- Ziggma

- Posts

- 🗞️ DataDog Joins the S&P 500

🗞️ DataDog Joins the S&P 500

as markets trade near all-time highs 🚀

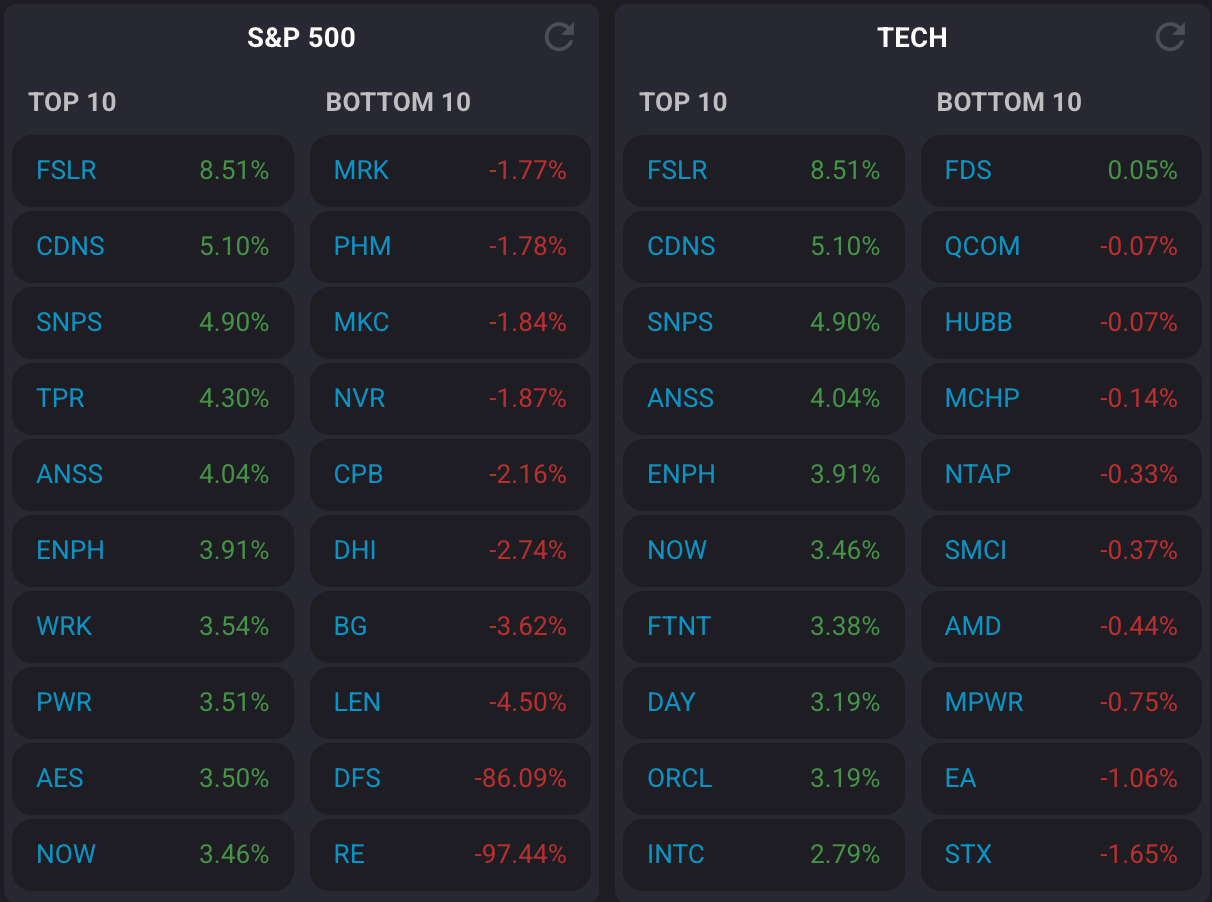

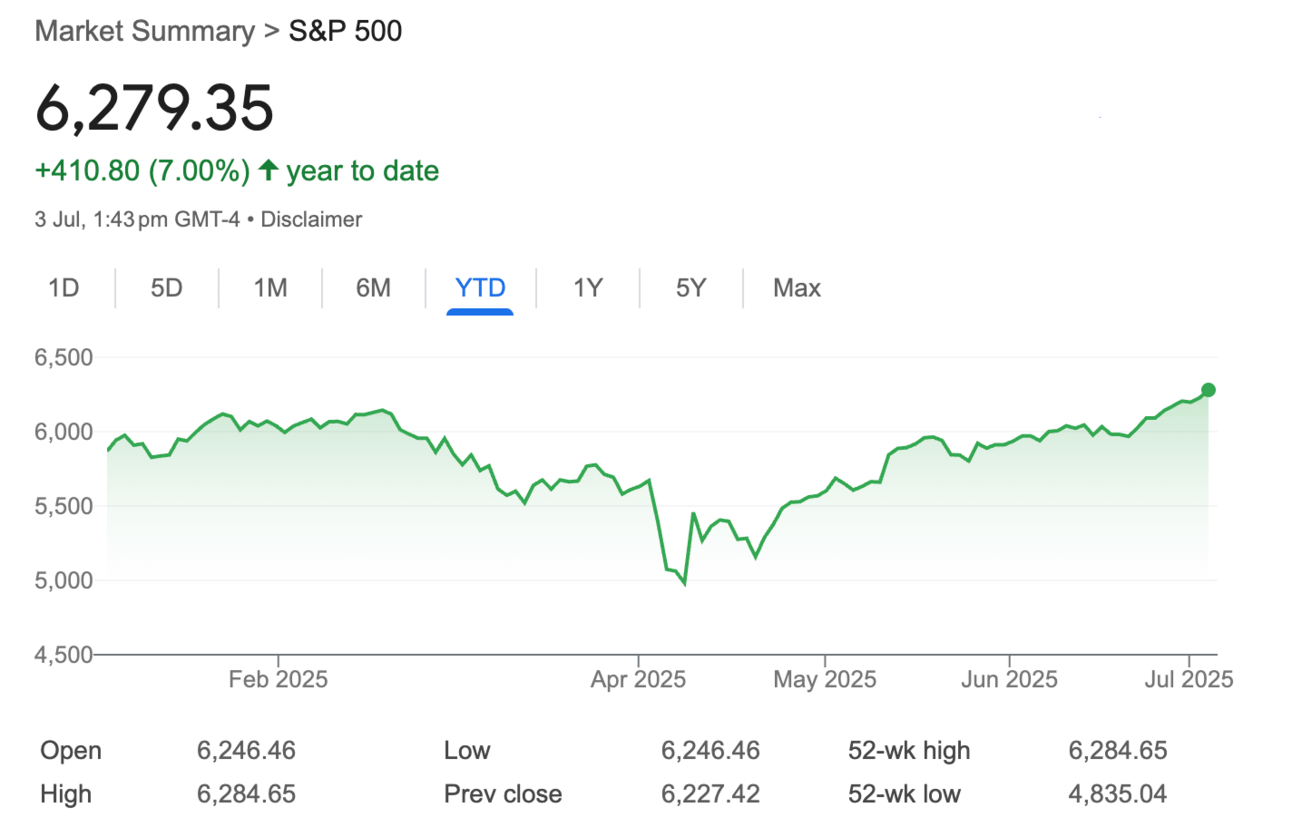

Market Performance

S&P 500: 6,279.35 (+0.83%)

Nasdaq: 20,601.10 (+1.02%)

Dow Jones: 44,828.53 (+0.77%)

Datadog Joins the S&P 500 Elite

Here's something that proves the cloud revolution isn't slowing down.

Datadog (DDOG) just scored a coveted spot in the S&P 500, replacing Juniper Networks effective July 9th.

The monitoring software provider's shares jumped 15% on the announcement, and for good reason.

This isn't just another tech stock getting promoted. Datadog's inclusion highlights how cloud infrastructure has become mission-critical for businesses worldwide.

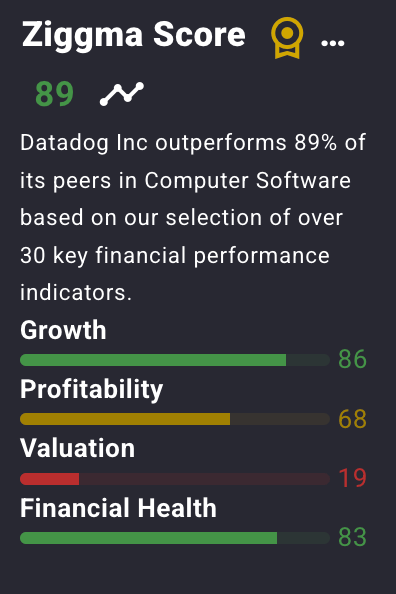

With 30,500 customers and an impressive 80% gross margin, the company is essentially generating substantial profits while helping enterprises effectively monitor their digital operations.

While Datadog has underperformed the broader tech sector this year (down 5.5% compared to the Nasdaq's 5.6% gain), its fundamentals remain solid.

It generated $762 million in Q1 revenue, representing 25% year-over-year growth, and maintains a healthy cash position of $4.4 billion.

The S&P 500 addition comes at a perfect moment as fund managers will be forced to buy shares to rebalance their portfolios, potentially providing additional upward momentum.

With competitors like Cisco (which acquired Splunk) and cloud giants Amazon and Microsoft all vying for market share, Datadog's inclusion validates its position as a pure-play winner in the observability space.

Our Takeaway

Datadog's inclusion in the S&P 500 is a testament to the maturation of cloud monitoring as a vital business function.

With AI workloads driving increased complexity and demand for observability tools, Datadog is positioned to capitalize on this long-term trend.

The stock's recent underperformance may present an opportunity for investors betting on continued digital transformation.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Market Overview

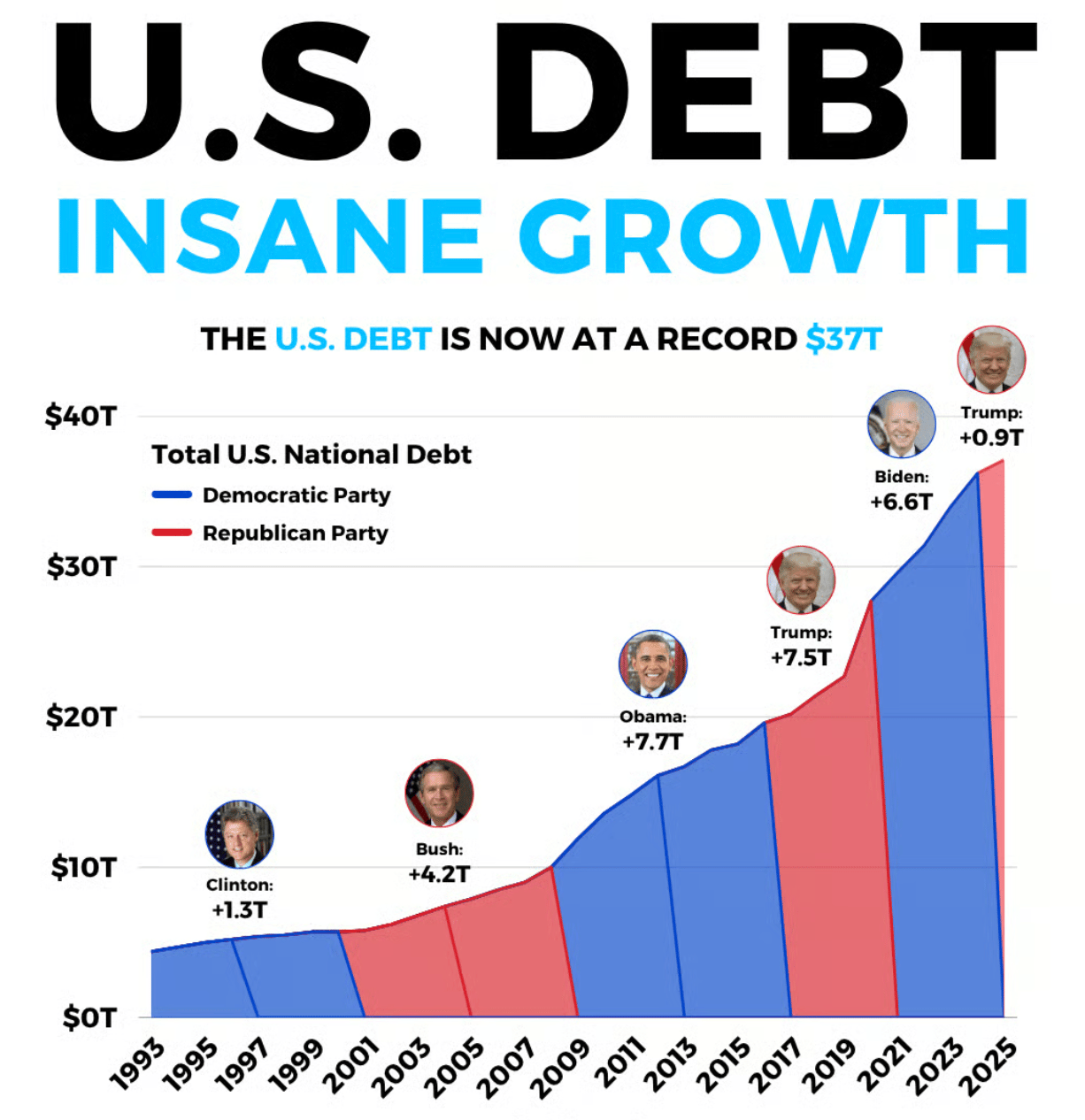

U.S. stock futures are in the red after President Trump delivered a tariff curveball over the weekend.

Futures tumbled as Trump threatened an additional 10% tariff on countries aligning with the "Anti-American policies of BRICS" and confirmed that tariffs will now take effect on August 1st, not July 9th, as initially planned.

Dow futures dropped 142 points, while S&P 500 and Nasdaq futures fell 0.47% and 0.56% respectively.

The delay provides breathing room for ongoing trade negotiations, but investors remain jittery about potential volatility in markets already trading at all-time highs.

Treasury Secretary Scott Bessent clarified that tariffs will "boomerang" back to April 2 levels on August 1st for countries without deals.

This gives negotiators nearly a month of extra runway, though Trump's BRICS comment adds a new wildcard to an already complex trade landscape.

The market had been riding high on optimism that severe tariffs would be avoided, with both the S&P 500 and Nasdaq hitting fresh records Friday.

As Morgan Stanley noted, trade negotiations typically take years, not months, suggesting this extended timeline might benefit markets by providing more certainty around implementation.

Headlines You Can't Miss

Meta Platforms upgraded to “hold” from “underperform” by Needham analyst, citing the highest free cash flow per employee among Big Tech peers.

Royal Caribbean reached all-time highs, along with 24 other S&P 500 stocks, with shares hitting levels not seen since its 1993 IPO.

American Express and JPMorgan both notched fresh all-time highs, leading a financial sector rally.

TripAdvisor surged 8% after WSJ reported activist investor Starboard Value took a stake exceeding 9%.

Russell 2000 turned positive for the year, rising 0.6% on Thursday and rallying nearly 24% from its April lows.

Treasury yields spiked after a strong jobs report showed 147,000 jobs added in June, beating expectations of 110,000.

Federal Reserve rate cut expectations plummet to just 5% chance for July meeting following robust employment data.

Short interest in S&P 500 and Nasdaq-100 has risen steadily all year despite record highs, suggesting investor skepticism persists.

Trending Stocks

First Solar (FSLR)

Solar stocks rallied as Trump’s megabill advanced closer to passage, with the measure dropping earlier proposed taxes on solar and wind projects.

FSLR stock jumped 8% as the renewable energy sector received a lifeline, with clean energy provisions remaining intact in the legislation.

Analyst Quote🎤: The Senate bill still phases out the clean electricity investment and production tax credits for wind and solar, though the timeline isn’t quite as strict as previous versions of the legislation. These credits have played a crucial role in the expansion of renewable energy in the U.S.

Cadence Design Systems (CDNS)

The tech stock gained over 5% after the U.S. government lifted restrictions on exporting chip-design software to China.

The move benefits Cadence and competitor Synopsys, as semiconductor design tools represent a critical link in the global chip supply chain.

Analyst Quote🎤: The export resumption means companies will only lose one month of revenue in the current quarter. The easing trade tensions may also clear the path for long-awaited Chinese approval of Synopsys’s $35 billion buyout of engineering firm Ansys.

CrowdStrike (CRWD)

The cybersecurity leader climbed 4% as Wedbush Analyst Dan Ives raised his price target to $575 from $525, citing “increased momentum in the field around its cyber platform approach.

Analyst Quote 🎤: We are raising our price target on CRWD to $575, reflecting increased momentum in the field around its cyber platform approach based on our recent checks coming in very strongly with healthy momentum into the next year for one of the stalwarts of cybersecurity.

What’s Next?

Earnings focus shifts to upcoming reports as Q2 season approaches with over 95% of S&P 500 companies having reported Q1 results.

Trump tariff negotiations continue with an August 1st deadline for countries without trade deals to avoid higher duties.

Federal Reserve policy likely on hold through July meeting following strong jobs data that reduced rate cut expectations.

BRICS summit in Rio de Janeiro continues amid Trump's threat of additional 10% tariffs on member countries.

Solar sector momentum could continue as Trump's megabill moves toward final passage without new clean energy taxes.

Track upcoming news and earnings on your portfolio companies with Ziggma.

Chart of the Day

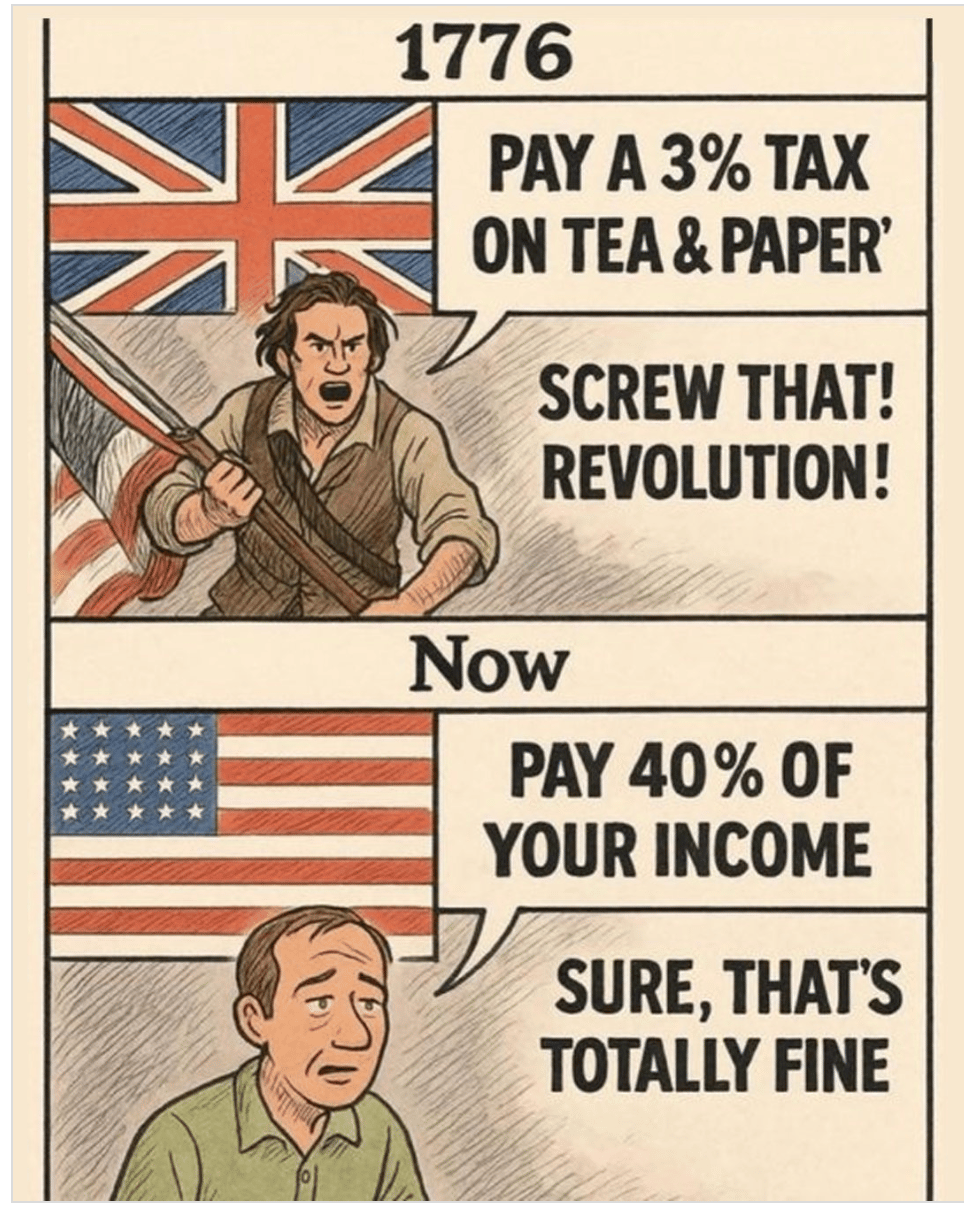

Meme of the Day

Great investing starts with great information. Forward The Market Scoop to anyone who wants to stay ahead of the market through a pertinent and entertaining newsletter format.

DISCLAIMER: None of this is financial advice. The newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research.