- Ziggma

- Posts

- 🗞️ Disney Invests $1B in OpenAI

🗞️ Disney Invests $1B in OpenAI

Big Moves Decoded: Visa, ADBE, and more

Market Performance

S&P 500: 6,901.00 ⬆️ 0.21%

Nasdaq: 23,593.86 ⬇️ 0.26%

Dow Jones: 48,704.01 ⬆️ 1.34%

Disney Inks $1 Billion Deal With OpenAI

Disney (DIS) is making a massive bet on artificial intelligence, striking a groundbreaking $1 billion deal with OpenAI that could reshape how fans interact with their favorite characters.

The three-year agreement allows Sora users to create short videos featuring over 200 Disney, Marvel, Pixar, and Star Wars characters—from Mickey Mouse to Darth Vader.

This marks a dramatic shift for a company that has actively fought AI platforms over copyright concerns, having recently sued Midjourney and sent cease-and-desist letters to Character.AI and Google.

Disney recognizes that fighting AI is futile—partnering strategically makes more sense.

The deal includes strict safeguards against copyright infringement and harmful content, addressing earlier controversies surrounding Sora's launch, when it was widely misused as a brand.

Beyond licensing, Disney becomes a major OpenAI customer, deploying ChatGPT across its workforce and integrating AI into Disney+ experiences.

Curated fan-created Sora videos will even stream on the platform starting early 2026.

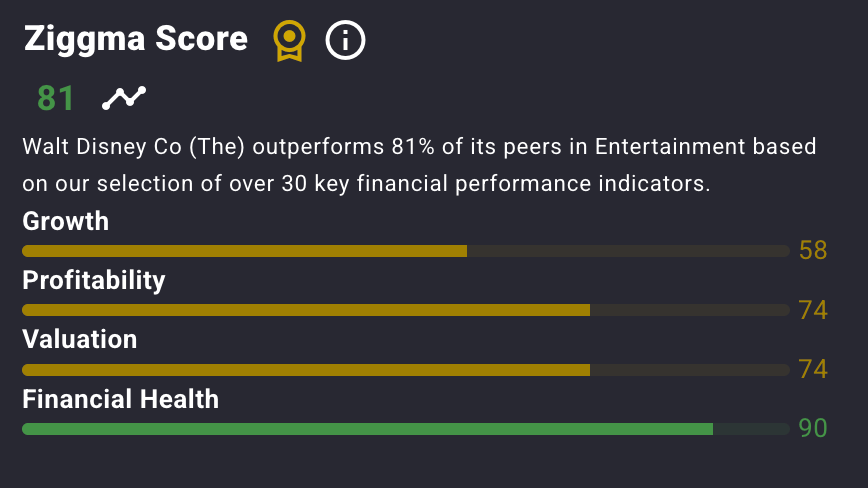

Disney stock has a Ziggma score of 81 and ranks above most peers in terms of profitability, valuation, and financial health.

The entertainment giant has fallen close to 30% in the past five years and trades at a reasonable valuation in December 2025.

Our Takeaway

This isn't just a licensing deal—it's Disney hedging its bets on AI's future while attempting to control how its IP is used.

The $1 billion investment and additional equity warrants signal Disney sees OpenAI as central to entertainment's evolution. If successful, expect other studios to follow suit rather than fight the AI wave.

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Market Overview 📈

Markets delivered mixed results on Thursday as investors rotated away from high-flying tech stocks following Oracle's disappointing results and the Fed's third rate cut of 2025.

The Dow and S&P 500 hit fresh records, gaining 1.34% and 0.21% respectively, while the Nasdaq slipped 0.26%.

Oracle's 11% plunge after missing revenue expectations sparked concerns about AI infrastructure returns, triggering a broader tech selloff.

Nvidia and Broadcom both fell by more than 1% as investors questioned when trillion-dollar AI commitments would generate meaningful profits.

The rotation benefited cyclical and financial stocks. The S&P 500 financials sector hit an all-time high, rising over 1% as Visa and Mastercard led gains.

Small-cap stocks also surged, with the Russell 2000 posting a new record as lower rates typically boost smaller companies with higher borrowing costs.

The Fed's 25 basis point cut on Wednesday, approved 9-3, placed its key rate at 3.5%-3.75%, though three dissents marked the most opposition since 2019, signaling growing division on future easing.

Stock Moves Deciphered 📈

⬇️ Oracle (ORCL)

Oracle plummeted 11% despite beating earnings estimates, reporting $2.26 per share versus $1.64 expected.

However, revenue of $16.06 billion missed the $16.21 billion consensus, with software revenue falling 3% to $5.88 billion, compared with a $6.06 billion estimate.

Most concerning was the negative free cash flow of $10 billion, compared with an expected $5.2 billion.

The miss sparked questions about Oracle's ability to deliver on ambitious AI infrastructure promises, with Morgan Stanley placing its price target "under review."

Remaining performance obligations soared 438% to $523 billion, driven by new commitments from Meta and Nvidia, but investors remain skeptical about execution timelines and mounting debt concerns.

💳 Visa (V)

Visa surged 6% following a Bank of America upgrade from neutral to buy, marking its best day since April.

Analyst Mihir Bhatia called the payments giant "a great business on sale," noting it trades at its lowest relative multiple in a decade.

The upgrade highlighted Visa's strong fundamentals and defensible moat, with stablecoin integration expected to strengthen, not undermine, its position.

BofA projects double-digit revenue and EPS growth over the medium term.

🎨 Adobe (ADBE)

Adobe slipped slightly despite reporting a strong fourth-quarter beat on both top and bottom lines.

The design software maker announced expectations for double-digit recurring revenue growth in 2026 as AI efforts expand.

However, fiscal 2026 guidance of $23.30-$23.50 EPS fell short of investor hopes, matching the FactSet consensus of $23.38 but lacking upside surprise.

Concerns persist about competition in the AI space and whether Adobe can successfully monetize new AI-powered tools like Firefly.

☀ First Solar (FSLR)

First Solar continued its upward momentum, benefiting from two catalysts. BMO Capital Markets raised its price target to $285, citing strong fundamentals in the solar industry.

Additionally, the company announced a new agreement to supply solar modules for Lockhart Power's projects, reinforcing its market leadership position.

The stock's strength reflects growing optimism about renewable energy demand and First Solar's competitive advantages in domestic manufacturing, particularly as policy support for clean energy remains robust.

Headlines You Can't Miss 👀

📊 Jobless claims jumped 44,000 to 236,000 for the week ended Dec. 6, well above the 223,000 estimate, with sharp spikes in California, Illinois, and New York following Thanksgiving.

🏦 Treasury Secretary Scott Bessent proposed overhauling the Financial Stability Oversight Council, shifting from tighter regulations toward looser oversight and a freer approach to financial markets.

🏠 45 stocks in the S&P 500 hit new 52-week highs, including Expedia at all-time levels, General Motors at highs since its 2010 IPO, and Citigroup at levels not seen since November 2008.

💊 Regeneron is reportedly exploring a $256 million acquisition of 23andMe, the struggling genetics testing company, to gain access to its valuable DNA database for drug development research.

⚡ Blackstone announced plans to acquire TXNM Energy in an $11.5 billion deal, expanding the private equity giant's growing portfolio of utility and infrastructure assets.

🚗 Alphabet's Waymo autonomous taxi service reached 10 million robotaxi trips, demonstrating continued progress in commercial self-driving technology deployment.

🏭 Apple supplier Foxconn committed to investing $1.5 billion in its India operations, continuing the shift of iPhone manufacturing capacity away from China.

💻 Synopsys shares rose over 2% after the electronic design automation company topped quarterly expectations and announced a strategic $2 billion investment from Nvidia earlier this month.

Trending Stocks 📊

📡 Planet Labs (PL)

Planet Labs rallied over 14% in extended trading after crushing revenue expectations for its fiscal third quarter.

The satellite imagery provider reported $81 million in revenue, significantly exceeding the $72 million.

This strong performance demonstrates growing demand for commercial satellite data across government and enterprise customers, validating Planet Labs' business model of operating the world's largest fleet of Earth-imaging satellites for applications ranging from agriculture monitoring to defense intelligence.

🛳️ Royal Caribbean (RCL)

Royal Caribbean announced a $1.00 quarterly dividend alongside a substantial $2 billion share buyback program, sending a strong signal about management's confidence in the cruise line's financial health and future cash flow generation.

The capital return initiative reflects the industry's continued post-pandemic recovery, with cruise demand remaining robust and pricing power strong.

This shareholder-friendly move demonstrates Royal Caribbean's ability to generate significant excess cash while still investing in its fleet expansion and innovation.

💊 Eli Lilly (LLY)

Eli Lilly shares gained 1.6% after announcing positive late-stage trial results for its next-generation obesity drug.

The highest dose delivered average weight loss of 23.7% at 68 weeks—potentially the highest yet seen in trials—while also reducing knee arthritis pain.

For patients who remained on treatment throughout the study, weight loss reached 28.7%.

The dual benefit of significant weight reduction and arthritis pain relief strengthens Lilly's competitive position in the booming GLP-1 obesity market.

What’s Next?

Key market and macro news 👇

💰 Broadcom's quarterly results will continue to drive sentiment in the semiconductor and AI sectors on Friday.

🎾 Johnson Outdoors reports fiscal fourth-quarter results, offering insight into consumer discretionary spending trends.

💸 Federal Reserve Bank of New York begins reserve management purchases of Treasury bills, potentially influencing market liquidity.

📊 UK GDP data release could influence international sentiment with ripple effects on U.S. markets.

⛽️ CFTC releases commodity speculative positioning data for crude oil, gold, and copper, offering insights into trader sentiment.

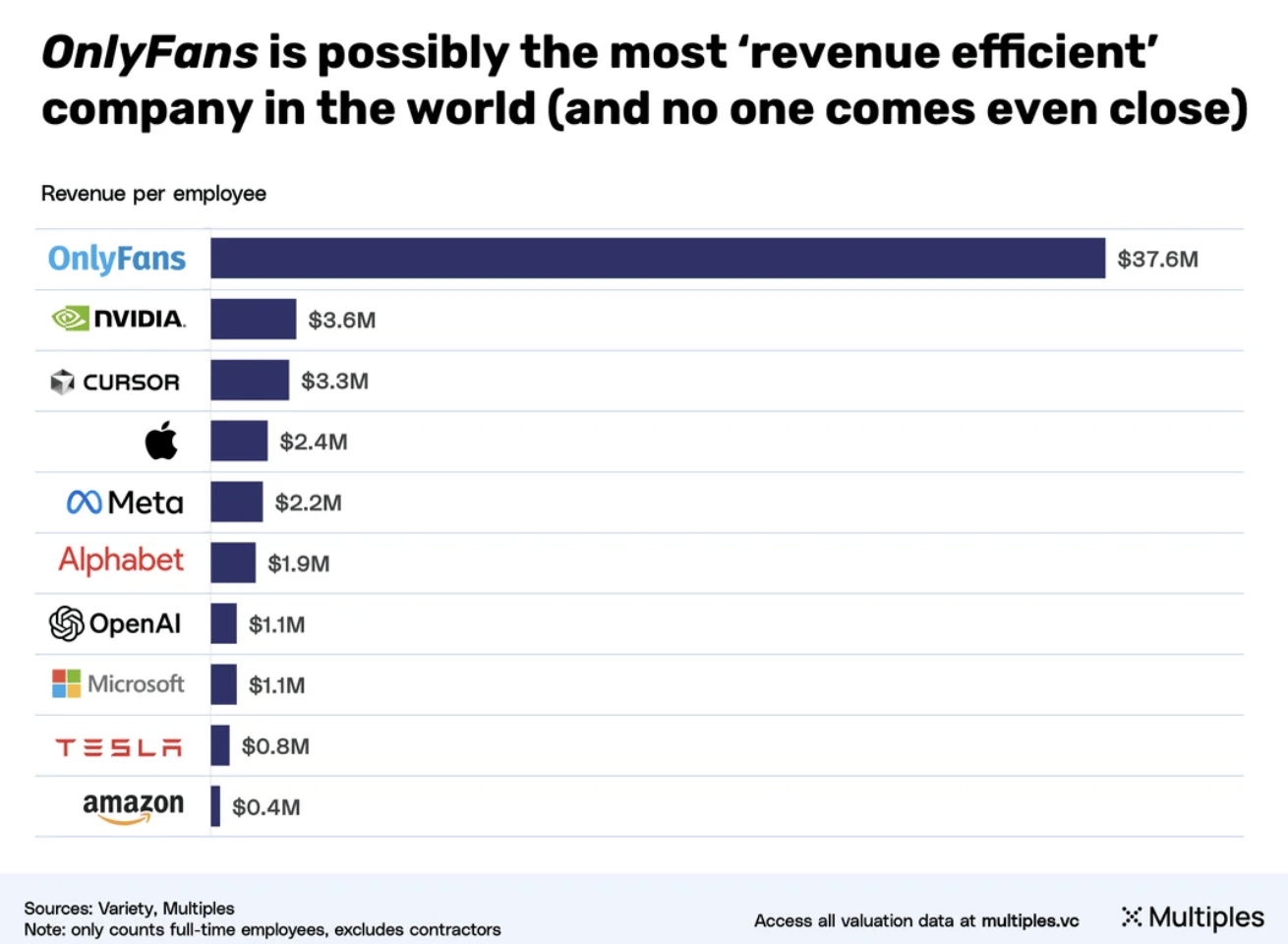

Chart of the Day

Meme of the Day

Great investing starts with great information.

Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please exercise caution and conduct your own research.