- Ziggma

- Posts

- Elon Musk's $1T Payout

Elon Musk's $1T Payout

Big Moves Decoded: ELF, DUOL, and more!

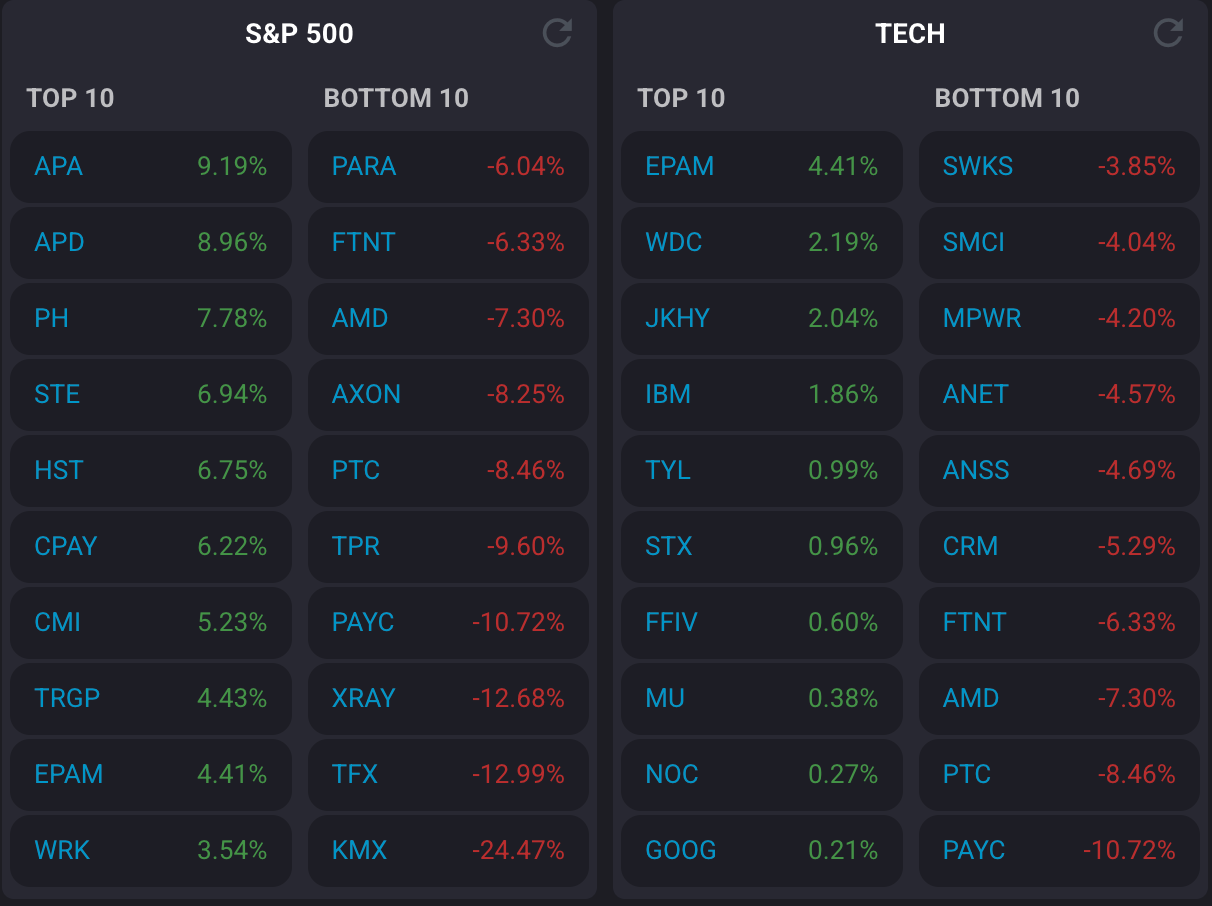

Market Performance

S&P 500: 6,720.32 ⬇️ 1.12%

Nasdaq: 23,053.99 ⬇️ 1.9%

Dow Jones: 46,912.30 ⬇️ 0.84%

Elon Musk’s $1 Trillion Payout is Approved

Tesla shareholders overwhelmingly approved CEO Elon Musk's audacious pay package with 75% support, potentially making it the largest executive compensation plan in corporate history.

The package includes 12 tranches of stock awards tied to ambitious milestones, including:

🚀 Market cap targets ranging from $2 trillion to $8.5 trillion

💰 Annual adjusted profits from $50 billion to $400 billion

🚗 20 million vehicle deliveries

🧑💻 10 million FSD subscriptions

🤖 1 million Optimus robots

This approval comes after Delaware's Court of Chancery struck down Musk’s 2018 compensation plan.

The new structure would boost Musk's ownership from 13% to 25%, granting him significantly more control over the company he leads—alongside running xAI, SpaceX, Neuralink, and The Boring Company.

Our Takeaway

While the market cap and operational targets seem stratospheric, Musk has a track record of achieving what others deem impossible.

However, investors should note that the plan includes "covered events" clauses that could allow payouts even if not all milestones are met.

With no restrictions on his political activities or minimum time commitments to Tesla, this unprecedented compensation structure raises questions about governance and shareholder value protection.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

Now open at $0.81/share, allocations limited – price moves on 11/20.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Market Overview 📈

U.S. equities tumbled on Thursday as AI stocks faced renewed valuation concerns, with the Nasdaq suffering its worst week since early April.

The tech-heavy index plunged 1.9%, dragged down by heavyweights Nvidia, Microsoft, Palantir, Broadcom, and AMD, all of which declined sharply due to profit-taking.

Adding to market anxiety, October layoff announcements surged to 153,074—the highest for the month in 22 years and nearly triple September's figures.

This represents a 175% increase year-over-year, marking 2025 as the worst year for job cuts since 2009.

The disruptive impact of AI on employment is becoming increasingly evident.

The Supreme Court heard arguments on Wednesday regarding Trump's tariff policies, with justices expressing skepticism about their legality.

The 30-year Treasury yield hit its highest level since October 2023 as concerns about ballooning deficits intensified.

Meanwhile, the month-long government shutdown—now the longest in U.S. history—continues to limit economic data availability, leaving investors flying blind on key indicators.

Market technicals suggest further weakness ahead unless the consumer holds up during the holiday season.

Stock Moves Deciphered 📈

🚘 CarMax (KMX)

The used car retailer's shares plummeted by over 24% after announcing its CEO's immediate departure, alongside a weak preliminary Q3 outlook.

The sudden leadership vacuum, combined with deteriorating business fundamentals, shattered investor confidence and sent the stock to multi-year lows.

🩻 Teleflex (TFX)

Shares plunged 13% despite beating Q3 earnings and revenue estimates, as the medical device maker slashed its full-year revenue guidance.

A significant goodwill impairment charge further dampened sentiment. Investors fled as the company's outlook deteriorated dramatically from previous expectations.

💸 Paycom (PAYC)

The payroll software provider tumbled over 10% after Q3 earnings missed analyst expectations.

While revenue grew year-over-year, profitability fell short of forecasts, prompting Jefferies to slash its price target.

Headlines You Can't Miss 👀

📊 Supreme Court likely to strike down Trump tariffs, Jefferies analysts predict, after justices questioned revenue-raising authority under IEEPA during Wednesday's hearing.

💊 Trump announces GLP-1 drug pricing deals with Eli Lilly and Novo Nordisk, lowering the costs of weight loss medications for Medicare/Medicaid users starting in 2026.

💰 Charles Schwab to acquire Forge Global for $660M, expanding retail investor access to private company shares like SpaceX and Anthropic.

🏥 Eli Lilly reveals promising obesity drug data for eloralintide, showing up to 20.1% weight loss in trials, strengthening its competitive moat in the GLP-1 market.

🏆 Ten S&P 500 stocks hit all-time highs, including American Express, Micron, Seagate, and Western Digital, while 21 names touched 52-week lows.

🥇 Gold retail buying plateaus, JPMorgan reports, with futures pulling back 5% from October's record high of $4,359.40 per ounce.

🤝 SoftBank explored a potential Marvell takeover earlier this year to combine it with Arm Holdings, though no active negotiations currently exist.

Trending Stocks 📊

💄 e.l.f. Beauty (ELF)

The guidance miss suggests intensifying competitive pressures in the beauty space and raises questions about e.l.f.'s ability to maintain its rapid growth trajectory.

🧑💻 Duolingo (DUOL)

The language learning platform plunged 25% on disappointing guidance as management prioritized long-term user growth over near-term monetization.

Q4 bookings guidance of $329.5-$335.5 million fell short of the $344.3 million estimate, while adjusted EBITDA forecasts also missed expectations.

🥤 Celsius Holdings (CELH)

Shares tumbled 25%, marking their worst day since March 2020, after management warned that integrating newly acquired Alani Nu into PepsiCo's distribution network would put pressure on results.

The company flagged Q4 as "noisy" due to incremental freight costs and tariff impacts on margins.

What’s Next?

Key market and macro news 👇

⚡️ Constellation Energy (CEG) Q3 Earnings: Analysts expect EPS of $3.12 (up 13.9% year-over-year) on revenue of $6.55 billion (flat year-over-year).

⛽️ Duke Energy (DUK) Q3 Earnings: Wall Street forecasts EPS of $1.75 (up 8.0% year-over-year) on revenue of $8.55 billion (up 4.9% year-over-year).

🔥 Enbridge (ENB) Q3 Earnings: Consensus estimates point to EPS of $0.39 (down from $0.55 year-over-year) on revenue of $10.86 billion.

👩💼 The U.S. Bureau of Labor Statistics is expected to release key jobs data, including the unemployment rate, non-farm employment change, and average hourly earnings.

📊 The preliminary release of the University of Michigan's Consumer Sentiment and Inflation Expectations survey will be closely watched. This report gauges consumer confidence in the economy and their outlook on inflation.

🇨🇳 The release of China's October trade data, including exports and imports, is expected to impact the market. Slower growth in China could have ripple effects across the global economy.

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.