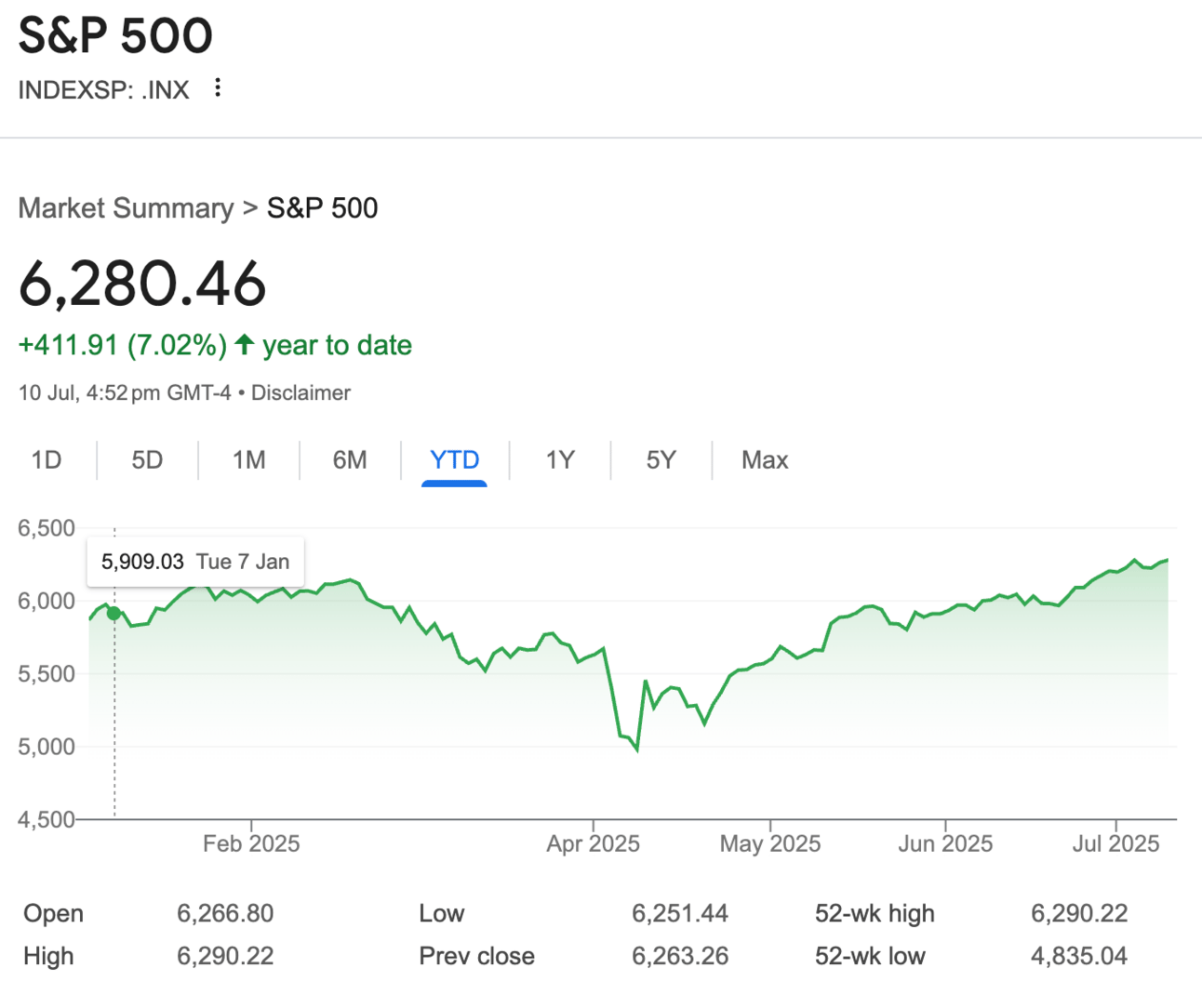

Market Performance

S&P 500: 6,280.46 (+0.27%)

Nasdaq: 20,630.67 (+0.09%)

Dow Jones: 44,650.64 (+0.43%)

Delta Air Lines Is Back In Business

Delta Air Lines (DAL) just delivered the kind of earnings report that reminds us why travel stocks can be absolute rockets when things go right.

The airline reinstated its 2025 profit outlook after pulling it back in April, and CEO Ed Bastian says bookings have finally stabilized.

Here's what's fascinating 👇

While Delta lowered its full-year earnings forecast to $5.25-$6.25 per share (down from its January prediction of $7.35 or more), investors are celebrating because the company is showing real resilience.

Premium product revenue jumped 5%, while main cabin sales dropped 5%, indicating that wealthy travelers are still spending, while budget-conscious individuals are pulling back.

The real story? Corporate travel has stabilized as businesses gain clarity on Trump's trade policies.

Delta's American Express partnership revenue reached $2 billion, a 10% year-over-year increase, indicating that premium customers aren't going anywhere.

Our Takeaway

Delta's ability to navigate tariff uncertainty while maintaining pricing power in premium segments signals that quality airlines with strong loyalty programs will weather economic headwinds better than budget carriers.

This earnings beat could spark a broader rally in travel stocks.

Market Overview

U.S. markets hit fresh record highs on Thursday before futures turned negative after President Trump announced 35% tariffs on Canada, effective August 1st.

The S&P 500 and Nasdaq both closed at all-time highs, with investors continuing to shrug off tariff concerns that have dominated headlines this week.

The rally began on Wednesday when Nvidia briefly reached a $4 trillion market capitalization, sparking a surge in the tech sector.

Consumer discretionary stocks led Thursday's gains as risk appetite remained strong despite President Trump's escalating trade war, which now includes 50% tariffs on Brazilian and copper imports.

Futures fell sharply in after-hours trading, with S&P 500 futures down 0.48% and Nasdaq futures dropping 0.57% after the Canada tariff news was released.

The 30-year Treasury yield has been climbing toward levels not seen since 2023, reflecting concerns about the deficit following recent spending bills.

Bitcoin continued its record-breaking run, hitting new highs above $116,000 as institutional adoption accelerates and short liquidations mount.

Headlines You Can't Miss

Tesla shares jumped 2.5% after Musk announced robotaxi expansion in Austin and Bay Area rollout in "a month or two."

Federal Reserve Governor Waller expects balance sheet cuts to continue, projecting a reduction to $5.8 trillion.

Oracle reportedly set to purchase $40B in Nvidia chips for OpenAI's U.S. data center infrastructure.

Bitcoin hits fresh record above $116,000 as institutional adoption drives massive short liquidations.

Jobless claims posted a surprise decline to 227,000, below expectations of 235,000 for the week.

Bank of America expects inflation to accelerate citing tariff-related price increases in coming months.

Trump announces 35% tariffs on Canada, starting August 1, and warns of higher levies if Ottawa retaliates.

VanEck Semiconductor ETF paces for 7th straight weekly gain, longest streak since 2019.

Trending Stocks

The Pentagon deal will help fund the expansion of magnet production capacity and rare earths processing, securing critical supply chains amid rising geopolitical tensions.

CEO Quote🎤: “I want to be very clear, this is not a nationalization. We remain a thriving public company. We now have a great new partner in our economically largest shareholder, DoD, but we still control our company. We control our destiny. We’re shareholder driven.”

WK Kellogg (KLG): The breakfast cereal maker surged 30% on news that Italian chocolate giant Ferrero agreed to acquire the company for $23 per share in cash, valuing the Froot Loops maker at $3.1 billion.

The deal represents a significant premium and validates the strength of iconic breakfast brands.

CEO Quote🎤: “This is more than just an acquisition – it represents the coming together of two companies, each with a proud legacy and generations of loyal consumers. Over recent years, Ferrero has expanded its presence in North America, bringing together our well-known brands from around the world with local jewels rooted in the U.S.”

Estée Lauder (EL): The beauty stock gained 6% after Bank of America reinstated coverage with a buy rating and $110 price target, citing improving Asian demand that could drive sales growth and margin expansion.

The 27% upside target reflects confidence in the recovery of the luxury beauty market.

Analyst Quote🎤: “Estée Lauder is the "#2 player in attractive market, where cyclical upside exists……The firm's "Beauty Reimagined" turnaround plan would "drive efficiency & rebuild volumes."

What’s Next?

Major airline earnings are expected to continue this month, following Delta's strong report.

Q1 earnings season enters final stretch with 95% of S&P 500 companies reported.

Federal officials continue speaking on the circuit, focusing on the timeline for balance sheet reduction.

Canada is expected to respond to President Trump's announcement of a 35% tariff.

Copper and Brazilian import tariffs take effect on August 1st.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.