- Ziggma

- Posts

- 💰 Intel Reboots After System Crash

💰 Intel Reboots After System Crash

PLUS: Why is Etsy rising?

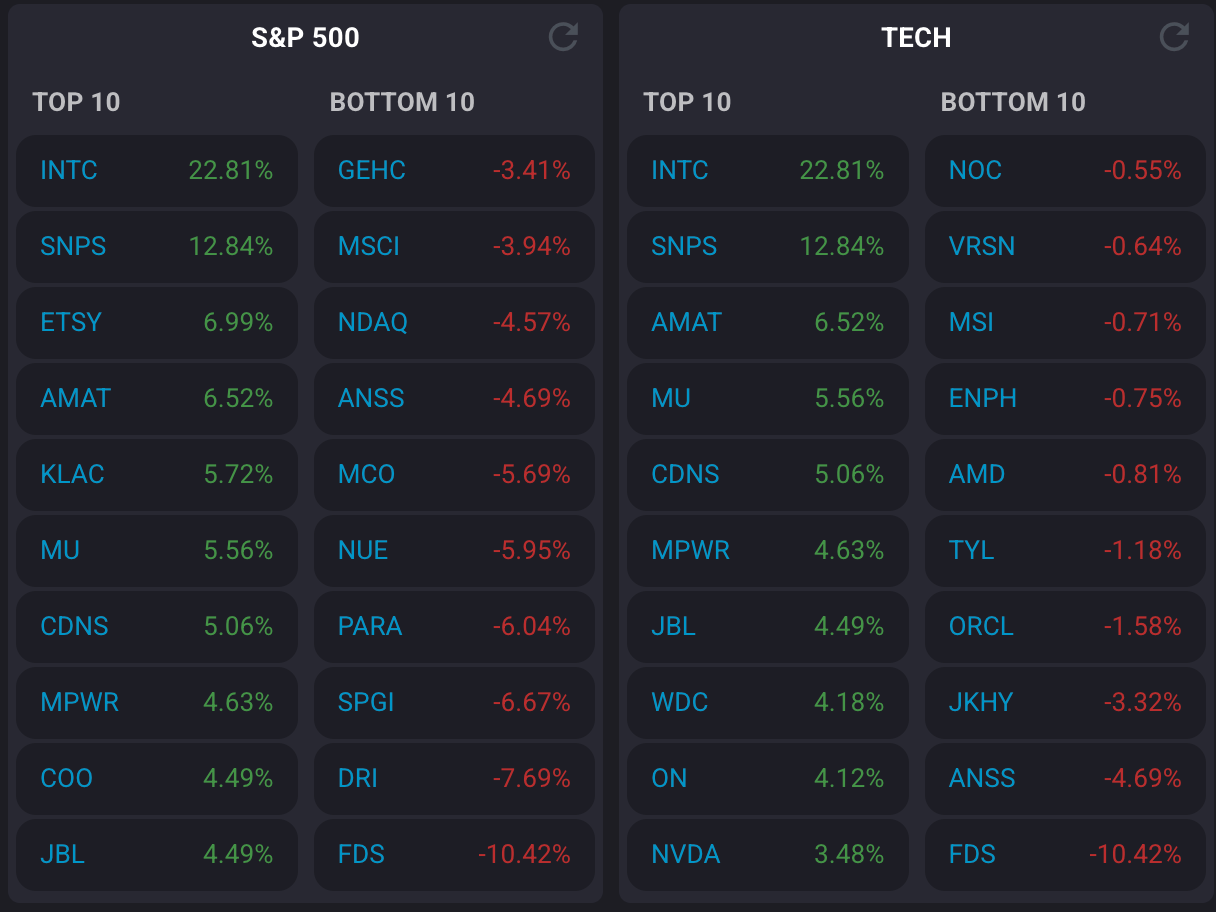

Market Performance

S&P 500: 6,631.96 ⬆️ 0.48%

Nasdaq: 22,470.73 ⬆️ 0.94%

Dow Jones: 46,142.42 ⬆️ 0.27%

Nvidia to Invest $5 Billion in Intel 💸

Nvidia (NVDA) announced it will invest $5 billion in Intel (INTC) to co-develop data center and PC chips, sending Intel shares soaring 23%, its best day since October 1987.

The investment comes at $23.28 per share, marking a dramatic reversal of fortunes between these two Silicon Valley giants.

Just five years ago, Intel dominated the chip world while Nvidia was a niche graphics company.

Today, Nvidia is worth over $4.25 trillion while Intel sits at just $143 billion.

The AI boom completely flipped their positions, with Intel missing the boat on AI chips while Nvidia became the undisputed king.

Nvidia gets access to Intel's vast x86 ecosystem and enterprise relationships, while Intel secures a massive customer for its struggling foundry business.

The collaboration will create AI systems that combine Intel's CPUs with Nvidia's GPUs, and Intel will also build x86 chips for Nvidia's platforms.

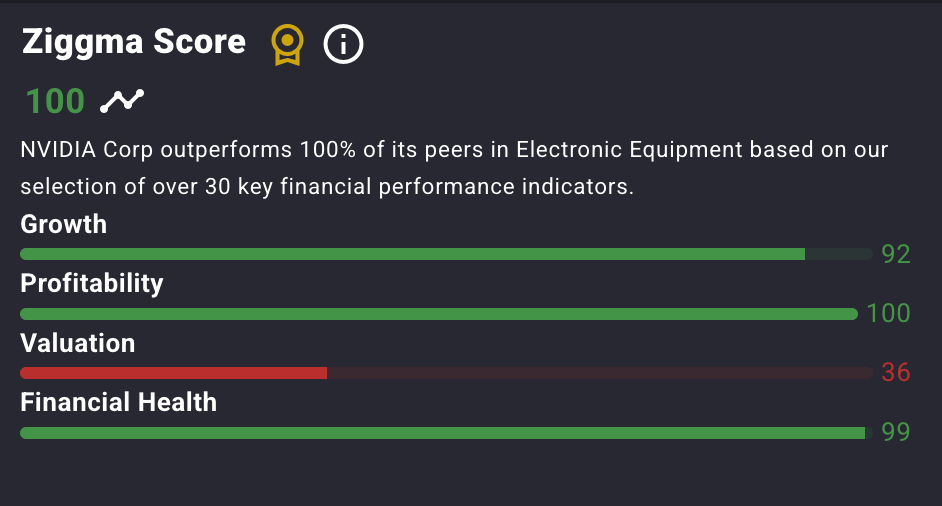

Nvidia currently has a Ziggma Stock Score of 100, despite ranking in the bottom half percentile for valuation.

Our Takeaway

This deal validates Intel's turnaround strategy under new CEO Lip-Bu Tan, but questions remain whether it's genuine collaboration or political theater.

With backing from Nvidia, SoftBank, and the U.S. government, Intel now has the resources to compete with other chip makers.

Professional Bitcoin Mining Made Simple

With Bitcoin breaking through $120k recently, smart entrepreneurs aren't just buying at record highs - they're generating Bitcoin through professional mining operations at production cost.

Abundant Mines makes Bitcoin mining completely turnkey. You own the Bitcoin-generating equipment in our green energy facilities while our professionals handle everything else. No technical expertise required. No equipment management. No operational headaches.

Receive daily BTC payouts straight to your wallet, benefit from massive tax advantages through 100% bonus depreciation, and acquire Bitcoin significantly below market rates. It's like owning the money printer instead of buying the money.

Perfect for busy professionals who want serious Bitcoin exposure without complexity. Our clients include successful entrepreneurs who've scaled from test investments to multi-million dollar mining operations.

Claim your free month of professional Bitcoin hosting and see how the smart money generates Bitcoin.

Market Overview 📈

The Federal Reserve's quarter-point rate cut on Wednesday continues to fuel market optimism, with all major indices hitting fresh record highs on Thursday.

Small-cap stocks led the charge, with the Russell 2000 surging 2.4% to notch its first record close since November 2021.

The rate cut, combined with Fed projections for two more cuts this year, has investors betting on continued monetary easing.

Small caps should benefit as they rely more heavily on external funding and are more sensitive to interest rate changes compared to cash-rich large caps.

David Tepper of Appaloosa Management captured the mood perfectly: "I don't love the multiples, but how do I not own it? I'm not ever fighting this Fed."

However, he warned that too much easing could push markets into "danger territory" by overheating the economy and reigniting inflation.

Wells Fargo raised its S&P 500 targets, now expecting the index to finish between 6,600 and 6,800 this year, up from 6,300 and 6,500 previously.

The bullish sentiment is spreading to individual investors as well, with AAII's weekly poll showing bullishness jumping to 41.7%, the highest level since early July.

Stock Moves Deciphered 📈

Darden Restaurants (DRI)

The Olive Garden parent dropped 7% after missing earnings expectations with adjusted EPS of $1.97 vs $2.00 expected.

While revenue met forecasts at $3.04 billion and same-store sales rose 4.7%, weakness in fine-dining segments offset strength from Olive Garden and LongHorn Steakhouse.

The company raised revenue guidance but kept earnings projections unchanged.

FactSet Research Systems (FDS)

Shares plunged 6% on disappointing Q4 results and weak guidance.

Adjusted earnings of $4.05 per share missed the $4.13 consensus, while full-year EPS guidance of $16.90-$17.60 fell short of $18.25 expectations.

Despite beating revenue estimates, increased technology expenses and margin pressure concerned investors about the financial data provider's outlook.

Nucor Corporation (NUE)

The steelmaker declined after providing a lower-than-expected Q3 profit forecast.

Management cited pressure across all key segments, including volume declines and increased costs, weighing on near-term performance.

The guidance miss reflects broader challenges in the steel industry amid economic uncertainty and fluctuating demand patterns.

Headlines You Can't Miss 👀

📈 Supreme Court scheduled oral arguments for Nov. 5 on Trump's "reciprocal" tariffs case that could scrap major trade levies.

🏦 The Bank of England kept rates steady at 4% with a 7-2 vote, focusing on squeezing out persistent inflationary pressures.

📊 Jobless claims dropped to 231,000 last week, down 33,000 from the previous week's spike, easing recession concerns.

🇨🇳 Google gained 1% after China reportedly dropped its antitrust probe into Android's dominance among Chinese phonemakers.

💊 Novo Nordisk surged 7.6% on the results of a late-stage obesity pill, which showed "significant" weight reduction matching that of Wegovy injections.

🎯 Wynn Resorts rose 2% after Stifel raised its price target to $145 on international gaming market tailwinds.

🛡️ Allstate jumped 4.8% after reporting catastrophe losses of $397M, well below $1.38 billion consensus for Q3.

⚡ Applied Materials and ASML gained on the semiconductor sector rally driven by Intel-Nvidia partnership optimism.

Trending Stocks 📊

Etsy (ETSY) - The e-commerce platform rallied amid broad market optimism and positive retail sentiment, benefiting from continued strength in online sales and consumer spending patterns.

Cracker Barrel (CBRL) - The restaurant chain fell 7.6% after reporting earnings of $0.74 per share vs. estimates of $0.80 per share, while revenue stood at $868 million, above estimates of $855 million.

Bullish (BLSH) - The cryptocurrency exchange surged 12% on its first earnings since its NYSE debut, reporting revenue of $57 million with adjusted earnings of $0.93 per share.

What’s Next?

Investors remain bullish 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

👉 Bullish sentiment among individual investors jumped to 41.7% in the week ended Wednesday, up from 28% the previous week and the highest level since July 2.

👉 Bullish sentiment rose above its historic average of 37.5% for the first time in seven weeks.

👉 Bearish sentiment dropped to 42.4% from 49.5% last week, which was the highest since early May.

👉 The degree of gloom remains “unusually high,” the AAII said, and above a historic average of just 31.0% for the 42nd time in 44 weeks.

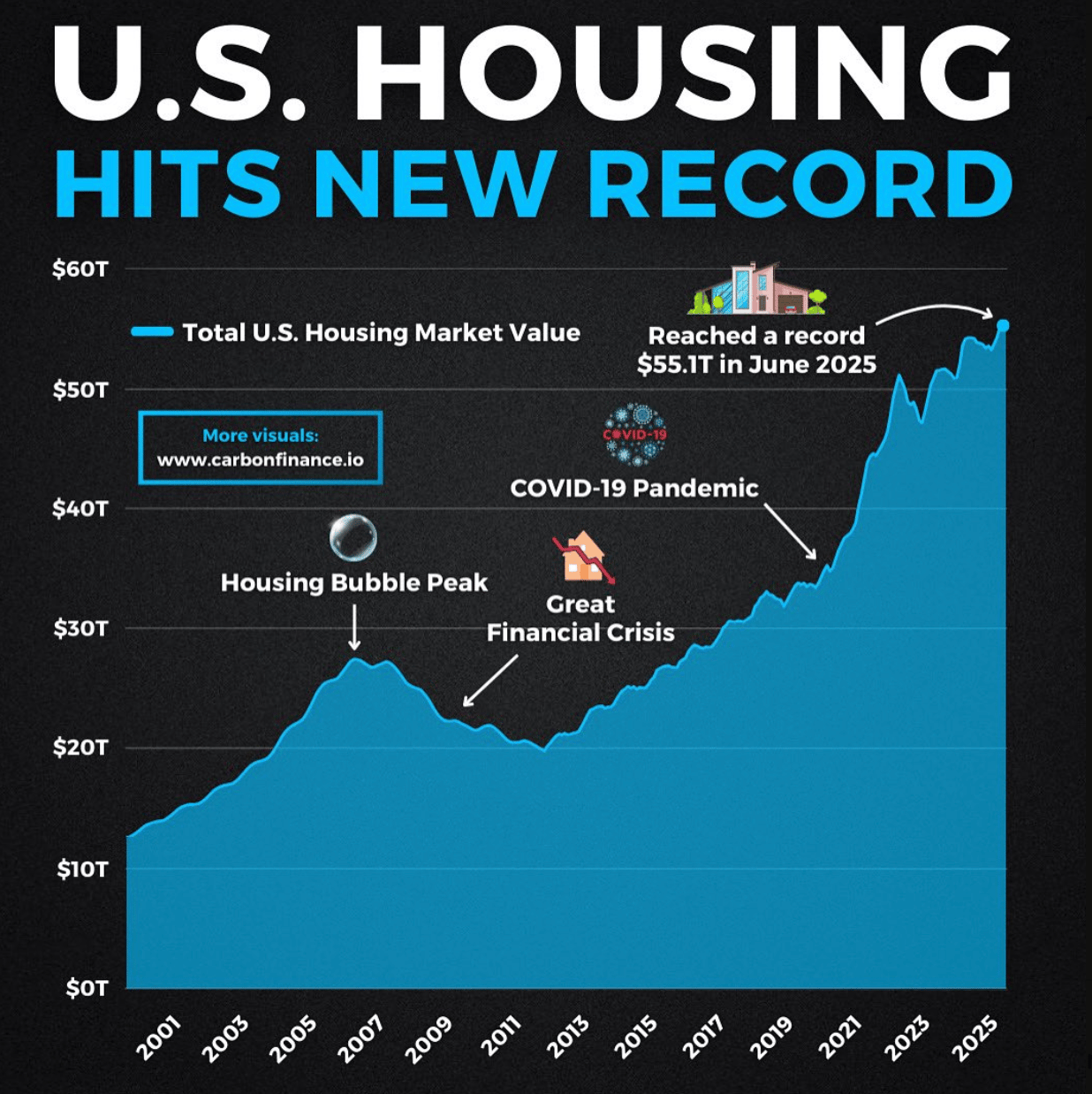

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.