair Jerome Powell and other Fed officials are scheduled to speak this week, which could provide further guidance on monetary policy and economic outlook.

Growth is expected to stall over the summer but avoid an official recession, with unemployment projected to rise slowly to 4.7% by year-end and peak at 5% in 2026.

Key economic data releases this week include U.S. PMI flash readings showing expansion (Composite PMI at 53, Manufacturing PMI at 52, Services PMI at 53.7), existing home sales steady at 4 million units, and personal income and spending showing modest growth.

Track upcoming news and earnings with Ziggma to get personalized alerts.

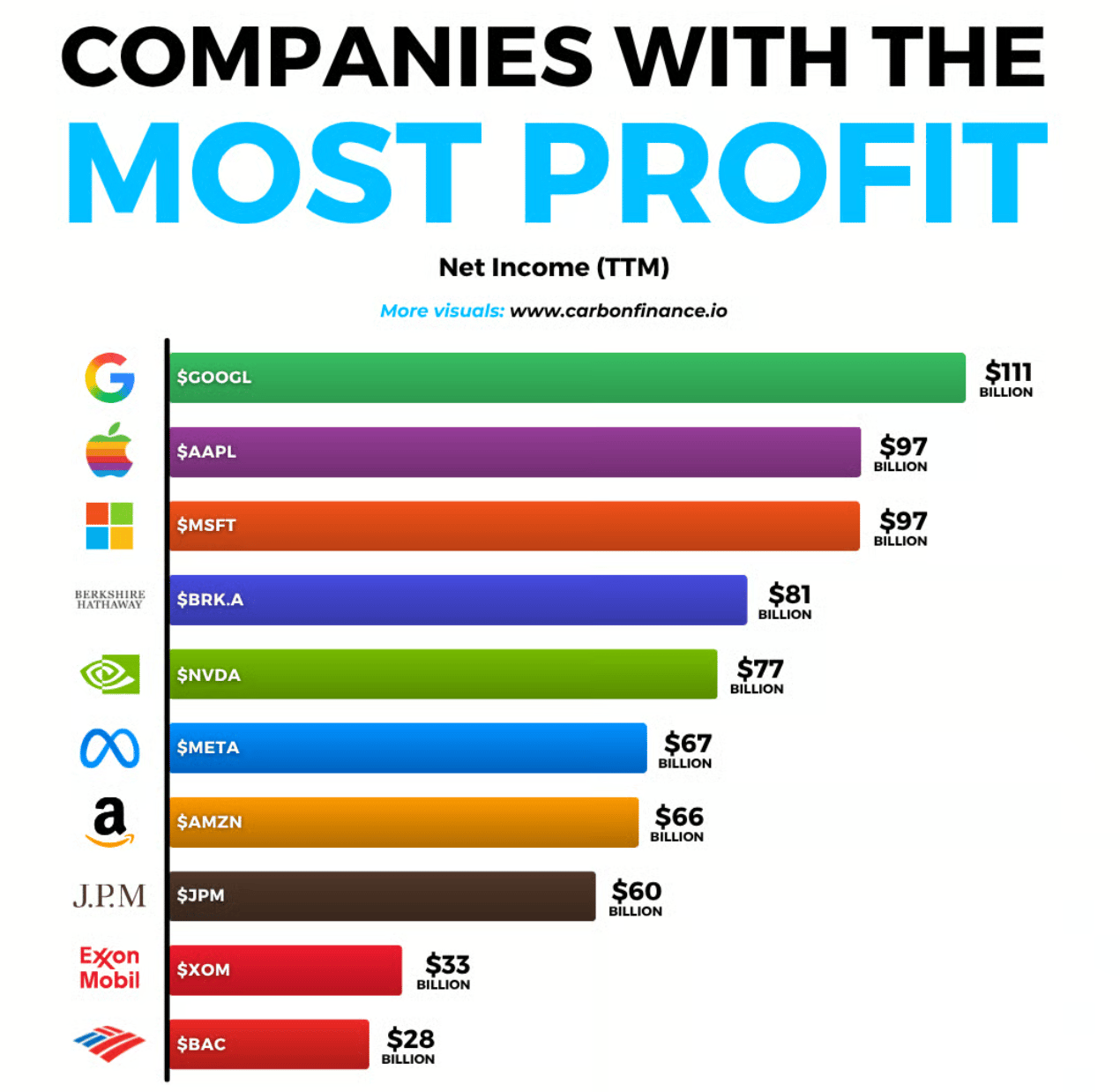

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the equity market.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.