Market Performance

S&P 500: 6,711.20 ⬆️ 0.34%

Nasdaq: 22,755.16 ⬆️ 0.42%

Dow Jones: 46,441.10 ⬆️ 0.09%

EV Sales are Rising for Ford, GM

American automakers just posted some of their best quarterly sales numbers in years, and it's all thanks to a last-minute rush before federal EV incentives disappeared.

Ford Motor (F) and General Motors (GM) reported roughly 8% sales increases in Q3, with EV sales more than doubling for GM and jumping 30% for Ford.

Hyundai's electric vehicle sales also doubled year-over-year.

The reason? Consumers scrambled to car dealerships before the $7,500 federal EV tax credit ended in September as part of Trump's "One Big Beautiful Bill Act."

Cox Automotive estimates that 410,000 EVs were sold in Q3, representing a 21% increase from the same period last year and capturing a record 10% market share.

GM even reclaimed its position as America's top automaker, with a 17.2% market share —the highest since 2015.

But here's the twist:

Ford CEO Jim Farley warned that EV market share could plummet from 10-12% down to just 5% now that the incentive program has ended.

Hyundai slashed pricing on its 2026 Ioniq 5 by up to $9,800 and is offering $7,500 cash incentives to match the old federal credits.

Meanwhile, GM and Ford are essentially extending the tax credit on leases through their financing arms.

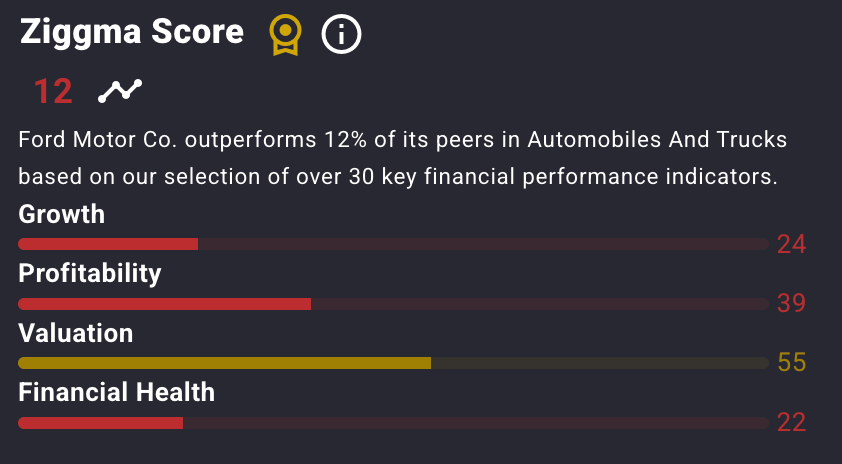

Ford stock currently has a Ziggma Stock Score of 12, and ranks in the bottom half percentile in terms of growth, profitability, and financial health.

Our Takeaway

This quarter proves EVs can compete when the price is right, but the real test starts now.

October and November sales will reveal whether the electric vehicle market can sustain momentum without federal support, or if we're headed for a steep correction.

Free email without sacrificing your privacy

Gmail is free, but you pay with your data. Proton Mail is different.

We don’t scan your messages. We don’t sell your behavior. We don’t follow you across the internet.

Proton Mail gives you full-featured, private email without surveillance or creepy profiling. It’s email that respects your time, your attention, and your boundaries.

Email doesn’t have to cost your privacy.

Market Overview 📈

The S&P 500 closed at a record high on Wednesday despite the U.S. federal government entering a shutdown after midnight.

Markets shrugged off shutdown concerns, with traders betting the stoppage will be brief and have minimal economic impact.

Health-care stocks led the gains with significant rallies in Regeneron Pharmaceuticals and Moderna.

However, the shutdown creates uncertainty around key economic data.

The Labor Department announced it would halt virtually all activity, meaning the September nonfarm payrolls report won't be released as scheduled.

Adding to labor market concerns, ADP reported that private payrolls fell by 32,000 in September, the largest decline since March 2023 and significantly below the 45,000 gain economists had expected.

Treasury yields dropped following the release of the disappointing jobs data, with the 10-year Treasury yield falling to 4.106%.

Prediction markets on Kalshi suggest the shutdown could last 11 days, while Polymarket traders give a 38% probability it won't end until October 15 or later.

Despite the data blackout, analysts believe the Federal Reserve will proceed with its expected rate cut later this month.

Stock Moves Deciphered 📈

AES Corporation (AES) ⚡️

AES shares surged over 16% following reports from the Financial Times that BlackRock-owned Global Infrastructure Partners is in late-stage talks to acquire the Virginia-based renewable and thermal power producer in a multi-billion-dollar deal.

The acquisition is seen as a strategic move to capitalize on the growing energy demands of artificial intelligence data centers.

The company's diverse portfolio of renewable and thermal power assets makes it an attractive target as energy infrastructure becomes increasingly critical for powering AI operations.

Biogen (BIIB) 💊

Biogen gained over 10% on positive regulatory developments for its Alzheimer's drug Leqembi in China, marking a significant milestone for the company's international expansion.

Investment bank Jefferies upgraded the stock to "Buy," citing improved confidence in the company's Alzheimer's franchise outlook and potential for broader adoption of Leqembi.

The Chinese market represents a massive opportunity for Alzheimer's treatments given the country's aging population.

Nike (NKE) 👟

Nike's stock rose by more than 6% after the company reported better-than-expected first-quarter earnings, indicating that its turnaround efforts are gaining traction.

However, profits fell 31% and gross margin dropped 3.2 percentage points to 42.2%, indicating the company is still working through excess inventory.

The sales growth suggests Nike's strategic initiatives under its turnaround plan are starting to resonate with consumers, though margin pressure remains a concern.

Headlines You Can't Miss 👀

📊 Supreme Court rules Fed Governor Lisa Cook can keep her job pending oral arguments in January despite Trump's push to fire her.

💊 Drug stocks rallied as Pfizer secured a three-year tariff exemption in exchange for domestic manufacturing investments and Medicaid drug discounts; Pfizer, Merck, Eli Lilly, and Amgen all gained 6%.

🏦 Financial stocks fell broadly as JPMorgan and Goldman Sachs lost 0.6%, Wells Fargo dropped 0.8%, and Citigroup shed 1% amid concerns about the shutdown.

🍰 Conagra rose 4% after first-quarter revenue, adjusted EBITDA, and earnings per share all topped Wall Street estimates.

💻 Fermi America jumped over 40% in its first day of trading after raising $683 million in its IPO. The data center developer plans an 11-gigawatt campus in Texas.

🏋️ Peloton shares climbed 3% after announcing a relaunched product line featuring AI-powered tracking and price increases for subscriptions and hardware.

💵 Dollar index fell 0.2% to 97.54, putting it on track for a 10% annual decline — the worst performance since 2003.

📈 The S&P 500 broke above 6,700 for the first time, reaching a fresh all-time intraday high during early afternoon trading on Wednesday.

Trending Stocks 📊

Lithium Americas (LAC) ⛏️

Lithium Americas skyrocketed 23% after U.S. Energy Secretary Chris Wright announced the government will take a 5% equity stake in both the company and its Thacker Pass lithium mine joint venture with General Motors.

Wright emphasized that this represents "economic common sense," as the government provides debt capital while ensuring that lithium is mined and refined domestically, thereby addressing national security concerns related to critical mineral supply chains.

Corteva (CTVA) 🌾

Corteva's stock fell by over 9% after announcing plans to split into two separate publicly traded companies in the second half of 2026.

The news created uncertainty among investors about the structure and valuations of the future entities, compounded by broader weakness across the agricultural sector as commodity prices remain under pressure and farming economics remain challenging.

Interpublic Group (IPG) 💸

Interpublic Group's stock dropped by more than 5% due to ongoing weakness in the advertising sector.

Investors are growing increasingly concerned that a slowing economy and potential recession could prompt corporations to reduce their marketing budgets.

What’s Next?

Key earnings and macro news 👇

📈 New IPOs: Commercial Bancgroup (CBK) prices its upsized IPO, while Black Titan Corporation (BTTC) lists on Nasdaq.

₿ ETF Launches: Bitwise, Carillon, and Vanguard are all launching new funds on NYSE Arca.

🔒 Government Shutdown Day 2: The ongoing US government shutdown continues to impact markets.

✂️ Fed Rate Cut Bets: Markets are pricing in a 100% probability of a rate cut by the Federal Reserve in October, primarily driven by economic uncertainty stemming from the shutdown.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.