- Ziggma

- Posts

- 💰 Intel Partners With Apple?

💰 Intel Partners With Apple?

Big moves decoded: FCX, AXON, and BABA

Market Performance

S&P 500: 6,637.97 ⬇️ 0.28%

Nasdaq: 22,497.86 ⬇️ 0.34%

Dow Jones: 46,121.28 ⬇️ 0.37%

Apple Might Invest in Intel

Intel (INTC) may have found another deep-pocketed investor in Apple.

Bloomberg reports that the iPhone maker has approached the struggling chipmaker about a potential investment, marking yet another potential lifeline for Intel as it battles to regain relevance in the AI era.

Apple was a longtime Intel customer before switching to its own custom silicon starting in 2020, and even acquired most of Intel's modem chip business in 2019.

Now, with Intel needing capital and Apple looking to diversify its chip supply chain away from Taiwan-based TSMC, this potential partnership makes strategic sense for both parties.

Intel shares surged 6.4% in regular trading and added another 2.2% after hours on the news.

The timing couldn't be better for Intel CEO Lip-Bu Tan, who's been actively courting investors as part of his turnaround strategy. This follows recent investments from SoftBank ($2 billion), the U.S. government (10% stake), and Nvidia ($5 billion).

For Apple, this move would strengthen its relationship with the Trump administration while reducing its dependence on overseas chip manufacturing—a smart hedge against the geopolitical tensions surrounding Taiwan.

Intel currently has a Ziggma Stock Score of 22, and ranks in the bottom half percentile in terms of growth and profitability.

However, its fundamentals are likely to improve given its big-ticket partnerships.

Our Takeaway

Intel's string of high-profile investments signals growing confidence in the turnaround story, but the real test lies in execution.

Apple's potential backing adds credibility, but Intel still needs to prove it can compete in the AI-driven future of the semiconductor industry.

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

Market Overview 📈

AI stocks continued their retreat for a second consecutive day, weighing on the broader market.

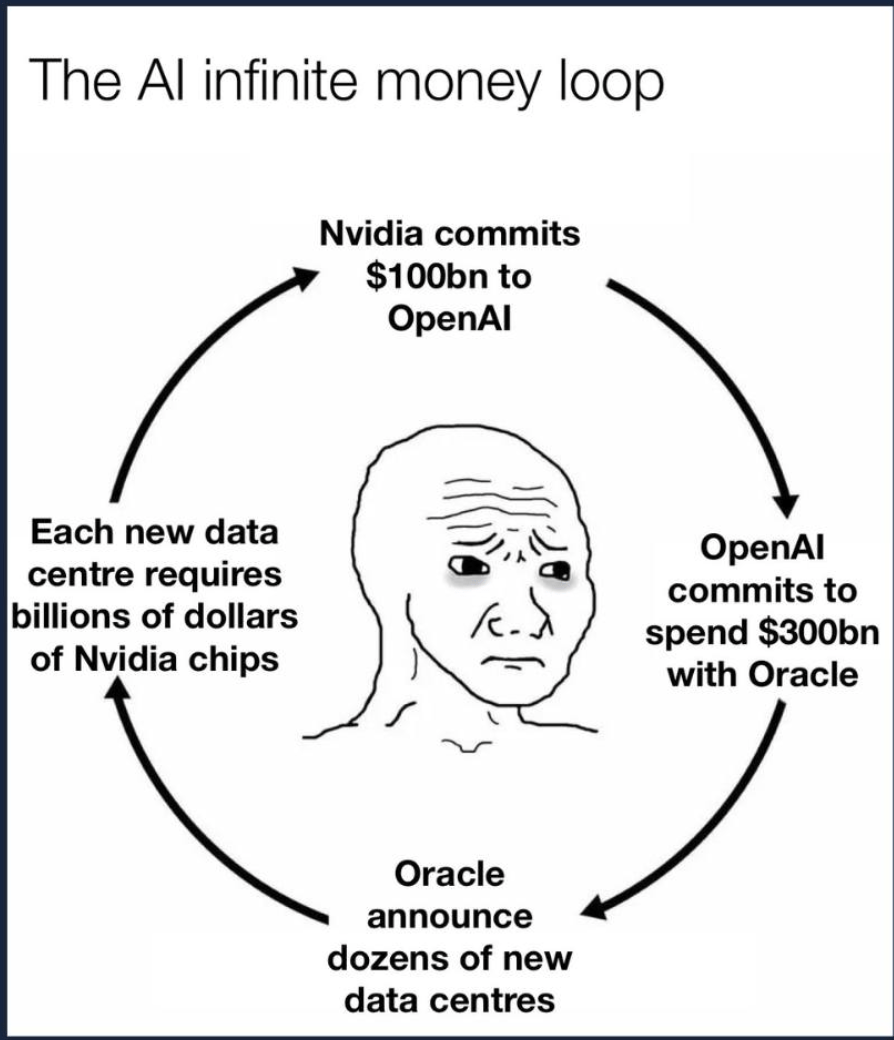

The selloff was led by concerns over the sustainability of the artificial intelligence boom, with investors questioning whether recent partnerships represent genuine value creation or circular financing reminiscent of the dot-com era.

Nvidia and Oracle both declined for the second straight day, despite Nvidia's announced $100 billion partnership with OpenAI earlier this week.

The chipmaker fell nearly 1%, continuing Tuesday's 2.8% decline as skepticism grew about the potentially circular nature of vendor financing – where Nvidia invests in customers who then spend that money on Nvidia chips.

Intel provided a bright spot, surging over 6% on reports of potential investment discussions with Apple.

This helped narrow some of the Nasdaq's losses heading into the close, though the tech-heavy index still finished down 0.34%.

Traders are positioning cautiously ahead of Thursday's jobless claims data and Friday's PCE inflation numbers.

Additional uncertainty stems from potential government shutdown risks, as President Trump has canceled meetings with congressional leaders that could have helped avert the September 30 deadline.

Stock Moves Deciphered 📈

Alibaba (BABA) stock surged 8.20% after announcing increased AI spending beyond its previously announced 380 billion yuan ($53 billion) three-year infrastructure initiative.

CEO Eddie Wu emphasized the company's commitment to preparing for the era of artificial superintelligence, unveiling new AI products and updates at Alibaba Cloud's annual technology conference.

Freeport-McMoRan (FCX) sank 10% after declaring force majeure at its Indonesian Grasberg mine following a fatal mud rush accident.

The company lowered its Q3 consolidated sales forecasts for copper by 4% and gold by nearly 6%, as the mine, which boasts some of the world's largest reserves, remains temporarily shut down for safety concerns.

Axon Enterprise (AXON) declined following news of its $800-900 million acquisition of emergency response software company Prepared.

Investors expressed concern over the high acquisition price and increased spending levels, despite Axon's strong market position in law enforcement technology.

Headlines You Can't Miss 👀

📈 FINRA eliminates the $25,000 minimum rule for pattern day trading, making active trading more accessible.

🏠 New home sales jumped 20.5% in August to 800,000 units, hitting the highest level since January 2022.

⚡ Energy sector rallies 3% this week as traditional oil names gain momentum, bringing quarterly gains above 6%.

🔬 UniQure soars 250% after experimental Huntington's disease gene therapy shows promise in clinical trial.

🏗️ Sphere Entertainment gets upgrade from Wolfe Research citing strong "Wizard of Oz" screening demand.

💊 Pfizer to acquire weight-loss drugmaker Metsera for $4.9 billion in cash, deal expected to close.

🏘️ Compass plans $1.6 billion all-stock acquisition of Anywhere (parent of Century 21, Coldwell Banker).

🚛 Thor Industries beats earnings expectations with $2.36 per share, surpassing the $1.28 estimate, on $2.52 billion in revenue.

Trending Stocks 📊

llumina (ILMN) - The Genomics leader's stock hit lowest levels since March 2025 amid ongoing Department of Justice settlement discussions and intensifying competition within the sector, reflecting broader investor uncertainty about regulatory outcomes.

Centene (CNC) - The managed care company gained ground after subsidiary Meridian Health announced $15 million in value-based provider payments, demonstrating operational progress despite mixed analyst coverage and ongoing legal challenges affecting the sector.

CF Industries (CF) - The fertilizer producer rallied on the announcement of a new clean ammonia partnership, with bullish technical indicators supporting the move despite previously mixed quarterly results that showed sector-wide weakness in agricultural materials.

What’s Next?

Key earnings and macro news 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

Costco quarterly results expected this week

More than 95% of S&P 500 companies have reported Q3 earnings

Nearly 78% have surpassed analyst expectations this season

Thursday: Weekly jobless claims data

Friday: PCE inflation numbers

Government shutdown deadline looms on September 30

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.