- Ziggma

- Posts

- 🗞️ Google 🤝 Anthropic

🗞️ Google 🤝 Anthropic

Big Moves Decoded: Ford, AAL, and IBM

Market Performance

S&P 500: 6,791.69 ⬆️ 0.79%

Nasdaq: 23,204.87 ⬆️ 1.15%

Dow Jones: 47,207.12 ⬆️ 1.01%

Alphabet’s Cloud Power Play

Anthropic, the AI safety-focused rival to OpenAI, has officially expanded its partnership with Alphabet's (GOOGL) Google in a cloud computing deal worth tens of billions of dollars.

Under the agreement, Anthropic gains access to up to one million of Google's custom-designed Tensor Processing Units (TPUs) to train and run its Claude large language models.

This cloud deal validates Google's unique TPU technology. Anthropic specifically chose Google's chips "due to their price performance and efficiency," highlighting a critical competitive advantage as AI companies scrutinize infrastructure costs more closely.

The partnership will add over a gigawatt of compute capacity by 2026, supporting Anthropic's surging $7 billion revenue run rate.

This is significant given that both tech giants have invested billions in Anthropic, with Google contributing approximately $3 billion and Amazon pledging around $8 billion.

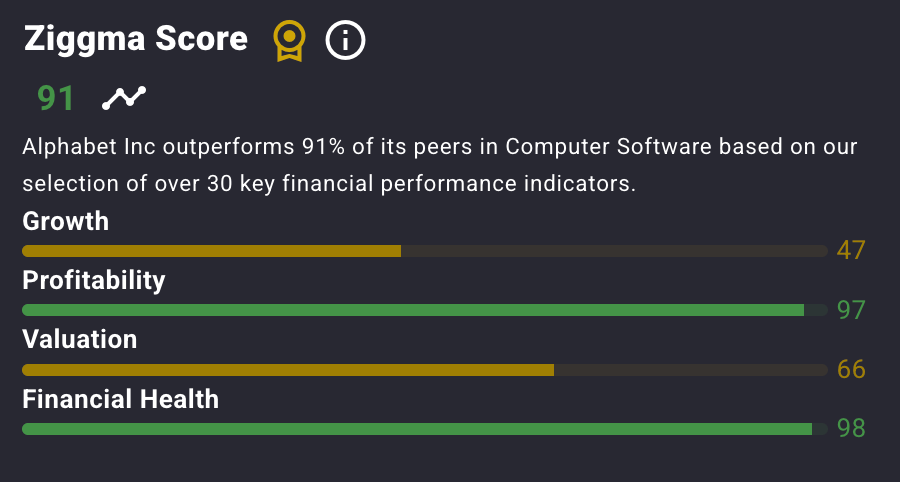

Alphabet stock has a Ziggma score of 91, and ranks in the top percentile for profitability and financial health.

Our Takeaway

This deal reinforces Google's position in the intensifying cloud infrastructure battle against Microsoft Azure and Amazon AWS.

For Anthropic, securing massive compute access from multiple providers maintains its independence while fueling rapid growth.

The AI race increasingly hinges on compute capacity, and Alphabet just demonstrated it has the chips to compete.

Free email without sacrificing your privacy

Gmail is free, but you pay with your data. Proton Mail is different.

We don’t scan your messages. We don’t sell your behavior. We don’t follow you across the internet.

Proton Mail gives you full-featured, private email without surveillance or creepy profiling. It’s email that respects your time, your attention, and your boundaries.

Email doesn’t have to cost your privacy.

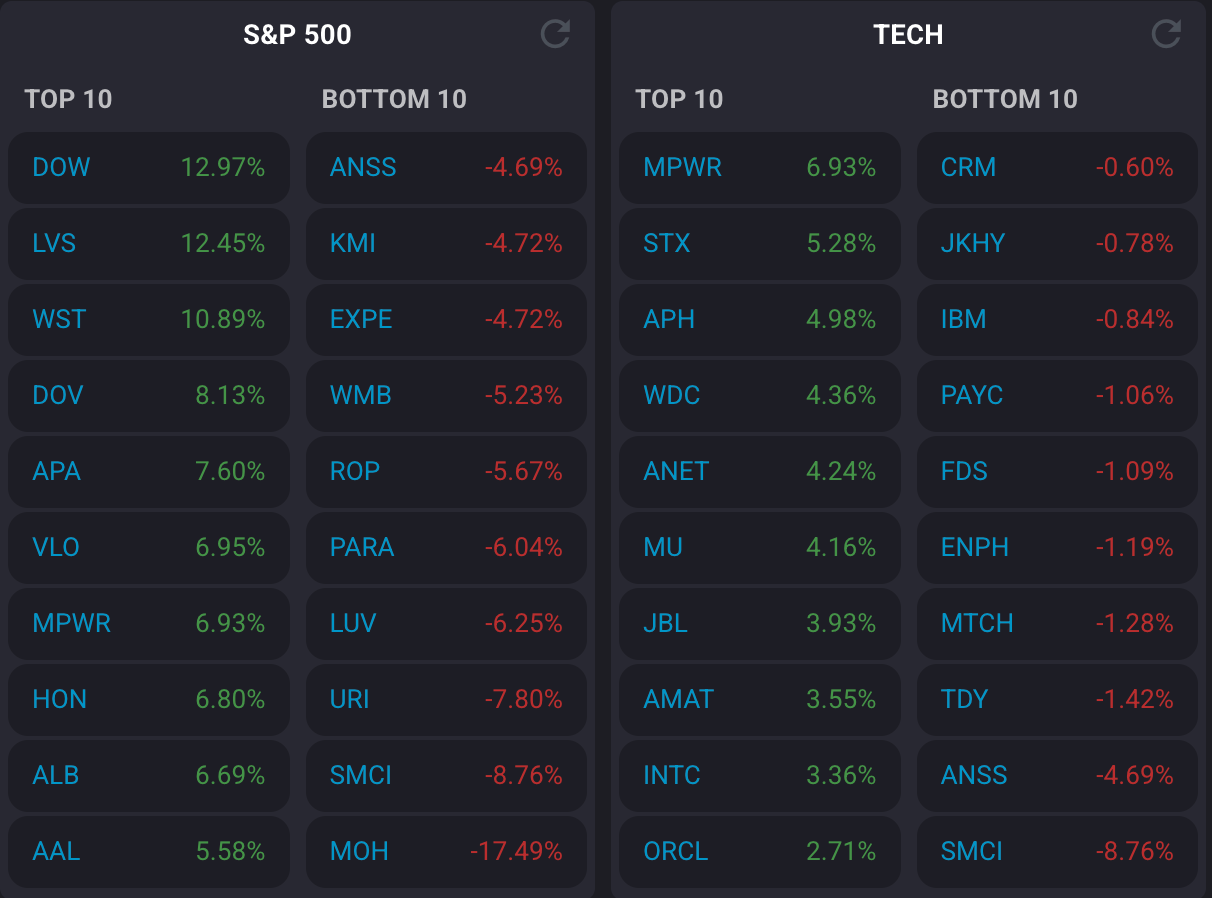

Market Overview 📈

U.S. stocks surged to new heights on Friday as cooler-than-expected inflation data sparked optimism that the Federal Reserve can continue its rate-cutting path.

The September consumer price index rose just 0.3% on the month, bringing annual inflation to 3%—below the 3.1% economists expected. Core CPI came in at 0.2% monthly and 3% annually, also lighter than forecasts.

Following the benign CPI report, traders dramatically increased bets on Fed rate cuts. Odds for a December rate cut jumped to 98.5% from roughly 91% before the data, according to the CME FedWatch tool.

The prospect of continued monetary easing sent bank stocks soaring, with JPMorgan, Wells Fargo, and Citigroup each rising 2%.

The milestone session saw the Dow secure its first-ever close above 47,000, while all three major indexes notched their second consecutive winning week with gains of around 2%.

The S&P 500 is now up 15% year-to-date, and the Nasdaq has surged 20%.

Goldman Sachs Asset Management's Lindsay Rosner noted: "There was little in today's benign CPI report to 'spook' the Fed and we continue to expect further easing at next week's Fed meeting."

Despite trade tensions—President Trump terminated negotiations with Canada over an Ontario advertisement featuring Ronald Reagan criticizing tariffs—markets remained focused on the positive inflation data and strong corporate earnings momentum.

Stock Moves Deciphered 📈

👟 Deckers (DECK) | ⬇️ 15%

Shares of footwear maker Deckers plunged after the company issued a disappointing outlook for fiscal 2026, trimming sales guidance for its key growth drivers—Hoka and Ugg.

The company now expects Hoka, its up-and-coming running shoe brand, to grow by only a low-teens percentage, down sharply from 24% growth in the prior year.

Ugg is expected to grow in the low- to mid-single-digit percentage range after posting 13% growth last year.

🚗 Ford (F) | ⬆️ 12%

The automaker reported adjusted earnings per share of 45 cents on revenue of $47.19 billion, crushing Wall Street expectations of 36 cents per share on $43.08 billion in revenue.

While Ford reduced its full-year guidance due to impacts from a fire at a key aluminum supplier, the market looked past this temporary disruption and focused on the underlying operational strength.

The company's ability to significantly exceed quarterly expectations demonstrated resilience in its core business and effective cost management.

🤖 IBM (IBM) | ⬆️ 7.9%

IBM shares soared to a record high following a major breakthrough in quantum computing error correction, achieved through collaboration with AMD.

This advancement solidifies IBM's leadership position in the emerging quantum computing industry, a field that could revolutionize computing power for complex problem-solving across sectors.

The partnership leverages AMD's chips to implement sophisticated error-correction techniques, addressing one of quantum computing's most significant technical challenges.

✈️ American Airlines (AAL) | ⬆️ 7.9%

American Airlines delivered a strong third-quarter performance, returning to profitability with a solid operating profit that exceeded investor expectations.

The airline has been strategically focused on outfitting premium cabins to capture higher-margin revenue from business and luxury travelers.

This strategy appears to be paying off as demand for premium travel experiences remains robust despite broader economic uncertainties.

Headlines You Can't Miss 👀

💰 Coinbase: Stock rose 3% after JP Morgan upgraded to overweight with a $404 price target, citing promising subscription services and DeFi platform developments.

🛒 Target: Shares rose after announcing an 8% corporate workforce reduction impacting 1,800 jobs—its first major layoff in a decade.

🖥️ Procter & Gamble: Stock jumped 2% on Q1 earnings beat with adjusted EPS of $1.99 versus $1.90 expected, maintaining full-year guidance.

💻 Intel: Shares surged 7% after Q3 sales beat estimates at $13.65 billion versus $13.14 billion expected, signaling recovering PC processor demand.

🌐 U.S.-China Relations: Chinese Commerce Minister Wang Wentao stressed that "dialogue and cooperation are the only right choice" ahead of the expected presidential meeting on October 30.

🎯 Earnings Season: Companies beating consensus estimates have delivered a median beat of ~6% and outperformed by 67 basis points, well above the long-term median of 33 basis points, according to Barclays.

Trending Stocks 📊

⛏️ Albemarle (ALB) | ⬆️ 9.1%

The specialty chemicals company saw shares jump after investment firm Rothschild & Co. issued a fresh "Buy" rating with a $135 price target.

The upgrade reflects renewed bullish sentiment on Albemarle's positioning in the lithium market and the battery materials sector, suggesting potential upside as global electric vehicle adoption continues despite near-term pricing pressures.

🛖 Mohawk Industries (MHK) | ⬇️ 7.1%

The flooring manufacturer tumbled after issuing a weak fourth-quarter profit forecast, citing persistent weak demand in the housing market.

The company pointed to challenging economic conditions, including elevated mortgage rates and reduced home sales activity, which continue to pressure demand for its products across both residential and commercial segments.

🥇 Newmont (NEM) | ⬇️ 4.0%

Despite beating third-quarter earnings estimates, the gold mining giant fell on disappointing production guidance and warnings of lower free cash flow ahead.

Investors engaged in profit-taking after the stock's recent rally, with concerns that operational challenges may limit near-term upside despite elevated gold prices and the company's strong balance sheet.

What’s Next?

Key market and macro news 👇

📊 Durable Goods Orders Data: The September durable goods orders report is scheduled for release. However, its publication is at risk due to the ongoing U.S. government shutdown.

🏠 New Home Sales Data: September's new home sales figures are also expected. This key housing market indicator may be delayed by the federal government shutdown, impacting market analysis.

🤝 Trump-Xi Meeting: The upcoming meeting between the U.S. and Chinese presidents on October 30th will be closely watched for any developments regarding trade relations and tariffs.

💰 Magnificent Seven Earnings: A pivotal week for big tech, with earnings reports from Microsoft, Apple, Amazon, Meta, and Alphabet expected to influence market direction and sentiment heavily.

💸 Revvity Earnings: The medical services company will report its Q3 earnings. Analysts expect a decline in earnings per share compared to the previous year, which could affect its stock price.

📣 Carter's Earnings: The apparel company is expected to report a substantial decrease in Q3 earnings. This could signal headwinds in the retail sector and impact investor sentiment.

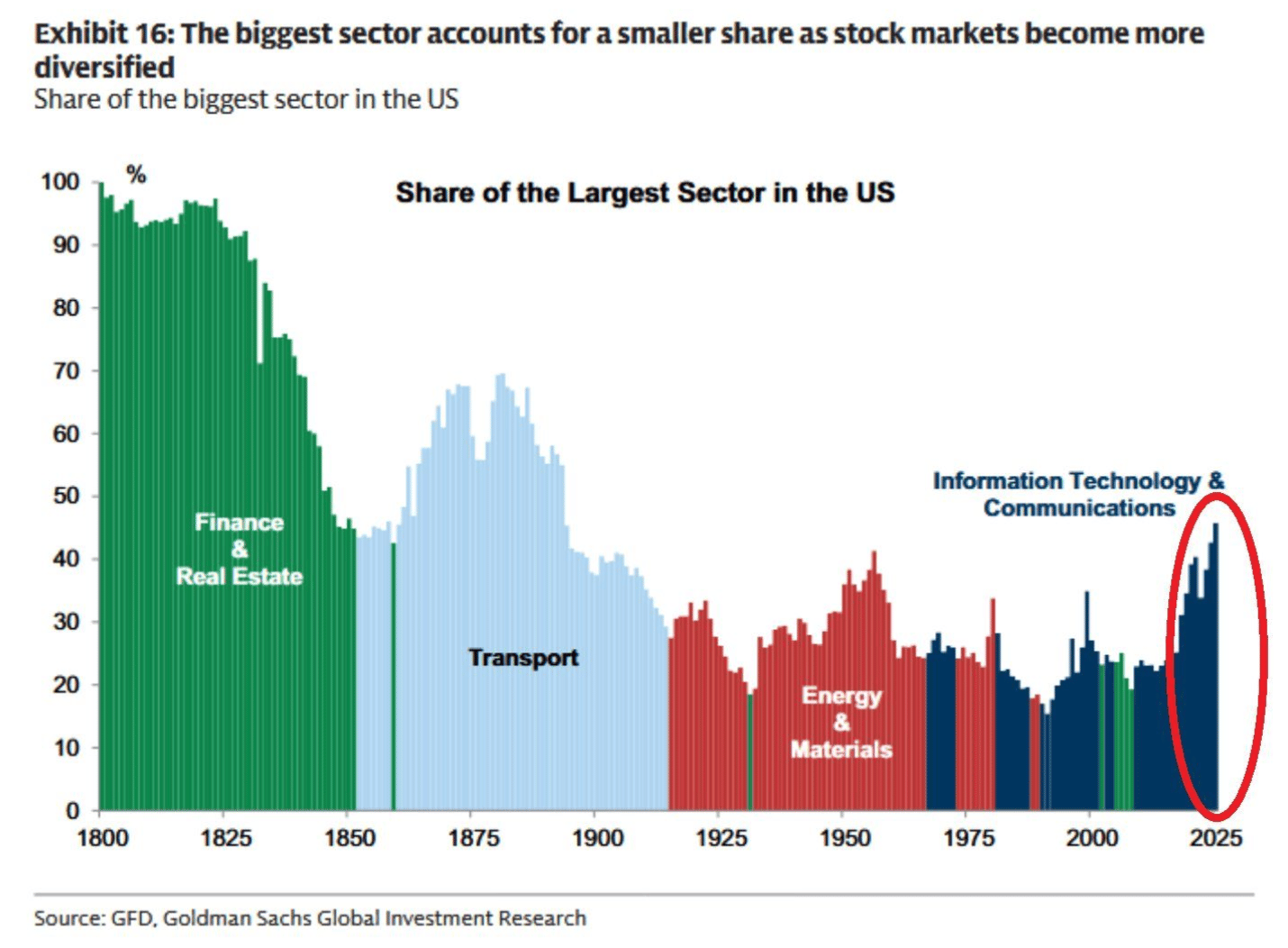

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.