- Ziggma

- Posts

- 💰 Elon Musk's $1 Trillion Payday

💰 Elon Musk's $1 Trillion Payday

PLUS: Why is Etsy rising?

Market Performance

S&P 500: 6,495.15 ⬆️ 0.21%

Nasdaq: 21,798.70 ⬆️ 0.45%

Dow Jones: 45,514.95 ⬆️ 0.25%

Tesla’s Trillion Dollar Pay Plan 💸

Tesla (TSLA) is asking investors to approve yet another massive pay plan for CEO Elon Musk worth approximately $975 billion.

Yes, you read that right. Musk’s total compensation may increase to a trillion dollars if he hits all milestones over the next decade.

This proposed plan consists of 12 tranches of shares tied to ambitious benchmarks, including reaching an $8.5 trillion market cap (starting at $2 trillion) and operational targets like delivering 20 million vehicles, 10 million FSD subscriptions, and one million robots.

Tesla Chairwoman Robyn Denholm defended the plan, stating it's designed to keep Musk "motivated and focused" with 1% equity for each half-trillion dollars of market cap growth.

The timing is bold given Tesla's multi-quarter sales slump, aging vehicle lineup, and Musk's divided attention across SpaceX, xAI, Neuralink, and X.

Tesla shareholders will also vote on whether the company should invest in Musk's AI venture, xAI.

This comes after Delaware courts struck down Musk's previous $56 billion pay package, calling it excessive and improperly granted.

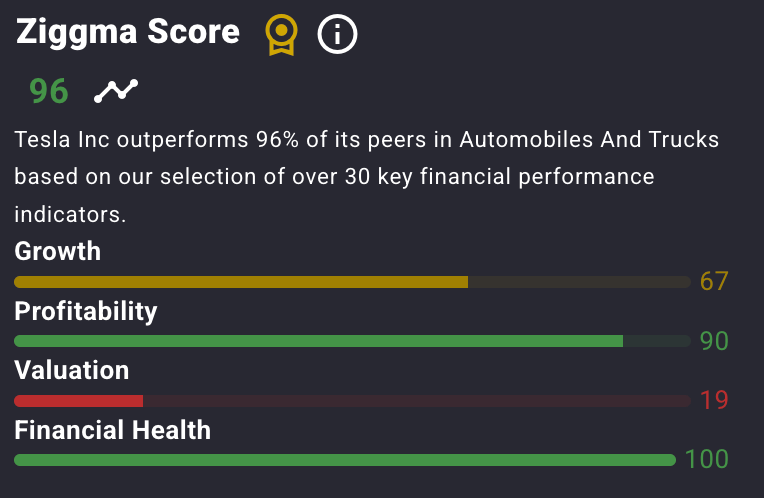

Tesla is an automobile stock and has a Ziggma score of 96. However, it still ranks in the bottom percentile in terms of valuation.

Our Takeaway

While the milestones are ambitious, this plan raises questions about corporate governance and whether any CEO, regardless of track record, deserves compensation approaching a trillion dollars.

The operational targets may be achievable, but the market cap goals seem astronomical given current headwinds.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Market Overview 📈

The S&P 500 ended Monday with modest gains as investors positioned ahead of two critical inflation reports this week.

The Nasdaq hit a record high, driven by semiconductor strength, with Broadcom gaining 3% and Nvidia recovering nearly 1% from recent losses. Amazon and Microsoft also contributed to the tech rally.

Investors are awaiting Wednesday's Producer Price Index and Thursday's Consumer Price Index reports for insights into Federal Reserve policy following Friday's weak jobs data.

The lackluster employment figures fueled hopes for September rate cuts, with traders pricing in a potential half-point reduction.

"There just continues to be great momentum for AI spend, AI infrastructure buildout," noted Ross Mayfield from Baird Private Wealth Management, highlighting broad-based tech strength beyond the Magnificent Seven.

However, analysts warn of potential "downside drift" given that the market is at all-time highs during a seasonally weak period.

Stock Moves Deciphered 📈

T-Mobile US (TMUS) stock dropped almost 4% after EchoStar announced its $17 billion spectrum sale to SpaceX.

This development is expected to intensify competition within the telecommunications sector, potentially affecting the market positioning of major wireless carriers.

Etsy (ETSY) stock surged over 7% following the appointment of Rafe Colburn as Chief Product and Technology Officer, effective September 25.

The leadership change boosted investor confidence in the e-commerce platform's technology direction.

CVS Health (CVS) stock plunged nearly 5% after Republican congressmen launched an investigation into the company.

Investor anxiety also grew over uncertainties surrounding government quality ratings for its Medicare Advantage plans.

Headlines You Can't Miss 👀

📈 Robinhood & AppLovin surge 15% and 12% respectively after being added to the S&P 500 index effective September 22.

📡 EchoStar rockets 19% on $17 billion spectrum license sale to SpaceX, creating telecom sector upheaval.

🎬 Cinemark jumps 4% following record-breaking opening weekend for "The Conjuring: Last Rites" horror film.

🍁 Canada Goose soars 14% after TD Cowen upgrade to buy rating, citing modernization strategy.

🔬 Fortrea drops 9% as pharmaceutical trial conductor faces profit-taking after recent rally.

🤖 Alibaba climbs 4% after leading $100 million funding round for Chinese humanoid startup X Square Robot.

Trending Stocks 📊

Alibaba (BABA)

The Chinese e-commerce giant climbed 4% after leading a $100 million funding round for humanoid robotics startup X Square Robot, demonstrating continued investment in artificial intelligence and automation technologies.

Robinhood Markets (HOOD)

Robinhood's stock skyrocketed over 15% on massive volume following the exciting news of its upcoming inclusion in the S&P 500 index, effective September 22.

This milestone marks the mainstream acceptance of the commission-free trading platform.

Chipotle Mexican Grill (CMG)

Chipotle's shares fell more than 3% as investors grew concerned about a challenging consumer environment and weak traffic trends.

The stock's decline to near 52-week lows amplified negative market sentiment around discretionary spending.

What’s Next?

Key Events to Watch 👇

September historically ranks as the worst month for equities, with the S&P 500 averaging 4.2% declines over the past five years.

Producer Price Index (PPI) data due Wednesday morning

Consumer Price Index (CPI) report Thursday – critical inflation reading

Stephen Miran Fed nomination committee vote on Wednesday

Tesla shareholder meeting on November 6 for Musk pay plan vote

Fed meeting September 16-17, with rate cut expectations rising

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.