- Ziggma

- Posts

- 🗞️ Google Leads the Charge

🗞️ Google Leads the Charge

Big Moves Decoded: Nike, Tesla, and more!

Market Performance

S&P 500: 6,845.50 ⬇️ 0.74%

Nasdaq: 23,241.99 ⬇️ 0.76%

Dow Jones: 48,063.29 ⬇️ 0.63%

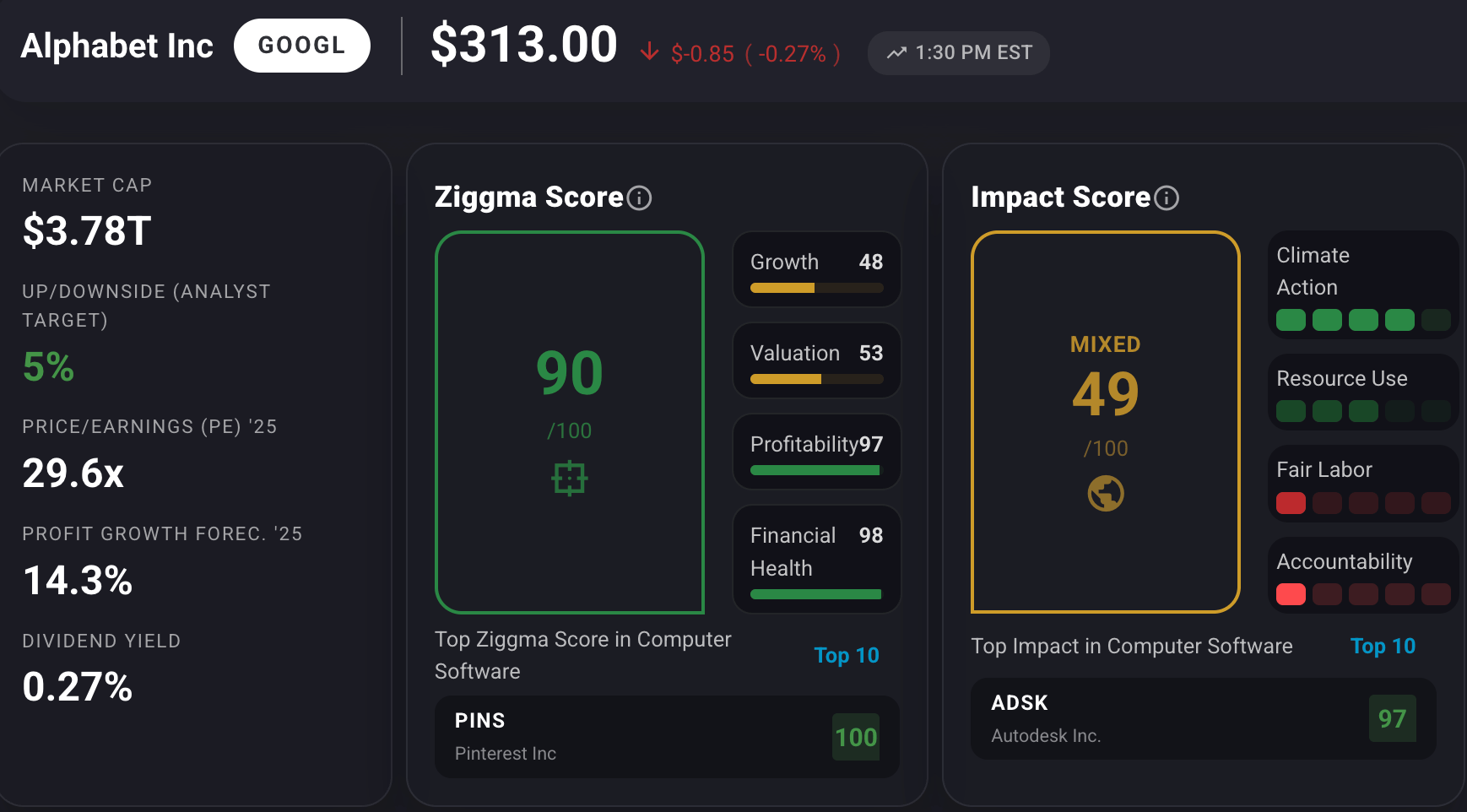

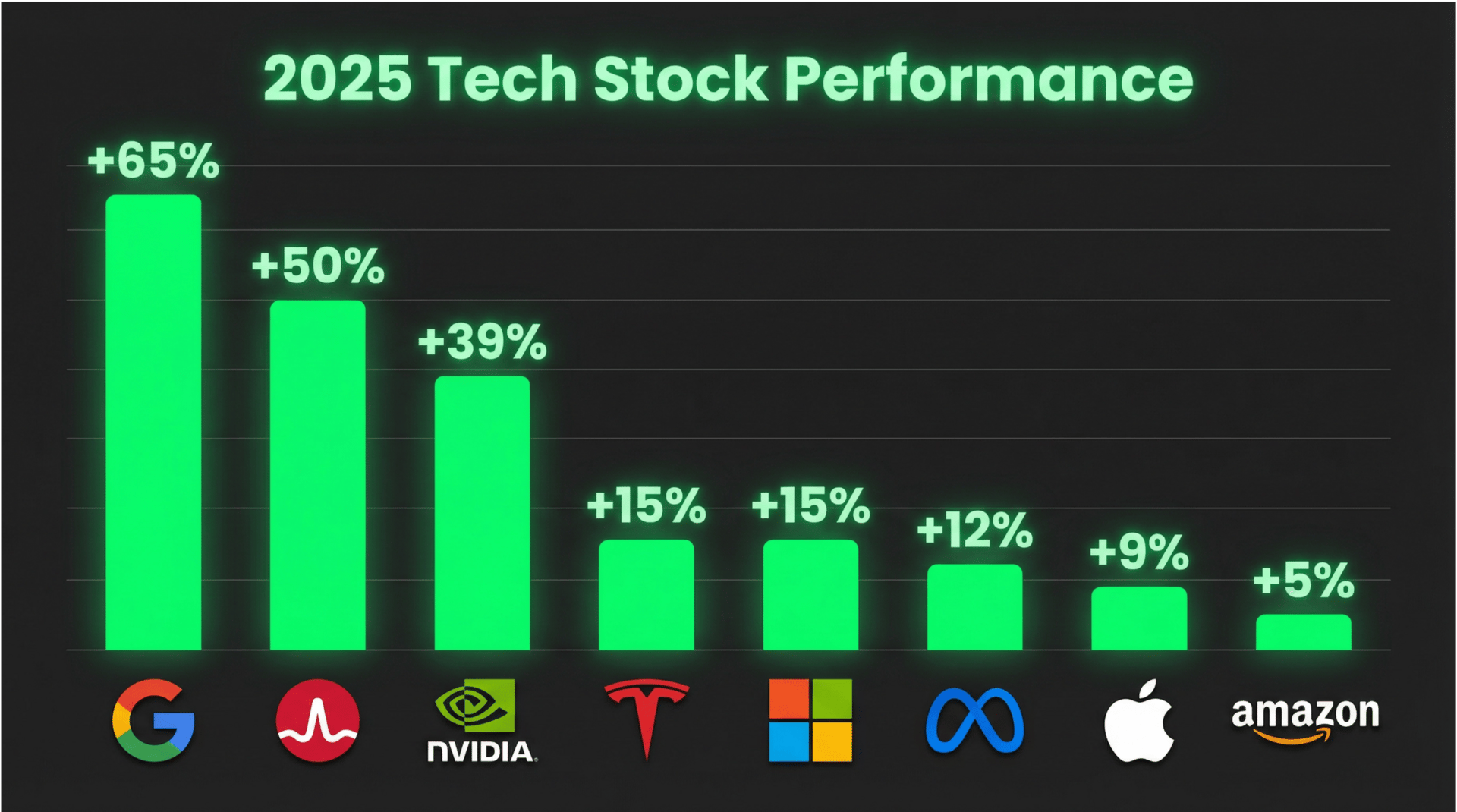

Alphabet Stock Surged 65% In 2025

After a turbulent start to the year, Alphabet (GOOGL) emerged as 2025's biggest winner among trillion-dollar tech giants, surging 65% — its strongest performance since it doubled during the 2009 financial crisis recovery.

This remarkable comeback required staring down existential questions about Google's future in the AI era.

When Trump's tariff threats sent markets tumbling in April, Alphabet hit its yearly low with shares plunging 18% in Q1 alone. Skeptics questioned whether the search giant could survive disruption from OpenAI's ChatGPT.

But Google fought back aggressively. The Gemini app dethroned ChatGPT atop Apple's App Store after its viral Nano Banana image generator launched in August.

A September court ruling preserved Google's lucrative default search payments to Apple, avoiding the worst antitrust remedies.

Most critically, Gemini's market share rose from 5% to 18% of generative AI traffic, while ChatGPT's dominance fell from 87% to 68%.

The momentum extends beyond consumer AI. Google Cloud signed more billion-dollar deals through Q3 2025 than the previous two years combined, driving analysts to project 15% Q4 revenue growth to $111 billion.

Our Takeaway

Alphabet proved the doubters catastrophically wrong, transforming potential disruption into dominance while capitalizing expenditures hit $93 billion.

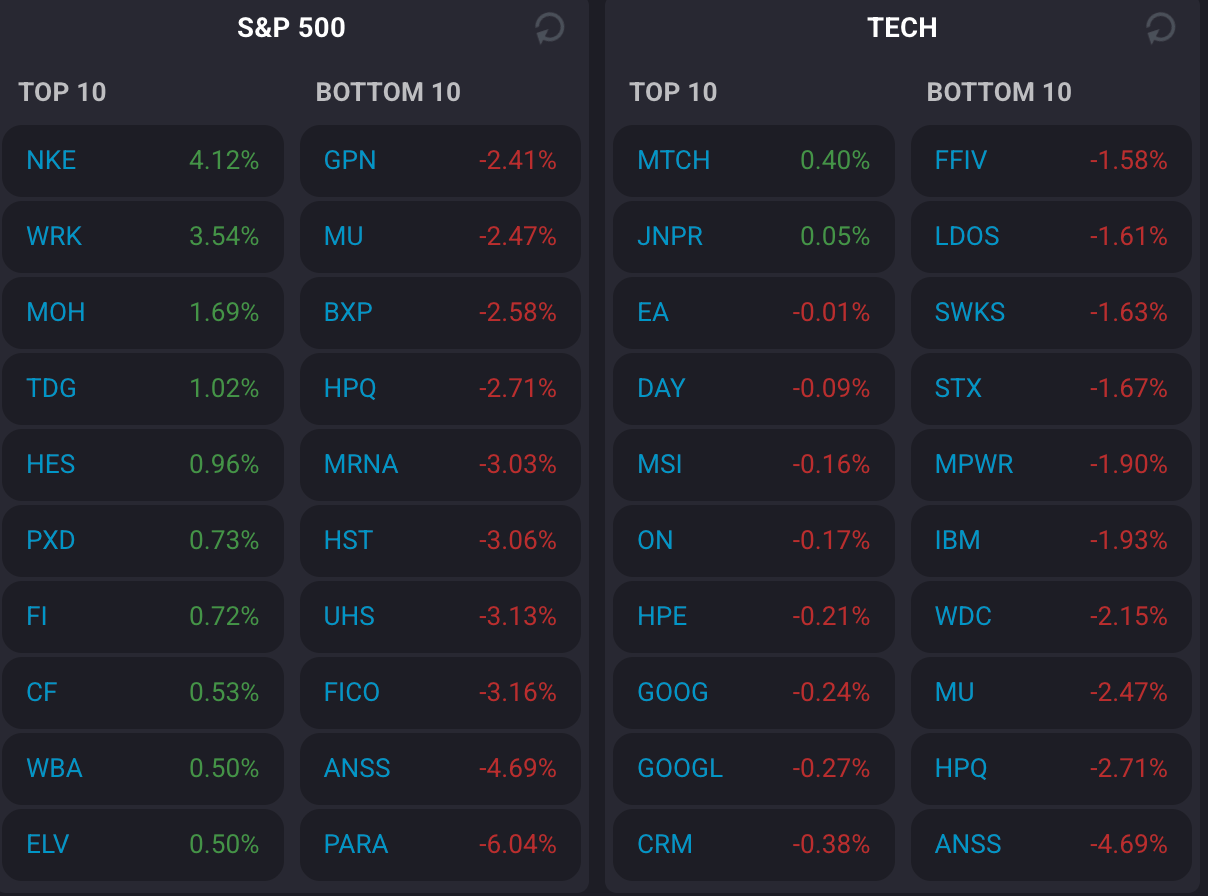

Market Overview 📈

Markets closed 2025's final session in the red, extending a mild four-day losing streak that threatened the traditional Santa Claus rally.

Despite the downbeat finish, the S&P 500 secured its eighth consecutive monthly gain — the longest streak in eight years — and third straight year of double-digit returns with a 16.39% annual advance.

The year's impressive 80% three-year cumulative gain masks recent volatility concerns. Strategists worry 2026 could see range-bound trading as corporate earnings growth catches up to elevated valuations.

The market's remarkable recovery from April's near-bear-market territory — when Trump's sweeping tariffs sent the S&P 500 down nearly 19% — demonstrated resilience, but lessons learned about gradual tariff implementation may be tested again.

Wednesday's jobless claims data provided a bright spot, falling to 199,000 versus expectations of 220,000, reflecting the persistent low-hire, low-fire labor environment.

Continuing claims dropped 47,000 to 1.87 million, suggesting underlying employment strength despite economic headwinds.

Stock Moves Deciphered 📈

💸 Intel (INTC)

Intel shares moved lower after Nvidia completed its $5 billion equity investment earlier this week.

The capital infusion provides Intel with crucial resources to accelerate its foundry ambitions and chip development roadmap amid intensifying competition from TSMC and Samsung.

🤖 Taiwan Semiconductor Manufacturing (TSM)

TSMC shares ticked up 1.44% after Reuters reported Nvidia requested increased H200 chip production to meet surging Chinese demand exceeding two million units for 2026.

This development underscores TSMC's critical role in the AI infrastructure buildout and highlights strong end-market demand despite ongoing geopolitical tensions.

The production ramp validates the company's capacity-expansion investments and positions it well for sustained growth in advanced-node manufacturing.

👟 Nike (NKE)

Nike shares climbed 4.12% after major insider buying from CEO Elliott Hill and Apple CEO Tim Cook, who is a Nike board member.

This executive confidence, despite a challenging year marked by weak sales in China and tariff pressures, outweighed, signaling a potential turnaround and boosting investor sentiment, despite the stock being down over 17% for the year.

Headlines You Can't Miss 👀

💰 Gold closed 2025 up 64%, marking its best annual performance since 1979's 113% surge during the inflation crisis era.

🥈 Silver skyrocketed 141% year-to-date, on pace for its strongest year since 1979, when it gained 468%, outpacing all major assets.

₿ Bitcoin struggled in 2025, down 5.8% for the year as regulatory uncertainty and macro headwinds weighed on cryptocurrency markets.

🛢️ WTI crude oil tumbled 19.2% for the year amid global demand concerns and increased production from non-OPEC nations, dampening prices.

🏦 Berkshire Hathaway faces uncertainty over its $300 billion equity portfolio as Warren Buffett officially retires, with no clear successor for stock selection.

🏥 Corcept Therapeutics plummeted 50% after the FDA rejected its drug relacorilant for hypercortisolism treatment, citing insufficient evidence of effectiveness.

💊 Molina Healthcare climbed 2.7% for its fourth straight positive session after investor Michael Burry highlighted the insurer in a Substack post.

Trending Stocks 📊

🚗 Tesla (TSLA)

Tesla's stock dropped 1% following news that a key South Korean battery supplier drastically reduced its supply deal.

This raised significant concerns about the production of Tesla's lower-cost 4680 battery cells, crucial for the affordable EV model and the Cybertruck, amid a slowing electric vehicle market and intensifying competition.

🚀 Ondas Holdings (ONDS)

Ondas saw its stock surge by 8.56% after announcing $10 million in new purchase orders for its autonomous drone and wireless systems.

This news highlighted strong demand from government and critical infrastructure clients, reinforcing the company's strong position in the rapidly growing autonomous technology market.

⬇️ Baidu (BIDU)

Baidu's stock declined 1.30% despite announcing a proposed spin-off of its AI chip unit. The market reacted to concerns about rising debt, a recent drop in quarterly revenue, and struggles in its core advertising business.

The AI chip unit's potential was not enough to offset the immediate financial pressures facing the Chinese tech giant.

What’s Next?

Key market and macro news 👇

📊 S&P 500 strategists surveyed by CNBC expect another potential double-digit advance in 2026 despite volatility concerns.

❓Focus shifts to whether markets can extend the three-year winning streak into a fourth consecutive year of gains.

📈 Investors are monitoring whether corporate earnings growth can justify current elevated valuations amid range-bound expectations.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.