- Ziggma

- Posts

- ⚡️Meta Goes Nuclear

⚡️Meta Goes Nuclear

PLUS: Intel continues to rally

Market Performance

S&P 500: 6,966.28 ⬆️ 0.65%

Nasdaq: 23,702.88 ⬆️ 0.95%

Dow Jones: 49,504.07 ⬆️ 0.48%

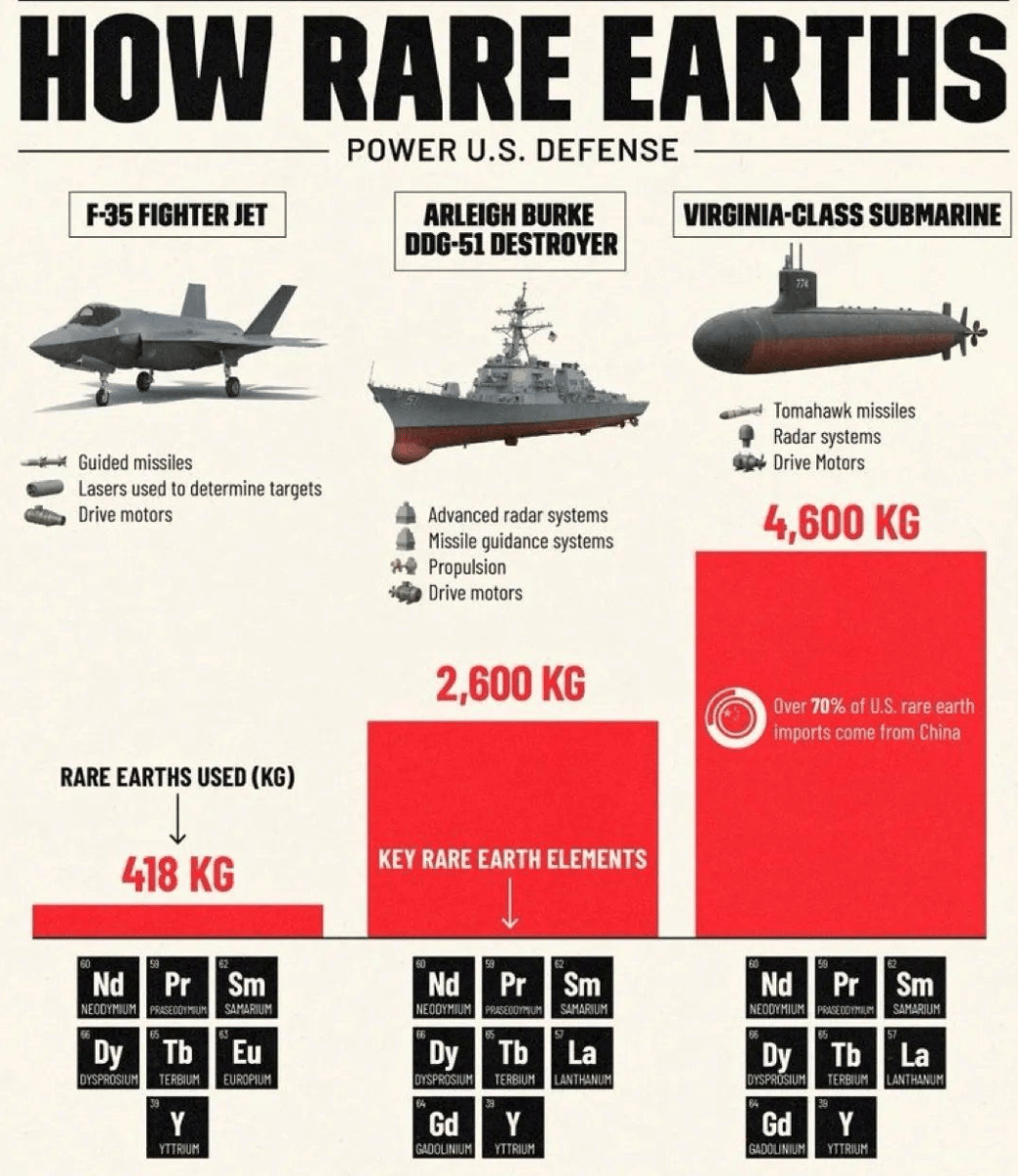

Meta Powers Up AI Ambitions with Nuclear Energy

Meta (META) just made a bold statement about the future of AI infrastructure, and it involves going nuclear—literally.

The tech giant announced agreements with three nuclear power providers on Friday, including Vistra, TerraPower, and Oklo (backed by OpenAI CEO Sam Altman), to fuel its massive Prometheus AI supercluster in Ohio.

These deals could add 6.6 gigawatts of power by 2035—enough to power all of New Hampshire.

Meta CEO Mark Zuckerberg is racing toward "superintelligence," and these nuclear partnerships are critical infrastructure for that moonshot.

The company will help fund extensions of Vistra's existing nuclear plants in Ohio and Pennsylvania, while TerraPower and Oklo are developing next-generation facilities expected online between 2030 and 2035.

Meta joins Amazon and Google in pledging support for tripling global nuclear energy production by 2050. The message is clear: whoever controls the power controls the AI future.

The market loved it—Vistra surged 10%, and Oklo jumped 8% on the news.

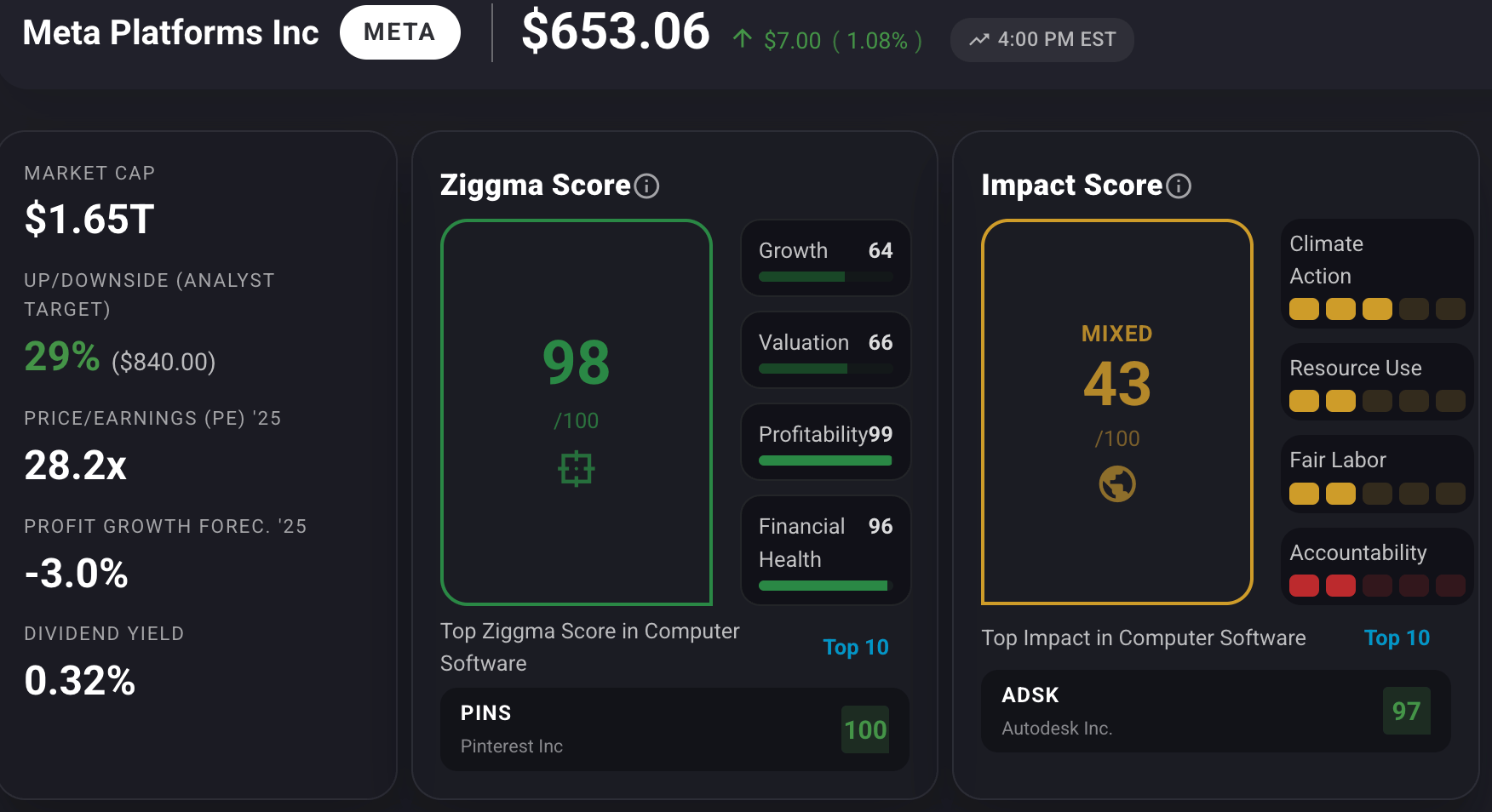

Meta stock has a Ziggma score of 98 and ranks in the top percentile for profitability and financial health. However, the tech stock has rallied 400% in the past three years and trades at a lofty valuation in 2026.

Our Takeaway

Meta's nuclear pivot signals that AI's biggest bottleneck isn't compute or algorithms—it's energy.

These partnerships create thousands of jobs and position Ohio as a strategic clean energy hub.

For investors, this validates the thesis that nuclear energy companies are critical AI infrastructure plays, not just utility stocks.

Market Overview 📈

The S&P 500 closed at a fresh record high on Friday, capping a strong week as investors digested the December jobs report and awaited a critical Supreme Court ruling on tariffs.

Nonfarm payrolls increased by just 50,000 in December—well below the 73,000 economists expected—but the unemployment rate ticked down to 4.4% from 4.6%.

While weaker than anticipated, the data reflected what Ameriprise Financial's Anthony Saglimbene called a "low-hire, low-fire" environment that's softening but remaining firm.

What could have spooked investors—a sharper employment decline—didn't materialize. The December report was also the first clean data in months, unaffected by the record-setting government shutdown that distorted October and November figures.

This reassured markets that the Fed likely won't need to cut rates in January or March.

Homebuilders rallied sharply after President Trump directed representatives to purchase $200 billion in mortgage bonds to drive down rates for homebuyers.

Meanwhile, the Supreme Court held off on its anticipated tariff ruling, leaving markets in limbo on a decision that could reshape trade policy and impact trillions in imports.

Stock Moves Deciphered 📈

🏡 Builders FirstSource (BLDR)

The building materials supplier surged over 12% Friday, riding a wave of optimism in the housing sector.

The rally came as homebuilders responded enthusiastically to Trump's directive to purchase $200 billion in mortgage bonds, which aims to lower rates for homebuyers.

BLDR benefited from the broader strength of the housing sector, with investors betting on increased construction activity and demand for building materials as mortgage rates potentially decline.

🤖 Intel (INTC)

Intel shares jumped nearly 11% after President Trump posted a flattering message on Truth Social following his meeting with CEO Lip-Bu Tan.

"The U.S. government is proud to be a Shareholder of Intel, and has already made, through its U.S.A. ownership position, Tens of Billions of Dollars for the American People—IN JUST FOUR MONTHS," Trump wrote.

The endorsement provided a significant boost in confidence for the chipmaker, which has struggled in recent years against competitors.

🚀 Lam Research (LRCX)

The semiconductor equipment maker hit fresh all-time highs dating back to its 1984 IPO, climbing as part of the broader chip sector rally.

Mizuho analyst Vijay Rakesh highlighted strong momentum in AI accelerators and wafer fabrication equipment (WFE) for 2026, noting that "AI spend, WFE and memory cycles all expected to remain strong" through the first half.

The stock's surge reflects growing optimism about semiconductor capital equipment demand driven by AI infrastructure buildout.

Headlines You Can't Miss 👀

📊 42 stocks in the S&P 500 hit new 52-week highs on Friday, including Alphabet, TJX Companies, Lockheed Martin, and Lam Research at all-time levels.

💻 Mizuho named Nvidia, Broadcom, and Lumentum top semiconductor picks for 2026, citing AI accelerator demand and strong memory cycles in first half.

📉 Goldman Sachs cut Netflix's price target to $112 from $130 (still 24% upside) ahead of Jan. 20 earnings, citing uncertainty around Warner Bros. acquisition.

⚖️ Supreme Court delayed tariff ruling that could determine legality of Trump's broad tariffs and potential reimbursements to importers who've paid duties.

🚗 General Motors will record $7.1 billion in special charges for Q4 2025 tied to EV pullback and China restructuring efforts.

🌿 Tilray Brands reported record revenue of $218 million for fiscal Q2, beating estimates of $211 million—shares jumped 8% in after-hours trading.

Trending Stocks 📊

✈️ Southwest Airlines (LUV)

Shares jumped more than 3% after JPMorgan upgraded the stock to overweight from underweight and raised its price target to $60 from $36.

The upgrade reflects improved confidence in Southwest's operational turnaround and network optimization efforts, positioning the airline to benefit from recovering travel demand and better cost management.

🧘 Lululemon (LULU)

The athletic apparel retailer fell nearly 4% amid persistent concerns over recent earnings and future growth prospects in the U.S. market.

UBS maintained a neutral rating on the stock, citing signs of weakening demand and competitive pressures in the athleisure space that continue to weigh on investor sentiment.

⛽️ Generac (GNRC)

Shares advanced almost 3% after Baird upgraded the stock to outperform, highlighting the company's expansion into large diesel generator sets for datacenters and commercial customers.

Baird estimates this opportunity could generate $400-800 million in incremental revenue by 2027-2028, with early results showing strong momentum in backlog and orders.

What’s Next?

Key market and macro news 👇

💸 The U.S. Treasury will conduct auctions of 10-year and 3-year notes. Auction results will signal investor demand for medium-term government debt, inflation expectations, and provide guidance on borrowing costs affecting equity valuations.

🏦 New York Fed President John Williams and Richmond Fed President Thomas Barkin will provide clues about monetary policy direction, inflation concerns, and the Fed's economic outlook.

📅 Netflix earnings due Jan. 20 – Investors await clarity on Warner Bros. acquisition integration and streaming subscriber growth trajectory.

⚖️ Supreme Court tariff ruling pending – Decision could impact trade policy and determine if importers receive reimbursements for duties already paid.

Chart of the Day

Source: Visual Capitalist

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.