- Ziggma

- Posts

- 🗞 Google Disappoints Wall Street

🗞 Google Disappoints Wall Street

and China targets Apple

Bulls, Bitcoin, & Beyond

Market Moves Yesterday

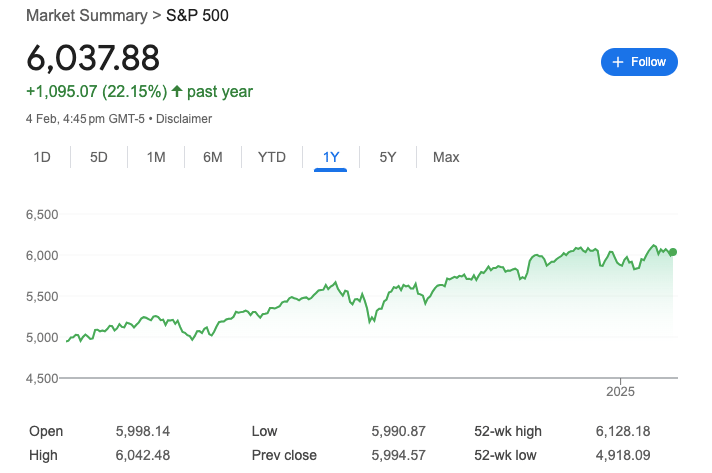

S&P 500 @ 6,037.88 ( ⬆️ 0.72%)

Nasdaq Composite @ 19,654.02 ( ⬆️ 1.35%)

Bitcoin @ $97,868.11 ( ⬇️ 0.09%)

Hey Scoopers,

Happy Wednesday! Are you ready to tackle the midweek mania?

👉 Alphabet’s revenue miss

👉 AMD’s mixed earnings

👉 Global gold demand touches record high

So, let’s go 🚀

Market Wrap

Hey, Scoopers!

Palantir stole the show on Tuesday with a jaw-dropping 24% surge after delivering outstanding Q4 results.

The tech darling's success even gave Nvidia a friendly boost, with the chip champion climbing 1.7%. Talk about spreading the wealth!

🌍 Global Trade Drama Heats Up

Things are getting spicy in the international trade arena! China is imposing new tariffs—up to 15% on U.S. coal and LNG, plus a 10% bump on crude oil and other goods.

But here's where it gets interesting: our North American neighbors are getting a breather! Both Canada and Mexico scored a 30-day tariff timeout from Team USA.

🎯 Expert Corner

Infrastructure Capital's Jay Hatfield is not sweating over the ongoing trade war.

His hot take? Everyone's too worried about these tariffs. With an S&P 500 target of 7,000, the analyst sees a silver lining where others see storm clouds.

Hatfield emphasized that these are "political tariffs, not economic tariffs," and his bullish outlook suggests there might be a method to the madness!

Trending Stocks 🔥

Chipotle Mexican Grill - Shares of the burrito chain are down 6% in pre-market after same-store sales in Q4 missed estimates.

Electronic Arts - Shares of the video game company are up 3% after it posted fiscal Q3 results that beat estimates.

Apple - Shares of the iPhone maker are down 2% after China is probing its App practices.

Google's Mixed Bag

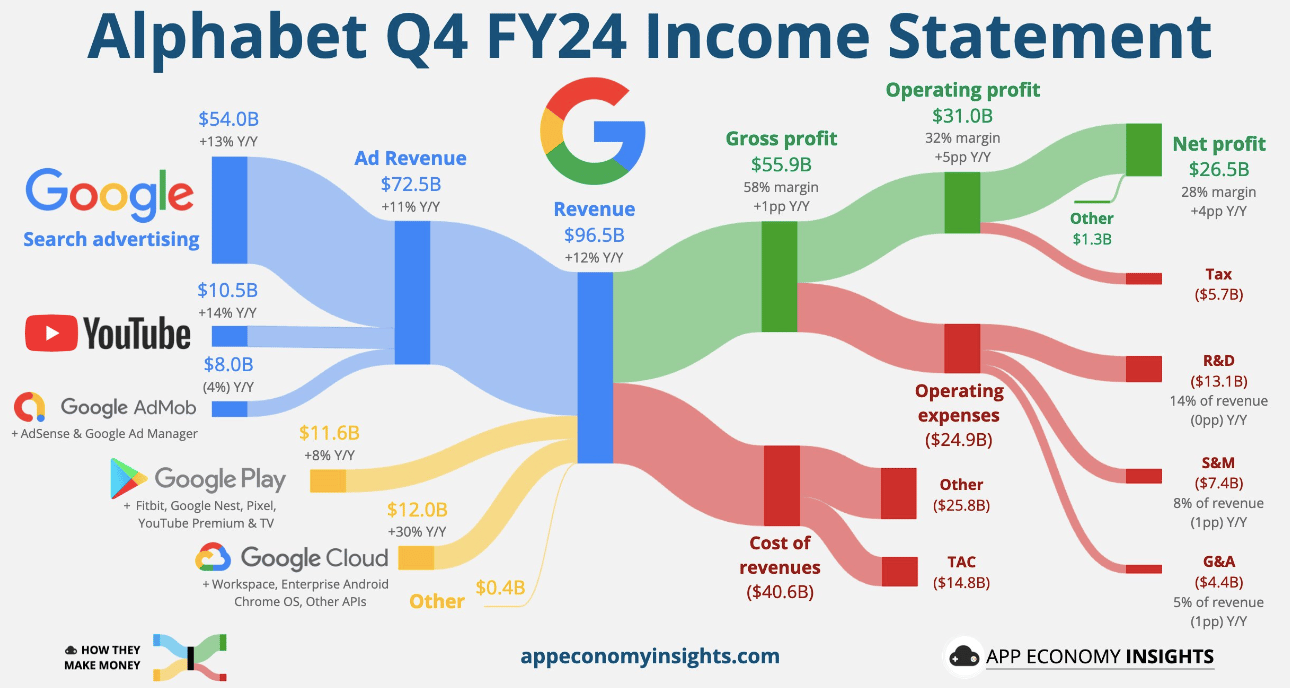

Whew, what a rollercoaster for Google's parent company! Following its Q4 results, Alphabet shares plunged 7% in after-hours trading.

While it squeaked past earnings expectations by two pennies per share, revenue came in slightly under target at $96.47 billion.

💰 The Big AI Bet

Hold onto your wallets, folks! CEO Sundar Pichai dropped a bombshell: Alphabet plans to invest $75 billion in capital expenditures by 2025.

That's way above the expected $59 billion, with a chunky $16-18 billion planned for Q1 alone.

Why? It's all about that AI infrastructure - we're talking servers, data centers, and plenty of computing muscle.

📊 By the Numbers

YouTube ads brought in $10.47 billion, beating expectations

Cloud revenue fell short at $11.96 billion

Overall revenue growth slowed to 12% year over year

The Other Bets segment (including Waymo) saw a 39% revenue drop

🏃♂️ The AI Race Heats Up

Alphabet isn't alone in this spending spree—Meta plans to invest $60-65 billion in AI this year, while Microsoft has committed to a massive $80 billion.

Meanwhile, there's a buzz that China's DeepSeek is making waves in the AI world and pushing U.S. companies to innovate faster.

Your 2024 Precious Metals Pulse

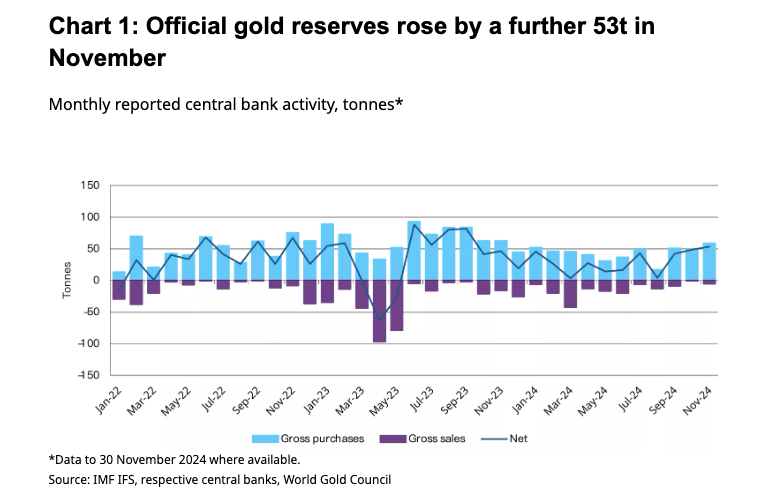

🏆 Breaking Records

Talk about a golden year! 2024 saw global gold demand soar to an all-time high of 4,974 tons. What's driving this glittering success? Let's dive in!

🏦 Central Banks Can't Get Enough

Central banks scooped up over 1,000 tons of gold for the third year running. Leading the pack:

Poland's central bank added a whopping 90 tons

Turkey: Close behind with 75 tons

India: Steady monthly purchases (except December)

💰 Investment Boom

Investment demand shot up 25% to a four-year high of 1,180 tons.

China and India led the charge in bar and coin demand, while ASEAN markets (Singapore, Indonesia, Malaysia, Thailand) all posted impressive double-digit growth.

💍 Jewelry's Golden Struggle

Not all that glitters is selling!

Jewelry demand took an 11% hit as high prices kept shoppers away. This trend might stick around, with gold prices hitting 40 record highs in 2024 (reaching $2,875.8 per ounce!).

🔮 Looking Ahead

2025's forecast? Expect central banks to keep driving demand, with ETF investors jumping back in as interest rates potentially ease. The golden age isn't over yet! ✨

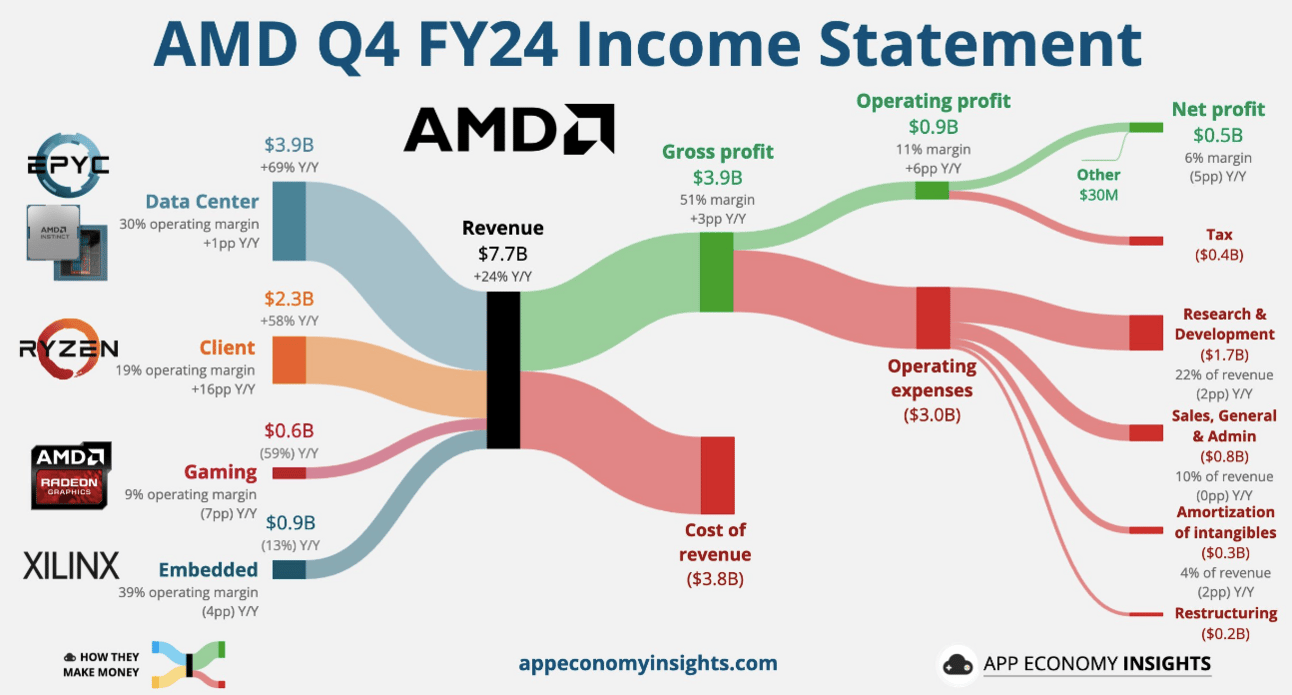

The AMD Update

📊 Numbers at a Glance

AMD had a mixed Q4. While it beat overall expectations with $7.66 billion in revenue and EPS of $1.09, after-hours trading told a different story, as shares are down 6%.

Here’s why 👇

🎯 Data Center Drama

AMD's data center segment reported sales of $3.86 billion (up 69% year-over-year), but Wall Street wanted more ($4.14 billion, to be exact).

Still, their AI GPU business is flexing, with $5 billion in sales for 2024. That's not too shabby!

💻 Client Comeback

Talk about a turnaround! Client revenue (think PCs and laptops) surged 58% to $2.3 billion. But it wasn't all sunshine as gaming GPU sales dropped 59% to $563 million.

🔮 Crystal Ball

CEO Lisa Su is optimistic about 2025, promising "strong double-digit percentage revenue and EPS growth."

Q1 guidance? A cool $7.1 billion (plus or minus $300 million).

🏃♂️ The AI Race

While they're still playing catch-up with Nvidia, AMD's making moves!

Meta and Amazon are already using AMD’s MI300X chips, and Su is betting that the AI business will grow from $5 billion to "tens of billions" in the coming years.

Game on! 🚀

Headlines You Can't Miss!

Novo Nordisk shares gain on Q4 earnings beat

TotalEnergies reports a 21% drop in profits

Toyota Motors reports a 28% drop in operating profit

Google removes pledge to not use AI for weapons

El Salvador increases BTC reserve to 6,068

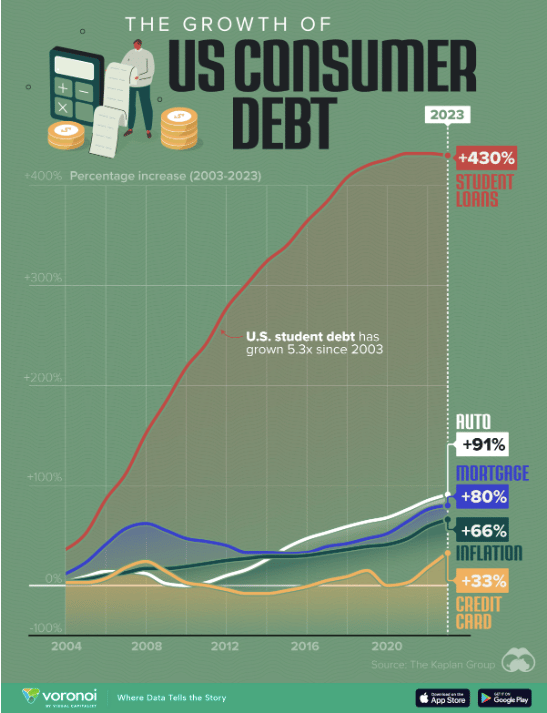

Chart of The Day

Meme of the Day

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.