- Ziggma

- Posts

- 💰 Is Apple's AI Still in Beta?

💰 Is Apple's AI Still in Beta?

PLUS: Why is FedEx rising?

Market Performance

S&P 500: 6,664.36 ⬆️ 0.49%

Nasdaq: 22,631.48 ⬆️ 0.72%

Dow Jones: 46,315.27 ⬆️ 0.37%

Apple’s iPhone 17 Hits the Shelves

The iPhone 17 hit store shelves worldwide on Friday, drawing lines from Beijing to London as Apple (AAPL) fights to regain lost ground in crucial markets.

While customers queued for hours for the new iPhone 17 Pro, Pro Max, and Air models, the real story is Apple's battle against surging competition, particularly in China, where it now holds just 10% market share.

Early signs look promising – JD.com reported first-minute preorders surpassed last year's entire first-day volume for iPhone 16.

Singapore and London also saw strong demand, with customers drawn to the premium Pro models and the new features of AirPods Pro 3.

But the elephant in the room remains Apple Intelligence. After a "somewhat underwhelming rollout" that began late last year, analysts are questioning whether Apple can deliver on its AI promises.

CCS Insight's Ben Wood didn't mince words: Apple "dropped the ball" by making big AI promises that failed to materialize.

The hardware heavyweight faces intense pressure to prove it can catch up in artificial intelligence, as competitors continue to advance their AI capabilities.

Apple currently has a Ziggma Stock Score of 76, despite ranking in the bottom half percentile for valuation and growth.

Our Takeaway

This launch is make-or-break for Apple's AI credibility.

While hardware demand appears solid, the company desperately needs to deliver meaningful AI features that justify the premium pricing.

As Wood noted, Apple has "enough runway to cope" for now, but time is running out to prove it can compete in the AI arms race while defending its premium market position.

The assistant that scales with you

Great leaders don’t run out of ideas. They run out of hours.

Wing gives you a dedicated assistant who plugs into your workflows – calendar, inbox, research, outreach, and ops – so execution never stalls. Wing can:

Onboard in days, not months

Run the day-to-day so you don’t have to

Adapt as your business grows

With Wing, you buy back time without adding headcount. More focus for strategy, more follow-through on priorities, and a lot fewer “forgot to send” moments.

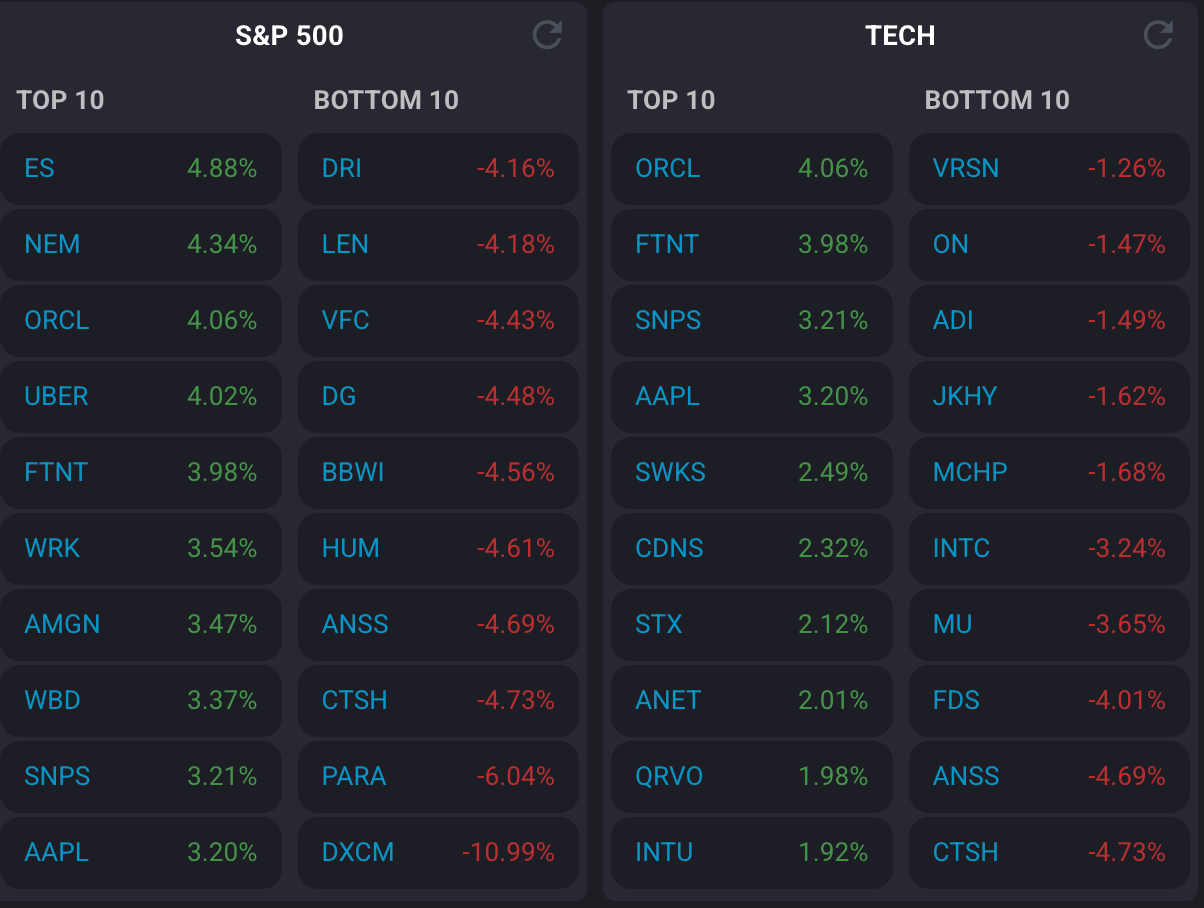

Market Overview 📈

Stocks closed at fresh highs on Friday, capping a winning week as investors digested the Federal Reserve's quarter-point rate cut.

The Fed's "risk management cut", its first reduction since December, provided the catalyst for last week's rally, despite Fed Chair Jerome Powell's cautious tone during his press conference.

Small caps benefited, with the Russell 2000 hitting its first record close since November 2021, ending a remarkable 967-trading-day streak without a new high.

With the S&P 500 trading at 22x forward earnings and volatility suppressed, a period of consolidation could be healthy.

The market has climbed 35% since March, defying September's historically weak performance, which suggests that investors remain optimistic about the economic outlook despite mounting concerns over government debt and potential tariff impacts.

Stock Moves Deciphered 📈

DexCom (DXCM)

DexCom shares plummeted after Hunterbrook Capital released a damaging short-seller report alleging serious safety issues and inaccuracies with the company's G7 glucose monitor.

The report prompted an FDA violation notice, raising concerns about product reliability and regulatory compliance.

Humana (HUM)

Humana stock declined on persistent concerns about Medicare Advantage margins and mounting regulatory headwinds.

The healthcare insurer faces pressure on profitability from proposed changes to competitive bidding for medical devices and ongoing scrutiny of Medicare Advantage reimbursement rates.

FedEx (FDX)

FedEx shares jumped 2.3% following a strong fiscal first-quarter earnings beat.

The shipping giant reported adjusted earnings of $3.83 per share on revenue of $22.24 billion, surpassing analyst expectations of $3.59 per share and $21.66 billion in revenue.

The better-than-expected results suggest resilient demand for shipping services and effective cost management, providing optimism about the company's ability to navigate economic uncertainties and maintain pricing power.

Headlines You Can't Miss 👀

📈 Brighthouse Financial soared 27% on reports that Aquarian Holdings is in talks to acquire the insurance company for $65-70 per share.

💰 ASML gained marginally as Bank of America raised its price target to $1,082, citing benefits from the Nvidia-Intel $5 billion deal.

⚡ SolarEdge Technologies climbed 2%, adding to its massive 24% weekly surge as solar stocks benefit from lower interest rates.

🥇 VanEck Uranium ETF hit new all-time highs, surpassing its 2017 record with a 5% Friday gain and 12% weekly jump.

🏠 Ray Dalio has warned of mounting debt pressures, urging investors to hold 10% of their portfolios in gold as non-fiat currencies become increasingly crucial.

💼 The Trump administration is reportedly considering a $550 billion investment fund for U.S. manufacturing, with a focus on semiconductors and critical minerals.

📊 The Russell 2000 ended its second-longest streak without new highs.

Trending Stocks 📊

Scholastic (SCHL)

The publisher tumbled 12% after reporting a wider-than-expected fiscal first-quarter loss of $2.52 per share, compared to a $2.13 loss in the prior year period, highlighting ongoing challenges in the educational publishing sector.

Lennar (LEN)

The homebuilder fell by over 4% despite beating earnings estimates with $2.29 per share.

Mortgage rate buydowns have failed to stimulate demand, as affordability concerns persist amid elevated home prices.

UPS (UPS)

United Parcel Service faces persistent macroeconomic challenges and demand recovery issues, with BMO citing negative impacts from trade policy shifts and the elimination of de minimis exemptions, which are affecting profitable trading routes.

What’s Next?

Key earnings and macro news 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

Micron Technology (MU) - Q4 results will reveal AI-driven memory chip demand and semiconductor sector health.

Costco Wholesale (COST) - Consumer spending indicator and retail sector bellwether earnings.

Core PCE Price Index - Sep 26: Fed's preferred inflation gauge will influence future rate decisions.

U.S. GDP Growth (Q2 Final) - Sep 25: Final revision could reshape economic growth expectations.

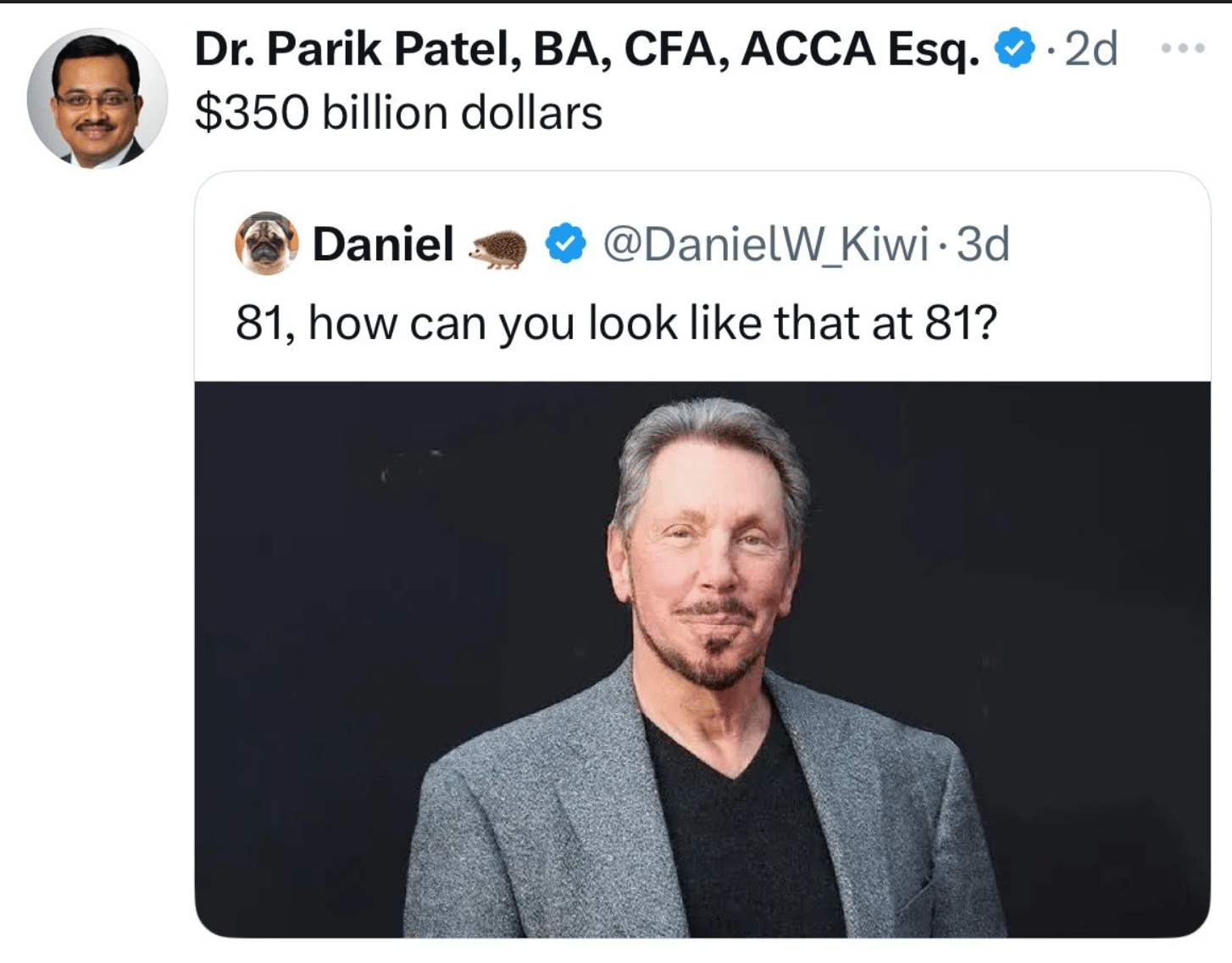

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.