- Ziggma

- Posts

- 🗞️ Ford's $2 Billion EV Plan

🗞️ Ford's $2 Billion EV Plan

Ford, INTC, EA, and more!

Market Performance

S&P 500: 6,373.45 (⬇️ 0.25% )

Nasdaq: 21,385.40 (⬇️ 0.30%)

Dow Jones: 43,975.09 (⬇️ 0.45%)

Ford’s Bold EV Gambit

Ford (F) on Monday announced a $2 billion investment in its Louisville, Kentucky assembly plant to build affordable electric vehicles, marking what CEO Jim Farley calls the company's next "Model T moment."

The investment, combined with a $3 billion battery park in Michigan, will create nearly 4,000 jobs.

Ford's new "Universal EV Program" will start with a midsize electric pickup priced at $30,000, roughly equivalent to the original Model T when adjusted for inflation.

This aggressive move comes as traditional automakers face mounting pressure from Chinese competitors like BYD, which recently outsold Tesla in Europe for the first time.

Ford's strategy centers on lithium iron phosphate batteries assembled in the U.S., not imported from China, positioning the company to navigate potential trade tensions.

The Louisville plant will employ about 600 fewer workers than its current configuration, but represents Ford's commitment to affordable EVs as the industry confronts shifting policies under President Trump, including the end of EV tax credits after September 30.

Our Takeaway

Ford is making a necessary but risky bet on affordable EVs.

With Chinese automakers proving tariffs won't stop them and Tesla struggling in key markets, Ford's $30,000 price point could be the differentiator that helps American automakers compete globally.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Market Overview

Stocks fell on Monday as traders braced for key inflation reports due this week.

The consumer price index, set for release today, and the producer price index on Thursday will be critical in shaping Federal Reserve policy for the September meeting.

Economists forecast July CPI will show a 0.2% monthly increase and 2.8% annually, with core CPI expected to rise 0.3% monthly and 3.1% yearly.

While markets price in an 87% chance of a September rate cut, analysts warn investors may be getting ahead of themselves.

President Trump extended the tariff deadline on Chinese goods by another 90 days, though markets showed little reaction to the widely anticipated move.

The dollar index hit its highest level since August 1, while Treasury yields remain elevated amid deficit concerns.

Meanwhile, cannabis stocks surged on reports that Trump is considering reclassifying marijuana to a lower danger level.

Stock Moves Deciphered 📈

Electronic Arts (EA)- The gaming giant gained more than 5% after DA Davidson raised its price target on the stock from $150 to $160 while maintaining a “Neutral” outlook.

Intel (INTC) - Intel stock jumps 3.7% after Trump calls meeting with CEO Lip-Bu Tan “interesting”, days after demanding resignation.

Intuit (INTU) - Shares of the fintech platform fell by more than 5% despite strong Q2 results as analysts have raised concerns about Intuit's high valuation amid slowing growth and potential disruptions from artificial intelligence (AI) technologies.

Headlines You Can't Miss

Paramount acquired UFC rights for $7.7 billion over seven years, beginning in 2026.

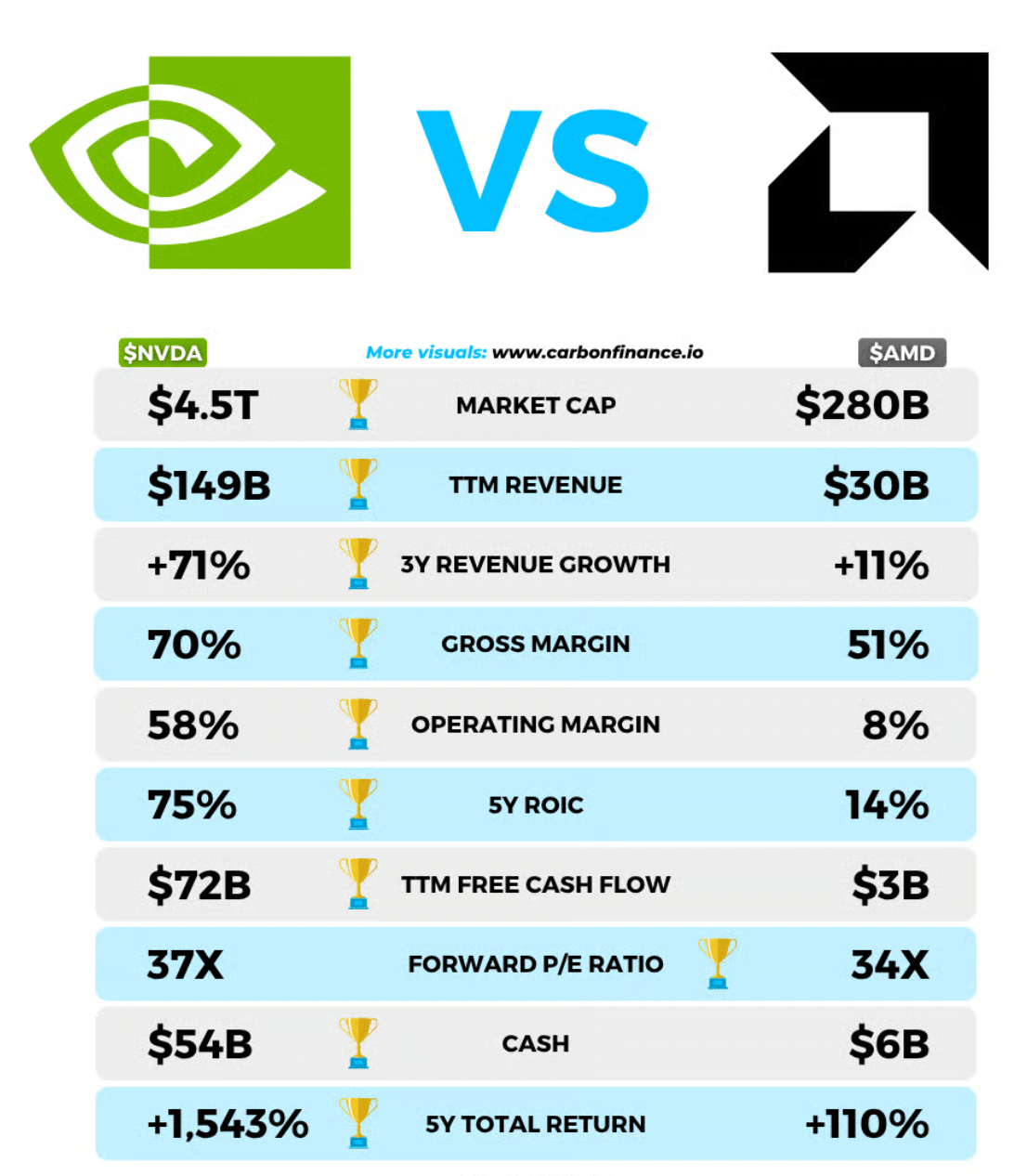

Nvidia & AMD agreed to give U.S. government 15% of China chip revenues in exchange for export licenses.

Trump announces gold will not face tariffs, sending December futures down 2.48%.

Bullish crypto exchange raised IPO size to $990 million, targeting $4.8 billion valuation.

Hershey fell 5% as cocoa futures surged 10% to the highest level since July 1.

Dollar index hit its highest level since August 1 at 99.32.

JPMorgan warns of "somewhat stagflationary backdrop" ahead in the second half of 2025.

Trending Stocks

C3.ai (AI) - The AI software company plunged 26% after issuing disappointing fiscal first-quarter guidance.

It expects revenue between $70.2-$70.4 million versus analyst estimates of $104 million. The company also announced a restructured sales organization with new regional leadership.

CEO Quote🎤: “Dealing with these health issues prevented me from participating in the sales process as actively as I have in the past. With the benefit of hindsight, it is now apparent that my active participation in the sales process may have had a greater impact than I previously thought.”

AAON (AAON) - Shares of the HVAC company dropped 12% after second-quarter results missed analyst estimates on both revenue and earnings.

AAON posted adjusted earnings of 22 cents per share on $311.6 million revenue versus expectations of 33 cents and $325 million. The company also cut full-year sales guidance.

CEO Quote🎤: “The underperformance was primarily driven by poor operational execution, mainly associated with the implementation of our new ERP system at our Longview facility. The April go-live of the new system directly impacted production of both finished products and coils at Longview.”

e.l.f. Beauty (ELF) - The beauty brand surged 9% after Morgan Stanley upgraded it to overweight from equal-weight.

The bank said consensus earnings estimates are "way too low," citing catalysts from product pricing and the acquisition contribution of the Rhode skincare brand.

CEO Quote🎤: “Our strong Q1 results, including 210 basis points of market share gains, are a continuation of the consistent, category-leading growth we’ve delivered over the past 26 quarters.”

What’s Next?

Key Earnings Today 👇

Circle (CRCL): Analysts expect the blockchain company to report revenue of $644.72 million with adjusted earnings of $0.34 per share in the June quarter.

CoreWeave (CRWV): Analysts expect the AI infrastructure giant to report revenue of $1.08 billion with adjusted losses of $0.20 per share in the June quarter.

CAVA (CAVA): Q2 revenue forecast at $285 million vs. $233 million last year. Adjusted earnings are expected to narrow from $0.17 per share to $0.13 per share.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.