- Ziggma

- Posts

- 🗞️ Intel Stuns Wall Street

🗞️ Intel Stuns Wall Street

Big Moves Decoded: DOW, LUV, and more!

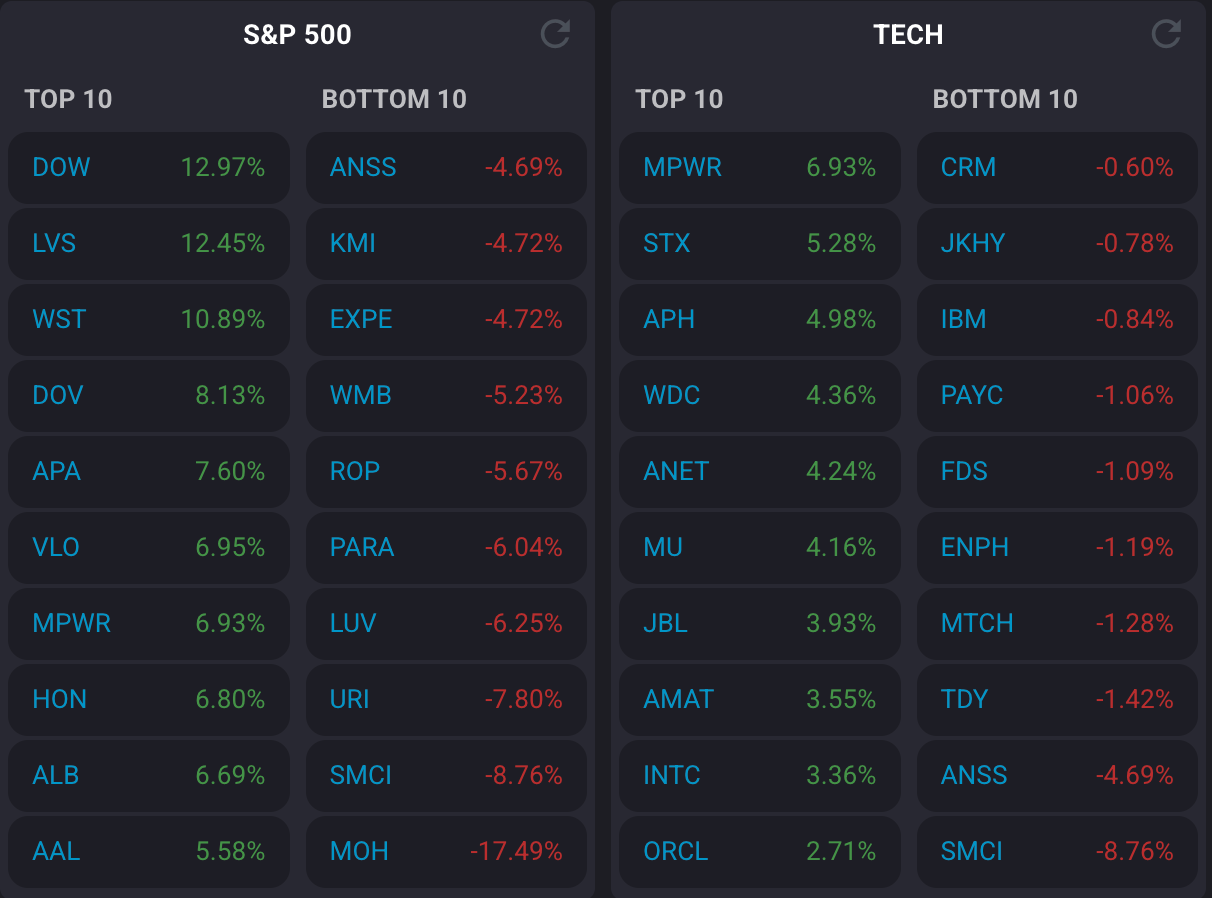

Market Performance

S&P 500: 6,738.44 ⬆️ 0.58%

Nasdaq: 22,941.80 ⬆️ 0.89%

Dow Jones: 46,734.61 ⬆️ 0.31%

Intel Beats Estimates in Q3

Intel reported better-than-expected revenue on Thursday, signaling that demand for its core x86 processors has recovered.

The stock jumped 7% after posting Q3 revenue of $13.65 billion versus an estimated $13.14 billion. The chipmaker also delivered adjusted earnings per share of $0.23, crushing expectations.

Intel received $5.7 billion from the U.S. government during the quarter as part of the Trump administration's $8.9 billion investment negotiated in August.

This makes the government a 9.9% stakeholder in Intel's mission to restore domestic semiconductor production.

Add Nvidia's $5 billion investment from September, and Intel now has two essential partners betting on its turnaround.

CEO Lip-Bu Tan emphasized that "AI is accelerating demand for compute," and the company's deal with Nvidia to integrate Intel CPUs alongside Nvidia's AI GPUs positions them strategically in the AI infrastructure market.

Intel also reported that demand for its chips outpaced supply—a trend expected to continue through next year.

The challenge? Intel Foundry, its third-party manufacturing division, still posted an operating loss of $2.3 billion and hasn't secured major outside customers yet.

The company has shifted its focus from its 18A process to 14A to attract external clients, with management expressing confidence in early customer feedback.

Intel stock has a Ziggma score of 7, and ranks in the bottom percentile for growth, profitability, and valuation.

Our Takeaway

Intel's recovery is real, driven by PC demand and government backing, but the foundry business remains the wildcard.

With $100 billion needed for full buildout and no major customers committed, investors should closely monitor the foundry's progress.

The Nvidia partnership could be transformative, but execution is key.

Trusted by millions. Actually enjoyed by them too.

Most business news feels like homework. Morning Brew feels like a cheat sheet. Quick hits on business, tech, and finance—sharp enough to make sense, snappy enough to make you smile.

Try the newsletter for free and see why it’s the go-to for over 4 million professionals every morning.

Market Overview 📈

The S&P 500 recovered fully from Wednesday's losses, as tech stocks led the charge following strong earnings results.

Markets got a significant boost after White House press secretary Karoline Leavitt announced that President Trump will meet with Chinese President Xi Jinping next Thursday in South Korea.

The news eased U.S.-China tensions that had pressured equities a day earlier, when Treasury Secretary Scott Bessent confirmed plans to curb exports of U.S. software to China.

More than 80% of S&P 500 companies that have reported so far have exceeded earnings expectations, according to FactSet.

Giuseppe Sette of Reflexivity noted, "Do not discount the bull market yet, just because of a volatility bout. A handful of tech stocks have led the rally, but now we stand to see how hundreds of global companies benefit from AI's productivity gains."

Oil prices jumped 5% after the Trump administration imposed new sanctions on Russia's two largest crude companies—Rosneft and Lukoil—citing Moscow's "lack of serious commitment to a peace process to end the war in Ukraine."

Brent crude rose to $65.65 per barrel, while U.S. crude climbed to $61.60.

Stock Moves Deciphered 📈

🧱 Dow Inc. (DOW) ⬆️ 13%

The materials giant gained ground on news of a smaller-than-expected quarterly loss, driven by cost cuts and resilient demand.

The positive earnings surprise outweighed the sales miss, signaling effective management amid challenging market conditions.

Investors rewarded management for its focus on operational efficiency as the company navigates a cyclical downturn in key end markets.

♠️ Las Vegas Sands (LVS) ⬆️ 12%

Shares surged after strong Q3 results, driven by robust performance in Singapore and Macao.

The company beat earnings estimates, raised its dividend, and expanded its share repurchase program, boosting investor confidence.

The casino operator's Macao operations continue to benefit from the recovery in Chinese tourism and premium mass gaming, while Singapore's Marina Bay Sands maintains strong positioning in the luxury segment.

👷 Dover Corporation (DOV) ⬆️ 8%

Shares rose after reporting strong Q3 results, with 5% revenue growth and record margins.

The company beat earnings estimates and raised its full-year EPS guidance, reflecting strong demand and operational efficiency.

Dover's diversified portfolio across engineered products, clean energy solutions, and imaging equipment continues to drive consistent performance.

Headlines You Can't Miss 👀

📈 CME Group was upgraded to buy by Deutsche Bank, citing growth in prediction markets and its partnership with FanDuel on event contracts.

🚗 Uber shares rose 2% after Nvidia announced an update on a collaboration to develop autonomous vehicles using Cosmos AI models and Uber's multi-view driving data.

🔬 Moderna fell 6% after its Phase 3 CMV vaccine study failed to meet the primary efficacy endpoint, though the company expects no impact on 2025 financial guidance.

⚡ Quantum computing stocks jumped broadly on reports that the Trump administration is in talks to take stakes in the sector.

🏗️ Carpenter Technology rallied 20% to a new all-time high after fiscal Q1 beat, posting adjusted EPS of $2.43 vs. $2.13 expected on revenue of $733.7M.

🏨 Honeywell shares jumped 7% after posting better-than-expected quarterly results and lifting its full-year outlook, leading the Dow's advance.

✈️ American Airlines rose 6% after posting a narrower-than-expected Q3 loss and upbeat Q4 guidance of 45-75 cents per share vs. 31 cents expected.

🥇 Gold pulled back 6% this week to $4,100 from record highs above $4,300, but Goldman Sachs maintains its $4,900 target by end-2026, citing central bank demand and Fed rate cuts.

Trending Stocks 📊

⛽️ APA Corporation (APA) ⬆️ 8%

The oil and gas exploration company jumped as crude prices surged by more than 5% amid new U.S. sanctions on Russian oil companies Rosneft and Lukoil.

The Trump administration's sanctions cited Russia's "lack of serious commitment to a peace process" in Ukraine, tightening global oil supply concerns and boosting energy sector sentiment across the board.

🖥️ Super Micro Computer (SMCI) ⬇️ 9%

Shares fell after its preliminary Q1 revenue forecast of $5 billion missed the consensus estimate of $6.48 billion.

The company attributed the shortfall to design-win upgrades that shifted revenue recognition to Q2, creating near-term uncertainty.

While the company maintains its technology leadership in AI server infrastructure, investors remain concerned about execution and visibility into the timing of large orders.

🚪United Rentals (URI) ⬆️ 8%

The equipment rental giant dropped despite reporting record Q3 revenues and raising full-year guidance.

The stock declined because its adjusted EPS missed analyst estimates, raising concerns about profitability and cost pressures despite strong demand.

Management cited higher maintenance costs and competitive pricing pressure in certain markets as headwinds offsetting volume growth.

What’s Next?

Key market and macro news 👇

🧴 Procter & Gamble (PG) Earnings: This consumer goods giant's performance can indicate the health of consumer spending. A miss on earnings could signal that consumers are cutting back, potentially impacting the broader market.

🏥 HCA Healthcare (HCA) Earnings: As a major hospital operator, HCA's results provide insight into the healthcare sector.

🛫 General Dynamics (GD) Earnings: This aerospace and defense company's earnings will be watched for indications of government spending and the health of the industrial sector.

🌏 World Economic Outlook Publication: The International Monetary Fund (IMF) is expected to release its World Economic Outlook. This report provides a global economic forecast, and any revisions could influence investor sentiment.

📊 Global Financial Stability Report: The IMF is also scheduled to release its Global Financial Stability Report, which assesses the health of the global financial system.

🇯🇵 Japan Inflation Data: The release of Japan's national inflation data could influence global markets, as it may affect the Bank of Japan's monetary policy.

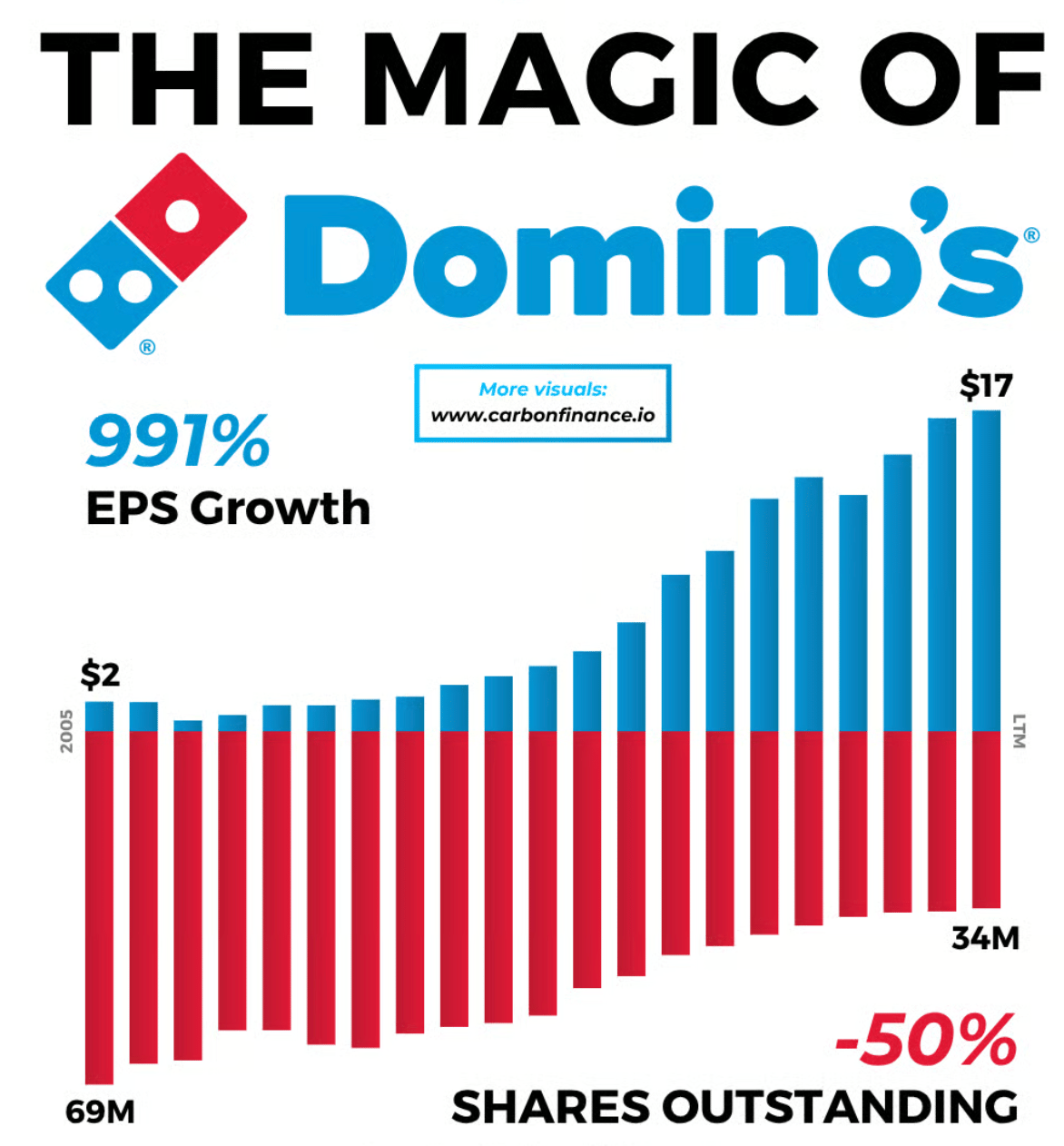

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.