- Ziggma

- Posts

- 🗞️ How Big Is Apple Services?

🗞️ How Big Is Apple Services?

Apple, AMC, and Bitcoin

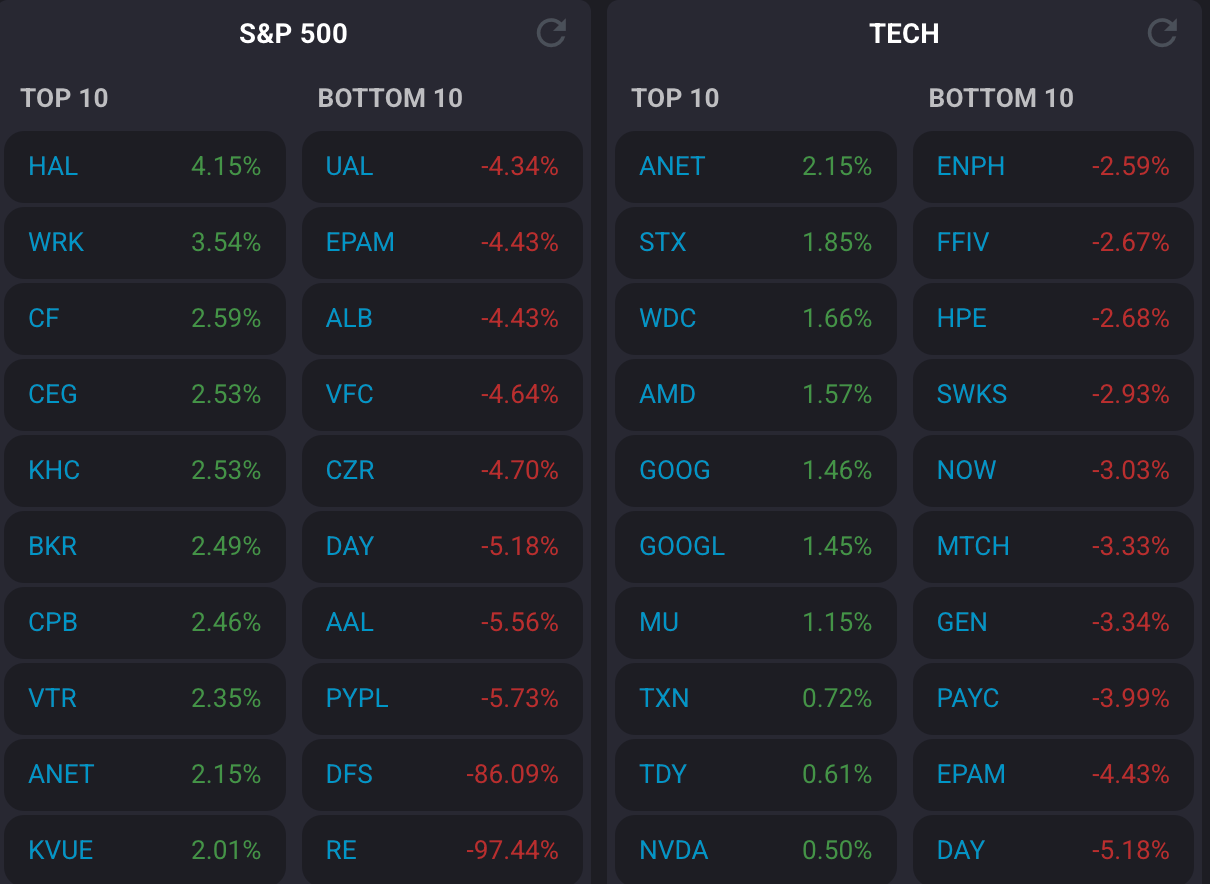

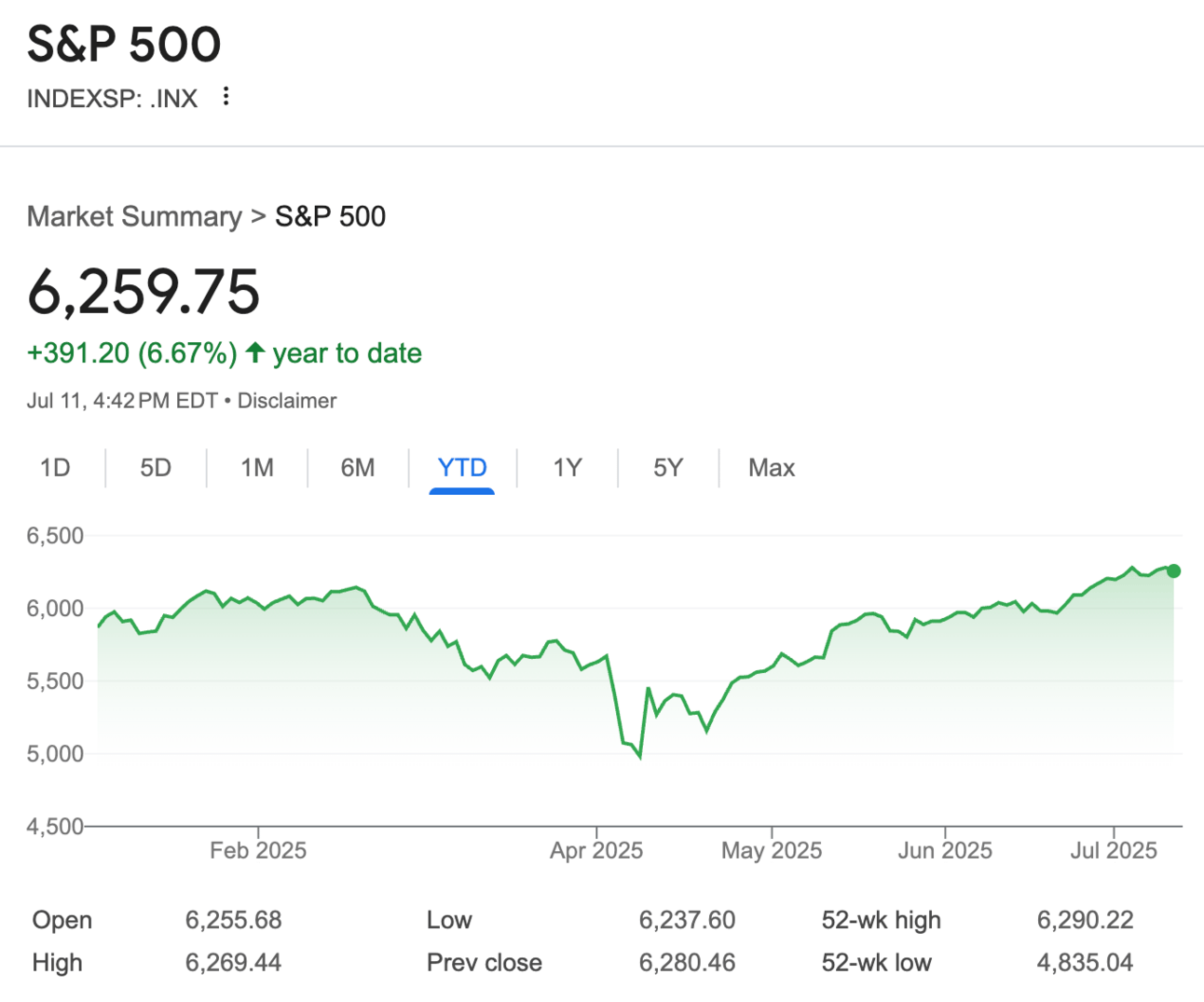

Market Performance

S&P 500: 6,259.75 (-0.33%)

Nasdaq: 20,585.53 (-0.22%)

Dow Jones: 44,371.51 (-0.63%)

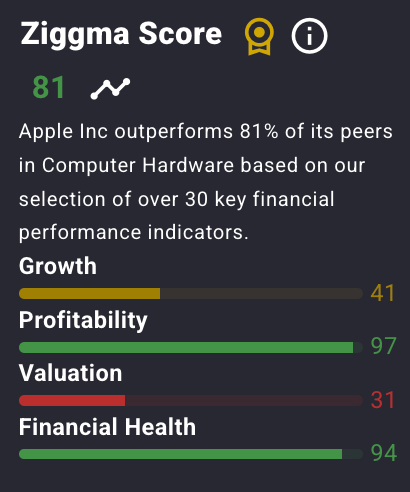

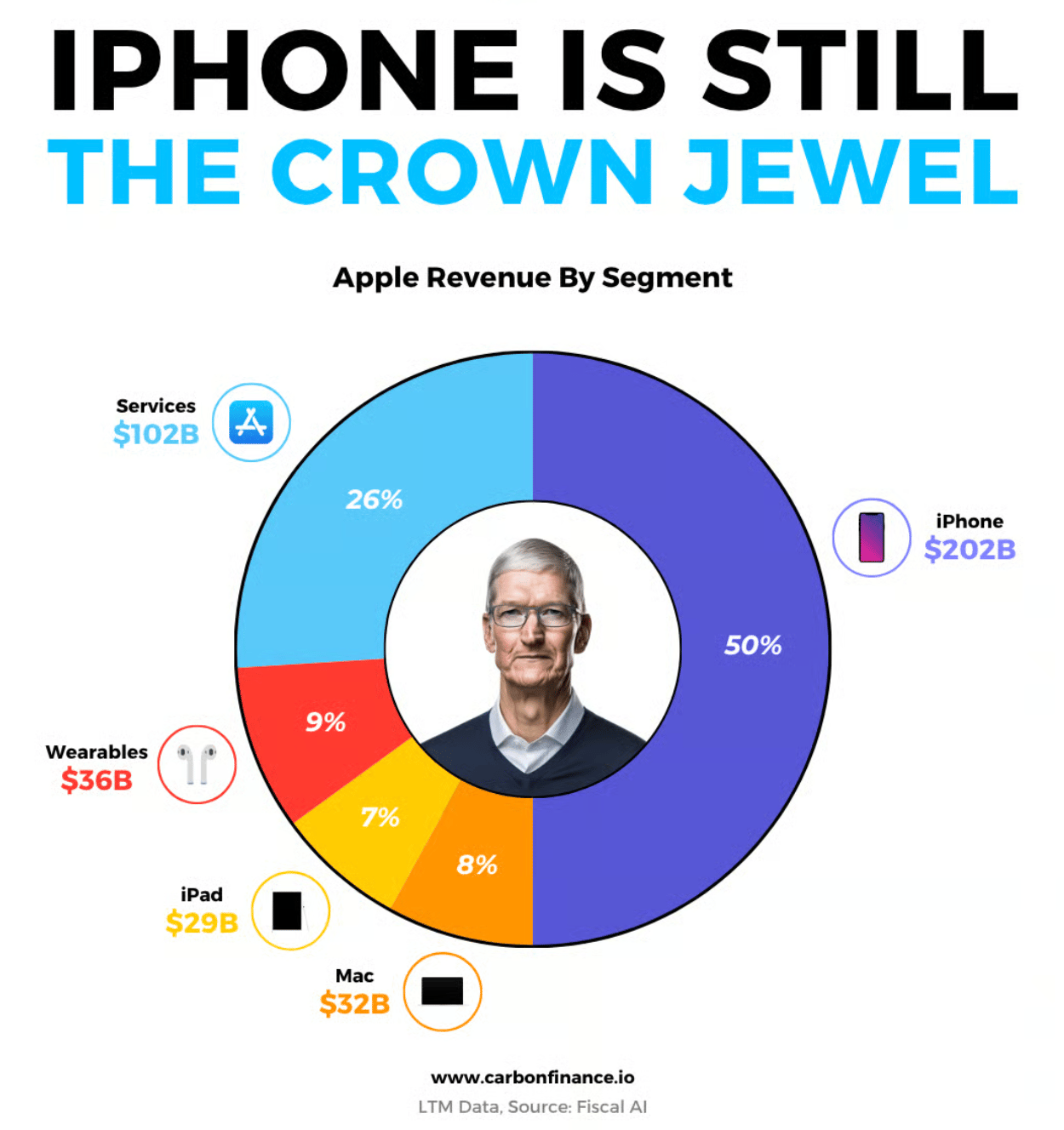

Apple’s Services Business Rakes In Over $100 Billion

Here's something that might surprise you about Apple's (AAPL) latest earnings: while everyone obsesses over iPhone sales, the real growth story is happening in services.

Apple's services division just hit an all-time revenue high of $26.65 billion in fiscal Q2 2025, up 11.8% year-over-year. That's more than double what it was five years ago.

But here's the kicker - this isn't just about growth, it's about survival. As smartphone innovation plateaus and replacement cycles stretch longer, Apple desperately needs recurring revenue streams to maintain its astronomical growth rates.

Services now provide that steady, high-margin income from Apple's 2.3+ billion active devices.

The timing couldn't be more critical. CEO Tim Cook warned that Trump's tariffs could add $900 million in costs for the June quarter alone.

While Apple successfully lobbied for smartphone exemptions from China's 145% tariffs, new semiconductor chip tariffs threaten to increase prices across Apple's entire product lineup.

Our Takeaway

Apple's services moat is impressive, but the iPhone maker faces a perfect storm of tariff pressures and hardware saturation.

The question isn't whether services will continue growing - it's whether that growth can offset the mounting external pressures on Apple's core business.

Market Overview

U.S. equity futures are down in pre-market as investors brace for escalating trade tensions and the start of the second-quarter earnings season.

S&P 500 futures lost 0.4%, while Nasdaq 100 futures dropped 0.5% and Dow futures fell 183 points.

The selling pressure comes after Trump announced 30% tariffs on the European Union and Mexico starting August 1st, adding to an already volatile trade environment.

Friday's session saw all three major averages close lower, with the Dow dropping 279 points as Trump's 35% tariff on Canada overnight caught markets off guard.

What's striking is how market sentiment has shifted. After initially shrugging off tariff announcements earlier last week, with the S&P 500 even hitting a new record high Thursday, investors are now showing more sensitivity to trade escalation.

The concerning part isn't just the tariff announcements themselves, but the unpredictable nature of their timing and scope.

Headlines You Can't Miss

Bitcoin hits new all-time highs crossing $120,000, fueled by record ETF inflows of $1.18 billion.

China's exports beat expectations in June while imports returned to growth, showing economic resilience.

Singapore warns of 'uncertainty' after it averts a technical recession in manufacturing and construction growth.

Asia-Pacific markets trade mixed as investors assess Trump's 30% tariffs on EU and Mexico.

Tesla supplier CATL has potential beyond just batteries, analysts say, expanding into energy storage.

European markets expected to head south after Trump slaps 30% tariff on EU.

BTS is back, Blackpink's on tour - here's what it means for high-flying K-pop stocks.

Trending Stocks

AMC Entertainment (AMC): AMC stock surged nearly 10% after Wedbush upgraded the movie theater chain to outperform from neutral, citing a more consistent film release slate and completion of what could be the last major share issuance.

The upgrade comes as AMC benefits from stronger box office trends and improved operational efficiency.

Analyst Quote🎤: “AMC, for years considered a "meme stock," has repaid or postponed all of its debt due next year, relieving near-term uncertainty and is completing what it expects to be its last major share issuance for a while, putting a significant headwind behind it."

Kraft Heinz (KHC): Kraft Heinz stock edged up following a Wall Street Journal report that the consumer goods giant may split its grocery business, including Kraft products, into a new entity valued at up to $20 billion. The potential breakup could unlock shareholder value by separating faster-growing segments from legacy brands.

Management Quote🎤: “As announced in May, Kraft Heinz has been evaluating potential strategic transactions to unlock shareholder value.”

Freeport-McMoRan (FCX): UBS downgraded Freeport-McMoRan to neutral after the mining stock jumped 50% in three months on copper tariff benefits. While raising the price target to $50, UBS noted that catalysts have largely played out with shares already reflecting higher U.S. copper prices from Trump's planned tariffs.

Analyst Quote🎤: “We see a more balanced risk vs reward and downgrade to Neutral."

What’s Next?

Earnings to Watch This Week 👇

Tuesday: JPMorgan Chase, Wells Fargo, Citigroup kick off bank earnings,

Wednesday: Johnson & Johnson, Bank of America, Goldman Sachs report quarterly results.

Thursday: PepsiCo and Netflix deliver Q2 earnings.

Friday: American Express closes out the week.

Key Economic Data:

Inflation readings will show how existing tariffs impact consumer prices.

Federal Reserve officials may comment on the interest rate outlook amid trade tensions.

China trade data could influence global market sentiment.

EU response to Trump's 30% tariff announcement expected.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Source: Carbon Finance

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.